- United Kingdom

- /

- Communications

- /

- AIM:MWE

3 UK Penny Stocks With Market Caps Under £200M To Consider

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic uncertainties. In such a climate, investors might consider exploring penny stocks, which despite their historical connotations, represent smaller or less-established companies that can offer potential value. By focusing on those with solid financial health and growth potential, these stocks may provide opportunities for stability and upside in a fluctuating market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.59 | £513.88M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.20 | £177.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.78 | £11.78M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.125 | £15.48M | ✅ 4 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.485 | $281.94M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.883 | £326.51M | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.125 | £179.1M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.70 | £9.64M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.42 | £73.73M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £1.828 | £690.48M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 290 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Beeks Financial Cloud Group (AIM:BKS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beeks Financial Cloud Group plc offers managed cloud computing, connectivity, and analytics services for capital markets and financial services sectors globally, with a market cap of £148.69 million.

Operations: The company's revenue is derived from its Public/Private Cloud segment, generating £25.61 million, and its Proximity/Exchange Cloud segment, contributing £10.31 million.

Market Cap: £148.69M

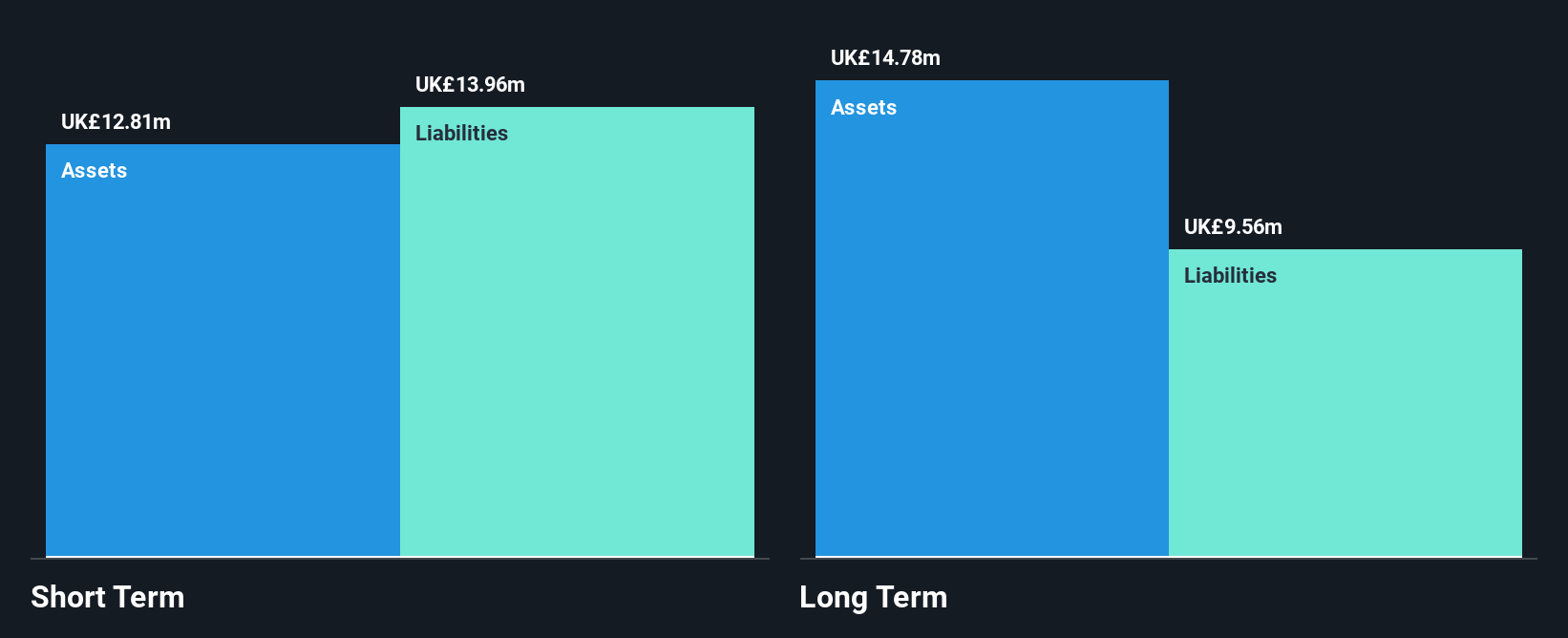

Beeks Financial Cloud Group plc, with a market cap of £148.69 million, continues to demonstrate robust growth in the cloud computing sector for financial markets. The company's earnings have grown significantly, outpacing industry averages, and it remains debt-free with strong asset coverage over liabilities. Recent announcements highlight strategic partnerships and product launches like Market Edge Intelligence and Exchange Cloud®, which are expected to enhance recurring revenue streams. Notable contracts such as those with TMX Datalinx indicate expanding global reach and client base. These developments underscore Beeks' potential for sustained growth in the competitive cloud services arena.

- Get an in-depth perspective on Beeks Financial Cloud Group's performance by reading our balance sheet health report here.

- Gain insights into Beeks Financial Cloud Group's future direction by reviewing our growth report.

eEnergy Group (AIM:EAAS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: eEnergy Group Plc, with a market cap of £20.72 million, operates as a digital energy services company in the United Kingdom and Ireland through its subsidiaries.

Operations: The company generates revenue of £29.10 million from its Energy Services segment.

Market Cap: £20.72M

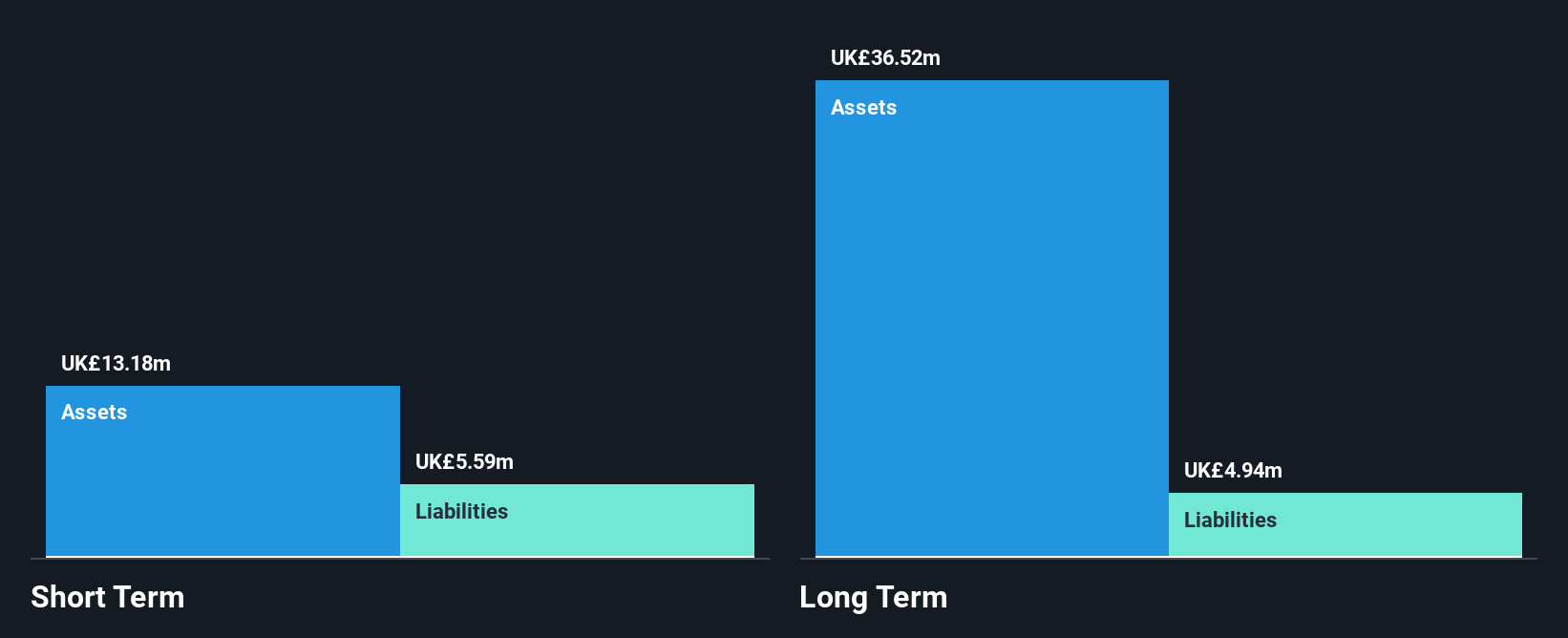

eEnergy Group Plc, with a market cap of £20.72 million, recently secured a significant contract as the preferred supplier for the Great British Energy Solar Partnership's Midlands Lot 1. This strengthens its position in the education sector with over 1,200 projects completed. Despite reporting sales of £10.07 million for H1 2025, eEnergy remains unprofitable and has a negative return on equity. The company has more cash than debt and sufficient cash runway for over three years but faces challenges with short-term liabilities exceeding assets and high share price volatility. Management is relatively new, averaging one year in tenure.

- Navigate through the intricacies of eEnergy Group with our comprehensive balance sheet health report here.

- Understand eEnergy Group's earnings outlook by examining our growth report.

M.T.I Wireless Edge (AIM:MWE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: M.T.I Wireless Edge Ltd. designs, develops, manufactures, and markets antennas for both military and civilian sectors with a market cap of £37.06 million.

Operations: The company's revenue is derived from three primary segments: Antennas ($15.67 million), Water Solutions ($17.52 million), and Distribution & Consultation ($14.58 million).

Market Cap: £37.06M

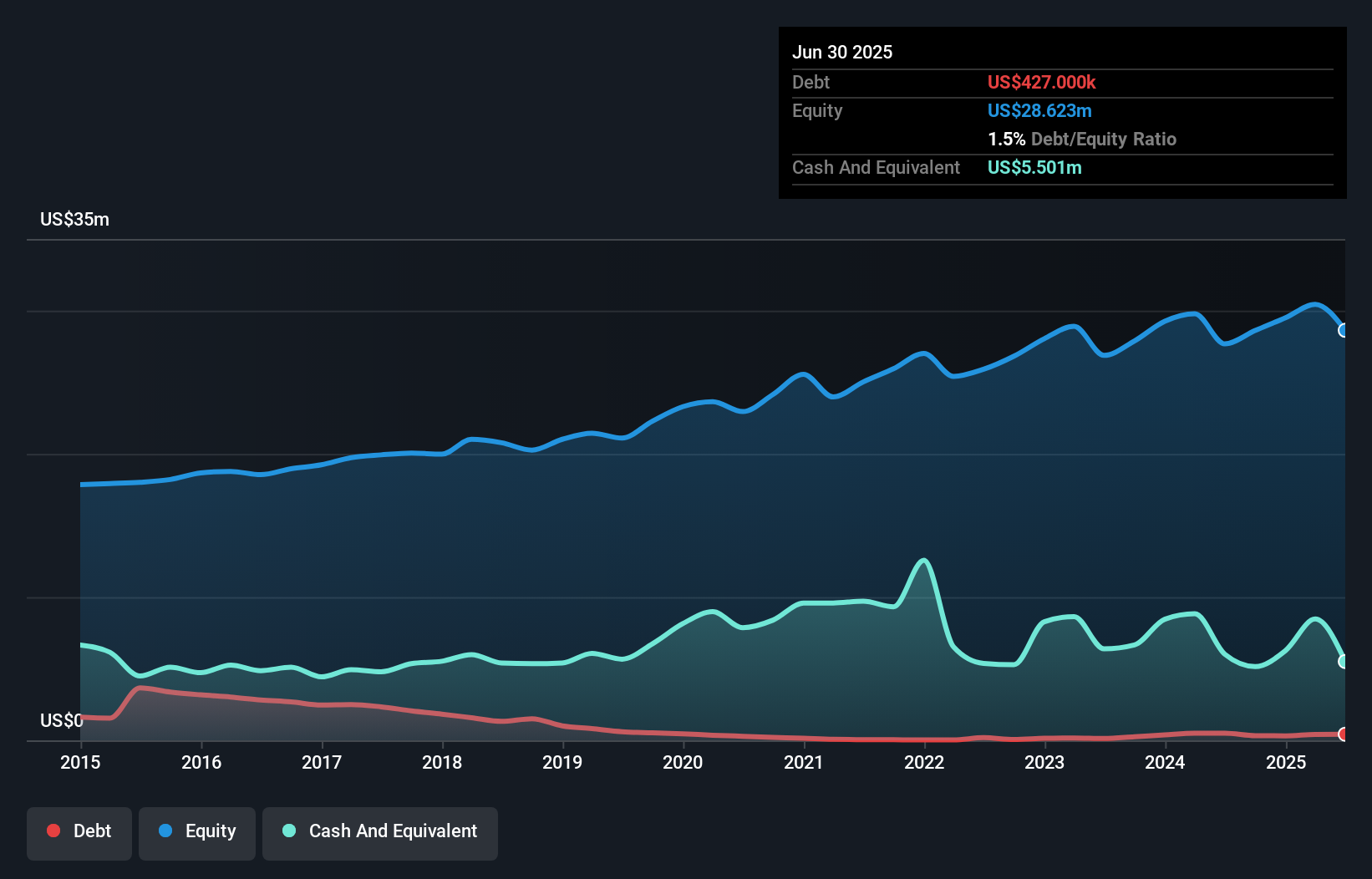

M.T.I Wireless Edge Ltd., with a market cap of £37.06 million, has demonstrated stable earnings growth, reporting US$24.14 million in sales for H1 2025 and a net income increase to US$2.16 million from the previous year. The company operates across antennas, water solutions, and distribution segments with strong cash flow covering its debt well. Despite an unstable dividend track record and low return on equity at 15%, it maintains high-quality earnings without shareholder dilution recently. Recent board changes include appointing Amalia Borovitz Bryl as Chair amidst ongoing M&A considerations to leverage opportunities in defense, 5G, and water management sectors.

- Jump into the full analysis health report here for a deeper understanding of M.T.I Wireless Edge.

- Assess M.T.I Wireless Edge's future earnings estimates with our detailed growth reports.

Summing It All Up

- Click this link to deep-dive into the 290 companies within our UK Penny Stocks screener.

- Looking For Alternative Opportunities? Uncover 10 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MWE

M.T.I Wireless Edge

Designs, develops, manufactures, and markets antennas for the military and civilian sectors.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives