- United Kingdom

- /

- Software

- /

- AIM:BIRD

UK Penny Stocks Under £20M Market Cap: 3 Picks To Consider

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic uncertainties. Amid these broader market fluctuations, penny stocks remain an intriguing area for investors seeking opportunities in smaller or newer companies. Despite the vintage connotation of their name, penny stocks can offer potential growth at lower price points when supported by strong financials and sound fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.64 | £54.25M | ✅ 4 ⚠️ 4 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.62 | £270.86M | ✅ 4 ⚠️ 1 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.51 | £249.63M | ✅ 4 ⚠️ 5 View Analysis > |

| Central Asia Metals (AIM:CAML) | £1.47 | £255.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.40 | £274.68M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.14 | £355.76M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.70 | £356.67M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.988 | £157.57M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.774 | £2.09B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.33 | £35.71M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 391 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Blackbird (AIM:BIRD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blackbird plc develops and operates a cloud-based video editing and publishing software platform, serving markets in the United Kingdom, Europe, North America, and internationally, with a market cap of £14.03 million.

Operations: The company's revenue is primarily generated from its integrated web-based platform, amounting to £1.61 million.

Market Cap: £14.03M

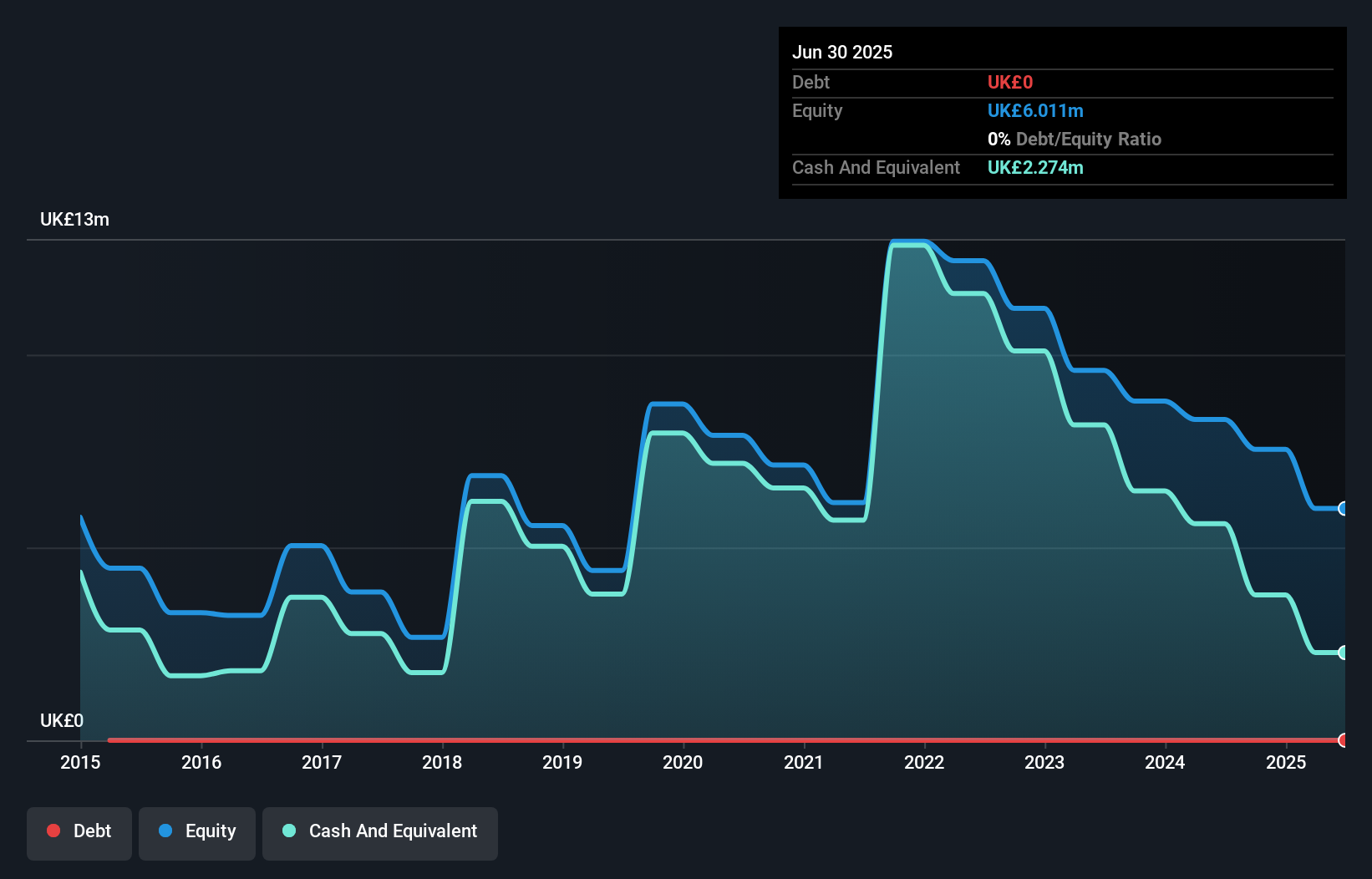

Blackbird plc, with a market cap of £14.03 million, operates a cloud-based video platform and reported revenue of £1.61 million for 2024, down from £1.94 million the previous year. The company remains unprofitable with a net loss of £2.35 million but is debt-free and has no long-term liabilities, offering some financial stability in the volatile penny stock market. Despite having an experienced board and management team, Blackbird's cash runway is limited to less than a year based on current free cash flow trends, highlighting potential liquidity concerns if revenue growth does not accelerate soon.

- Dive into the specifics of Blackbird here with our thorough balance sheet health report.

- Examine Blackbird's past performance report to understand how it has performed in prior years.

Gelion (AIM:GELN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gelion plc, with a market cap of £15.96 million, is involved in the research and development, manufacture, and sale of battery systems both in the United Kingdom and internationally.

Operations: The company generates revenue from its Battery Production and Development segment, totaling £2.33 million.

Market Cap: £15.96M

Gelion plc, with a market cap of £15.96 million, is pre-revenue with earnings of GBP 0.381 million for the half-year ending December 2024 and remains unprofitable with a net loss of GBP 3.61 million. The company recently announced a strategic partnership with the Max Planck Institute to advance sulfur battery technology, potentially accelerating its commercialization pathway. Gelion's financial position shows short-term assets exceeding liabilities and no debt burden; however, it faces liquidity challenges with less than one year of cash runway if current cash flow trends persist amidst high stock volatility in the penny stock sector.

- Click here to discover the nuances of Gelion with our detailed analytical financial health report.

- Gain insights into Gelion's historical outcomes by reviewing our past performance report.

Itaconix (AIM:ITX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Itaconix plc, with a market cap of £15.17 million, develops plant-based polymers for home and personal care applications in North America and Europe.

Operations: The company has not reported any specific revenue segments.

Market Cap: £15.17M

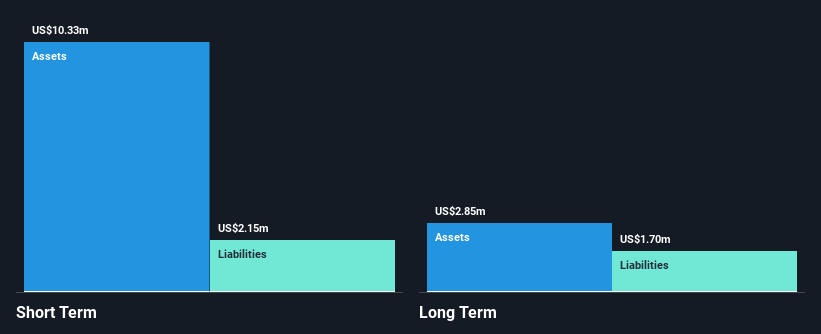

Itaconix plc, with a market cap of £15.17 million, reported US$6.5 million in sales for 2024 but remains unprofitable with a net loss of US$1.87 million. The company is debt-free and has sufficient cash runway for over a year based on current free cash flow, though its share price has been highly volatile recently. While short-term assets exceed liabilities, the firm faces challenges in achieving profitability within the next three years. The board's average tenure suggests relative inexperience, potentially impacting strategic direction amidst ongoing losses and declining sales compared to the previous year.

- Click to explore a detailed breakdown of our findings in Itaconix's financial health report.

- Learn about Itaconix's future growth trajectory here.

Key Takeaways

- Access the full spectrum of 391 UK Penny Stocks by clicking on this link.

- Want To Explore Some Alternatives? Explore 21 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackbird might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BIRD

Blackbird

Develops and operates a cloud-based video editing and publishing software platform under the Blackbird name in the United Kingdom, rest of Europe, North America, and internationally.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.