- United Kingdom

- /

- Software

- /

- AIM:AOM

ActiveOps And 2 Other UK Penny Stocks To Watch For Potential Growth

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Amidst these broader market fluctuations, penny stocks present a unique opportunity for investors seeking growth potential at lower entry points. While the term "penny stocks" may seem outdated, these smaller or newer companies can offer significant upside when backed by strong fundamentals and robust financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.855 | £11.77M | ✅ 3 ⚠️ 3 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.642 | £54.21M | ✅ 4 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.81 | £290.07M | ✅ 5 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.05 | £327.19M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.71 | £419.25M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.785 | £364.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.58 | £981.79M | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.97 | £154.7M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.844 | £2.11B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.345 | £37.33M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 388 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

ActiveOps (AIM:AOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ActiveOps Plc provides hosted operations management software as a service to various industries across Europe, the Middle East, India, Africa, North America, and Asia Pacific with a market cap of £78.50 million.

Operations: The company's revenue is primarily derived from its SaaS (Software as a Service) segment, contributing £25.03 million, and its Training & Implementation segment, which adds £3.01 million.

Market Cap: £78.5M

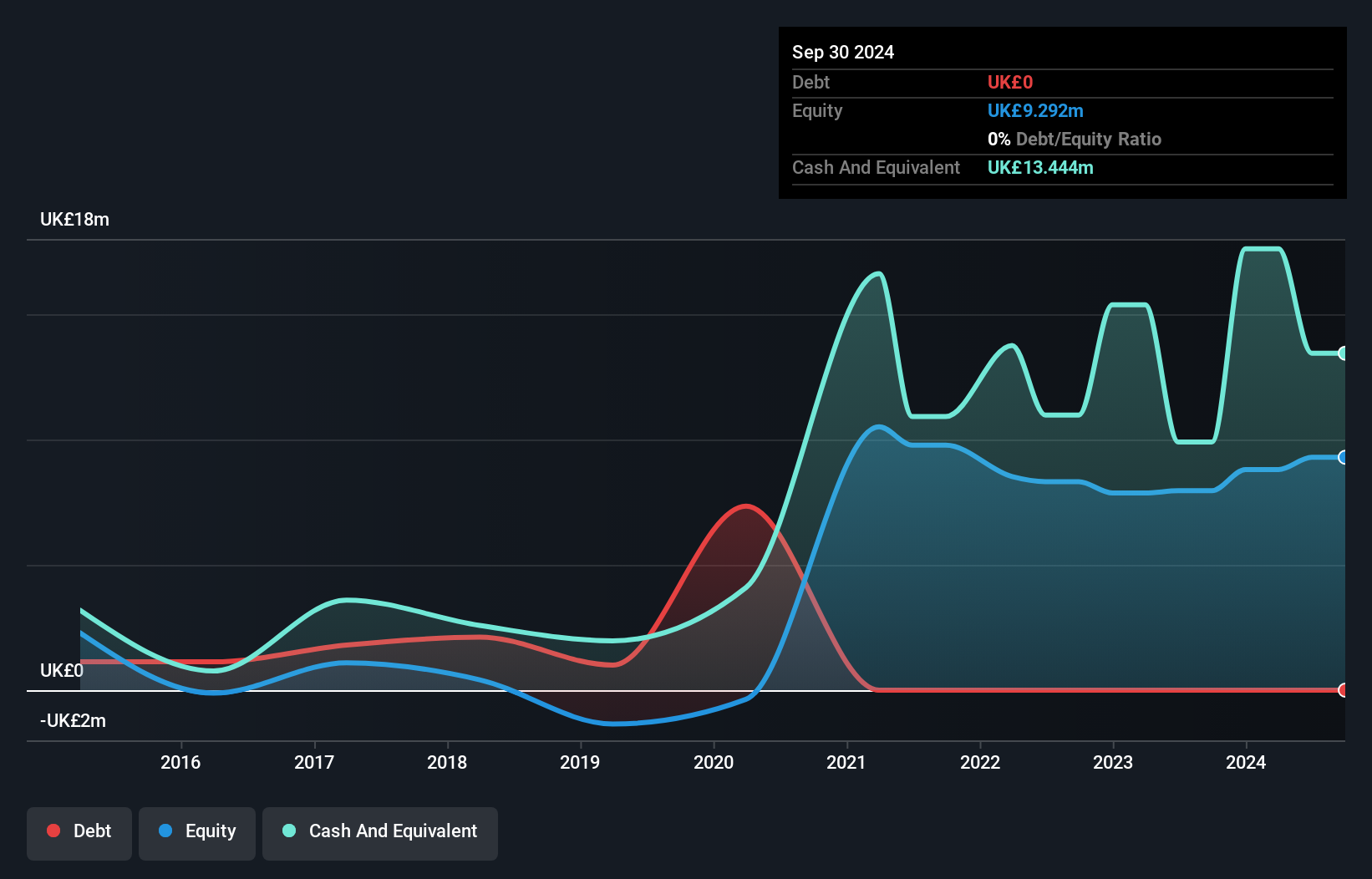

ActiveOps Plc, with a market cap of £78.50 million, primarily generates revenue from its SaaS segment (£25.03 million) and Training & Implementation (£3.01 million). The company has shown impressive earnings growth of 1031% over the past year, surpassing the software industry average and its own five-year average growth rate of 68.8%. Despite this rapid growth, future earnings are forecasted to decline by an average of 19.6% annually over the next three years. ActiveOps is debt-free with strong asset coverage for liabilities and stable weekly volatility at 7%. Recent leadership changes include appointing Paul Maguire as Group Managing Director to drive sustainable global expansion.

- Click to explore a detailed breakdown of our findings in ActiveOps' financial health report.

- Evaluate ActiveOps' prospects by accessing our earnings growth report.

AO World (LSE:AO.)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AO World plc, along with its subsidiaries, operates as an online retailer specializing in domestic appliances and ancillary services in the United Kingdom and Germany, with a market capitalization of approximately £560.20 million.

Operations: The company generates revenue of £1.07 billion from its online retailing of domestic appliances and ancillary services.

Market Cap: £560.2M

AO World plc, with a market cap of £560.20 million, benefits from strong cash flow coverage of debt and reduced debt-to-equity ratio over five years. Despite stable weekly volatility and seasoned management, the company faces challenges with short-term liabilities exceeding short-term assets (£251.4M vs £264.6M) and negative earnings growth (-1.1%) last year compared to industry trends. However, AO's profitability has improved over five years with high-quality earnings and interest payments well-covered by EBIT (14.5x). Trading below estimated fair value may present opportunities amidst recent executive changes appointing Mark Higgins as COO alongside his CFO role.

- Unlock comprehensive insights into our analysis of AO World stock in this financial health report.

- Review our growth performance report to gain insights into AO World's future.

LSL Property Services (LSE:LSL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LSL Property Services plc provides business-to-business services to mortgage intermediaries and estate agent franchisees, as well as valuation services to lenders in the UK, with a market cap of £290.07 million.

Operations: The company's revenue is primarily derived from three segments: Financial Services (£48.40 million), Surveying and Valuation (£97.82 million), and Estate Agency excluding Financial Services (£26.96 million).

Market Cap: £290.07M

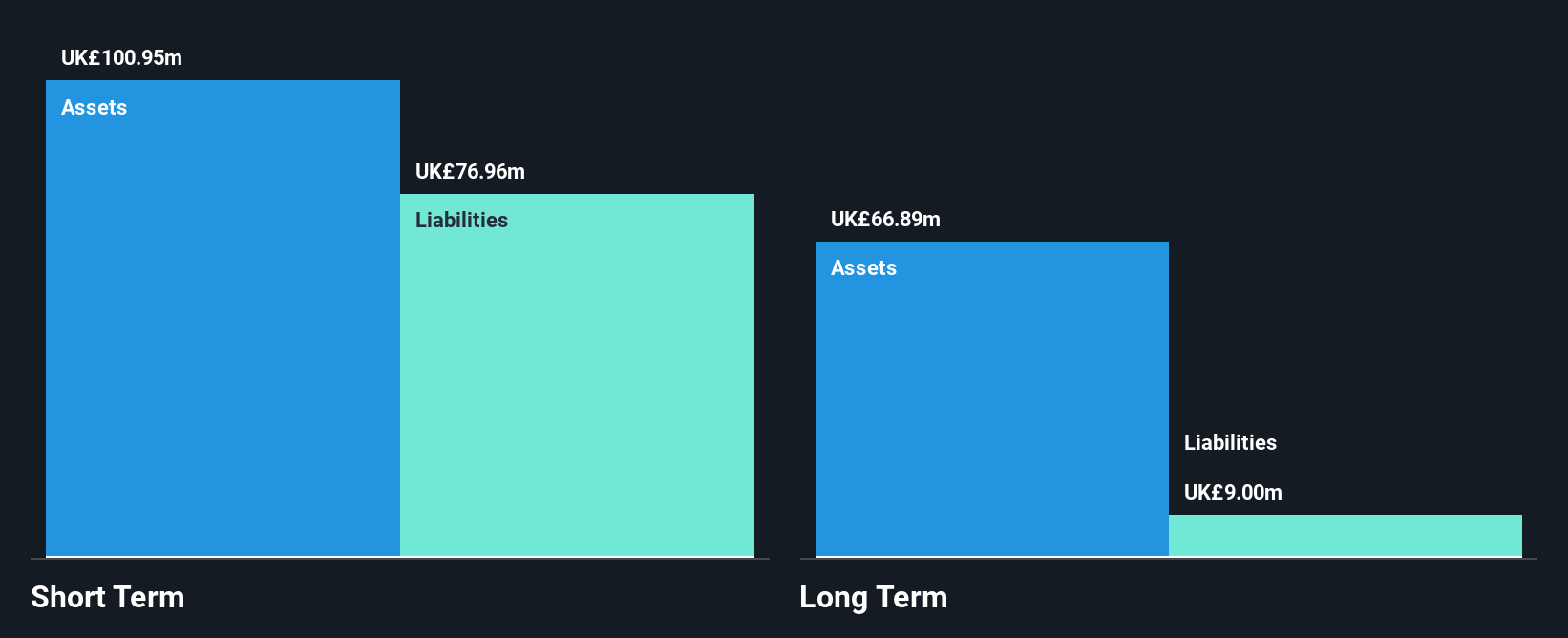

LSL Property Services, with a market cap of £290.07 million, showcases promising financial health as short-term assets (£101.0M) exceed both long-term (£9.0M) and short-term liabilities (£77.0M). The company reported a significant earnings turnaround with net income of £17.36 million for 2024 compared to a loss the previous year, driven by strong performance across its segments: Financial Services, Surveying and Valuation, and Estate Agency excluding Financial Services. Despite unstable dividends, LSL's earnings growth surpassed industry averages last year while trading below estimated fair value offers potential upside amidst executive transitions enhancing governance structure.

- Get an in-depth perspective on LSL Property Services' performance by reading our balance sheet health report here.

- Assess LSL Property Services' future earnings estimates with our detailed growth reports.

Make It Happen

- Click this link to deep-dive into the 388 companies within our UK Penny Stocks screener.

- Searching for a Fresh Perspective? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:AOM

ActiveOps

Engages in the provision of hosted operations management software as a service solution to industries in Europe, the Middle East, India, Africa, North America, and Asia Pacific.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives