- United Kingdom

- /

- Building

- /

- AIM:ALU

December 2024 UK Exchange Penny Stocks To Watch

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced challenges, closing lower amid weak trade data from China, highlighting concerns over global economic recovery. Despite these broader market fluctuations, penny stocks—though an older term—still capture investor interest by offering potential growth opportunities at lower price points. When backed by strong financial health and fundamentals, these smaller or newer companies can present intriguing prospects for those seeking to navigate the current market landscape.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.23 | £840.18M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.405 | £438.1M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.18 | £100.7M | ★★★★★★ |

| Solid State (AIM:SOLI) | £1.25 | £71.31M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4135 | $240.38M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.00 | £190.77M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.04 | £78.76M | ★★★★★★ |

Click here to see the full list of 469 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Alumasc Group (AIM:ALU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Alumasc Group plc manufactures and sells building products, systems, and solutions across various regions including the United Kingdom, Europe, North America, the Middle East, and the Far East with a market cap of £114.00 million.

Operations: The company's revenue is derived from three main segments: Water Management (£48.32 million), Building Envelope (£37.60 million), and Housebuilding Products (£14.81 million).

Market Cap: £114M

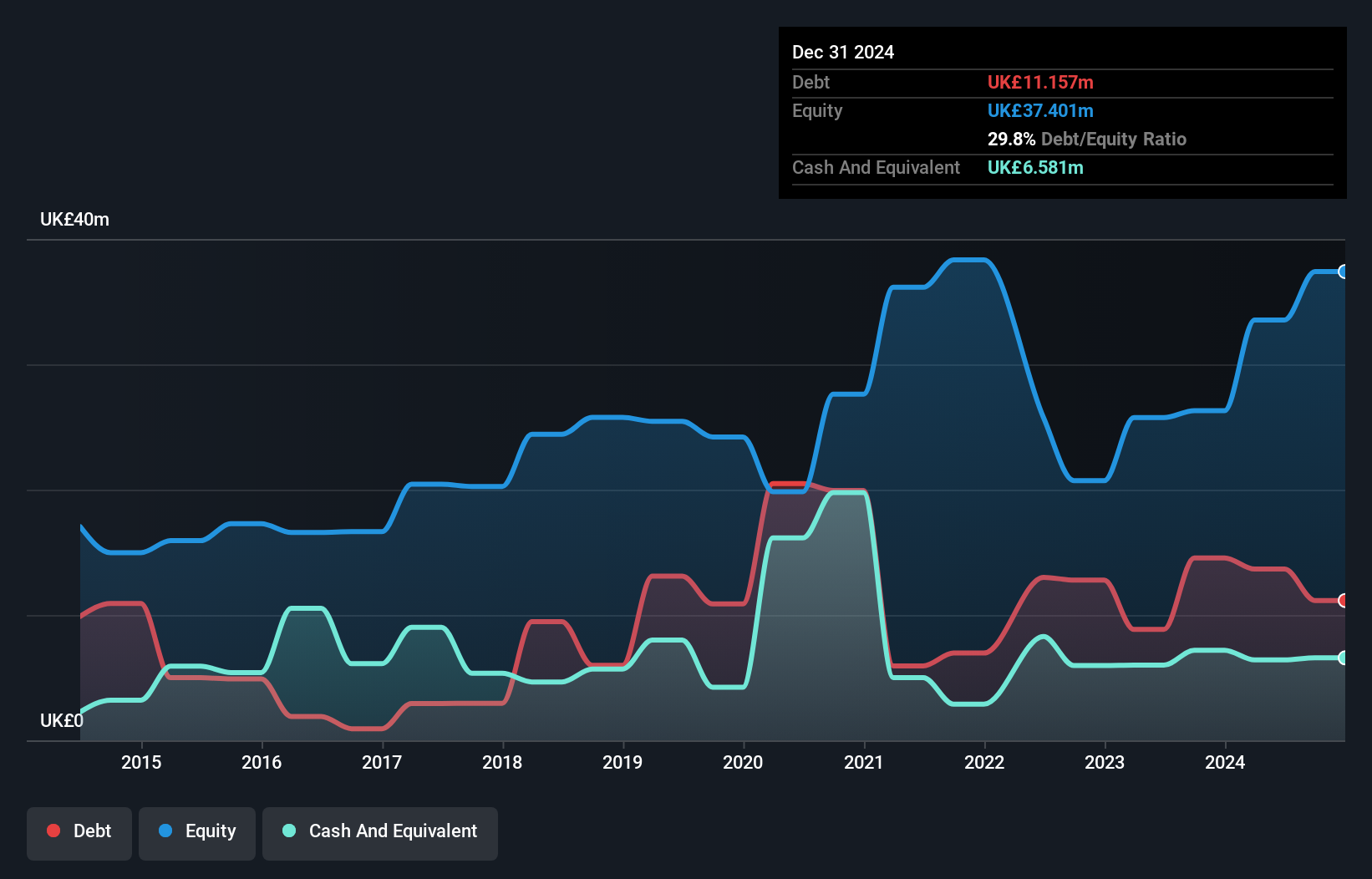

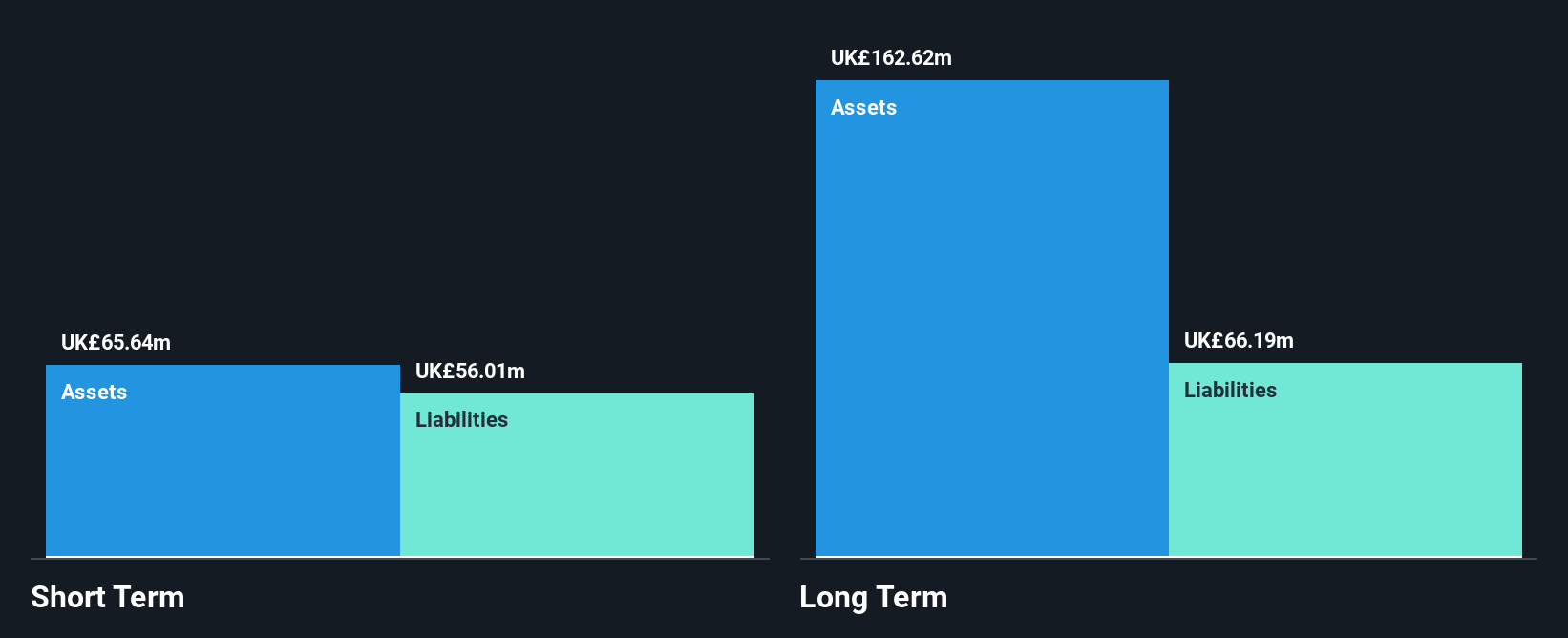

Alumasc Group, with a market cap of £114 million, exhibits stable weekly volatility and satisfactory debt management. Its earnings growth of 4.7% last year outpaced the industry average, although it lags behind its five-year growth rate of 27.9%. The company maintains high-quality earnings and a strong return on equity at 26.1%, while interest payments are well-covered by EBIT. Despite a recent dip in profit margins from 9.4% to 8.7%, Alumasc is trading below estimated fair value by over one-third, suggesting potential undervaluation in the market for investors interested in penny stocks with solid fundamentals and strategic leadership changes underway.

- Dive into the specifics of Alumasc Group here with our thorough balance sheet health report.

- Understand Alumasc Group's earnings outlook by examining our growth report.

IQE (AIM:IQE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IQE plc, along with its subsidiaries, develops, manufactures, and sells advanced semiconductor materials and has a market cap of £122.60 million.

Operations: The company's revenue segments are comprised of CMOS++ generating £1.19 million, Wireless contributing £70.22 million, and Photonics (including Infra-Red) bringing in £57.85 million.

Market Cap: £122.6M

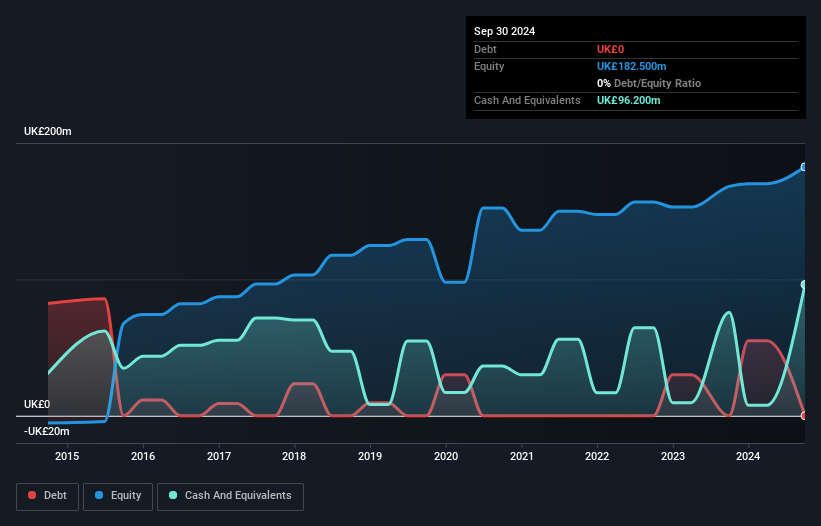

IQE plc, with a market cap of £122.60 million, is navigating challenges as it remains unprofitable, with losses increasing over the past five years. Despite this, its short-term assets exceed both short- and long-term liabilities, indicating some financial stability. Recent strategic moves include a comprehensive review to strengthen its capital position and explore options for its Taiwan operations amid flat revenue forecasts for 2024 at around £115 million. Leadership changes have seen Jutta Meier step in as interim CEO following Americo Lemos's departure. The company aims to capitalize on market opportunities while managing high volatility in share price and board transitions.

- Unlock comprehensive insights into our analysis of IQE stock in this financial health report.

- Explore IQE's analyst forecasts in our growth report.

On the Beach Group (LSE:OTB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: On the Beach Group plc is an online retailer specializing in short-haul beach holidays under the On the Beach brand in the United Kingdom, with a market cap of £347.34 million.

Operations: On the Beach Group does not report specific revenue segments.

Market Cap: £347.34M

On the Beach Group plc, with a market cap of £347.34 million, demonstrates strong financial health as its short-term assets (£423.7M) surpass both short- (£310.9M) and long-term liabilities (£2.5M). The company is debt-free, alleviating concerns over interest coverage or cash flow constraints. Despite high share price volatility, earnings growth has been impressive at 90.6% over the past year, outpacing industry averages and improving profit margins to 15.8%. While management tenure is relatively new at 1.7 years on average, the board's experience provides stability amid anticipated earnings growth of 20.83% annually.

- Take a closer look at On the Beach Group's potential here in our financial health report.

- Gain insights into On the Beach Group's future direction by reviewing our growth report.

Key Takeaways

- Gain an insight into the universe of 469 UK Penny Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ALU

Alumasc Group

Manufactures and sells building products, systems, and solutions in the United Kingdom, Europe, North America, the Middle East, the Far East, and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives