- United Kingdom

- /

- Hospitality

- /

- AIM:YNGA

UK Stocks That May Be Undervalued In September 2024

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently experienced a downturn, influenced by weak trade data from China and sluggish domestic demand in the world's second-largest economy. Despite these challenges, identifying undervalued stocks can present opportunities for investors who focus on strong fundamentals and potential for growth amidst broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Triple Point Social Housing REIT (LSE:SOHO) | £0.651 | £1.30 | 49.8% |

| Gaming Realms (AIM:GMR) | £0.399 | £0.76 | 47.3% |

| Topps Tiles (LSE:TPT) | £0.463 | £0.89 | 48.1% |

| Victrex (LSE:VCT) | £9.62 | £17.31 | 44.4% |

| Informa (LSE:INF) | £8.50 | £16.78 | 49.3% |

| Redcentric (AIM:RCN) | £1.2925 | £2.45 | 47.2% |

| Moonpig Group (LSE:MOON) | £2.05 | £3.70 | 44.5% |

| Tortilla Mexican Grill (AIM:MEX) | £0.505 | £1.01 | 49.9% |

| SysGroup (AIM:SYS) | £0.34 | £0.66 | 48.3% |

| Foxtons Group (LSE:FOXT) | £0.636 | £1.19 | 46.5% |

Here's a peek at a few of the choices from the screener.

Young's Brewery (AIM:YNGA)

Overview: Young & Co.'s Brewery, P.L.C. operates and manages pubs and hotels in the United Kingdom with a market cap of £503.03 million.

Operations: Young & Co.'s Brewery, P.L.C. generates its revenue primarily from its Managed Houses segment, which accounts for £388.20 million.

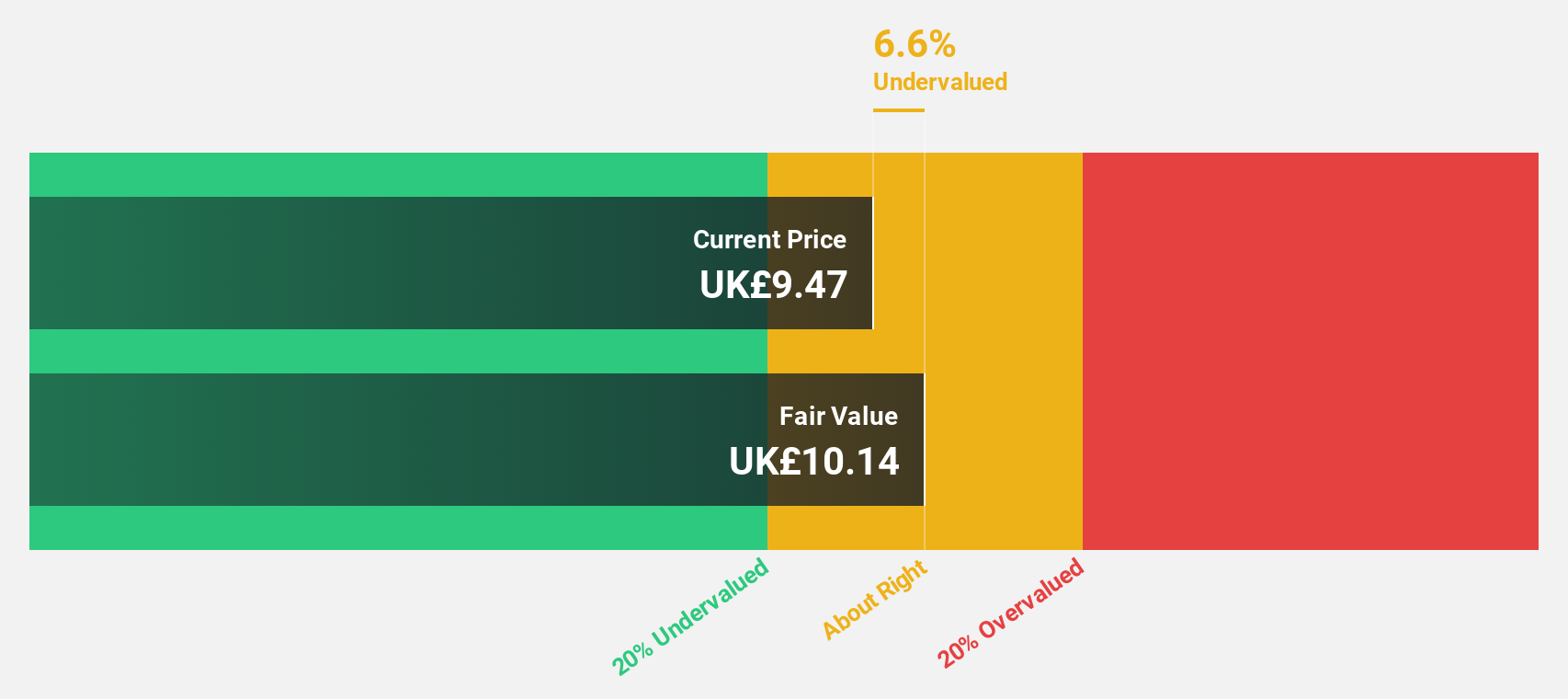

Estimated Discount To Fair Value: 14.5%

Young's Brewery, trading 14.5% below our fair value estimate of £10.74, shows potential as an undervalued stock based on cash flows. Despite recent one-off items impacting financial results and a low forecasted return on equity (5.4%), its earnings are expected to grow significantly at 35% per year, outpacing the UK market's 14.2%. However, profit margins have declined from 8.1% to 2.9%, and shareholders experienced dilution over the past year.

- The analysis detailed in our Young's Brewery growth report hints at robust future financial performance.

- Navigate through the intricacies of Young's Brewery with our comprehensive financial health report here.

Babcock International Group (LSE:BAB)

Overview: Babcock International Group PLC, with a market cap of £2.51 billion, specializes in designing, developing, manufacturing, and integrating specialist systems for aerospace, defense, and security across various regions including the UK, Europe, Africa, North America, Australasia and internationally.

Operations: The company's revenue segments include Land (£1.10 billion), Marine (£1.43 billion), Nuclear (£1.52 billion), and Aviation (£341.50 million).

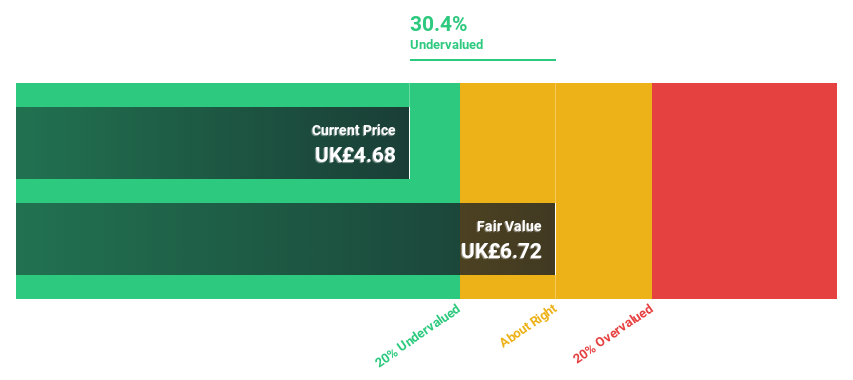

Estimated Discount To Fair Value: 28.0%

Babcock International Group, trading 28% below its estimated fair value of £6.92, presents a compelling case as an undervalued stock based on cash flows. The company has returned to profitability with net income of £165.7 million for FY24 compared to a net loss last year. Earnings are forecast to grow 15.21% annually, outpacing the UK market's growth rate of 14.2%. However, Babcock carries significant debt and modest revenue growth projections at 4% per year may temper expectations.

- Our expertly prepared growth report on Babcock International Group implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Babcock International Group.

Moonpig Group (LSE:MOON)

Overview: Moonpig Group PLC, with a market cap of £707.05 million, operates in the Netherlands and the United Kingdom offering online greeting cards and gifts through its subsidiaries.

Operations: The company's revenue segments include £241.33 million from Moonpig, £51.24 million from Greetz, and £48.58 million from Experiences.

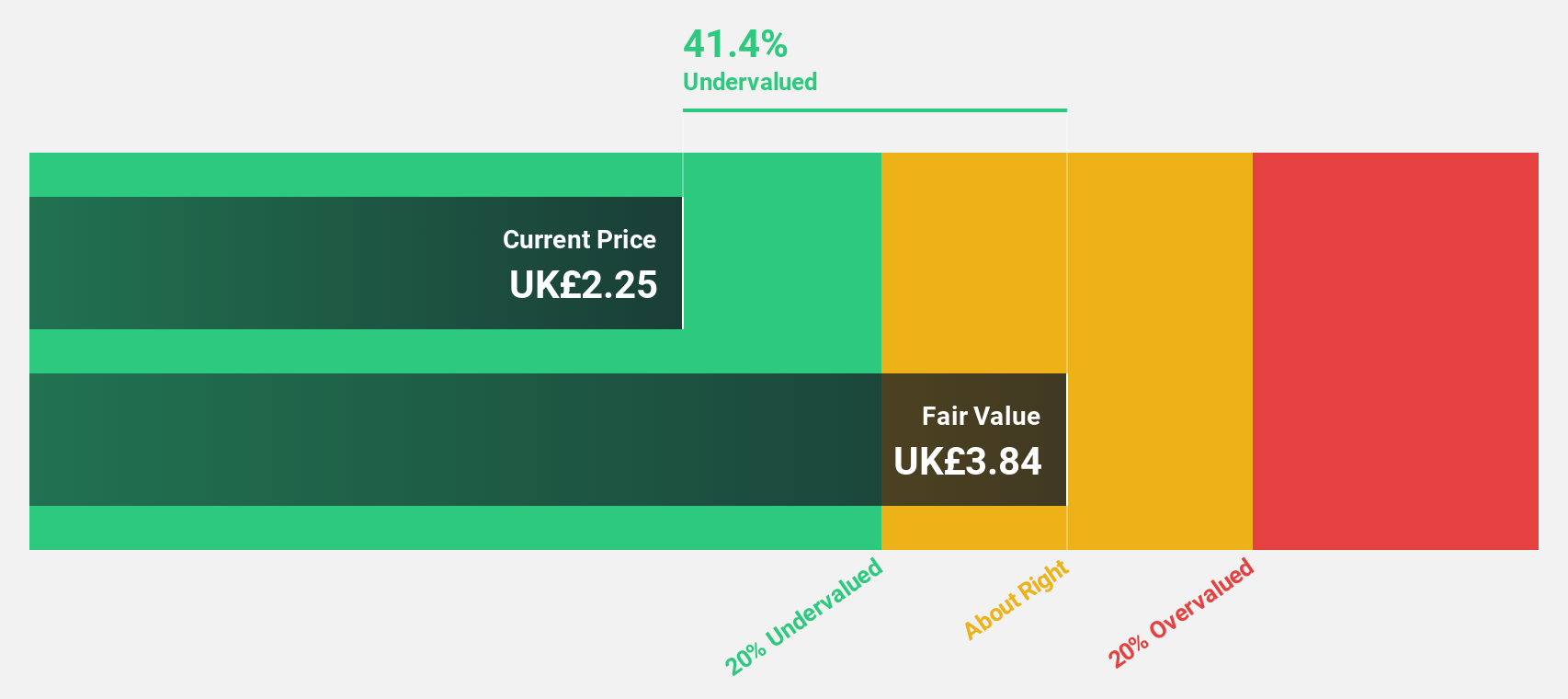

Estimated Discount To Fair Value: 44.5%

Moonpig Group, trading 44.5% below its estimated fair value of £3.7, appears undervalued based on cash flows. The company reported FY24 sales of £341.14 million and net income of £34.17 million, with earnings per share from continuing operations rising to £0.1 from £0.078 a year ago. Revenue is forecast to grow at 7.5% annually, outpacing the UK market's 3.7%, while earnings are expected to increase by 16.8% per year despite high debt levels and recent insider selling.

- According our earnings growth report, there's an indication that Moonpig Group might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Moonpig Group.

Seize The Opportunity

- Dive into all 55 of the Undervalued UK Stocks Based On Cash Flows we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:YNGA

Young's Brewery

Engages in the operation and management of pubs and hotels in the United Kingdom.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives