- United Kingdom

- /

- Metals and Mining

- /

- LSE:CGS

3 UK Dividend Stocks To Consider With Up To 8.3% Yield

Reviewed by Simply Wall St

The UK market has recently faced turbulence, with the FTSE 100 closing lower amid weak trade data from China, highlighting global economic uncertainties. Despite these challenges, dividend stocks can offer a stable income stream and potential for long-term growth, making them an attractive option in volatile markets.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.92% | ★★★★★★ |

| 4imprint Group (LSE:FOUR) | 3.34% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.41% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.89% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.84% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.42% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 5.23% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.79% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.48% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.52% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top UK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Castings (LSE:CGS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Castings P.L.C. engages in iron casting and machining activities across the UK, Europe, the Americas, and internationally, with a market cap of £131.68 million.

Operations: Castings P.L.C. generates £250.98 million from Foundry Operations and £37.65 million from Machining Operations.

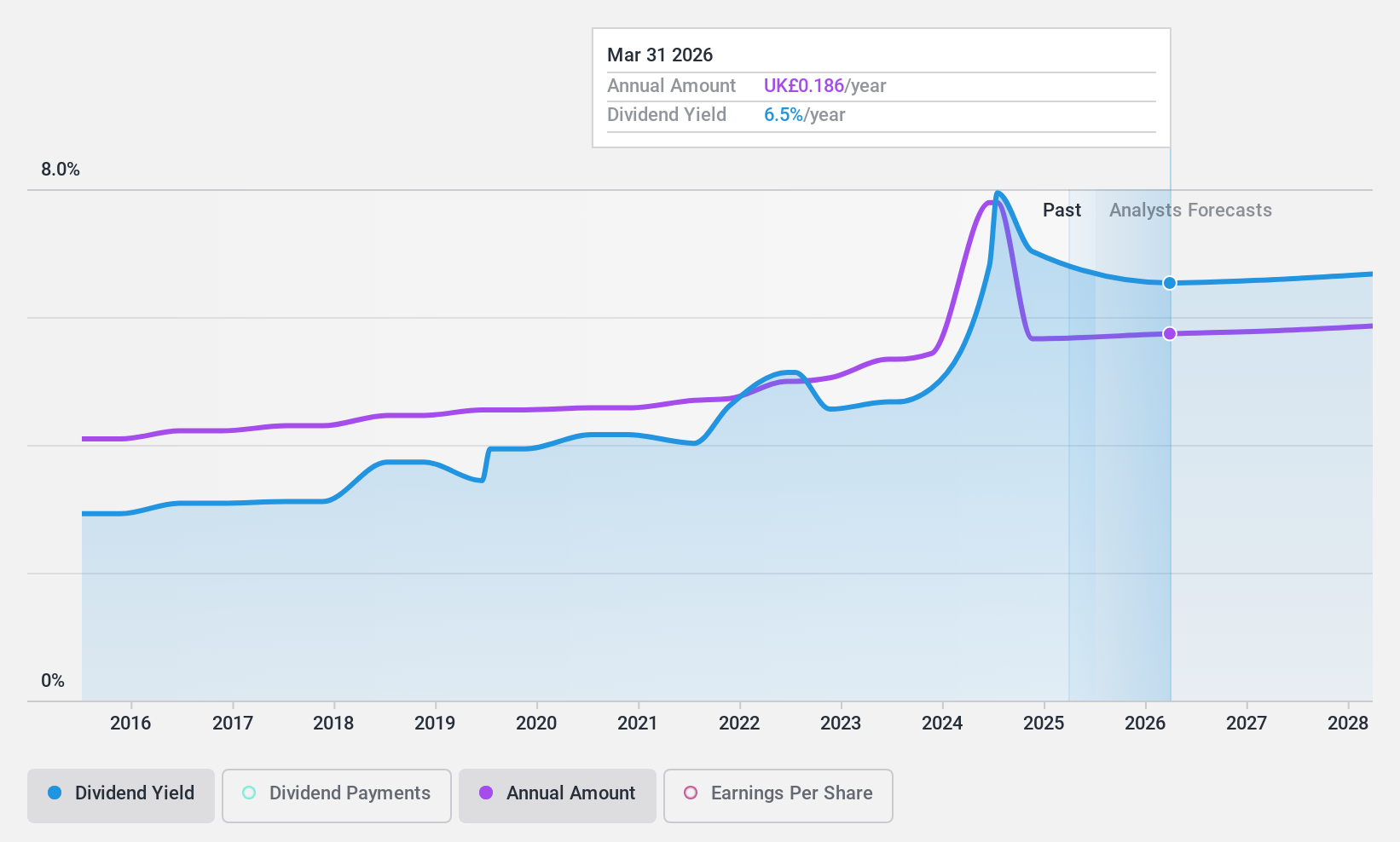

Dividend Yield: 8.4%

Castings offers a compelling dividend yield at 8.36%, placing it in the top 25% of UK dividend payers. The company's dividends have been stable and growing over the past decade, though they are not well covered by free cash flows, with a high cash payout ratio of 100.4%. Despite this, earnings grew by 21.3% last year, although they are forecasted to decline by an average of 11.5% annually over the next three years.

- Click here to discover the nuances of Castings with our detailed analytical dividend report.

- Our valuation report unveils the possibility Castings' shares may be trading at a discount.

Kingfisher (LSE:KGF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kingfisher plc, with a market cap of £5.12 billion, supplies home improvement products and services primarily in the United Kingdom, Ireland, France, and internationally through its subsidiaries.

Operations: Kingfisher plc generates £12.98 billion in revenue from the supply of home improvement products and services.

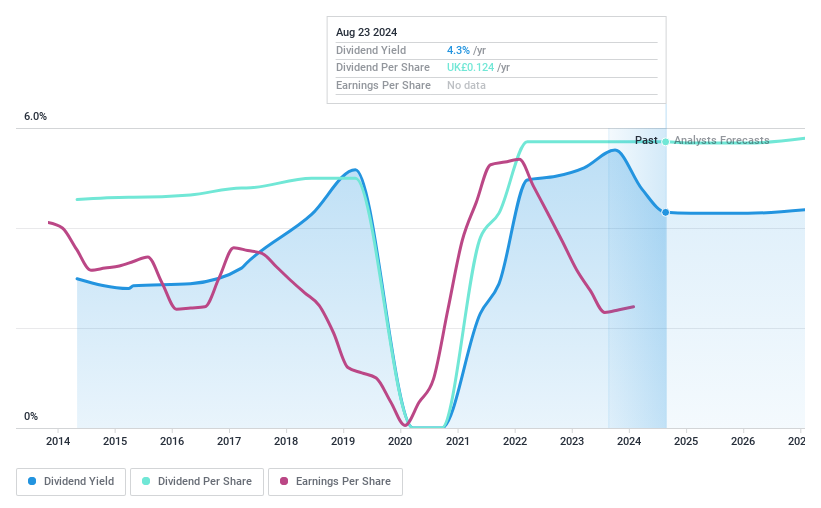

Dividend Yield: 4.4%

Kingfisher's dividend payments are covered by earnings (68.2% payout ratio) and cash flows (23.7% cash payout ratio), indicating sustainability. However, the dividend yield of 4.43% is below the UK market's top 25%. Over the past decade, dividends have increased but have been volatile and unreliable at times. The stock trades at a good value with a P/E ratio of 14.8x versus the market's 16.5x, supported by expected annual earnings growth of 11.78%.

- Click to explore a detailed breakdown of our findings in Kingfisher's dividend report.

- Our valuation report here indicates Kingfisher may be undervalued.

Plus500 (LSE:PLUS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Plus500 Ltd. is a fintech company that operates technology-based trading platforms across Europe, the United Kingdom, Australia, and internationally, with a market cap of £1.91 billion.

Operations: Plus500 Ltd. generates $750.80 million from its CFD Trading segment.

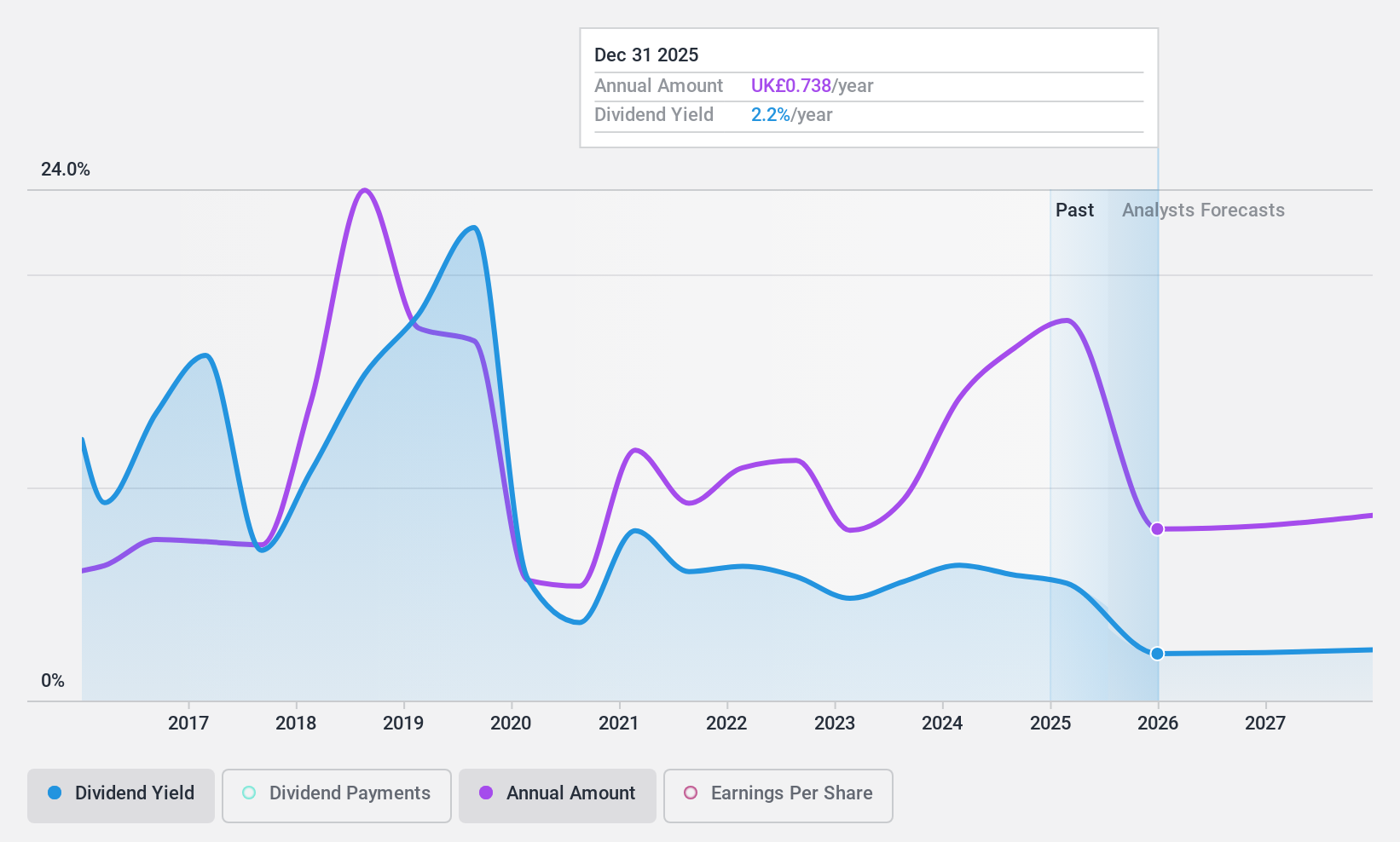

Dividend Yield: 5.8%

Plus500's dividend payments are well covered by earnings (24.9% payout ratio) and cash flows (37.3% cash payout ratio), suggesting sustainability despite a volatile history over the past decade. The stock offers a high yield of 5.84%, placing it in the top 25% of UK dividend payers. Recent buybacks, including $100 million completed by August 2024, reflect management's confidence in financial stability and future shareholder returns, bolstered by solid earnings growth and revenue increases.

- Take a closer look at Plus500's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Plus500 is priced lower than what may be justified by its financials.

Summing It All Up

- Gain an insight into the universe of 58 Top UK Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CGS

Castings

Engages in the iron casting and machining activities in the United Kingdom, Germany, Sweden, the Netherlands, rest of Europe, North and South America, and internationally.

Flawless balance sheet, undervalued and pays a dividend.