- United Kingdom

- /

- Commercial Services

- /

- LSE:MTO

January 2025's Undervalued Small Caps With Insider Action On UK Markets

Reviewed by Simply Wall St

Amidst the backdrop of a faltering FTSE 100 and sluggish global cues, particularly from China, the UK market is navigating through a period of uncertainty with key indices reflecting these challenges. As larger companies grapple with external pressures, small-cap stocks may present unique opportunities for investors seeking potential growth in undervalued segments. In this environment, identifying small-cap stocks that exhibit strong fundamentals and insider activity can be crucial for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| NCC Group | NA | 1.3x | 27.76% | ★★★★★★ |

| 4imprint Group | 15.9x | 1.3x | 38.51% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 35.04% | ★★★★★☆ |

| Robert Walters | 34.5x | 0.2x | 30.71% | ★★★★☆☆ |

| Sabre Insurance Group | 11.3x | 1.5x | 12.65% | ★★★★☆☆ |

| iomart Group | 24.2x | 0.6x | 33.77% | ★★★★☆☆ |

| XPS Pensions Group | 11.3x | 3.2x | 6.02% | ★★★☆☆☆ |

| Telecom Plus | 18.0x | 0.7x | 30.43% | ★★★☆☆☆ |

| Warpaint London | 24.2x | 4.2x | 0.88% | ★★★☆☆☆ |

| THG | NA | 0.3x | -519.29% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

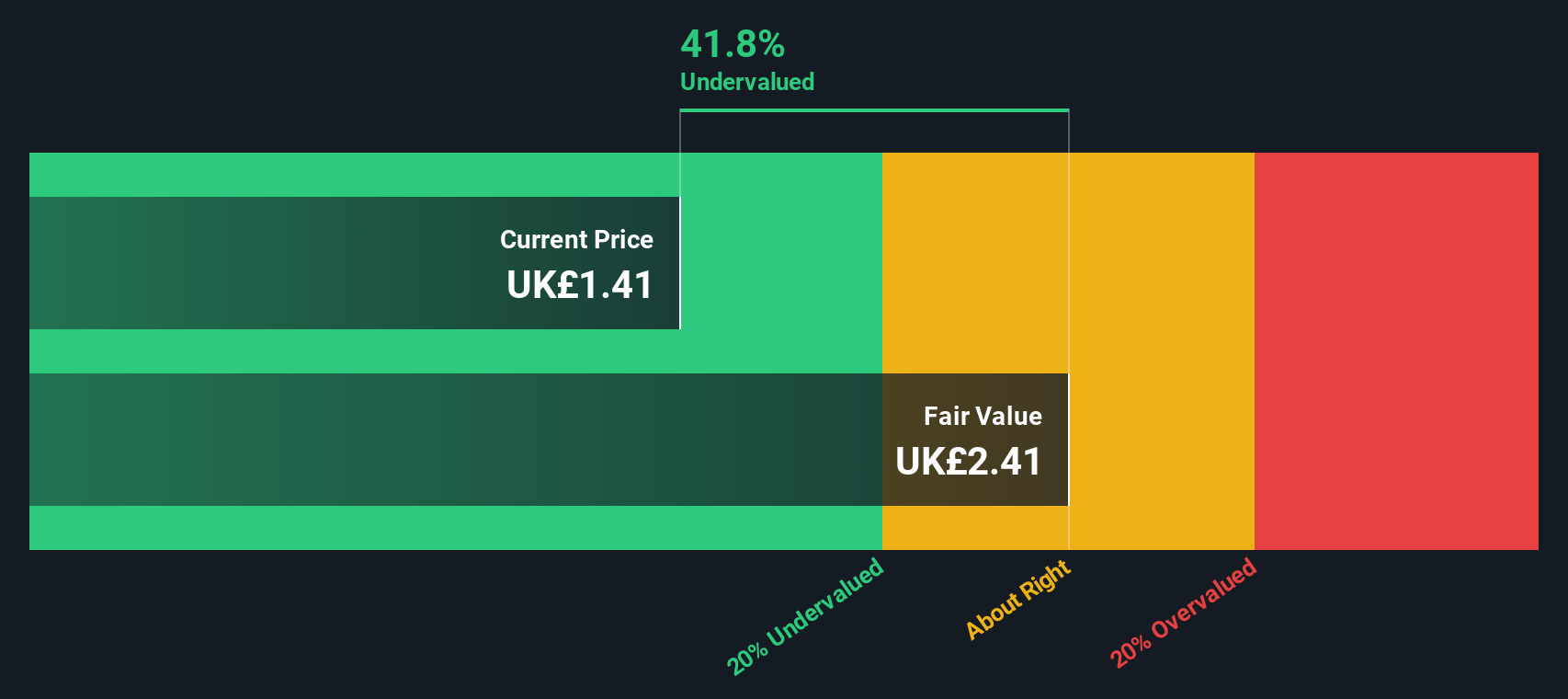

Card Factory (LSE:CARD)

Simply Wall St Value Rating: ★★★★★★

Overview: Card Factory is a UK-based retailer specializing in greeting cards, gifts, and party products through its extensive network of physical stores and online platforms, with a market cap of approximately £0.40 billion.

Operations: The primary revenue stream is from Cardfactory Stores, generating £491.90 million, followed by smaller contributions from Cardfactory Online and Partnerships. The gross profit margin has shown a notable trend, peaking at 37.98% in early 2019 before fluctuating and settling around 36.22% by late 2023.

PE: 8.2x

Card Factory, a smaller company in the UK market, is attracting attention due to insider confidence with notable share purchases over the past year. Their total sales reached £506.6 million for the eleven months ending December 2024, marking a 6.2% increase from the previous year despite tough conditions in non-food retail. With earnings projected to grow at 13% annually, Card Factory's reliance on external borrowing poses some risk but also underscores its potential for growth amidst industry challenges.

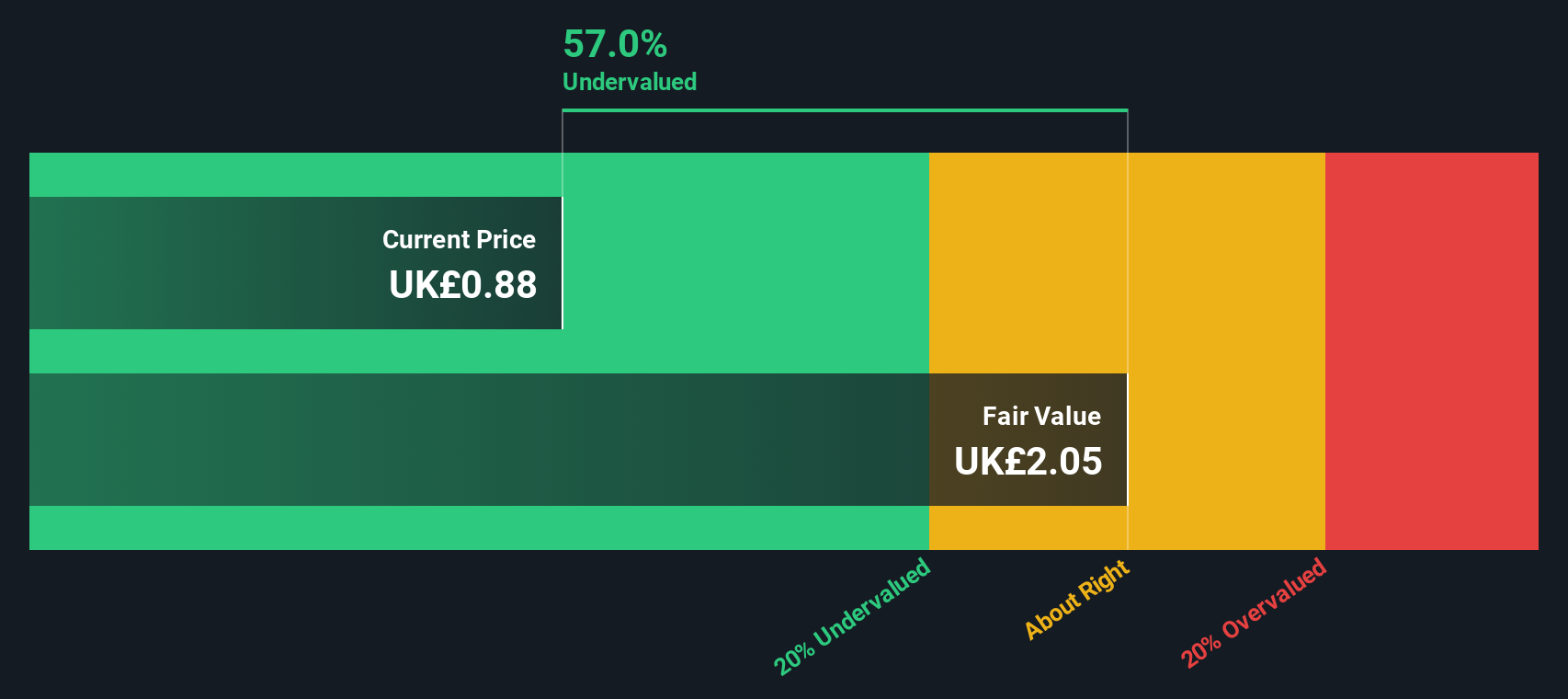

Mitie Group (LSE:MTO)

Simply Wall St Value Rating: ★★★★★★

Overview: Mitie Group is a UK-based facilities management and professional services company with operations spanning communities, business services, and technical services, holding a market capitalization of £1.22 billion.

Operations: The company's revenue streams are primarily derived from Business Services, Technical Services, and Communities segments. Over recent periods, the net income margin shows an upward trend, reaching 2.52% by September 2024. Operating expenses and non-operating expenses are significant cost components impacting profitability.

PE: 11.6x

Mitie, a UK-based company, has been drawing attention with its insider confidence as Phil Bentley acquired 200,000 shares for £217,180 in October 2024. The firm forecasts mid-to-high single-digit revenue growth for the second half of 2024 and aims to reach nearly £5 billion in annual revenue. Despite a slight dip in net income compared to last year, Mitie remains on track with its earnings guidance through 2025. Additionally, the company completed a significant share repurchase of 45.2 million shares for £54.6 million by September 2024. With an interim dividend set at one-third of the prior year's total dividend and a focus on exceeding incremental revenue targets by fiscal year-end 2027, Mitie's strategic moves signal potential growth amidst external borrowing risks.

- Take a closer look at Mitie Group's potential here in our valuation report.

Assess Mitie Group's past performance with our detailed historical performance reports.

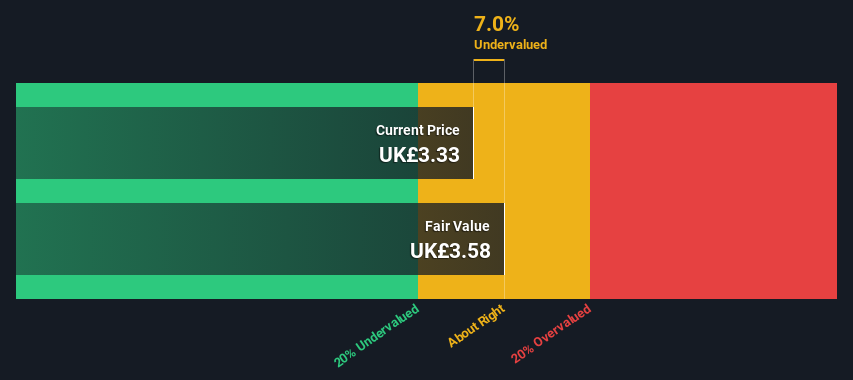

XPS Pensions Group (LSE:XPS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: XPS Pensions Group provides pension and employee benefit solutions, with a focus on consulting services, and has a market capitalization of approximately £0.42 billion.

Operations: The company's revenue primarily comes from Pension and Employee Benefit Solutions, with recent figures reaching £218.34 million. Over time, the gross profit margin has shown variability, currently standing at 44.88%. Operating expenses have been a significant part of the cost structure, recently recorded at £56.13 million. Net income margins have experienced fluctuations but show an improvement to 28.28% in the latest period.

PE: 11.3x

XPS Pensions Group, a small player in the UK market, has shown promising financial growth with sales reaching £113.41 million for the half year ending September 2024, up from £94.51 million previously. Net income also improved to £13.04 million from £5.47 million a year ago, indicating strong operational performance despite reliance on external borrowing for funding. Insider confidence is evident as insiders have been purchasing shares recently, suggesting belief in future prospects despite expected earnings decline over the next three years by 15% annually.

- Navigate through the intricacies of XPS Pensions Group with our comprehensive valuation report here.

Where To Now?

- Get an in-depth perspective on all 36 Undervalued UK Small Caps With Insider Buying by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MTO

Mitie Group

Provides facilities management and professional services in the United Kingdom and internationally.

Very undervalued with solid track record.