We wouldn't blame ASOS Plc (LON:ASC) shareholders if they were a little worried about the fact that Nicholas Robertson, the Founder & Non-Executive Director recently netted about UK£1.0m selling shares at an average price of UK£4.01. However, it's crucial to note that they remain very much invested in the stock and that sale only reduced their holding by 8.7%.

See our latest analysis for ASOS

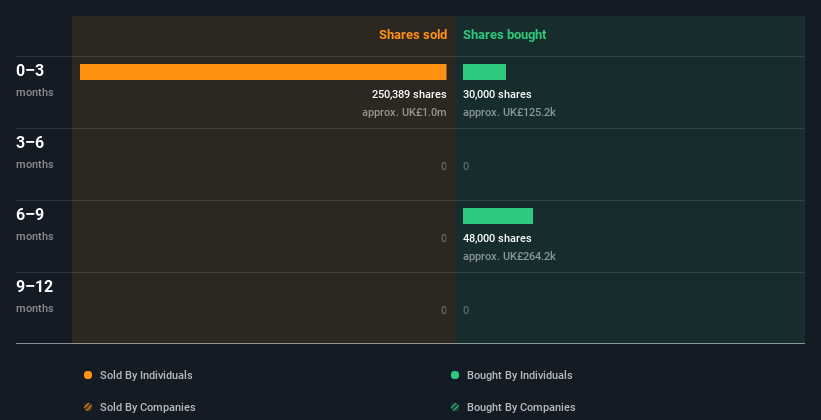

ASOS Insider Transactions Over The Last Year

In fact, the recent sale by Nicholas Robertson was the biggest sale of ASOS shares made by an insider individual in the last twelve months, according to our records. So we know that an insider sold shares at around the present share price of UK£3.83. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. Given that the sale took place at around current prices, it makes us a little cautious but is hardly a major concern.

In the last twelve months insiders purchased 78.00k shares for UK£389k. On the other hand they divested 250.39k shares, for UK£1.0m. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insider Ownership Of ASOS

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Insiders own 2.4% of ASOS shares, worth about UK£11m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Does This Data Suggest About ASOS Insiders?

The insider sales have outweighed the insider buying, at ASOS, in the last three months. And our longer term analysis of insider transactions didn't bring confidence, either. Insiders own shares, but we're still pretty cautious, given the history of sales. We'd practice some caution before buying! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing ASOS. When we did our research, we found 4 warning signs for ASOS (2 are concerning!) that we believe deserve your full attention.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ASC

ASOS

Operates as an online fashion retailer in the United Kingdom, the European Union, the United States, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026