- United Kingdom

- /

- Consumer Durables

- /

- LSE:BOOT

UK Penny Stocks: ITM Power And 2 Other Companies To Watch

Reviewed by Simply Wall St

The UK stock market has recently experienced a downturn, with the FTSE 100 index closing lower due to weak trade data from China, highlighting ongoing global economic challenges. In such fluctuating conditions, investors often seek out stocks that offer potential value and growth opportunities. Penny stocks, though an older term, still represent smaller or less-established companies that can provide significant returns when backed by strong financials. This article will explore three promising penny stocks in the UK market, including ITM Power, which may offer stability and upside potential for investors looking to tap into under-the-radar opportunities.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.59 | £516.12M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.00 | £164M | ✅ 4 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.075 | £14.72M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.16 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.5375 | $313.92M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.52 | £262.74M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.40 | £120.64M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.45 | £70.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.075 | £175.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.70 | £9.64M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

ITM Power (AIM:ITM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ITM Power Plc designs and manufactures proton exchange membrane (PEM) electrolysers for hydrogen production, operating in the UK, Germany, Europe, the US, Australia, and internationally with a market cap of £481.55 million.

Operations: The company's revenue is primarily derived from its Electric Equipment segment, totaling £26.04 million.

Market Cap: £481.55M

ITM Power, with a market cap of £481.55 million, operates in the green hydrogen sector and has shown significant commercial traction with its NEPTUNE V units. Recent agreements, such as the 150MW capacity reservation with RWE and a supply agreement for the West Wales Hydrogen project, highlight growing demand for ITM's technology. Despite being unprofitable and experiencing increased losses over five years, ITM remains debt-free with substantial short-term assets exceeding liabilities. Revenue is forecast to grow significantly, supported by an order backlog and strategic partnerships. However, high share price volatility persists amidst these developments.

- Click here and access our complete financial health analysis report to understand the dynamics of ITM Power.

- Learn about ITM Power's future growth trajectory here.

AO World (LSE:AO.)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AO World plc, along with its subsidiaries, operates as an online retailer of domestic appliances and ancillary services in the United Kingdom and Germany, with a market cap of £541.76 million.

Operations: The company generates revenue of £1.14 billion from its online retailing of domestic appliances and ancillary services.

Market Cap: £541.76M

AO World, with a market cap of £541.76 million, operates in the online retail space for domestic appliances and has seen its debt-to-equity ratio significantly decrease from 31.9% to 1.3% over five years. Despite recent negative earnings growth and reduced profit margins, AO's debt is well covered by operating cash flow, indicating strong financial management. The company forecasts a 36% annual earnings growth and expects group revenue to rise by 13% year on year for the period ending September 2025. Recent board changes include appointing Sophie Tomkins as an Independent Non-Executive Director, enhancing governance with her extensive experience.

- Get an in-depth perspective on AO World's performance by reading our balance sheet health report here.

- Understand AO World's earnings outlook by examining our growth report.

Henry Boot (LSE:BOOT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Henry Boot PLC operates in the United Kingdom, focusing on property investment and development, land promotion, and construction activities, with a market cap of £292.95 million.

Operations: The company's revenue is primarily derived from property investment and development (£180.58 million), land promotion (£96.95 million), and construction activities (£78.70 million).

Market Cap: £292.95M

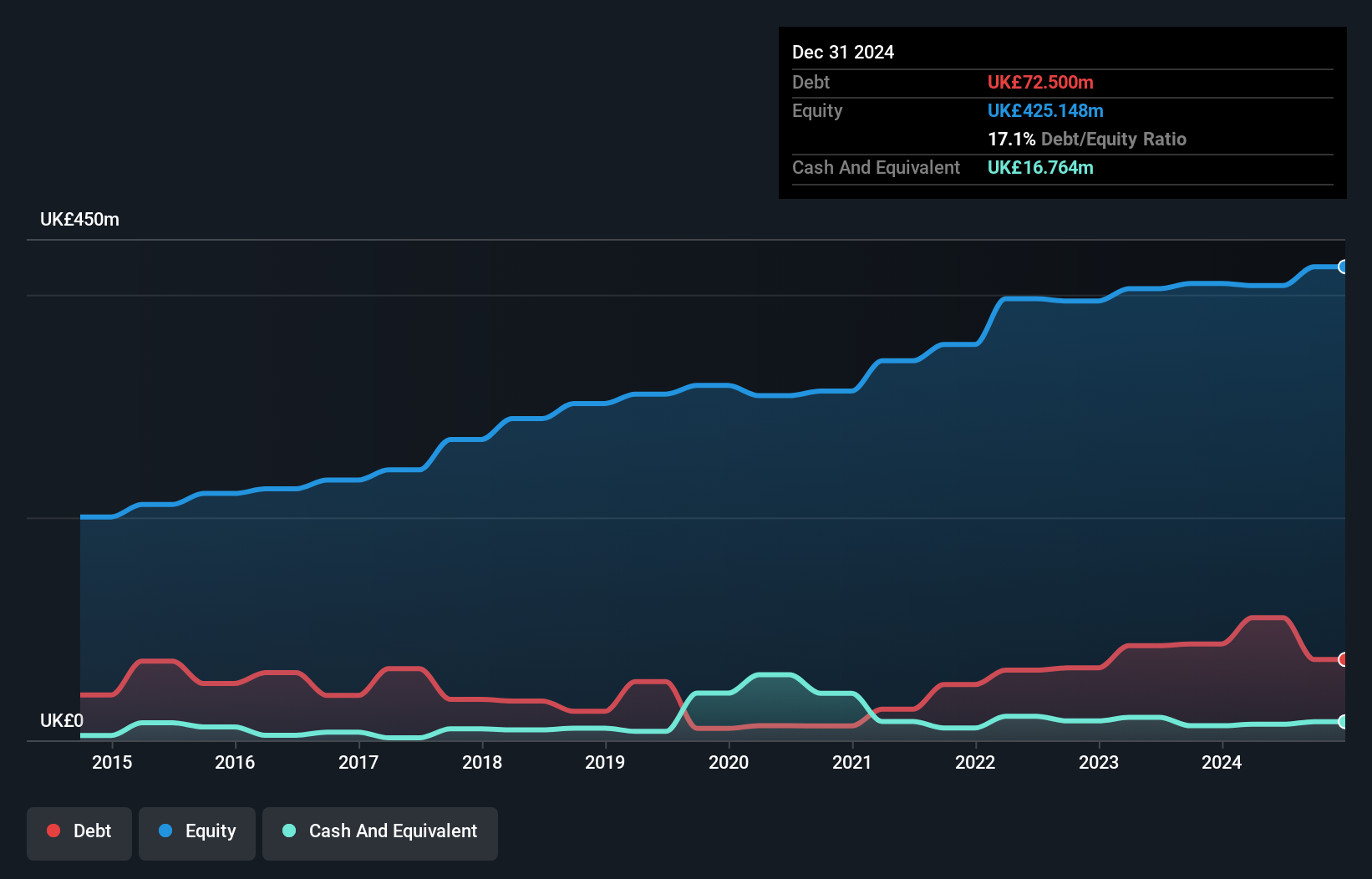

Henry Boot PLC, with a market cap of £292.95 million, demonstrates financial stability in the property investment and development sector. Its debt is well managed, covered by operating cash flow at 24%, and interest payments are comfortably met with EBIT coverage of 7.8 times. The company's recent earnings growth of 130.1% surpasses its five-year average decline, indicating a positive turnaround in profitability. Despite a low return on equity at 6.4%, Henry Boot's strategic projects like the Duxford AvTech campus and residential developments in Tamworth and Fareham highlight its capacity for significant future contributions to regional economies and sustainability efforts.

- Navigate through the intricacies of Henry Boot with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Henry Boot's future.

Key Takeaways

- Embark on your investment journey to our 295 UK Penny Stocks selection here.

- Searching for a Fresh Perspective? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henry Boot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BOOT

Henry Boot

Engages in the property investment and development, land promotion, and construction activities in the United Kingdom.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives