- United Kingdom

- /

- Software

- /

- AIM:QTX

Quartix Technologies And 2 Other UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices both experiencing declines due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, investors may find opportunities in penny stocks—smaller or newer companies that can offer growth potential at a lower cost. By focusing on those with strong financials and clear growth paths, investors might uncover promising opportunities within this niche segment of the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.59 | £290.03M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.63 | £412.97M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £2.925 | £290.91M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.21M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.245 | £409.2M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.846 | £71.81M | ★★★★★★ |

| Croma Security Solutions Group (AIM:CSSG) | £0.865 | £11.88M | ★★★★★★ |

| Van Elle Holdings (AIM:VANL) | £0.392 | £42.41M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.378 | £212.53M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.16 | £154.1M | ★★★★★☆ |

Click here to see the full list of 442 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Quartix Technologies (AIM:QTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Quartix Technologies plc specializes in the design, development, marketing, and delivery of vehicle telematics services across the United Kingdom, France, the United States, and European Territories with a market capitalization of £92.43 million.

Operations: There are no specific revenue segments reported for Quartix Technologies plc.

Market Cap: £92.43M

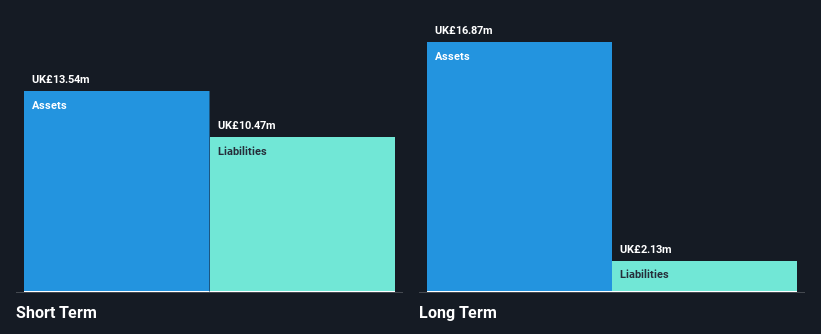

Quartix Technologies plc, with a market cap of £92.43 million, has shown significant financial improvement by becoming profitable in the past year, reporting sales of £32.4 million and net income of £4.77 million for 2024. The company is debt-free, with short-term assets exceeding both short and long-term liabilities, indicating strong liquidity. Despite a relatively inexperienced management team and board with an average tenure of 1.4 years, Quartix offers high-quality earnings and a strong return on equity at 24.3%. Recent dividend increases further highlight its commitment to returning value to shareholders amidst stable yet volatile share price performance.

- Unlock comprehensive insights into our analysis of Quartix Technologies stock in this financial health report.

- Gain insights into Quartix Technologies' outlook and expected performance with our report on the company's earnings estimates.

Vertu Motors (AIM:VTU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vertu Motors plc is an automotive retailer in the United Kingdom with a market cap of £173.51 million.

Operations: The company generates revenue primarily from its Retail - Gasoline & Auto Dealers segment, which amounts to £4.79 billion.

Market Cap: £173.51M

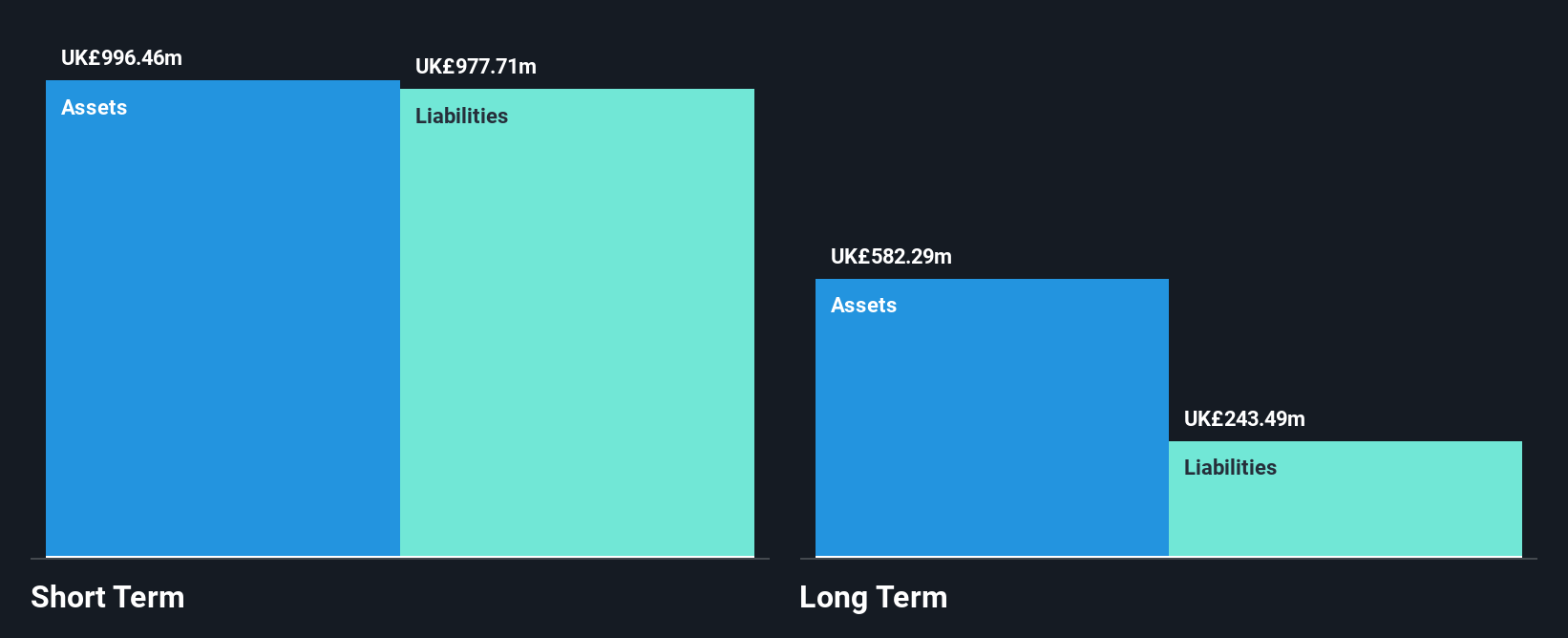

Vertu Motors, with a market cap of £173.51 million, operates in the automotive retail sector and generates substantial revenue of £4.79 billion. The company has experienced a rise in its debt-to-equity ratio over the past five years but maintains satisfactory net debt levels relative to equity at 23.1%. Despite recent negative earnings growth and lower profit margins compared to last year, Vertu's short-term assets comfortably cover both short and long-term liabilities, indicating solid financial stability. A recent share buyback program worth up to £12 million aims to reduce share capital using existing cash resources, potentially enhancing shareholder value.

- Take a closer look at Vertu Motors' potential here in our financial health report.

- Examine Vertu Motors' earnings growth report to understand how analysts expect it to perform.

Water Intelligence (AIM:WATR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Water Intelligence plc, with a market cap of £65.58 million, offers leak detection and remediation services for both potable and non-potable water across the United States, the United Kingdom, Australia, Canada, and other international markets.

Operations: The company's revenue is derived from Franchise Royalty Income ($6.66 million), Franchise Related Activities ($10.83 million), US Corporate Operated Locations ($53.53 million), and International Corporate Operated Locations ($7.80 million).

Market Cap: £65.58M

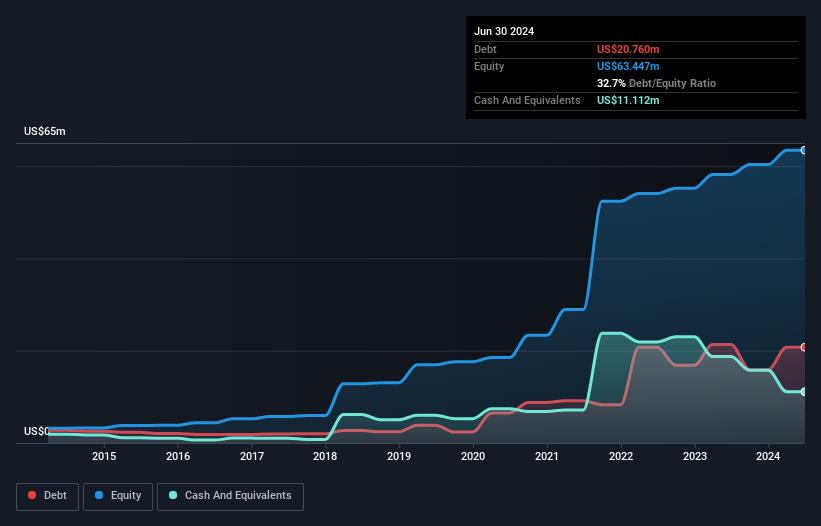

Water Intelligence plc, with a market cap of £65.58 million, has shown consistent earnings growth at 15.9% annually over the past five years and accelerated to 20.7% last year, though it did not outperform its industry peers. The company maintains high-quality earnings and covers debt well with operating cash flow at 61.6%. Its short-term assets exceed both short- and long-term liabilities, indicating solid financial footing despite an increased debt-to-equity ratio from 22.8% to 32.7%. Trading significantly below estimated fair value suggests potential for price appreciation while maintaining stable weekly volatility at 3%.

- Dive into the specifics of Water Intelligence here with our thorough balance sheet health report.

- Evaluate Water Intelligence's prospects by accessing our earnings growth report.

Key Takeaways

- Click here to access our complete index of 442 UK Penny Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quartix Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:QTX

Quartix Technologies

Engages in the design, development, marketing, and delivery of vehicle telematics services in the United Kingdom, France, the United States, and the European Territories.

Flawless balance sheet and good value.