- United Kingdom

- /

- Medical Equipment

- /

- AIM:SPEC

3 Promising Penny Stocks On UK Exchange In January 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market fluctuations, penny stocks—often smaller or newer companies—can still present compelling opportunities for investors. By focusing on those with strong financial foundations and growth potential, these stocks may offer both stability and upside in uncertain times.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £5.00 | £481.98M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.972 | £153.33M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.68 | £420.17M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.045 | £770.58M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.415 | £180.2M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.505 | £348.59M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.90 | £186M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.05 | £89.71M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.02 | £144.11M | ★★★★★☆ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Angling Direct (AIM:ANG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Angling Direct PLC, with a market cap of £31.68 million, operates in the sale of fishing tackle products and equipment across the United Kingdom, Europe, and internationally.

Operations: The company's revenue is derived from its UK-based stores (£46.48 million), online sales within the UK (£33.39 million), and operations in Europe (£4.29 million).

Market Cap: £31.68M

Angling Direct PLC, with a market cap of £31.68 million, is engaging in a £4 million share buyback program to utilize surplus capital. The company has demonstrated strong financial health, being debt-free and maintaining stable weekly volatility. Its earnings have grown significantly by 66.1% over the past year, outpacing the Specialty Retail industry average and marking consistent profitability growth over five years at 19.8% annually. Despite trading at a significant discount to its estimated fair value, Angling Direct's return on equity remains low at 4.1%. The management team and board are experienced with average tenures of 4.7 and 3.9 years respectively.

- Click here to discover the nuances of Angling Direct with our detailed analytical financial health report.

- Learn about Angling Direct's future growth trajectory here.

Condor Gold (AIM:CNR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Condor Gold Plc is a gold exploration and development company operating in the United Kingdom and Nicaragua, with a market capitalization of £65.83 million.

Operations: No revenue segments are reported for this company.

Market Cap: £65.83M

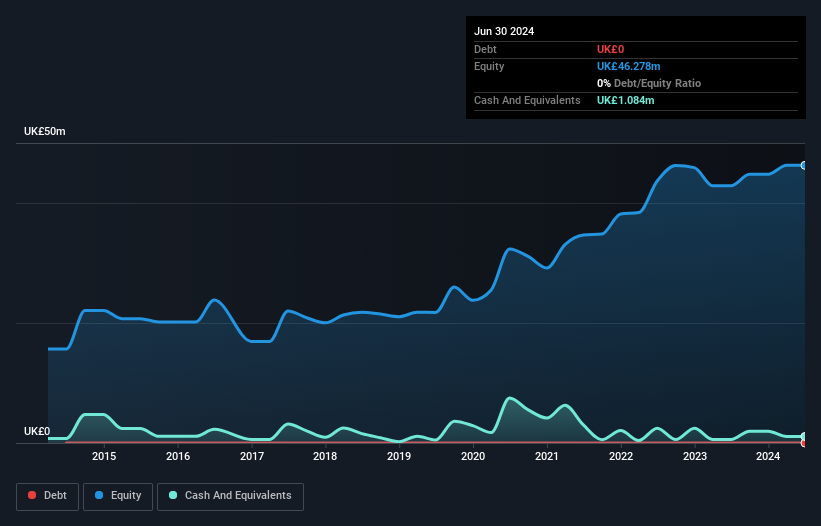

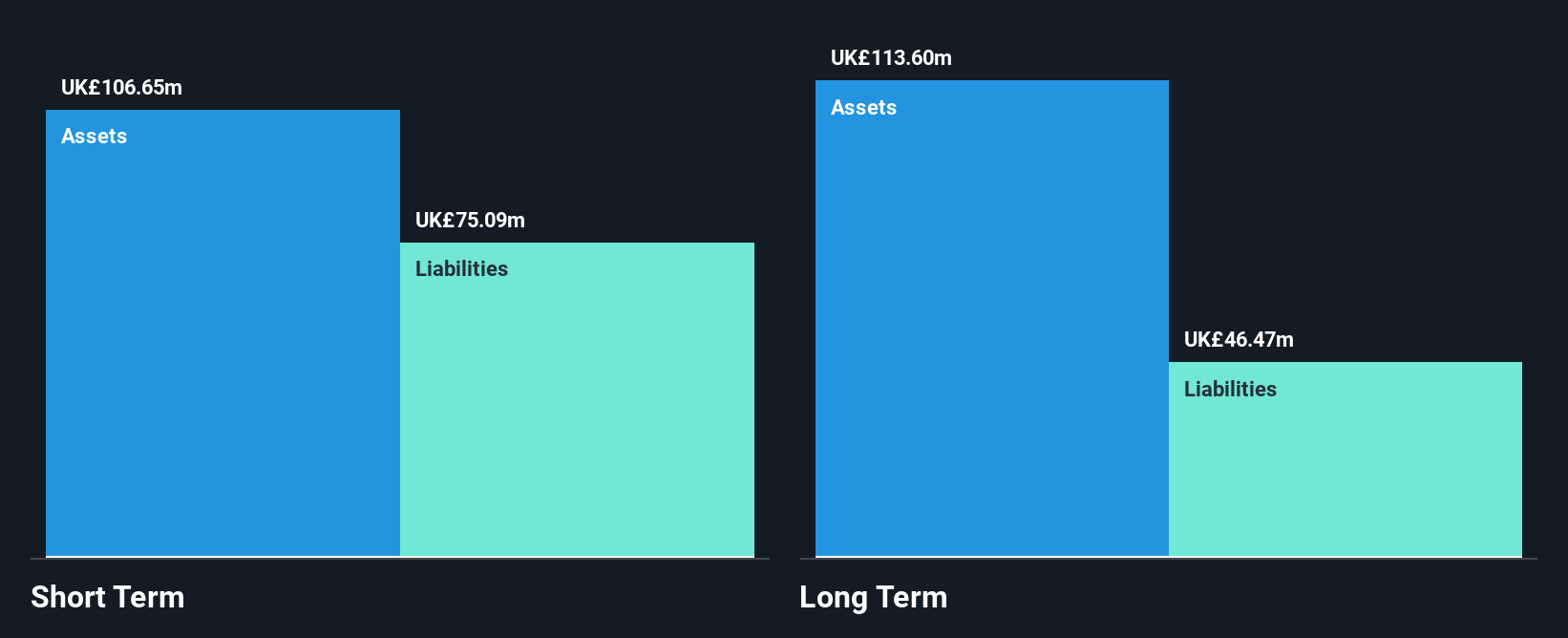

Condor Gold Plc, with a market cap of £65.83 million, is pre-revenue and has recently undergone significant changes due to its acquisition by Metals Exploration. The company's shares were delisted from AIM and the Toronto Stock Exchange following the completion of this acquisition. Despite being debt-free and having short-term assets significantly exceeding liabilities, Condor Gold faces financial challenges with less than a year of cash runway based on current free cash flow. The company remains unprofitable with increasing losses over five years and exhibits high share price volatility compared to most UK stocks.

- Jump into the full analysis health report here for a deeper understanding of Condor Gold.

- Examine Condor Gold's past performance report to understand how it has performed in prior years.

INSPECS Group (AIM:SPEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: INSPECS Group plc is a global company that designs, produces, sells, markets, and distributes fashion eyewear, lenses, and OEM products with a market cap of £42.70 million.

Operations: The company's revenue is primarily derived from Frames and Optics (£174.94 million), Manufacturing (£21.12 million), and Lenses (£4.92 million).

Market Cap: £42.7M

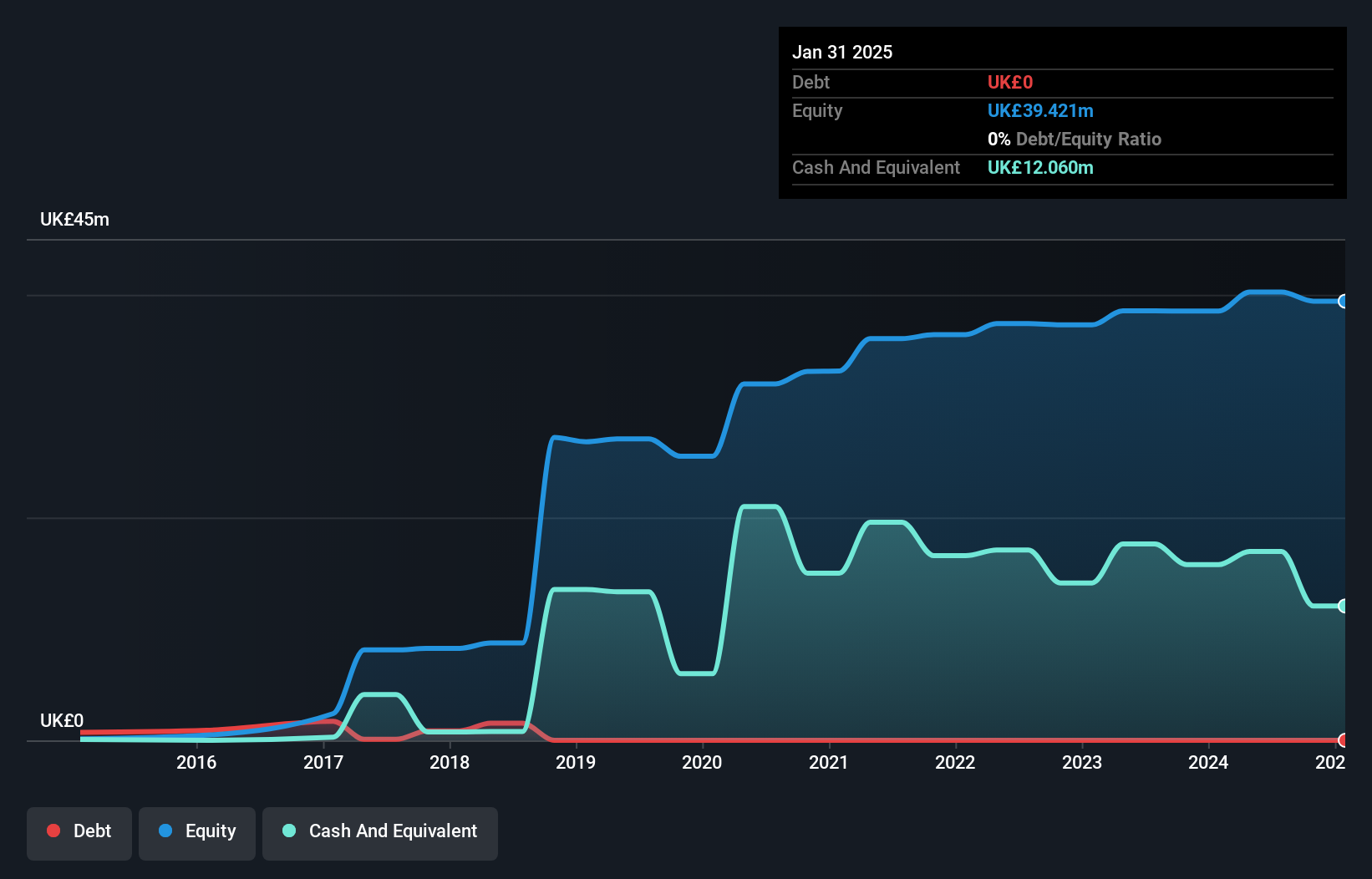

INSPECS Group plc, with a market cap of £42.70 million, is navigating its unprofitable status by maintaining a positive free cash flow and sufficient cash runway for over three years. The company recently provided earnings guidance for 2024, expecting revenues around £197 million. Despite not being forecast to achieve profitability in the next three years, INSPECS has reduced its debt-to-equity ratio from 69.3% to 43.6% over five years and maintains satisfactory net debt levels at 19.4%. The management and board are experienced, with average tenures of 4.7 and 5 years respectively, supporting stability amid leadership changes as Robin Totterman plans to step down as Executive Chair in 2025.

- Unlock comprehensive insights into our analysis of INSPECS Group stock in this financial health report.

- Review our growth performance report to gain insights into INSPECS Group's future.

Summing It All Up

- Get an in-depth perspective on all 445 UK Penny Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SPEC

INSPECS Group

Designs, produces, sells, markets, and distributes fashion eyewear, lenses, and OEM products worldwide.

Flawless balance sheet and undervalued.