- United Kingdom

- /

- Luxury

- /

- LSE:COA

Coats Group And 2 Other UK Undervalued Small Caps With Recent Insider Buying

Reviewed by Simply Wall St

The United Kingdom's stock market has been experiencing some turbulence, with the FTSE 100 and FTSE 250 indices both closing lower due to weak trade data from China, highlighting concerns about global economic recovery. In such a volatile environment, investors often seek opportunities in small-cap stocks that may be undervalued yet possess potential for growth, especially when there is recent insider buying indicating confidence in the company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| 4imprint Group | 15.1x | 1.2x | 41.78% | ★★★★★☆ |

| NCC Group | NA | 1.4x | 36.03% | ★★★★★☆ |

| Headlam Group | NA | 0.2x | 35.84% | ★★★★★☆ |

| iomart Group | 24.1x | 0.6x | 33.99% | ★★★★☆☆ |

| Sabre Insurance Group | 11.9x | 1.6x | 7.70% | ★★★★☆☆ |

| Optima Health | NA | 1.2x | 48.95% | ★★★★☆☆ |

| Telecom Plus | 18.0x | 0.7x | 30.29% | ★★★☆☆☆ |

| Treatt | 20.5x | 1.9x | 46.15% | ★★★☆☆☆ |

| Gooch & Housego | 40.3x | 1.0x | 33.54% | ★★★☆☆☆ |

| THG | NA | 0.3x | -968.51% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

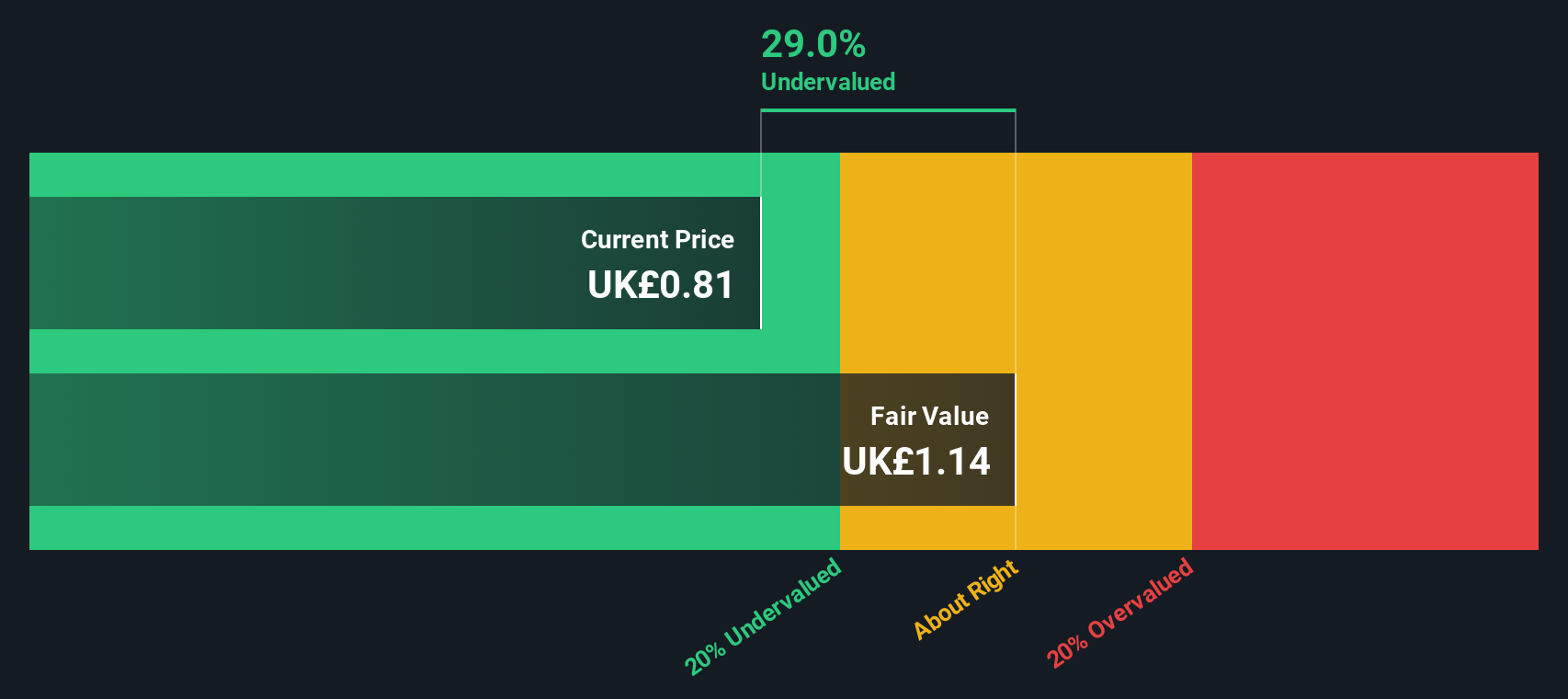

Coats Group (LSE:COA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Coats Group is a global industrial thread manufacturer specializing in apparel, footwear, and performance materials with a market cap of approximately £1.18 billion.

Operations: Coats Group generates revenue primarily from its Apparel, Footwear, and Performance Materials segments. The company experienced a notable trend in its net income margin, which improved from -0.021% in 2013 to 0.069% by mid-2024. Operating expenses are a significant component of costs, with General & Administrative and Sales & Marketing being key areas of expenditure.

PE: 18.7x

Coats Group, a smaller player in the UK market, recently showcased an 11% sales growth from July to October 2024, driven by strong performance in Footwear and Apparel. Despite its reliance on external borrowing for funding, the company maintains a solid financial position. Insider confidence is evident with recent share purchases over several months. With earnings projected to grow at 15% annually, Coats presents potential for future expansion amidst its current challenges.

- Click here and access our complete valuation analysis report to understand the dynamics of Coats Group.

Examine Coats Group's past performance report to understand how it has performed in the past.

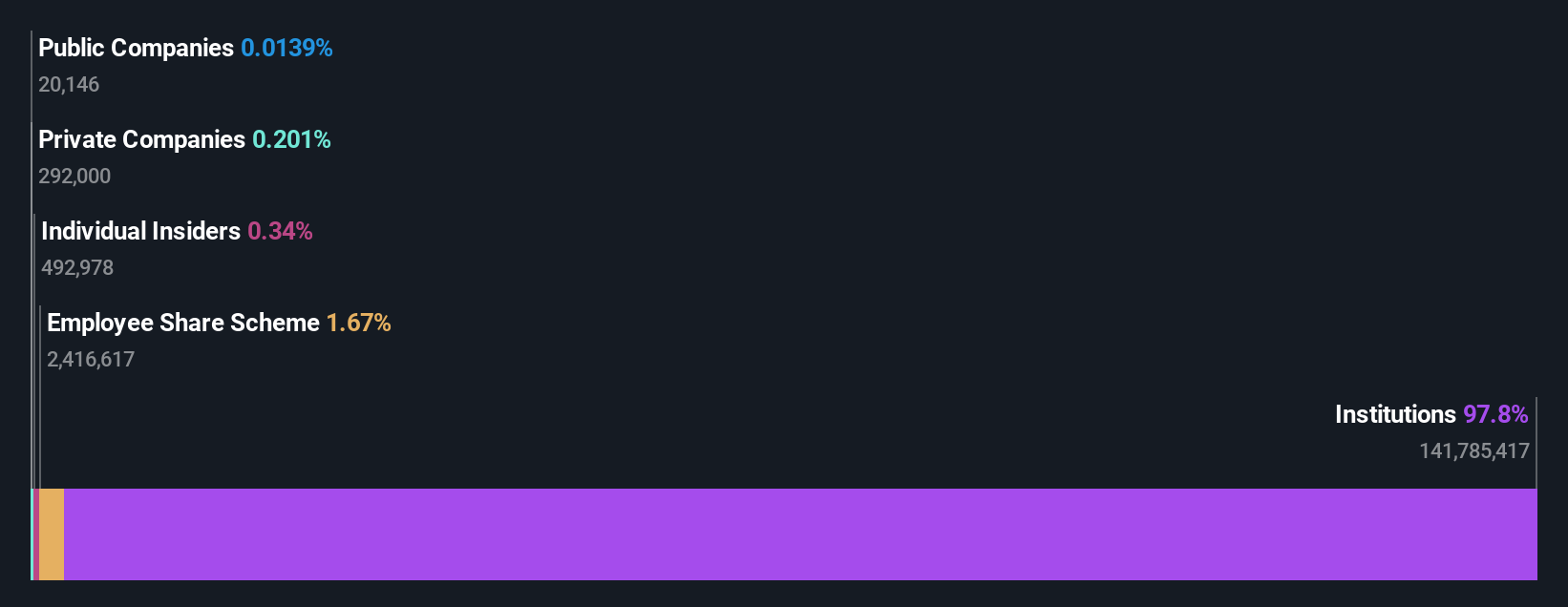

SThree (LSE:STEM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: SThree is a specialist staffing company focused on providing recruitment services in science, technology, engineering, and mathematics sectors across various regions including the USA, DACH, Rest of Europe, Middle East & Asia, and the Netherlands (including Spain), with a market capitalization of £1.19 billion.

Operations: SThree generates revenue primarily from its operations in DACH, Netherlands (including Spain), USA, and other regions. The company has experienced a decrease in gross profit margin from 30.83% to 24.91% over the analyzed periods, indicating changes in cost efficiency or pricing strategies. Operating expenses are a significant component of the company's cost structure, with general and administrative expenses being a major part of these costs.

PE: 6.3x

SThree, a UK-based recruitment firm, is navigating challenging waters with earnings projected to decline by 36.3% annually over the next three years. Despite its small size in the market, there's insider confidence as insiders have been purchasing shares recently. The company relies entirely on external borrowing for funding, which elevates risk levels compared to customer deposits. A potential £20 million share repurchase program is under consideration, reflecting management's belief in its intrinsic value amidst volatile share prices.

- Click here to discover the nuances of SThree with our detailed analytical valuation report.

Understand SThree's track record by examining our Past report.

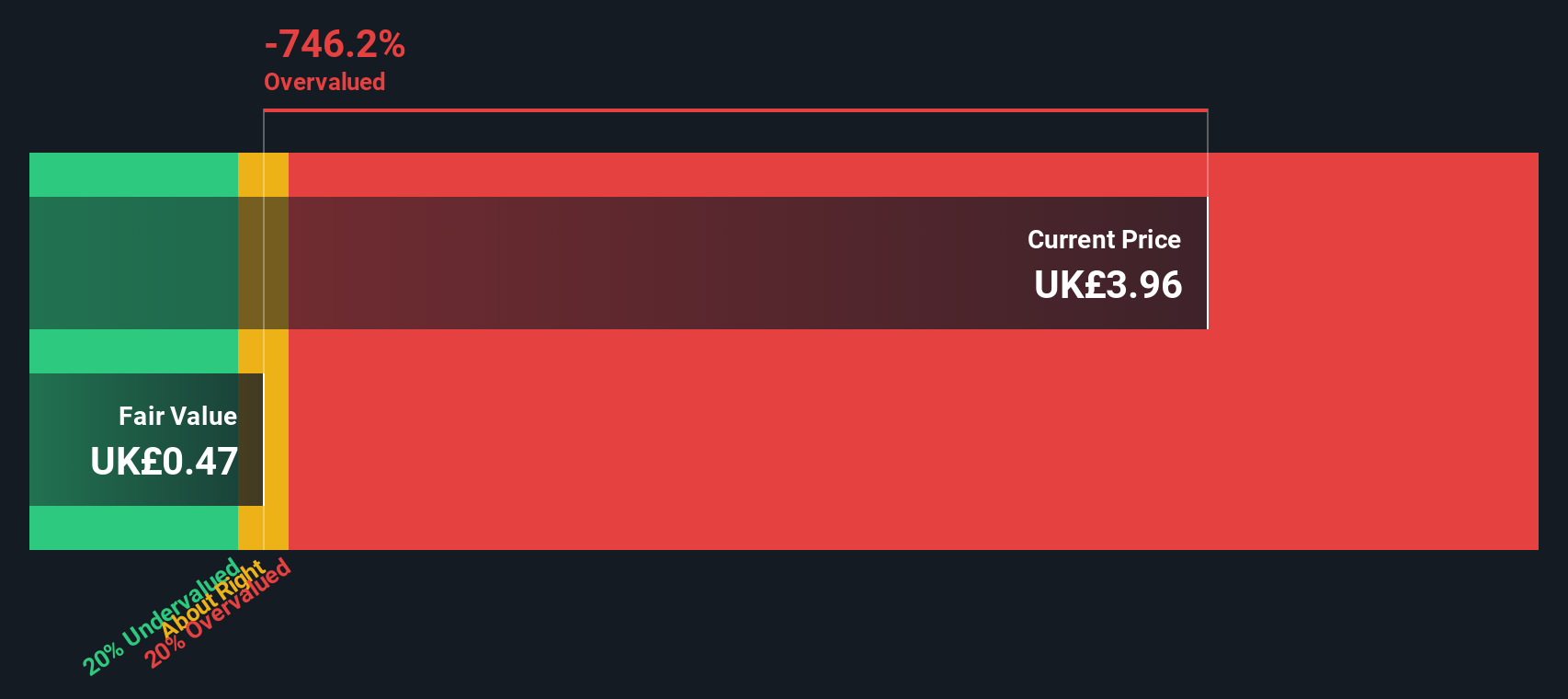

Workspace Group (LSE:WKP)

Simply Wall St Value Rating: ★★★★★★

Overview: Workspace Group is a company that provides business accommodation for rent and has a market capitalization of approximately £1.15 billion.

Operations: Workspace Group's revenue primarily comes from providing business accommodation for rent, with recent figures reaching £186 million. The company's gross profit margin has shown fluctuations, recently recorded at 67.58%. Operating expenses have varied over time, impacting net income significantly.

PE: -27.4x

Workspace Group, a dynamic player in the UK market, recently reported a turnaround with net income of £10.2 million for the half-year ending September 2024, contrasting sharply with a prior net loss of £147.9 million. This financial improvement is paired with insider confidence shown through share purchases earlier this year. The company has also embraced sustainability by opening Leroy House, its first fully net zero building, reflecting its commitment to environmental responsibility and innovative workspace solutions for small businesses in London.

- Take a closer look at Workspace Group's potential here in our valuation report.

Assess Workspace Group's past performance with our detailed historical performance reports.

Make It Happen

- Access the full spectrum of 35 Undervalued UK Small Caps With Insider Buying by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:COA

Coats Group

Manufactures and supplies industrial sewing threads worldwide.

Solid track record with excellent balance sheet.