- United Kingdom

- /

- Food

- /

- AIM:MPE

Exploring Three Undiscovered Gems in the United Kingdom Market

Reviewed by Simply Wall St

In the current climate, the United Kingdom's market has been experiencing volatility, with the FTSE 100 and FTSE 250 indices reflecting concerns over weak trade data from China and its impact on global economies. Amidst these challenges, investors are increasingly looking for stocks that demonstrate resilience and potential for growth despite broader economic pressures. In this context, exploring lesser-known companies in the UK market can reveal opportunities that are not immediately apparent but hold promise due to their unique positioning or innovative approaches.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MS INTERNATIONAL | NA | 13.42% | 56.55% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| FW Thorpe | 5.89% | 11.97% | 12.07% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

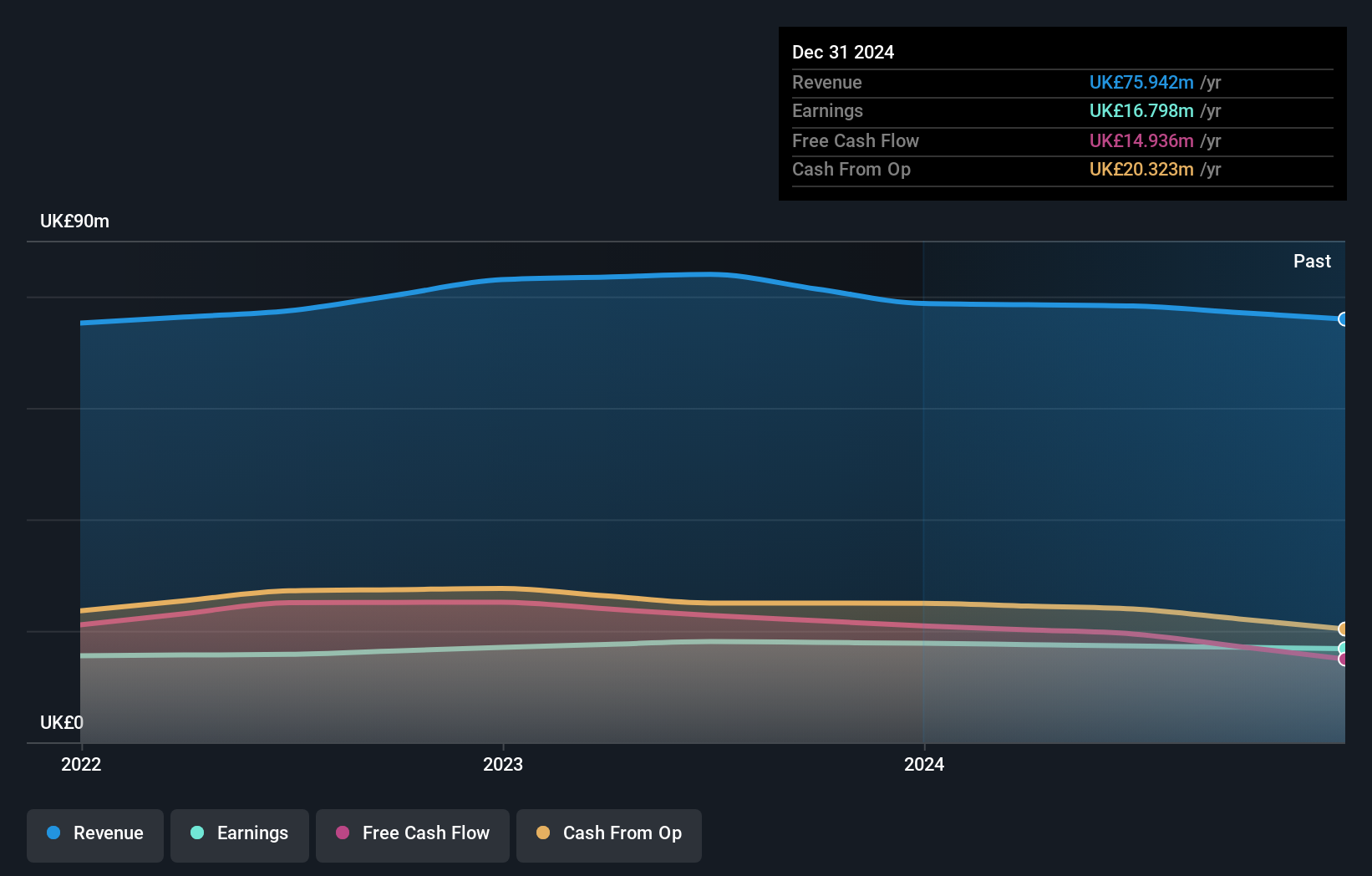

Andrews Sykes Group (AIM:ASY)

Simply Wall St Value Rating: ★★★★★★

Overview: Andrews Sykes Group plc is an investment holding company that specializes in the hire, sale, and installation of environmental control equipment across the United Kingdom, Europe, the Middle East, Africa, and other international markets with a market capitalization of £206.78 million.

Operations: Andrews Sykes generates revenue primarily through the hire, sale, and installation of environmental control equipment across various regions. The company's financial performance is highlighted by its net profit margin, which reflects its ability to manage costs effectively relative to its revenue streams.

Andrews Sykes Group, a UK-based company, presents an intriguing profile with its debt-free status and high-quality past earnings. Despite facing a challenging year with negative earnings growth of 4.3%, it still outperformed the Trade Distributors industry average of 8.4%. The company trades at 44.8% below its estimated fair value, suggesting potential undervaluation in the market. Over the last five years, it has successfully eliminated its debt from a previous ratio of 6.7%, enhancing financial stability and flexibility for future opportunities in the sector without concerns over interest payments or cash runway issues due to profitability.

- Click here to discover the nuances of Andrews Sykes Group with our detailed analytical health report.

Evaluate Andrews Sykes Group's historical performance by accessing our past performance report.

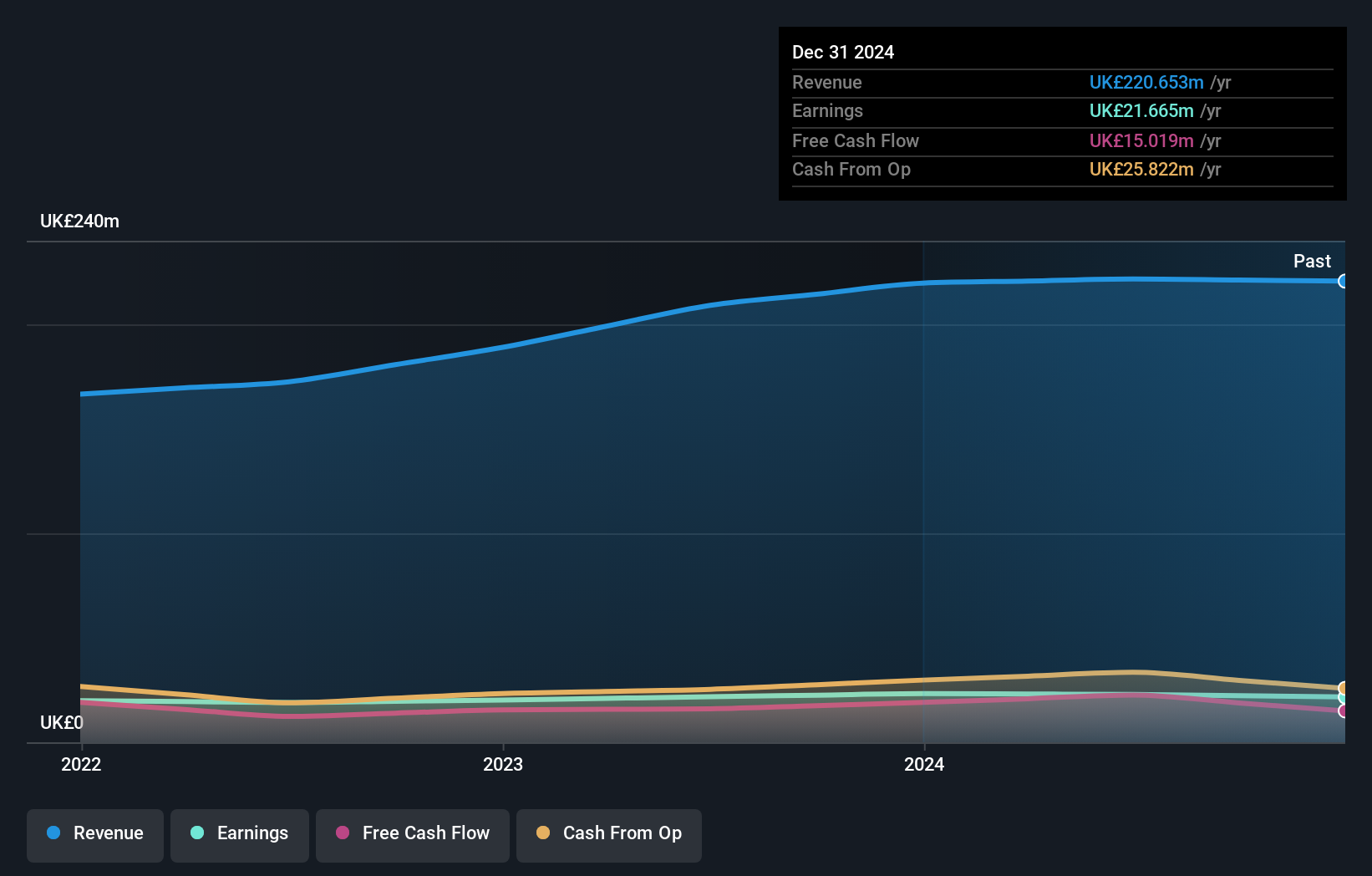

London Security (AIM:LSC)

Simply Wall St Value Rating: ★★★★★★

Overview: London Security plc is an investment holding company that manufactures, sells, and rents fire protection equipment across several European countries, with a market cap of £416.84 million.

Operations: Revenue from the provision and maintenance of fire protection and security equipment amounts to £221.72 million.

In the bustling machinery sector, LSC stands out with its impressive financial health. Over the past five years, it has significantly reduced its debt-to-equity ratio from 7.3% to just 0.2%, showcasing strong fiscal management. The company boasts high-quality earnings and has grown its profits by 5.2% in the last year, outpacing the industry average of -8.8%. With more cash than total debt and positive free cash flow, financial stability seems assured. Trading at a substantial discount of 55% below estimated fair value suggests potential upside for investors seeking undervalued opportunities in this space.

- Click here and access our complete health analysis report to understand the dynamics of London Security.

Review our historical performance report to gain insights into London Security's's past performance.

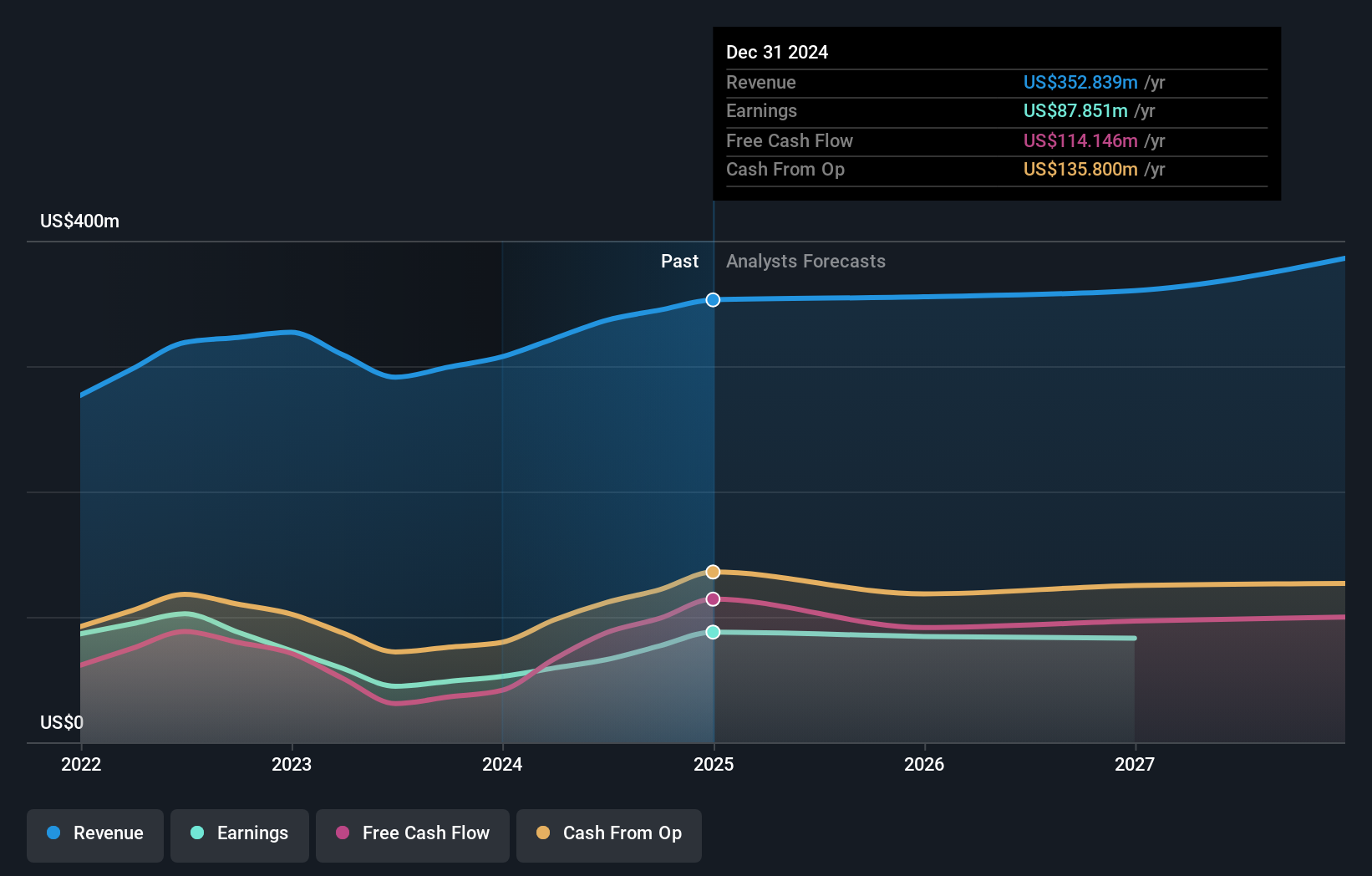

M.P. Evans Group (AIM:MPE)

Simply Wall St Value Rating: ★★★★★★

Overview: M.P. Evans Group PLC is involved in the ownership and development of oil palm plantations in Indonesia and Malaysia, with a market capitalization of £499.29 million.

Operations: The primary revenue stream for M.P. Evans Group comes from its plantation operations in Indonesia, generating $336.59 million.

M.P. Evans Group, a notable player in the palm oil sector, has shown robust financial health with its interest payments well covered by EBIT at 35.1 times. Over the past five years, it reduced its debt to equity ratio from 17.1% to 8.7%, reflecting prudent financial management with a satisfactory net debt to equity ratio of 1.5%. The company also boasts impressive earnings growth of 47.8%, outpacing the Food industry average of 25.3%. Despite significant insider selling recently, MPE trades at an attractive valuation, about 70% below estimated fair value and maintains high-quality earnings performance.

Taking Advantage

- Reveal the 66 hidden gems among our UK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MPE

M.P. Evans Group

Through its subsidiaries, engages in the ownership and development of oil palm plantations in Indonesia and Malaysia.

Very undervalued with flawless balance sheet and pays a dividend.