- United Kingdom

- /

- Metals and Mining

- /

- AIM:ORR

Conroy Gold And Natural Resources Alongside 2 Other UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK stock market has recently experienced some turbulence, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic challenges. In such conditions, investors may find it worthwhile to explore opportunities beyond the well-known blue-chip stocks. Penny stocks, though a somewhat outdated term, continue to offer investment potential in smaller or newer companies that can surprise with their resilience and growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.065 | £778.02M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £148.28M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.155 | £98.68M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.26 | £194.33M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.34 | £170.65M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.925 | £390.36M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.433 | $251.71M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.875 | £184.81M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.30 | £293.88M | ★★★★★★ |

Click here to see the full list of 468 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Conroy Gold and Natural Resources (AIM:CGNR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Conroy Gold and Natural Resources plc focuses on the exploration and development of mineral properties in Ireland and Finland, with a market cap of £1.46 million.

Operations: Conroy Gold and Natural Resources plc does not report distinct revenue segments.

Market Cap: £1.46M

Conroy Gold and Natural Resources is pre-revenue, focusing on gold exploration in Ireland with promising projects like the "Discs of Gold." Despite a market cap of £1.46 million, it faces financial challenges, including doubts about its ability to continue as a going concern. Recent leadership changes followed the passing of its founder. The company has undertaken additional drilling and geological studies to enhance resource estimates at Clontibret and other targets. However, short-term liabilities exceed assets, leading to shareholder dilution through equity offerings as it seeks partnerships for project advancement.

- Click to explore a detailed breakdown of our findings in Conroy Gold and Natural Resources' financial health report.

- Assess Conroy Gold and Natural Resources' previous results with our detailed historical performance reports.

Oriole Resources (AIM:ORR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Oriole Resources PLC is involved in the exploration and development of gold and other base metals across Turkey, East Africa, and West Africa, with a market cap of £10.23 million.

Operations: Oriole Resources PLC does not report distinct revenue segments.

Market Cap: £10.23M

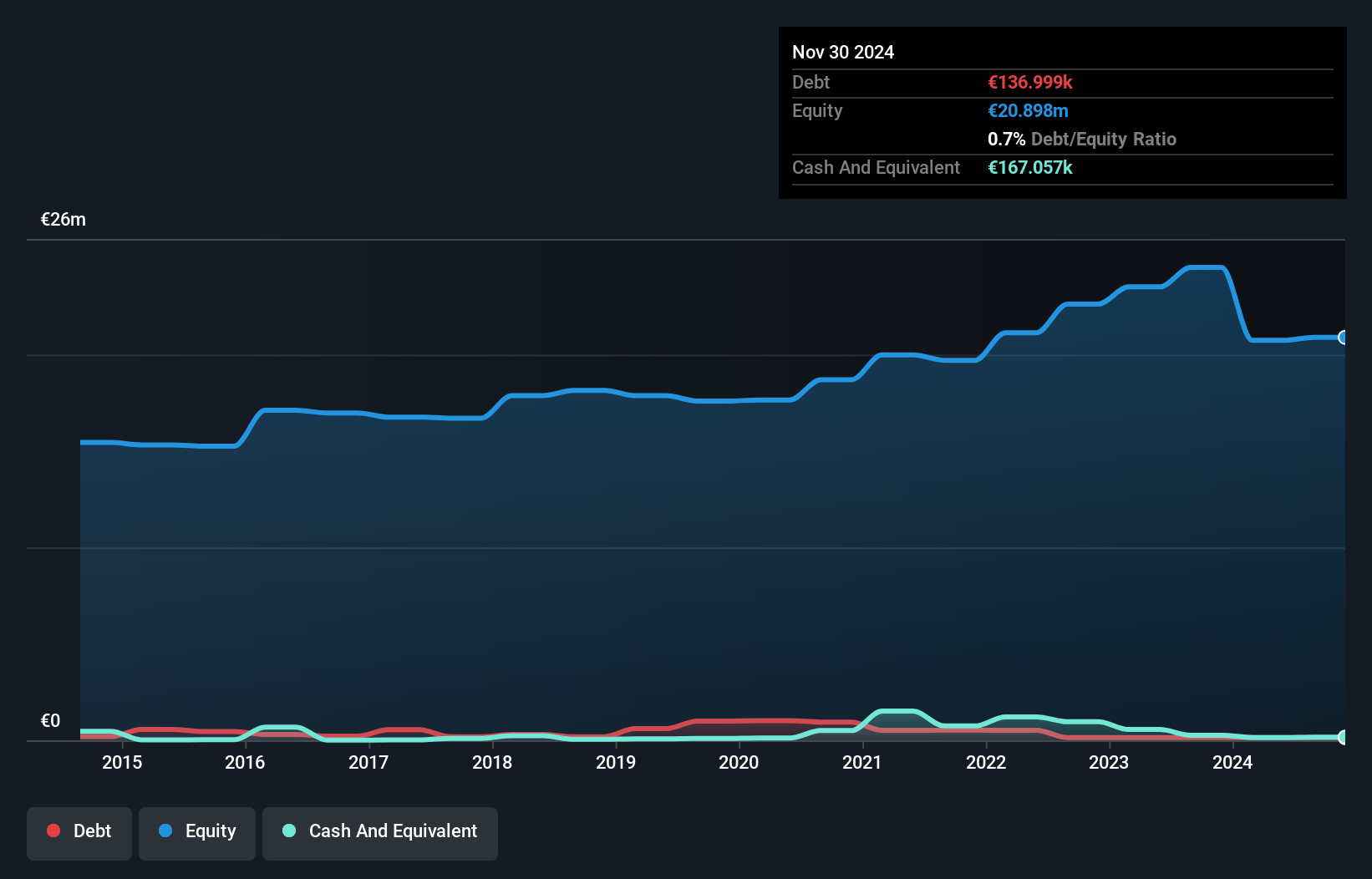

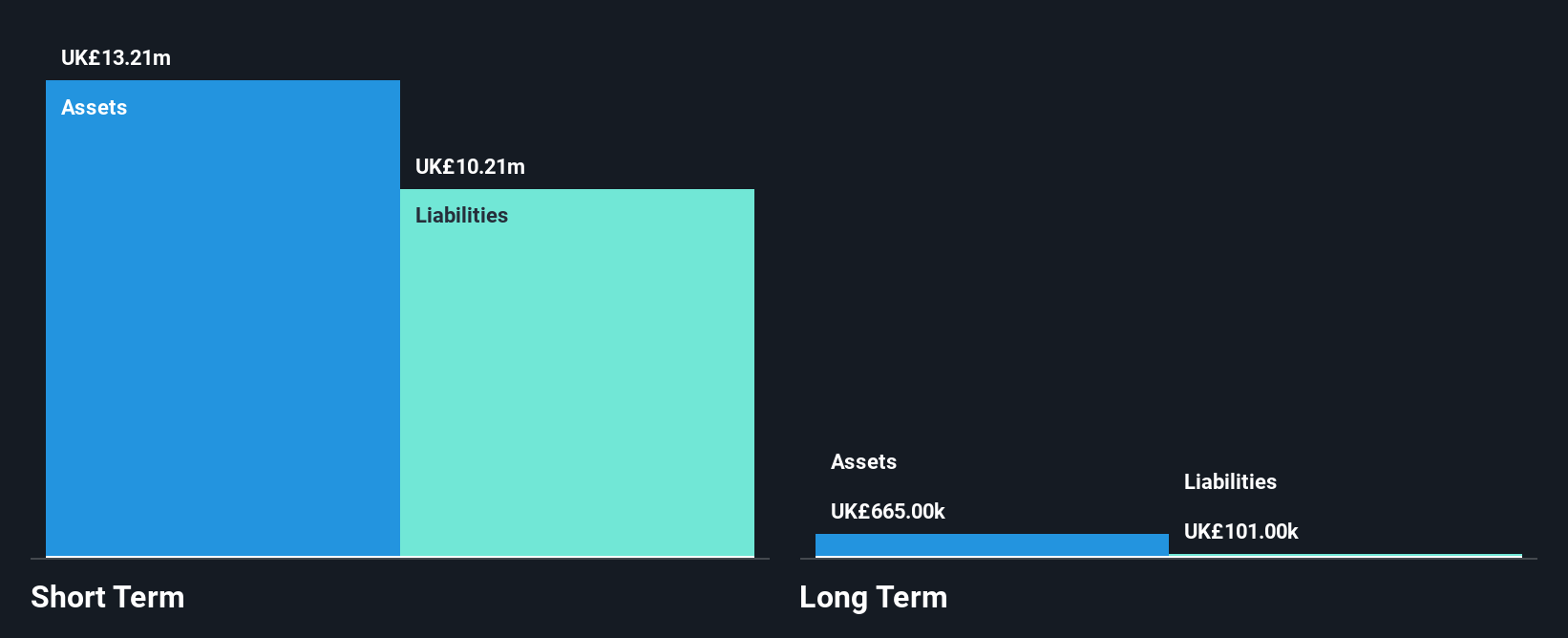

Oriole Resources is a pre-revenue company with a market cap of £10.23 million, focusing on gold exploration in regions like Cameroon. Its recent activities include fully funded drilling programs at the Mbe and Bibemi projects, supported by BCM International's investment of up to US$4 million. The company has no debt and sufficient cash runway for over two years, but remains unprofitable with increasing losses over the past five years. Despite high share price volatility, Oriole's experienced management team continues to advance its exploration projects, aiming to expand resource estimates through ongoing drilling efforts.

- Take a closer look at Oriole Resources' potential here in our financial health report.

- Gain insights into Oriole Resources' past trends and performance with our report on the company's historical track record.

Field Systems Designs Holdings (OFEX:FSD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Field Systems Designs Holdings Plc is an investment holding company that operates in the United Kingdom, focusing on the design, project management, supply, installation, commissioning, servicing, and maintenance of mechanical and electrical projects with a market cap of £2.29 million.

Operations: The company generates revenue of £17.81 million from mechanical and electrical projects primarily within the power, waste, and water industries.

Market Cap: £2.29M

Field Systems Designs Holdings Plc, with a market cap of £2.29 million, operates debt-free and reported revenue of £17.81 million for the year ending May 31, 2024, showing growth from the previous year's £13.75 million. Despite its low Return on Equity at 17.3%, the company maintains high-quality earnings and improved net profit margins to 2.6%. The firm's short-term assets comfortably cover both short- and long-term liabilities, indicating financial stability without shareholder dilution over the past year. However, its earnings growth did not surpass industry standards despite a significant annual increase of 32.7%.

- Click here and access our complete financial health analysis report to understand the dynamics of Field Systems Designs Holdings.

- Gain insights into Field Systems Designs Holdings' historical outcomes by reviewing our past performance report.

Make It Happen

- Click here to access our complete index of 468 UK Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ORR

Oriole Resources

Engages in the exploration and development of gold and other base metals in Turkey, East Africa, and West Africa.

Excellent balance sheet with moderate risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion