The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic vulnerabilities. For investors seeking opportunities beyond the well-known large-cap stocks, penny stocks—typically representing smaller or newer companies—can present intriguing possibilities. Despite their vintage name, these stocks can offer surprising value when backed by strong financial health and may provide growth potential in uncertain times.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.065 | £778.02M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £148.28M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.155 | £98.68M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.26 | £194.33M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.34 | £170.65M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.925 | £390.36M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.433 | $251.71M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.875 | £184.81M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.30 | £293.88M | ★★★★★★ |

Click here to see the full list of 468 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Gear4music (Holdings) (AIM:G4M)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gear4music (Holdings) plc is a retailer of musical instruments and equipment operating in the United Kingdom, Europe, and internationally with a market cap of £35.66 million.

Operations: The company generates £143.49 million in revenue from the sale of musical instruments and equipment across its operational regions.

Market Cap: £35.66M

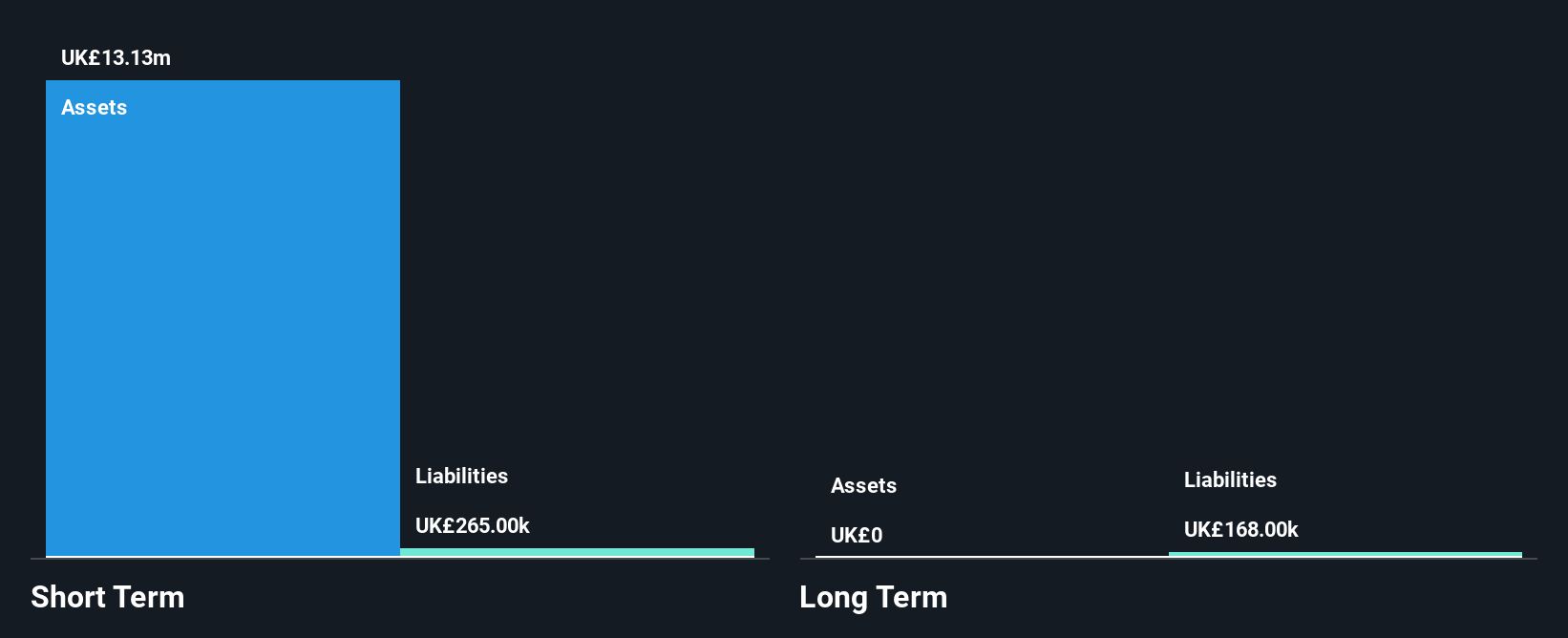

Gear4music (Holdings) plc, with a market cap of £35.66 million, is trading significantly below its estimated fair value, suggesting potential undervaluation. The company has achieved profitability in the last year, though earnings growth comparisons are challenging due to historical losses. Despite stable weekly volatility and no shareholder dilution recently, Gear4music's financials show a net loss of £1.23 million for the half-year ending September 2024. Short-term assets exceed both short and long-term liabilities, indicating solid liquidity management; however, low return on equity and insufficient interest coverage highlight ongoing financial challenges amidst modest revenue forecasts.

- Dive into the specifics of Gear4music (Holdings) here with our thorough balance sheet health report.

- Assess Gear4music (Holdings)'s future earnings estimates with our detailed growth reports.

Mineral & Financial Investments (AIM:MAFL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Mineral & Financial Investments Limited is an investment company that focuses on natural resources, minerals, metals, and oil and gas projects in the Cayman Islands with a market cap of £4.82 million.

Operations: The company generates revenue of £2.57 million from its involvement in natural resources, minerals, metals, and oil and gas projects.

Market Cap: £4.82M

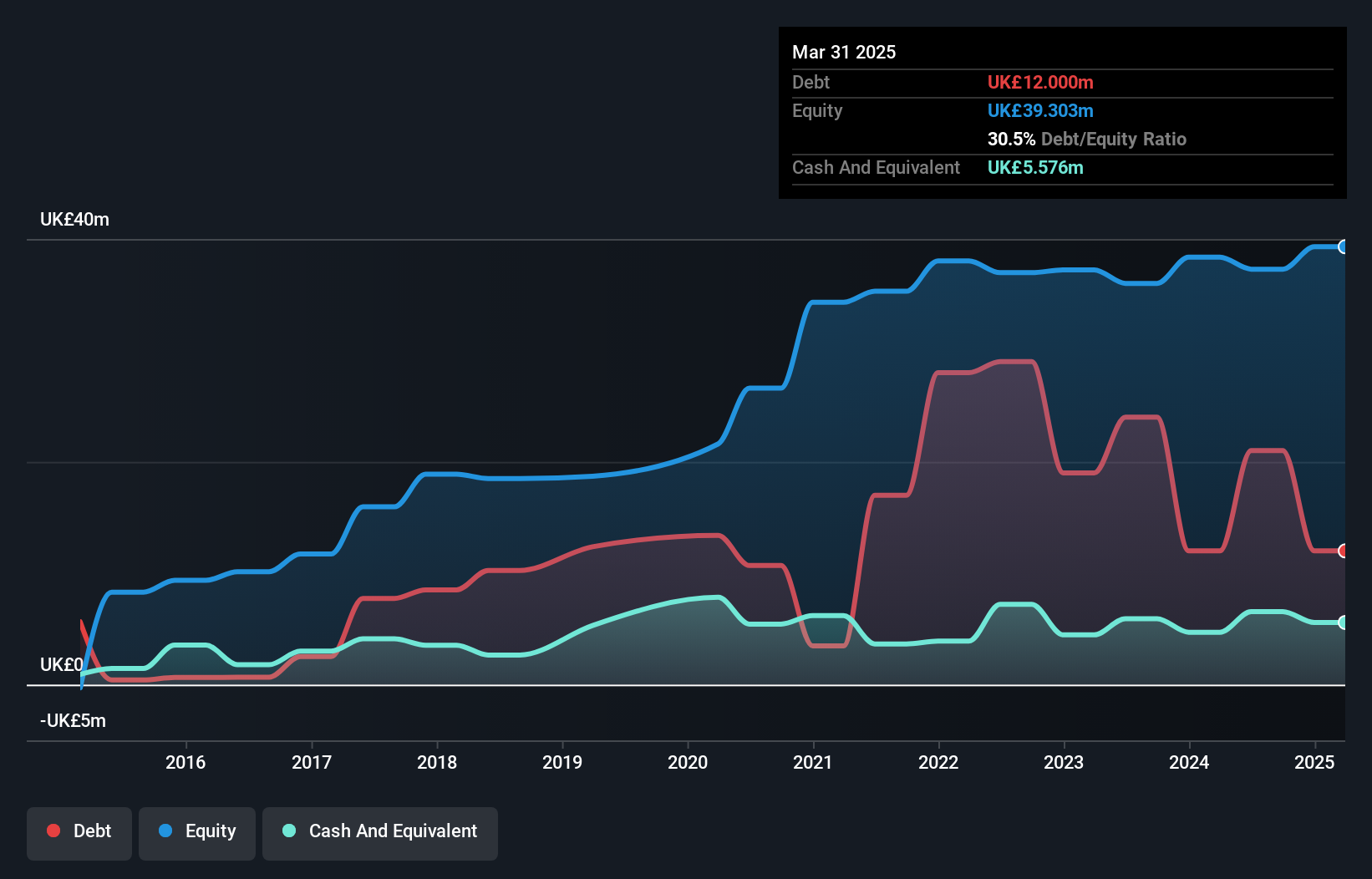

Mineral & Financial Investments Limited, with a market cap of £4.82 million, is trading significantly below its estimated fair value. The company reported revenue of £2.57 million and net income of £2.01 million for the year ended June 30, 2024, showing strong profit growth over the past year at 29.4%, outpacing industry averages. It maintains high-quality earnings with no recent shareholder dilution and robust liquidity as short-term assets far exceed liabilities. Despite having more cash than debt and reduced debt levels over five years, negative operating cash flow indicates challenges in covering debt obligations effectively without sufficient revenue streams.

- Click here and access our complete financial health analysis report to understand the dynamics of Mineral & Financial Investments.

- Review our historical performance report to gain insights into Mineral & Financial Investments' track record.

Trustpilot Group (LSE:TRST)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Trustpilot Group plc operates an online review platform for businesses and consumers across the United Kingdom, North America, Europe, and other international markets, with a market cap of £1.28 billion.

Operations: The company generates $191.59 million in revenue from its role as an internet information provider.

Market Cap: £1.28B

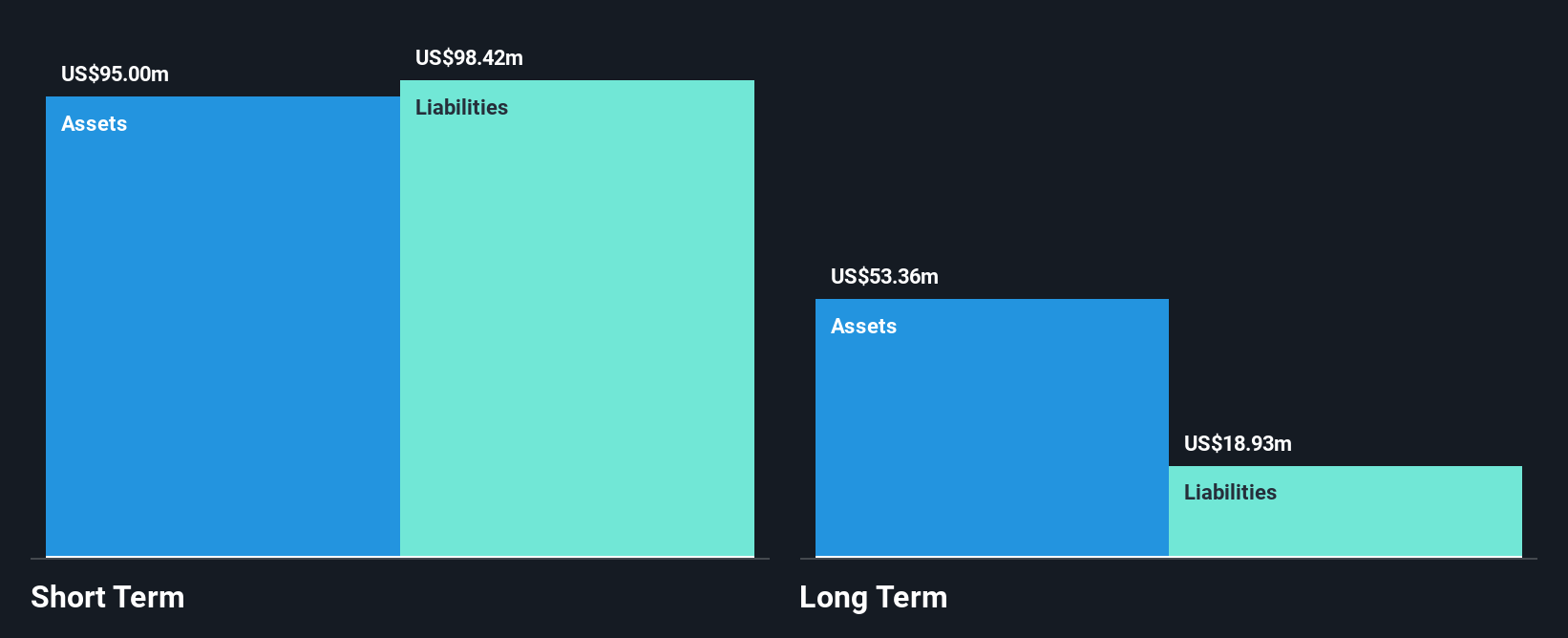

Trustpilot Group plc, with a market cap of £1.28 billion, recently became profitable and has demonstrated high-quality earnings growth over the past five years. The company is debt-free, alleviating concerns about interest coverage or cash flow constraints related to debt servicing. Trustpilot's return on equity stands at a high 32%, reflecting efficient use of shareholder funds. While revenue is forecasted to grow by 15.9% annually, earnings are expected to decline slightly by 0.2% per year over the next three years. The board is experienced; however, the management team is relatively new with an average tenure of 1.1 years.

- Jump into the full analysis health report here for a deeper understanding of Trustpilot Group.

- Gain insights into Trustpilot Group's future direction by reviewing our growth report.

Seize The Opportunity

- Reveal the 468 hidden gems among our UK Penny Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trustpilot Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TRST

Trustpilot Group

Engages in the development and hosting of an online review platform for businesses and consumers in the United Kingdom, North America, Europe, and internationally.

Flawless balance sheet with proven track record.