- United Kingdom

- /

- Energy Services

- /

- AIM:POS

Promising UK Penny Stocks To Consider In March 2025

Reviewed by Simply Wall St

The UK market has been experiencing some turbulence, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting ongoing global economic challenges. In such a climate, investors might consider exploring penny stocks—typically smaller or newer companies—as they can offer unique opportunities for growth at lower price points. While the term "penny stocks" may seem outdated, these investments remain relevant for those seeking value and potential upside in less conventional areas of the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.72 | £61.03M | ✅ 4 ⚠️ 4 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.75 | £281.51M | ✅ 4 ⚠️ 1 View Analysis > |

| Next 15 Group (AIM:NFG) | £3.145 | £312.79M | ✅ 4 ⚠️ 5 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.08 | £148.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.30 | £347.39M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.59 | £408.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.47 | £430.89M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.005 | £160.17M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.032 | £2.23B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.34 | £36.79M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 449 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Plexus Holdings (AIM:POS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Plexus Holdings plc, with a market cap of £10.10 million, offers equipment and services for the oil and gas drilling industry in the UK, US, and internationally.

Operations: The company generates revenue of £12.72 million from its oil well equipment and services segment.

Market Cap: £10.1M

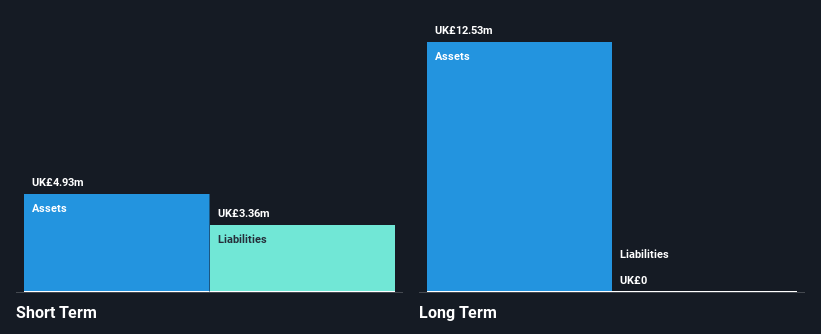

Plexus Holdings, with a market cap of £10.10 million, has recently completed follow-on equity offerings totaling approximately £4 million to bolster its financial position. Despite high share price volatility over the past three months, the company has become profitable in the last year and maintains high-quality earnings. Its debt is well-covered by operating cash flow, and short-term assets exceed liabilities. However, earnings are forecast to decline by an average of 13.1% per year over the next three years. The management team is relatively new with an average tenure of 0.7 years, suggesting recent leadership changes.

- Dive into the specifics of Plexus Holdings here with our thorough balance sheet health report.

- Understand Plexus Holdings' earnings outlook by examining our growth report.

Somero Enterprises (AIM:SOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Somero Enterprises, Inc. designs, assembles, remanufactures, sells, and distributes concrete leveling, contouring, and placing equipment globally with a market cap of £145.39 million.

Operations: The company's revenue is primarily derived from its Construction Machinery & Equipment segment, which generated $109.15 million.

Market Cap: £145.39M

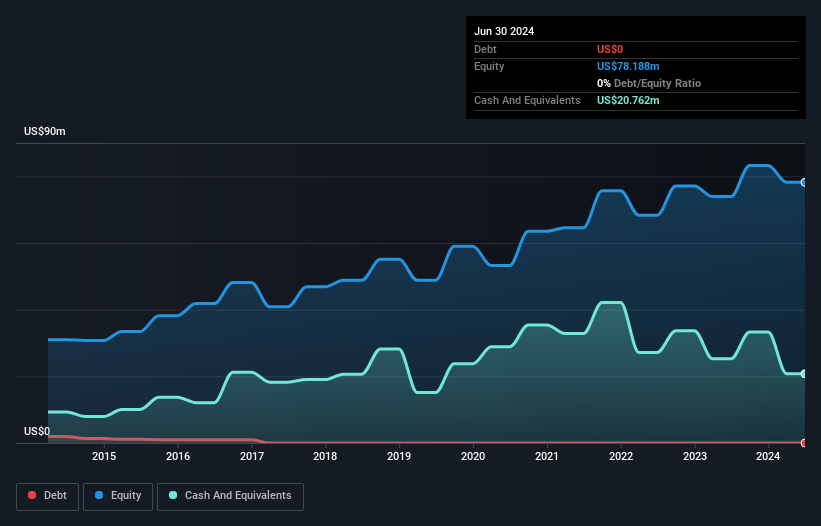

Somero Enterprises, with a market cap of £145.39 million, has faced recent challenges as its earnings declined over the past year, with revenue dropping to US$109.15 million from US$120.7 million previously. Despite this setback, the company maintains a strong financial position with no debt and short-term assets significantly exceeding liabilities. Somero's return on equity is high at 22.1%, reflecting efficient management of shareholder funds. Recent executive changes bring Timothy Aloysius Averkamp as CEO, who brings extensive industry experience that could potentially drive future strategic growth initiatives and operational improvements for the company amidst current market conditions.

- Click here and access our complete financial health analysis report to understand the dynamics of Somero Enterprises.

- Review our historical performance report to gain insights into Somero Enterprises' track record.

Care REIT (LSE:CRT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Impact Healthcare REIT plc focuses on acquiring, renovating, extending and redeveloping high-quality healthcare real estate assets in the UK, leasing them to established healthcare operators under long-term agreements; it has a market cap of £452.49 million.

Operations: The company generates revenue of £54.15 million from its healthcare real estate investment trust segment.

Market Cap: £452.49M

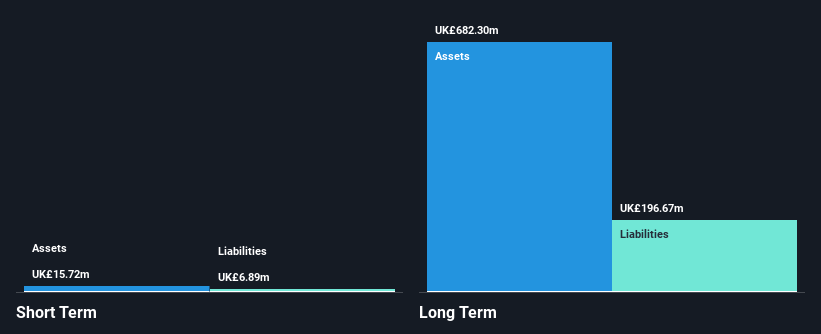

Impact Healthcare REIT plc, with a market cap of £452.49 million, recently reported revenue growth to £54.15 million for 2024 despite facing challenges such as negative earnings growth and a high debt-to-equity ratio increase over five years. A significant one-off gain of £18.2 million impacted its financial results, complicating profit assessments. The company's short-term assets cover liabilities well, but long-term liabilities remain uncovered by these assets alone. An acquisition agreement by CareTrust REIT for approximately £450 million is underway, expected to delist the company post-approval in 2025's second quarter, potentially impacting future governance structures and shareholder dynamics.

- Unlock comprehensive insights into our analysis of Care REIT stock in this financial health report.

- Review our growth performance report to gain insights into Care REIT's future.

Taking Advantage

- Click this link to deep-dive into the 449 companies within our UK Penny Stocks screener.

- Ready For A Different Approach? Trump's oil boom is here — pipelines are primed to profit. Discover the 20 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:POS

Plexus Holdings

Provides equipment and services for the oil and gas drilling industry in the United Kingdom, the United States, and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success