- United Kingdom

- /

- Consumer Finance

- /

- LSE:IPF

August 2024's Top Undervalued Small Caps With Insider Action In United Kingdom

Reviewed by Simply Wall St

The UK market has recently faced headwinds, with the FTSE 100 closing lower due to weak trade data from China and broader global economic concerns. Despite these challenges, there are opportunities in the small-cap sector where undervalued stocks with insider action can offer potential for growth.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 24.8x | 5.6x | 11.88% | ★★★★★☆ |

| C&C Group | NA | 0.4x | 47.51% | ★★★★★☆ |

| GB Group | NA | 3.0x | 33.73% | ★★★★★☆ |

| Norcros | 7.7x | 0.5x | 1.35% | ★★★★☆☆ |

| Foxtons Group | 26.7x | 1.3x | 45.25% | ★★★★☆☆ |

| Harworth Group | 13.9x | 7.3x | -501.48% | ★★★★☆☆ |

| CVS Group | 22.5x | 1.2x | 40.83% | ★★★★☆☆ |

| Hochschild Mining | NA | 1.6x | 45.90% | ★★★★☆☆ |

| Diaceutics | NA | 4.4x | -1.81% | ★★★☆☆☆ |

| Hammerson | NA | 5.9x | 17.76% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Assura (LSE:AGR)

Simply Wall St Value Rating: ★★★☆☆☆

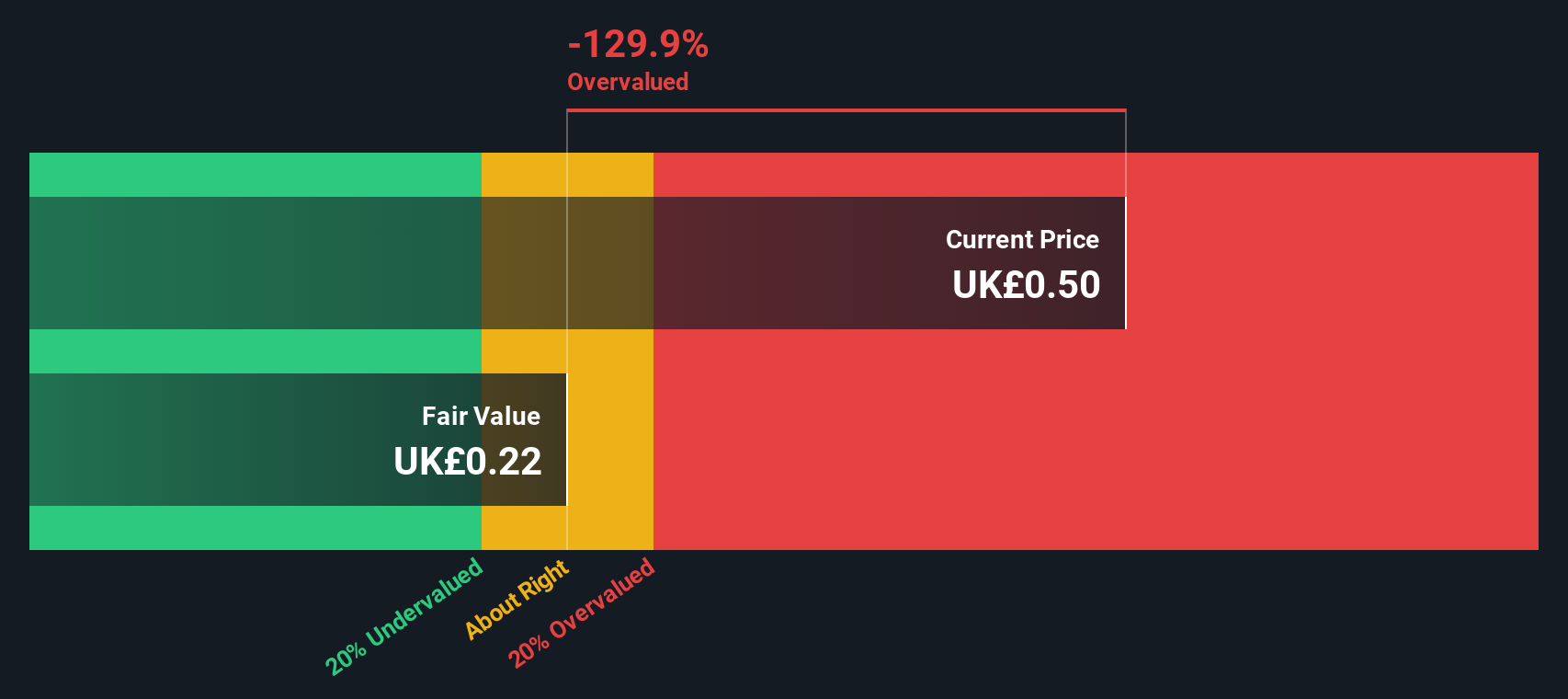

Overview: Assura is a UK-based real estate investment trust focused on designing, building, and managing primary care medical centers with a market cap of approximately £2.24 billion.

Operations: Assura's revenue primarily comes from its core segment, generating £157.8 million. The company reported a gross profit of £143.3 million for the latest period ending on 2024-03-31, with operating expenses totaling £14 million and non-operating expenses at £158.1 million. Notably, the net income margin has shown significant variability recently, reaching -0.18% in the same period.

PE: -43.7x

Assura, a healthcare property investor and developer, is currently trading at attractive valuations. The company has forecasted earnings growth of 40.91% per year and announced a strategic GBP 250 million joint venture with the Universities Superannuation Scheme to invest in NHS infrastructure. Insider confidence is evidenced by recent share purchases over the past six months. Despite reporting a net loss of GBP 28.8 million for FY2024, Assura's strategic moves and strong pipeline suggest potential for future growth in the UK healthcare sector.

- Take a closer look at Assura's potential here in our valuation report.

Examine Assura's past performance report to understand how it has performed in the past.

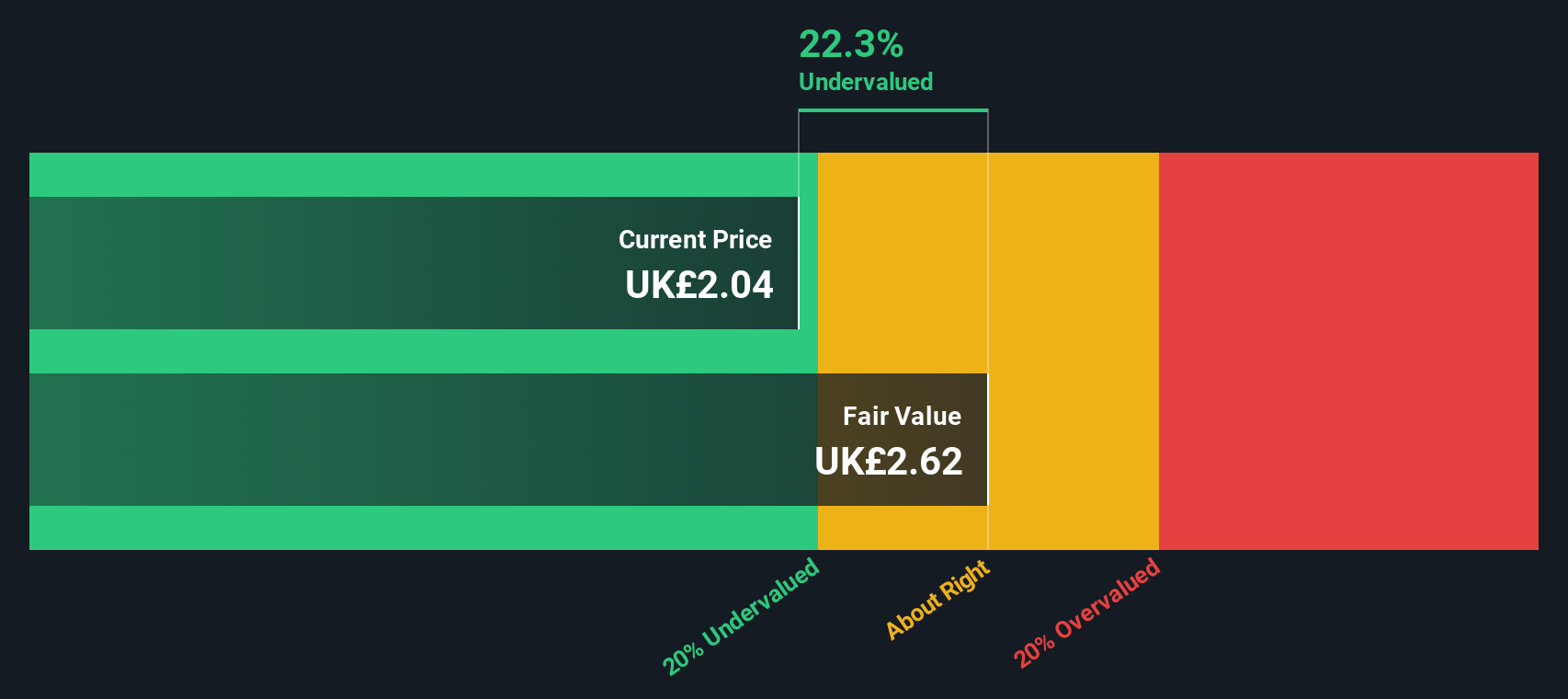

International Personal Finance (LSE:IPF)

Simply Wall St Value Rating: ★★★★★★

Overview: International Personal Finance provides consumer credit services through its digital platform and home credit operations in Mexico and Europe, with a market cap of approximately £0.22 billion.

Operations: International Personal Finance generates revenue from three primary segments: Digital (£128.1M), Mexico Home Credit (£276.1M), and European Home Credit (£355.3M). The company's gross profit margin has shown a range between 62.47% and 89.76% over the observed periods, with recent figures around 80%. Operating expenses are consistently significant, often exceeding £400 million, impacting net income margins which have varied from -9.71% to 8.79%.

PE: 7.1x

International Personal Finance, a UK-based small-cap, shows insider confidence with recent share purchases. The company announced a £15 million share buyback program on July 31, 2024. Despite higher-risk external funding sources and interest payments not being well covered by earnings, IPF forecasts a 16% annual earnings growth. For H1 2024, sales reached £371.7 million with net income at £19.7 million. The interim dividend increased by 9.7%, reflecting strong performance and positive future prospects.

- Delve into the full analysis valuation report here for a deeper understanding of International Personal Finance.

Learn about International Personal Finance's historical performance.

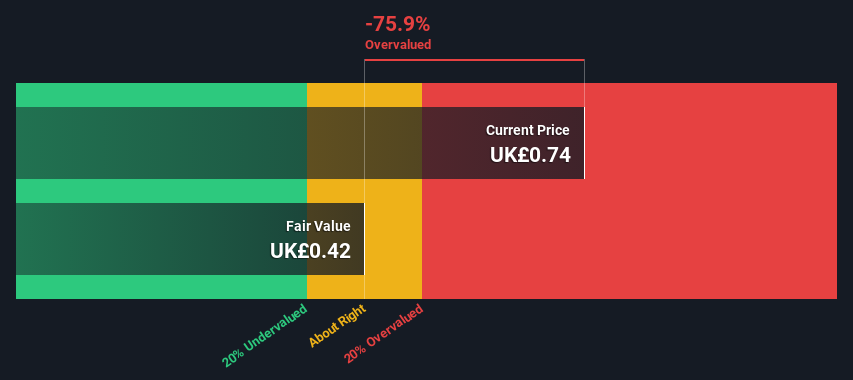

Sirius Real Estate (LSE:SRE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sirius Real Estate is a property investment company specializing in owning and operating business parks, industrial complexes, and office buildings with a market cap of approximately €1.50 billion.

Operations: Sirius Real Estate generates revenue primarily from property investments, with a recent gross profit margin of 57.50%. The company incurs substantial costs of goods sold (COGS) and operating expenses, impacting its net income margin which was 37.25% in the latest period.

PE: 15.4x

Sirius Real Estate, a company focusing on business parks in Germany and the UK, recently completed a £152.5 million equity offering to fuel its acquisition strategy. The firm reported strong earnings growth with net income rising to €107.8 million for the year ending March 2024, up from €79.6 million previously. Notably, Asset Management Director Craig Hoskins showed insider confidence by purchasing 218,283 shares worth approximately £216,122 in July 2024. This aligns with Sirius's ongoing expansion and consistent dividend increases over the past decade.

- Unlock comprehensive insights into our analysis of Sirius Real Estate stock in this valuation report.

Assess Sirius Real Estate's past performance with our detailed historical performance reports.

Key Takeaways

- Delve into our full catalog of 22 Undervalued UK Small Caps With Insider Buying here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IPF

International Personal Finance

Provides consumer credit in Europe and Mexico.

Very undervalued established dividend payer.