- United Kingdom

- /

- Oil and Gas

- /

- AIM:RBD

3 UK Penny Stocks With Market Caps Under £40M To Consider

Reviewed by Simply Wall St

The UK market has recently experienced some turbulence, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic interdependencies. In such a climate, investors often seek opportunities in less conventional areas like penny stocks—companies that are typically smaller or newer and can offer unique growth potential. Although the term 'penny stock' might seem outdated, these investments remain relevant for those looking to uncover hidden value in firms with strong financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.825 | £465.11M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £1.00 | £157.74M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.55 | £405.37M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.892 | £712.93M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.158 | £178.6M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.355 | £333.67M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.90 | £186M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £1.905 | £135.91M | ★★★★★☆ |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Ebiquity (AIM:EBQ)

Simply Wall St Financial Health Rating: ★★★★★☆

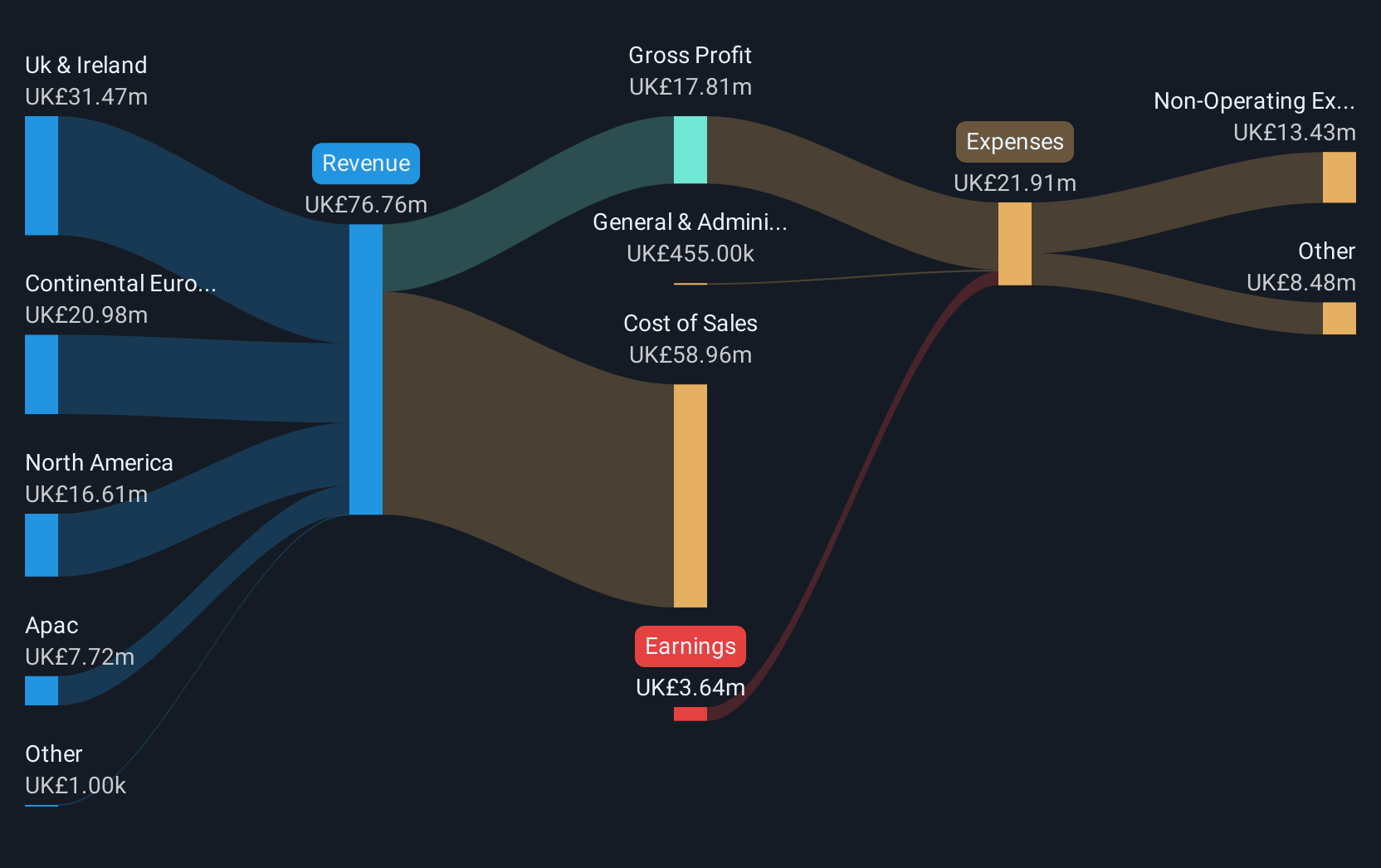

Overview: Ebiquity plc, with a market cap of £29.72 million, offers media consultancy and investment analysis services across the United Kingdom, Ireland, North America, Continental Europe, and the Asia Pacific.

Operations: The company generates revenue from four key regions: £31.58 million from the UK & Ireland, £19.95 million from Continental Europe, £17.19 million from North America, and £8.57 million from the Asia Pacific.

Market Cap: £29.72M

Ebiquity plc, with a market cap of £29.72 million, operates across several key regions and is currently unprofitable but has a positive outlook with earnings forecasted to grow significantly. The company maintains a satisfactory net debt to equity ratio of 38.3% and has sufficient cash runway for over three years despite its current losses. Recent executive changes include the appointment of Ruben Schreurs as CEO, who aims to drive profitable growth and enhance shareholder value by transforming Ebiquity into a tech-enabled business. The company trades at 56.5% below its estimated fair value, indicating potential investment appeal among penny stocks.

- Take a closer look at Ebiquity's potential here in our financial health report.

- Examine Ebiquity's earnings growth report to understand how analysts expect it to perform.

Reabold Resources (AIM:RBD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Reabold Resources Plc is an investment holding company focused on the development, appraisal, exploration, and evaluation of oil and gas projects, with a market cap of £4.33 million.

Operations: Reabold Resources Plc does not report distinct revenue segments.

Market Cap: £4.33M

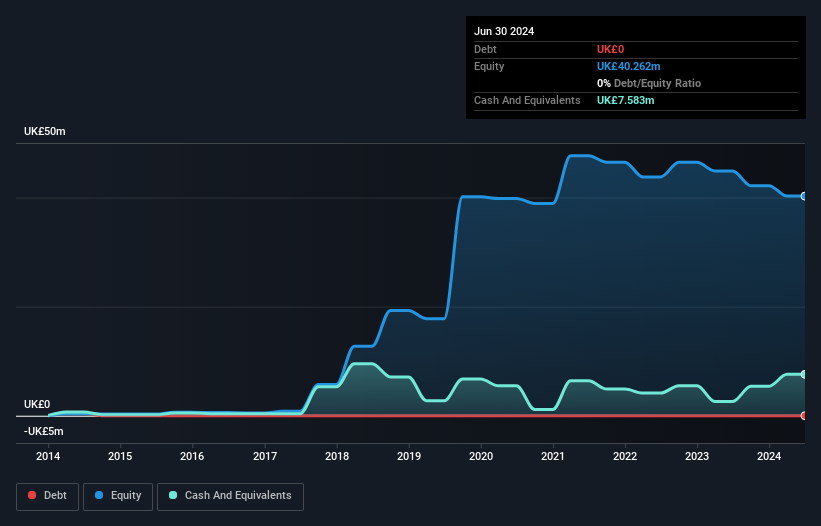

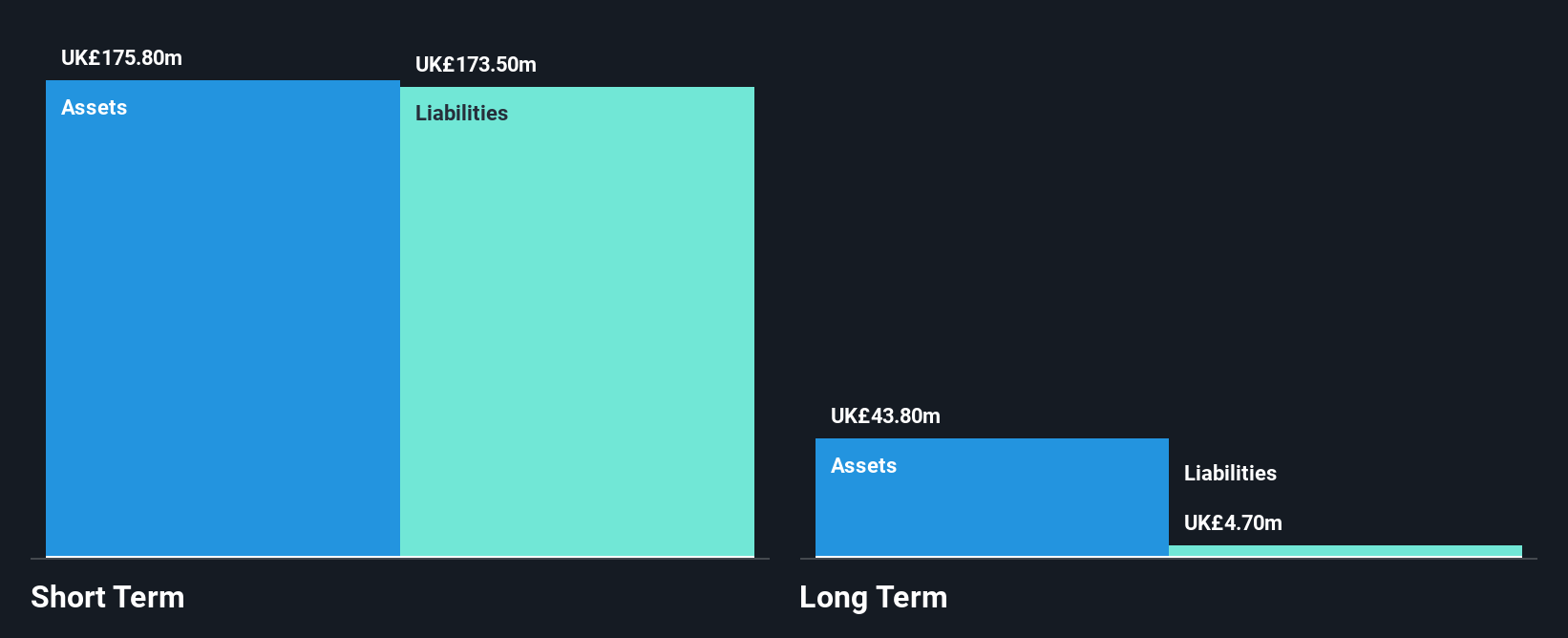

Reabold Resources Plc, with a market cap of £4.33 million, is pre-revenue and remains unprofitable with increasing losses over the past five years. Despite this, the company benefits from a seasoned management team and board with an average tenure of 7.3 years. Reabold's short-term assets (£7.8M) comfortably cover both its short-term (£171K) and long-term liabilities (£455K), while it operates debt-free. The firm has a sufficient cash runway for more than one year based on current free cash flow levels, although its share price has been highly volatile recently compared to most UK stocks.

- Click here to discover the nuances of Reabold Resources with our detailed analytical financial health report.

- Understand Reabold Resources' track record by examining our performance history report.

Staffline Group (AIM:STAF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Staffline Group plc operates in the United Kingdom and the Republic of Ireland, offering recruitment, outsourced human resource services, and skills and employment training, with a market cap of £32.78 million.

Operations: The company's revenue is primarily derived from its Recruitment GB segment at £814.8 million, followed by Recruitment Ireland at £107.6 million and PeoplePlus at £66 million.

Market Cap: £32.78M

Staffline Group plc, with a market cap of £32.78 million, is unprofitable but shows potential in the recruitment sector. The company's revenue streams are substantial, led by its Recruitment GB segment (£814.8M). Despite negative return on equity (-49.01%), it has reduced its debt to equity ratio from 111.7% to 34% over five years and maintains a satisfactory net debt to equity ratio (20.7%). The firm has more than three years of cash runway even with shrinking free cash flow and benefits from an experienced management team and board, though short-term liabilities exceed short-term assets slightly (£147.4M vs £158.3M).

- Click here and access our complete financial health analysis report to understand the dynamics of Staffline Group.

- Gain insights into Staffline Group's outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Access the full spectrum of 443 UK Penny Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RBD

Reabold Resources

An investment holding company, engages in the development, appraisal, exploration, and evaluation of oil and gas projects.

Flawless balance sheet slight.

Market Insights

Community Narratives