- United Kingdom

- /

- Real Estate

- /

- LSE:IWG

Market Still Lacking Some Conviction On International Workplace Group plc (LON:IWG)

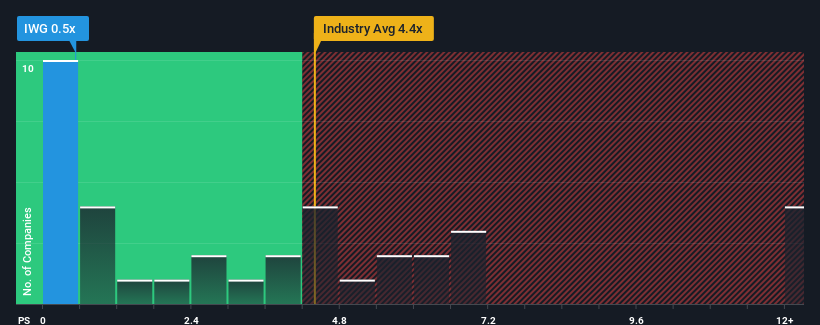

With a price-to-sales (or "P/S") ratio of 0.5x International Workplace Group plc (LON:IWG) may be sending very bullish signals at the moment, given that almost half of all the Real Estate companies in the United Kingdom have P/S ratios greater than 4.4x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for International Workplace Group

How International Workplace Group Has Been Performing

International Workplace Group could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think International Workplace Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For International Workplace Group?

In order to justify its P/S ratio, International Workplace Group would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 25% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to remain somewhat buoyant, growing by 2.6% during the coming year according to the seven analysts following the company. While this isn't a particularly impressive figure, it should be noted that the the industry is expected to decline by 5.3%.

In light of this, it's quite peculiar that International Workplace Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Bottom Line On International Workplace Group's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of International Workplace Group's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for International Workplace Group with six simple checks.

If these risks are making you reconsider your opinion on International Workplace Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:IWG

International Workplace Group

Provides workspace solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives