For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like IXICO (LON:IXI), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for IXICO

IXICO's Improving Profits

Over the last three years, IXICO has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, IXICO's EPS shot from UK£0.015 to UK£0.027, over the last year. You don't see 86% year-on-year growth like that, very often.

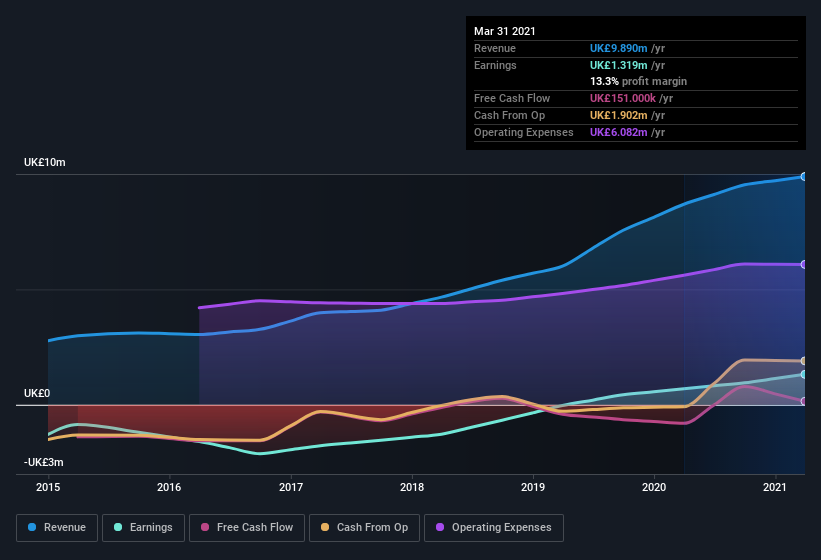

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. IXICO maintained stable EBIT margins over the last year, all while growing revenue 14% to UK£9.9m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

IXICO isn't a huge company, given its market capitalization of UK£27m. That makes it extra important to check on its balance sheet strength.

Are IXICO Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for IXICO shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Mark Warne, the Senior Independent Director of the company, paid UK£8.9k for shares at around UK£0.63 each.

Does IXICO Deserve A Spot On Your Watchlist?

IXICO's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. If you're like me, you'll find it hard to ignore that sort of explosive EPS growth. And indeed, it could be a sign that the business is at an inflection point. For me, this situation certainly piques my interest. Even so, be aware that IXICO is showing 5 warning signs in our investment analysis , and 2 of those make us uncomfortable...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of IXICO, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:IXI

IXICO

Provides data analytics services to the biopharmaceutical industry in the United Kingdom, Switzerland, the Netherlands, Ireland, rest of Europe, and the United States.

Flawless balance sheet slight.

Market Insights

Community Narratives