- United Kingdom

- /

- Hospitality

- /

- LSE:OTB

3 Promising UK Penny Stocks With Under £300M Market Cap

Reviewed by Simply Wall St

The UK market has faced challenges recently, with the FTSE 100 index closing lower due to weak trade data from China, highlighting concerns about global economic recovery. In such a climate, identifying stocks that combine financial strength with growth potential is crucial for investors. Penny stocks, while an older term, still represent smaller or emerging companies that can offer unique opportunities when backed by solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.78 | £471.81M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.55 | £360.49M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.125 | £821.34M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.025 | £391.86M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.53 | £180.75M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.324 | £205.74M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.53 | £191.03M | ★★★★★☆ |

| Ultimate Products (LSE:ULTP) | £1.42 | £115.25M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £3.51 | £451.71M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.15 | £200.13M | ★★★★★★ |

Click here to see the full list of 475 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

hVIVO (AIM:HVO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: hVIVO plc is a pharmaceutical service and contract research company based in the United Kingdom, with a market cap of £192.55 million.

Operations: The company generates its revenue from medical and scientific research services, amounting to £67.21 million.

Market Cap: £192.55M

hVIVO plc has demonstrated robust financial growth, with earnings increasing significantly over the past year and a solid net profit margin improvement. The company is debt-free, enhancing its financial stability, and trades at a substantial discount to estimated fair value. Recent revenue figures show an increase to £35.64 million for H1 2024, reflecting strong operational performance. hVIVO's decision to consolidate its stock listing on AIM aims to streamline operations and reduce costs without affecting share trading. Despite forecasts of declining earnings in the coming years, hVIVO maintains high-quality earnings and experienced management.

- Jump into the full analysis health report here for a deeper understanding of hVIVO.

- Gain insights into hVIVO's future direction by reviewing our growth report.

Mercia Asset Management (AIM:MERC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mercia Asset Management PLC is a private equity and venture capital firm focused on a wide range of investment stages, including incubation and growth capital, with a market cap of £131.55 million.

Operations: The company generates revenue of £30.43 million from its Proactive Specialist Asset Management segment.

Market Cap: £131.55M

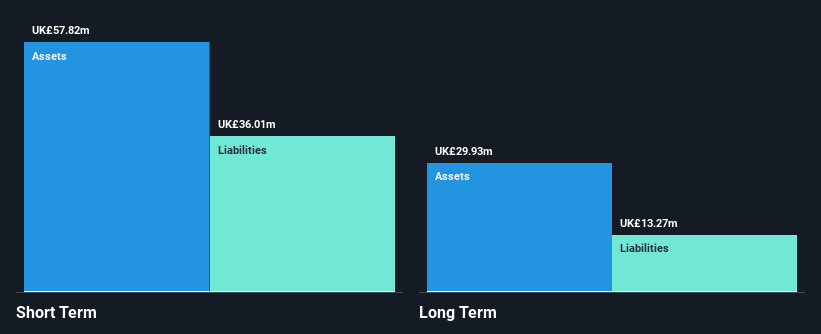

Mercia Asset Management PLC, with a market cap of £131.55 million, operates without debt and has robust short-term assets (£50.9M) that cover both its short-term (£11.5M) and long-term liabilities (£4.1M). Despite being unprofitable, the company has reduced losses by 8.3% annually over five years and is forecasted to grow earnings by 112.8% per year. Trading at a significant discount to fair value estimates, it offers potential upside as analysts expect the stock price to rise substantially (97.9%). The management team is experienced with an average tenure of 6.1 years, enhancing operational stability.

- Get an in-depth perspective on Mercia Asset Management's performance by reading our balance sheet health report here.

- Assess Mercia Asset Management's future earnings estimates with our detailed growth reports.

On the Beach Group (LSE:OTB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: On the Beach Group plc is an online retailer specializing in short haul beach holidays in the United Kingdom, with a market cap of £249.49 million.

Operations: The company's revenue is derived from three segments: Classic Package Holidays (£7.1 million), Classic Collection Holidays (£56.4 million), and its online platforms Onthebeach.Co.Uk and Sunshine.Co.Uk (£114.6 million).

Market Cap: £249.49M

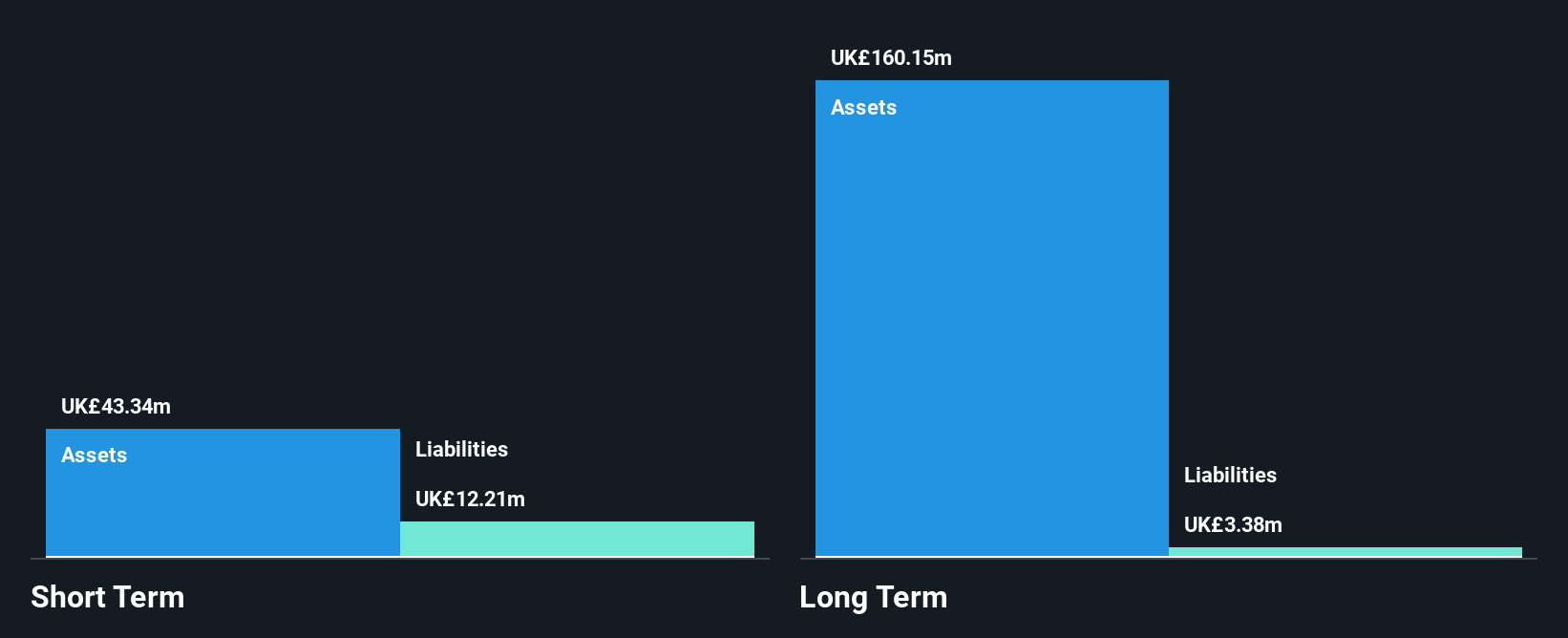

On the Beach Group plc, with a market cap of £249.49 million, demonstrates a strong financial position as its short-term assets (£538.1M) surpass both short-term (£449.4M) and long-term liabilities (£1.4M). Despite a low Return on Equity (9.3%), the company shows significant earnings growth, with profits rising by 532% over the past year, outperforming industry trends. Trading at 51.1% below estimated fair value suggests potential for upward price movement, although negative operating cash flow poses challenges in covering debt obligations. The management team is relatively new with an average tenure of 1.6 years, indicating potential for strategic shifts ahead.

- Click to explore a detailed breakdown of our findings in On the Beach Group's financial health report.

- Understand On the Beach Group's earnings outlook by examining our growth report.

Seize The Opportunity

- Unlock more gems! Our UK Penny Stocks screener has unearthed 472 more companies for you to explore.Click here to unveil our expertly curated list of 475 UK Penny Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OTB

On the Beach Group

Operates as an online retailer of short haul beach holidays under the On the Beach brand name in the United Kingdom.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives