- United Kingdom

- /

- Media

- /

- LSE:INF

High Growth Tech Stocks In The United Kingdom

Reviewed by Simply Wall St

The FTSE 100 index has recently experienced a downturn, influenced by weak trade data from China and broader global economic concerns. In this challenging market environment, identifying high-growth tech stocks in the United Kingdom requires focusing on companies with innovative solutions and strong potential for future growth despite current economic headwinds.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 67.08% | 130.82% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Genus (LSE:GNS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genus plc is an animal genetics company with operations spanning North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market cap of £1.30 billion.

Operations: Genus plc generates revenue primarily through its Genus ABS and Genus PIC segments, contributing £314.90 million and £352.50 million respectively. The company operates across various regions including North America, Latin America, the UK, Europe, the Middle East, Russia, Africa, and Asia.

Genus, a prominent player in the biotech sector, has shown mixed performance recently. Despite a 76.3% decline in earnings over the past year due to a significant one-off loss of £47.8M, its future looks promising with forecasted annual earnings growth of 39.4%. The company reported sales of £668.8M for the full year ending June 30, 2024, down from £689.7M the previous year; however, R&D expenses remain robust at £68M or roughly 10% of revenue, underscoring its commitment to innovation and long-term growth potential. Another tech firm worth noting is heavily investing in AI and software solutions that are transforming industry standards by shifting towards SaaS models—ensuring recurring revenue streams from subscriptions while enhancing client retention rates significantly. This strategic pivot is expected to drive sustainable growth as businesses increasingly demand scalable and flexible software solutions tailored to their evolving needs.

- Dive into the specifics of Genus here with our thorough health report.

Assess Genus' past performance with our detailed historical performance reports.

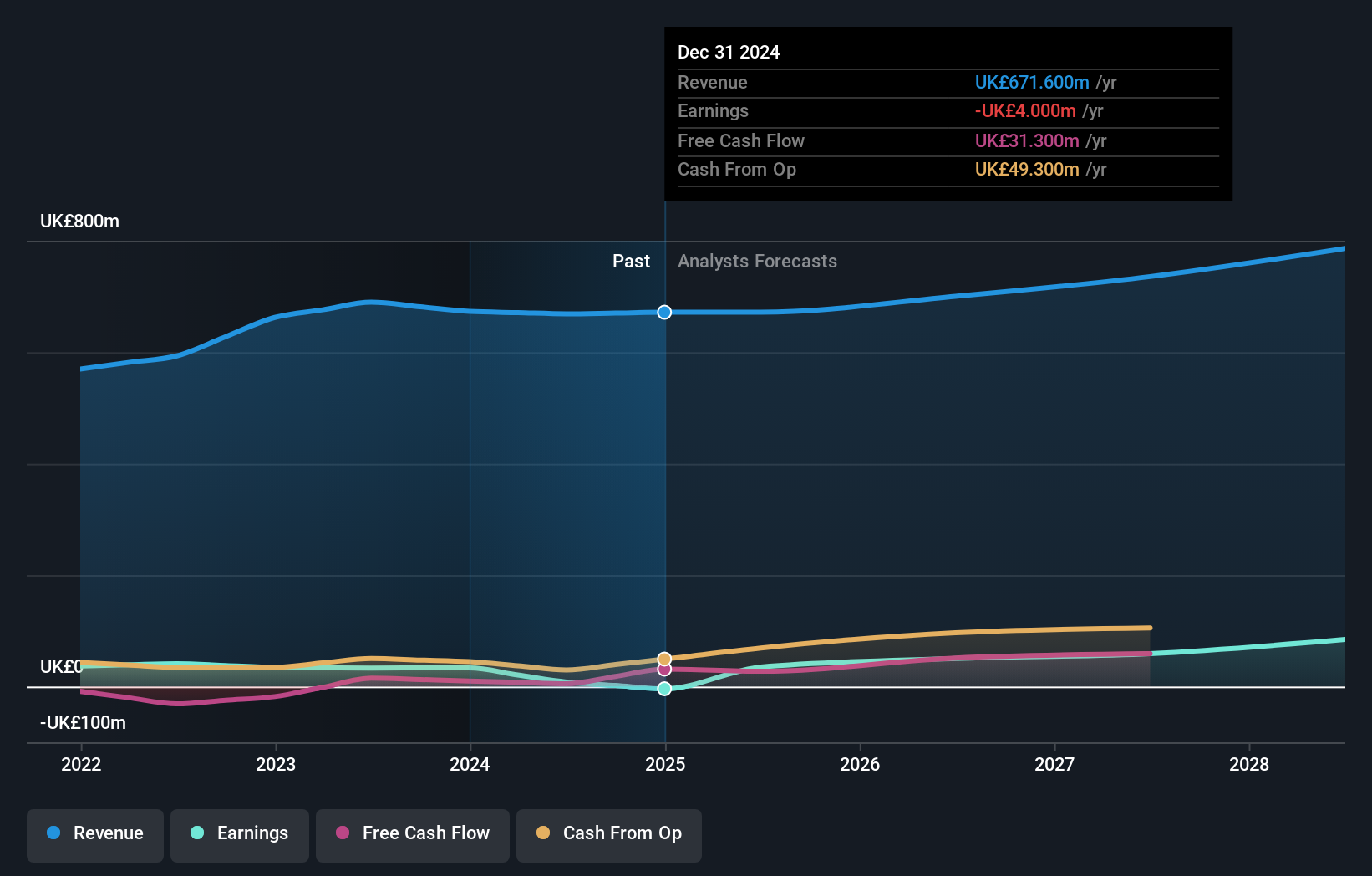

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally with a market cap of £11.22 billion.

Operations: The company generates revenue primarily through four segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million).

Informa's recent performance shows a mixed bag with earnings expected to grow at 21.5% annually, outpacing the UK market's 14.2%. Despite a significant one-off loss of £213.5M impacting last year's results, the company’s R&D expenses of £68M (10% of revenue) underscore its commitment to innovation. The firm has also repurchased 41.67 million shares for £338.9M in the first half of 2024, reflecting strategic capital allocation efforts amidst evolving industry dynamics and client needs.

- Take a closer look at Informa's potential here in our health report.

Gain insights into Informa's past trends and performance with our Past report.

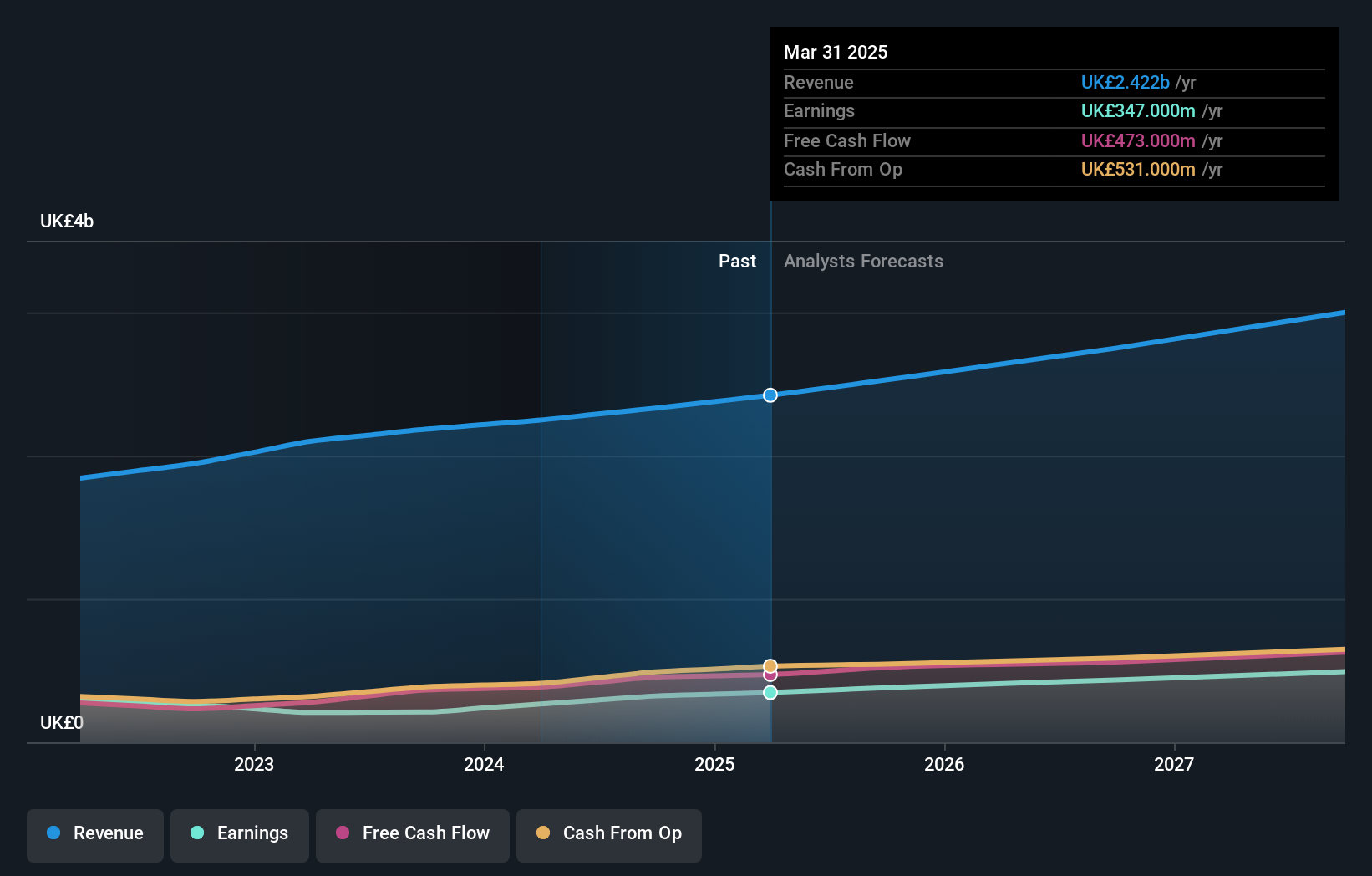

Sage Group (LSE:SGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Sage Group plc, along with its subsidiaries, offers technology solutions and services for small and medium businesses across the United States, the United Kingdom, France, and internationally, with a market cap of £10.29 billion.

Operations: Sage Group generates revenue primarily from Europe (£595 million), North America (£1.01 billion), and the United Kingdom & Ireland (£488 million). The company focuses on providing technology solutions and services tailored to small and medium businesses across these regions.

Sage Group's earnings growth of 28.4% over the past year significantly outpaced the software industry's 19.9%, showcasing its robust performance. The company's R&D expenses, at £130M or 15.1% of revenue, highlight its commitment to innovation and development within the SaaS model, ensuring recurring revenue streams from subscriptions. Recent strategic partnerships, like with VoPay for advanced payment technology integration into Sage Business Cloud Payroll, enhance operational efficiency for SMBs and drive further growth prospects in financial management solutions.

Make It Happen

- Discover the full array of 46 UK High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:INF

Informa

Operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally.

Reasonable growth potential with adequate balance sheet.