- United Kingdom

- /

- Professional Services

- /

- AIM:SAG

January 2025 UK Penny Stocks: Promising Picks To Consider

Reviewed by Simply Wall St

The United Kingdom's stock market has recently been affected by weak trade data from China, leading to declines in the FTSE 100 and FTSE 250 indices. In such fluctuating markets, investors often seek opportunities in less conventional areas like penny stocks, which can still offer growth potential despite their vintage moniker. These stocks, typically representing smaller or newer companies, may present attractive prospects when backed by strong financial health and a clear path for growth.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.825 | £465.11M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £1.00 | £157.74M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.55 | £405.37M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.892 | £712.93M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.158 | £178.6M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.355 | £333.67M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.90 | £186M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £1.905 | £135.91M | ★★★★★☆ |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Learning Technologies Group (AIM:LTG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Learning Technologies Group plc, with a market cap of £778.22 million, offers talent and learning solutions, content, services, and digital platforms to corporate and government clients through its subsidiaries.

Operations: The company generates revenue through two main segments: Content & Services, which contributed £390.17 million, and Software & Platforms, which added £137.88 million.

Market Cap: £778.22M

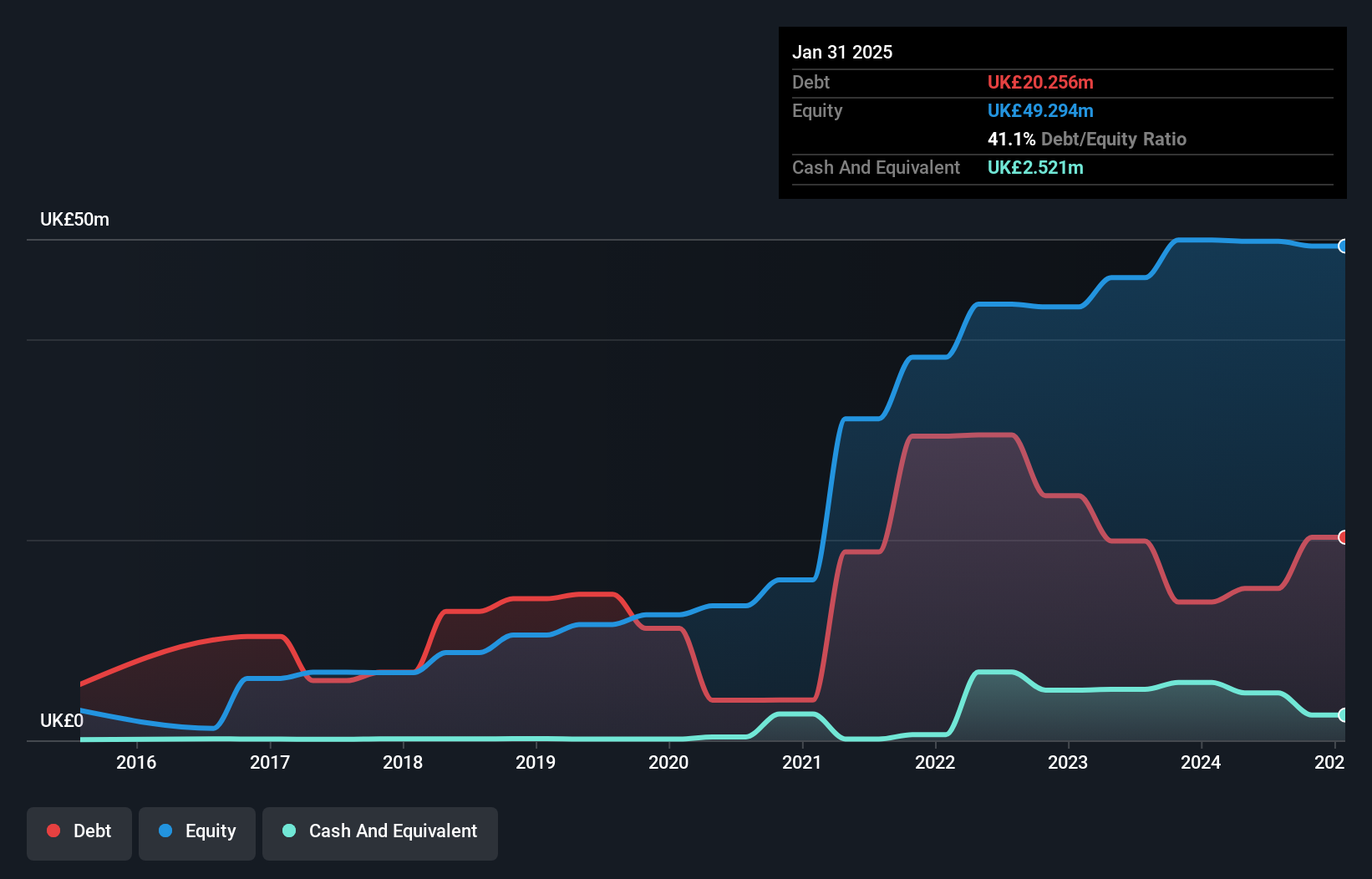

Learning Technologies Group plc, with a market cap of £778.22 million, demonstrates strong financial health through its satisfactory net debt to equity ratio of 13% and well-covered interest payments by EBIT at 7.3x. The company has experienced significant earnings growth, with a 67% increase over the past year, outpacing both its historical average and industry peers. Despite this growth, future earnings are forecasted to decline by an average of 9% annually over the next three years. The stock trades at good value compared to peers and is currently priced below estimated fair value by 25.4%.

- Jump into the full analysis health report here for a deeper understanding of Learning Technologies Group.

- Review our growth performance report to gain insights into Learning Technologies Group's future.

Science Group (AIM:SAG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Science Group plc is a science, engineering, and technology company offering consultancy services and systems businesses across the UK, Europe, North America, Asia, and globally with a market cap of £208.03 million.

Operations: The company's revenue is primarily derived from consultancy services (£75.51 million) and freehold properties (£3.98 million).

Market Cap: £208.03M

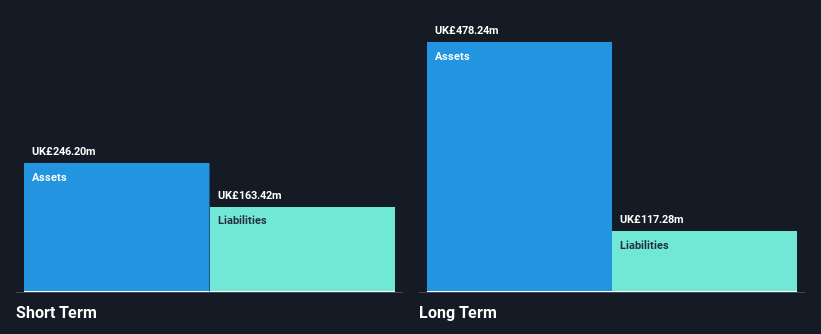

Science Group plc, with a market cap of £208.03 million, shows robust financial health as its cash exceeds total debt and short-term assets (£65.0M) cover both short-term (£32.4M) and long-term liabilities (£19.2M). Despite recent negative earnings growth, the company has achieved significant profit growth averaging 24.5% annually over five years. The stock trades at a substantial discount to estimated fair value and analysts agree on a potential price increase of 45.4%. However, current net profit margins have declined from last year, and the return on equity remains low at 7.1%.

- Take a closer look at Science Group's potential here in our financial health report.

- Evaluate Science Group's prospects by accessing our earnings growth report.

Ultimate Products (LSE:ULTP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ultimate Products Plc, along with its subsidiaries, supplies branded household products across the United Kingdom, Germany, the rest of Europe, and internationally, with a market cap of £91.42 million.

Operations: The company generates revenue from its Wholesale - Miscellaneous segment, amounting to £155.50 million.

Market Cap: £91.42M

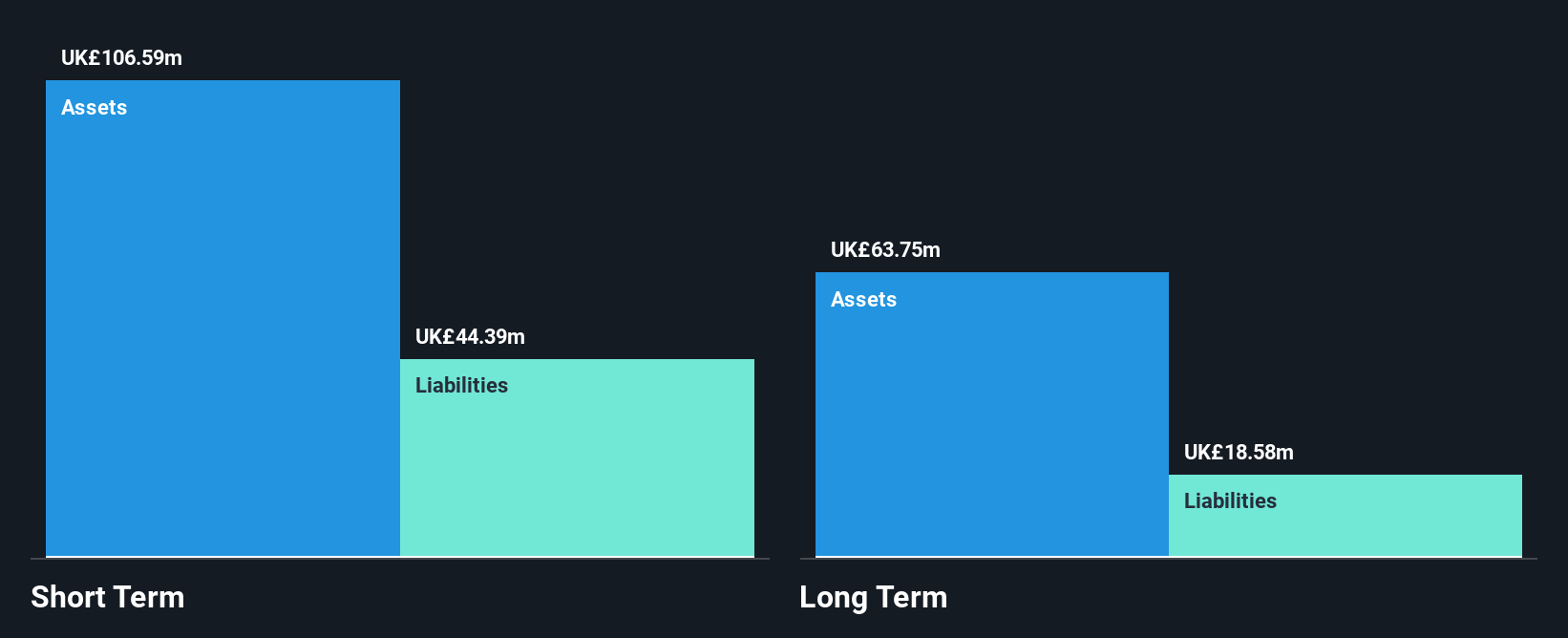

Ultimate Products Plc, with a market cap of £91.42 million, demonstrates financial stability as its short-term assets (£71.7M) exceed both short and long-term liabilities. The company has reduced its debt to equity ratio significantly over the past five years and maintains satisfactory interest coverage with EBIT 11.4 times interest payments. Despite a decline in net profit margins from the previous year, Ultimate Products continues to generate substantial revenue (£155.50 million). Analysts forecast earnings growth of 10.85% annually, while the stock trades below estimated fair value, suggesting potential for appreciation amidst stable weekly volatility (5%).

- Click to explore a detailed breakdown of our findings in Ultimate Products' financial health report.

- Assess Ultimate Products' future earnings estimates with our detailed growth reports.

Where To Now?

- Unlock more gems! Our UK Penny Stocks screener has unearthed 440 more companies for you to explore.Click here to unveil our expertly curated list of 443 UK Penny Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SAG

Science Group

A science, engineering, and technology business company, provides consultancy services and systems businesses in the United Kingdom, rest of Europe, North America, Asia, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives