- United Kingdom

- /

- Biotech

- /

- LSE:OXB

3 High Growth UK Tech Stocks To Watch In Your Portfolio

Reviewed by Simply Wall St

The United Kingdom market has been flat over the last week but is up 11% over the past year, with earnings forecasted to grow by 14% annually. In such a dynamic environment, identifying high-growth tech stocks that align with these promising earnings projections can be an essential strategy for investors looking to strengthen their portfolios.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| Oxford Biomedica | 21.00% | 98.44% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

GB Group (AIM:GBG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GB Group plc, along with its subsidiaries, offers identity data intelligence products and services across the UK, US, Australia, and globally with a market capitalization of £809.29 million.

Operations: The company generates revenue through three primary segments: Identity (£156.06 million), Location (£81.07 million), and Fraud (£40.20 million). Its operations span the UK, US, Australia, and other international markets.

GB Group, navigating through a challenging yet opportunistic tech landscape, shows promising signs with expected revenue growth at 6.1% annually, outpacing the UK market's 3.5%. Despite current unprofitability, projections indicate a shift towards profitability within three years, buoyed by an earnings forecast growing at an impressive rate of 90.56% per year. Recent strategic moves include a dividend increase to 4.20 pence and an upcoming sales report set for mid-October which could provide further insights into its operational trajectory and market positioning.

- Dive into the specifics of GB Group here with our thorough health report.

Assess GB Group's past performance with our detailed historical performance reports.

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc is an international company specializing in events, digital services, and academic research with operations spanning the United Kingdom, Continental Europe, the United States, China, and other regions globally; it has a market capitalization of approximately £10.93 billion.

Operations: Informa generates revenue primarily through its segments: Informa Markets (£1.67 billion), Informa Connect (£630.20 million), Informa Tech (£426.70 million), and Taylor & Francis (£636.70 million). The company operates across diverse sectors, focusing on events, digital services, and academic research globally.

Amidst a bustling tech landscape, Informa has positioned itself through strategic expansions and partnerships, notably enhancing its presence in luxury and lifestyle markets with Monaco, which could bolster its B2B events segment. Despite a challenging past year with earnings dipping by 11.3%, the company's forward-looking strategies signal revitalization, underscored by an aggressive share repurchase program that saw £338.9 million spent to buy back shares in the first half of 2024 alone. With R&D expenses aligned closely with revenue growth expectations of 7.6% annually—above the UK market average—Informa is nurturing a fertile ground for innovation, particularly in digital and tech sectors as part of its broader portfolio diversification strategy.

- Navigate through the intricacies of Informa with our comprehensive health report here.

Gain insights into Informa's historical performance by reviewing our past performance report.

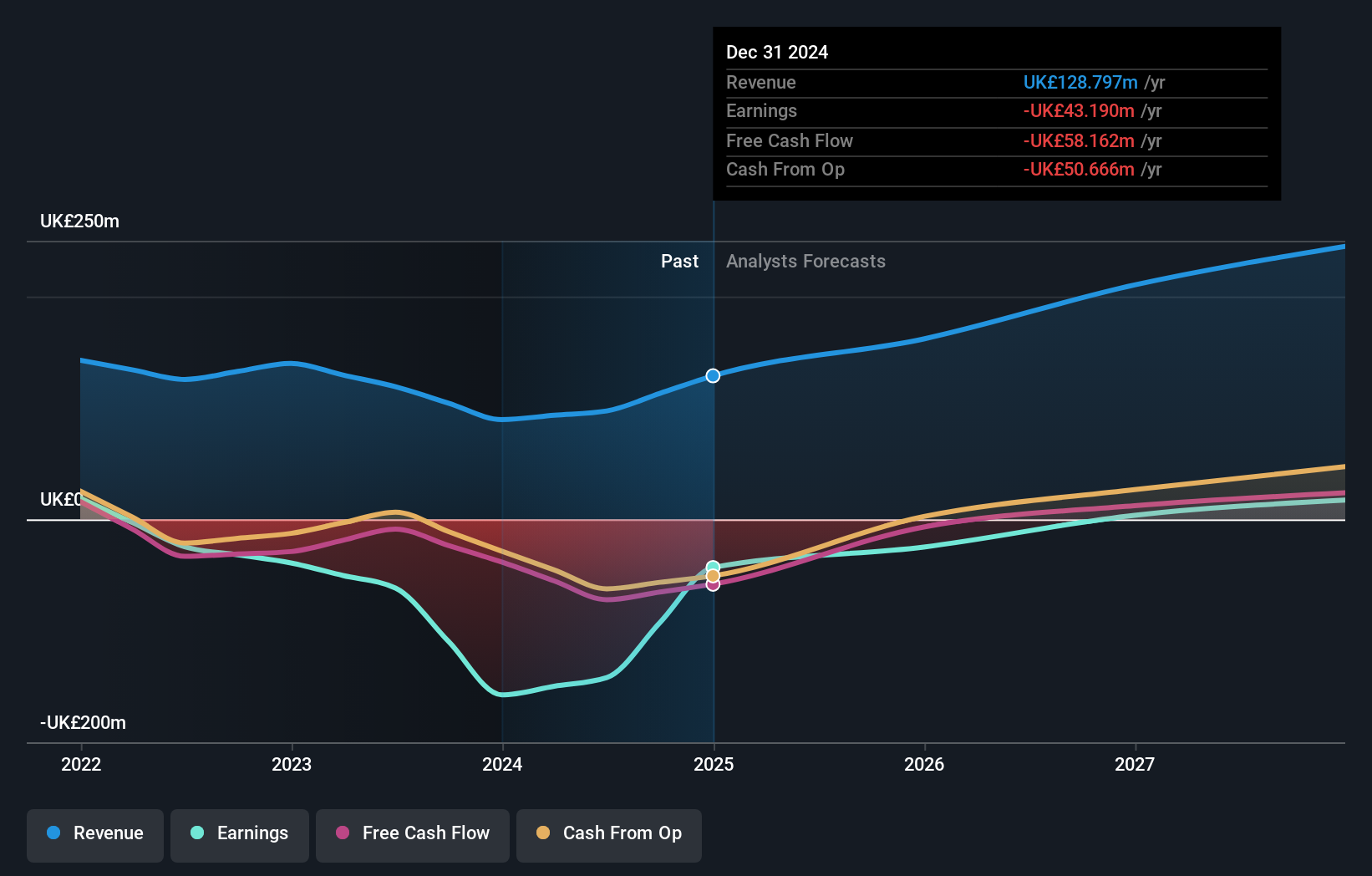

Oxford Biomedica (LSE:OXB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Oxford Biomedica plc is a contract development and manufacturing organization that specializes in delivering therapies to patients globally, with a market capitalization of £437.24 million.

Operations: Oxford Biomedica generates revenue primarily through its Platform segment, which accounts for £97.24 million. The company operates as a contract development and manufacturing organization, focusing on global therapeutic delivery.

Oxford Biomedica is navigating a transformative phase with promising financial forecasts and strategic leadership enhancements. The company's revenue is expected to surge by 21% annually, outpacing the UK market's growth of 3.5%. This upward trajectory is supported by a robust R&D commitment, vital for sustaining long-term innovation in biotechnology. Recent earnings show a reduction in net loss to £32.49 million from £47.96 million year-over-year, alongside an aggressive revenue guidance projecting up to £134 million by year-end, illustrating potential recovery and growth. Moreover, the appointment of Lucinda Crabtree as CFO could inject new vigor into financial strategies, aligning with Oxford Biomedica’s ambitious expansion plans in gene and cell therapy sectors.

- Unlock comprehensive insights into our analysis of Oxford Biomedica stock in this health report.

Evaluate Oxford Biomedica's historical performance by accessing our past performance report.

Taking Advantage

- Dive into all 47 of the UK High Growth Tech and AI Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OXB

Oxford Biomedica

A contract development and manufacturing organization, focuses on delivering therapies to patients worldwide.

High growth potential and good value.