- United Kingdom

- /

- Entertainment

- /

- LSE:CASS

Companies Like Guild Esports (LON:GILD) Are In A Position To Invest In Growth

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should Guild Esports (LON:GILD) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Guild Esports

Does Guild Esports Have A Long Cash Runway?

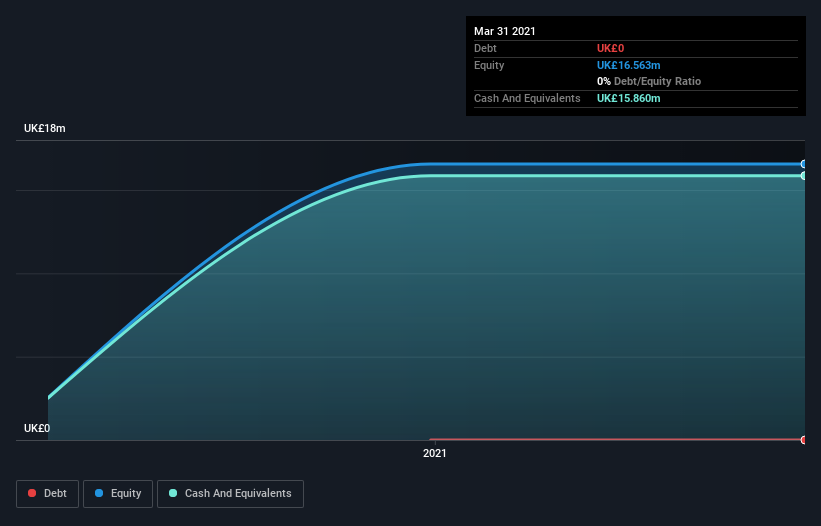

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Guild Esports last reported its balance sheet in March 2021, it had zero debt and cash worth UK£16m. Looking at the last year, the company burnt through UK£6.8m. That means it had a cash runway of about 2.3 years as of March 2021. Arguably, that's a prudent and sensible length of runway to have. Depicted below, you can see how its cash holdings have changed over time.

Can Guild Esports Raise More Cash Easily?

Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Guild Esports has a market capitalisation of UK£19m and burnt through UK£6.8m last year, which is 35% of the company's market value. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

Is Guild Esports' Cash Burn A Worry?

Given it's an early stage company, we don't have a lot of data with which to judge Guild Esports' cash burn. However, it is fair to say that its cash runway gave us comfort. To be frank most cash burning companies are relatively risky, but this one seems safer than most, in our view. Taking a deeper dive, we've spotted 4 warning signs for Guild Esports you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course Guild Esports may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:CASS

Cassell Capital

Operates as a team organization and lifestyle brand that fields professional players in gaming competitions under the Guild banner worldwide.

Moderate and slightly overvalued.

Similar Companies

Market Insights

Community Narratives