For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Future (LON:FUTR). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Future with the means to add long-term value to shareholders.

Check out our latest analysis for Future

Future's Improving Profits

Over the last three years, Future has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Outstandingly, Future's EPS shot from UK£0.59 to UK£1.02, over the last year. Year on year growth of 71% is certainly a sight to behold. That could be a sign that the business has reached a true inflection point.

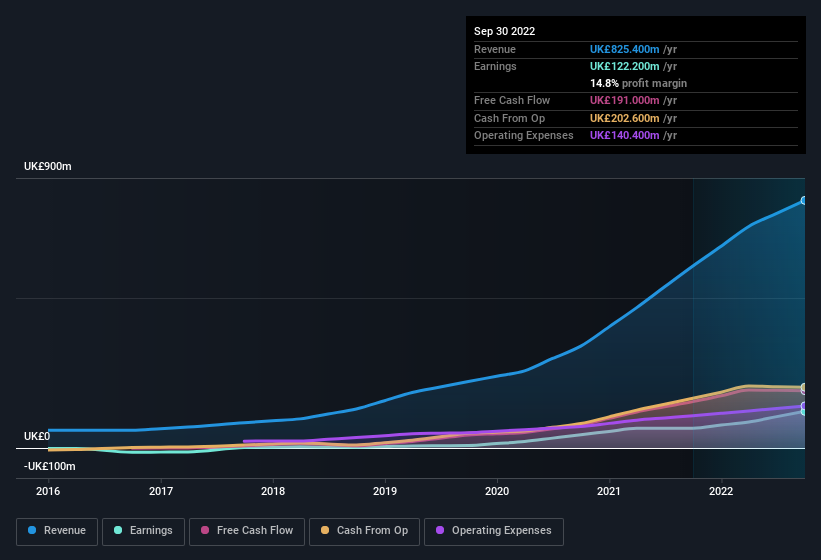

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Future achieved similar EBIT margins to last year, revenue grew by a solid 36% to UK£825m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Future?

Are Future Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's good to see Future insiders walking the walk, by spending UK£479k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. Zooming in, we can see that the biggest insider purchase was by CEO & Executive Director Zillah Byng-Thorne for UK£233k worth of shares, at about UK£31.42 per share.

The good news, alongside the insider buying, for Future bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth UK£99m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Does Future Deserve A Spot On Your Watchlist?

Future's earnings have taken off in quite an impressive fashion. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Future deserves timely attention. We should say that we've discovered 1 warning sign for Future that you should be aware of before investing here.

The good news is that Future is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:FUTR

Future

Future plc, together with its subsidiaries, publishes and distributes content for technology, gaming, sports, fashion, beauty, homes, wealth, and knowledge sectors in the United States and the United Kingdom.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives