- United Kingdom

- /

- Capital Markets

- /

- AIM:FRP

Discover UK Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn following weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, investors often seek opportunities in penny stocks—smaller or newer companies that can offer growth potential when backed by strong financial health. Although the term "penny stock" might seem outdated, it remains relevant as an investment area where hidden value and long-term potential can be uncovered.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.50 | £173.92M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.865 | £459.28M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.28 | £323.7M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.135 | £800.61M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.235 | £409.76M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.41 | £163.26M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.42 | £121.65M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.414 | £216.54M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.49 | £190.39M | ★★★★★☆ |

| Serabi Gold (AIM:SRB) | £0.915 | £67.71M | ★★★★★★ |

Click here to see the full list of 476 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Cirata (AIM:CRTA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cirata plc, along with its subsidiaries, develops and provides collaboration software across North America, Europe, China, and other international markets with a market cap of £36.77 million.

Operations: The company generates $7.14 million in revenue from the development and sale of software licenses, along with related maintenance and support services.

Market Cap: £36.77M

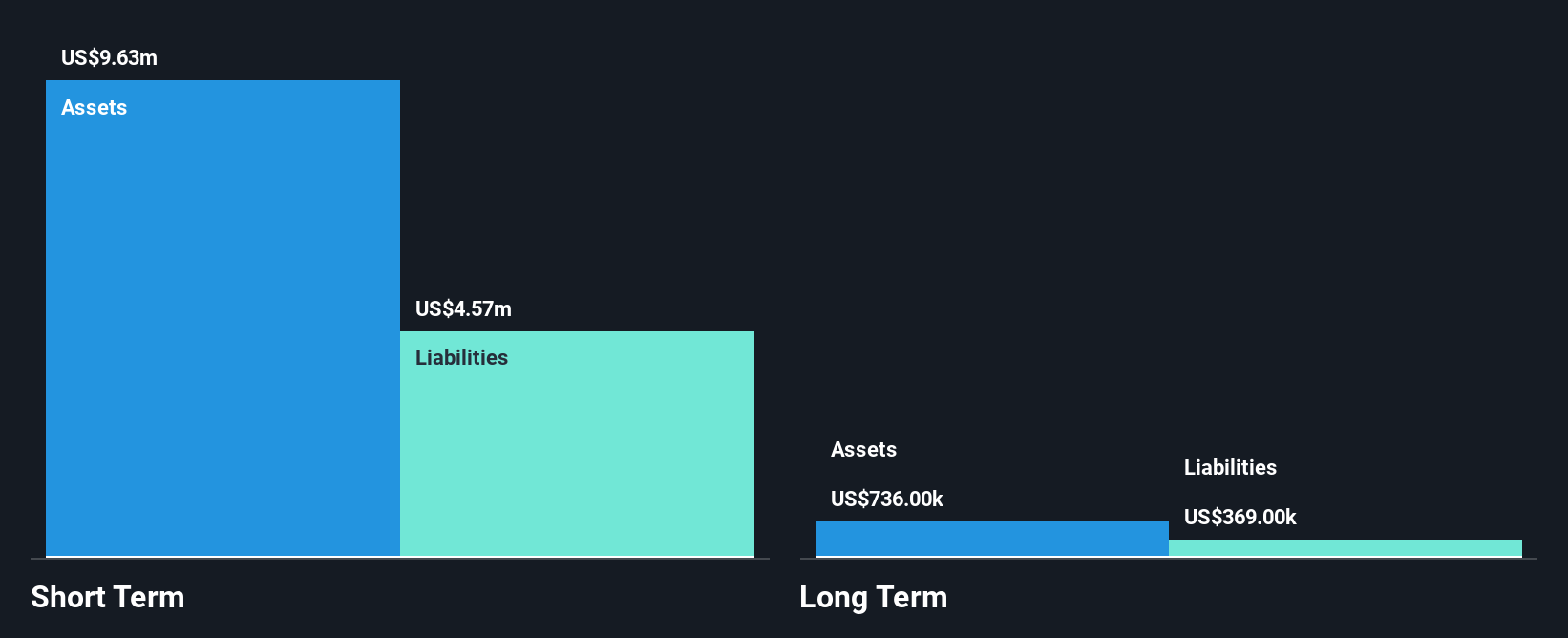

Cirata plc, with a market cap of £36.77 million, operates in the software sector and has recently amended its OEM sales agreement with IBM to enhance data migration capabilities. Despite generating $7.14 million in revenue, the company remains unprofitable with increasing losses over five years and a negative return on equity of -283.4%. Cirata's financial stability is bolstered by short-term assets exceeding liabilities and being debt-free; however, shareholder dilution occurred last year. Recent management changes aim to stabilize leadership amid ongoing volatility in share price and high weekly volatility relative to UK stocks.

- Jump into the full analysis health report here for a deeper understanding of Cirata.

- Understand Cirata's earnings outlook by examining our growth report.

FRP Advisory Group (AIM:FRP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: FRP Advisory Group plc, with a market cap of £323.70 million, offers business advisory services to companies, lenders, investors, individuals, and other stakeholders through its subsidiaries.

Operations: The company generates revenue of £128.20 million from providing specialist business advisory services.

Market Cap: £323.7M

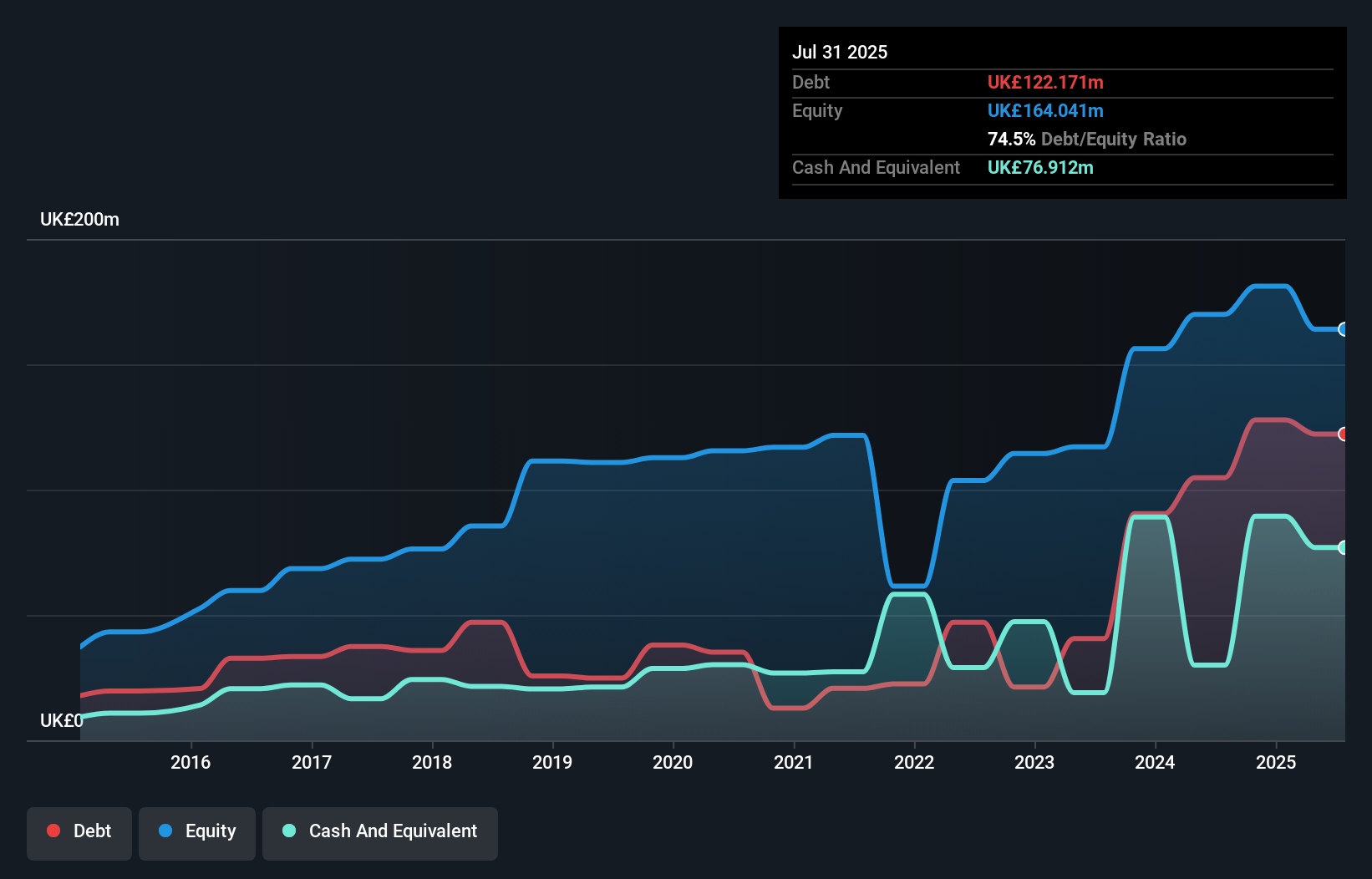

FRP Advisory Group, with a market cap of £323.70 million, has demonstrated strong financial health and growth potential. Earnings have grown significantly by 41.6% annually over the past five years, with recent acceleration to 73.2%. The company's debt is well-covered by operating cash flow and it holds more cash than total debt, indicating robust liquidity management. Despite an unstable dividend record and shareholder dilution last year, FRP's return on equity remains high at 28.2%, supported by experienced management and board teams. Analysts agree the stock is undervalued, trading below estimated fair value with positive growth forecasts.

- Get an in-depth perspective on FRP Advisory Group's performance by reading our balance sheet health report here.

- Examine FRP Advisory Group's earnings growth report to understand how analysts expect it to perform.

Next 15 Group (AIM:NFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Next 15 Group plc, along with its subsidiaries, offers communications services across the United Kingdom, Europe, Africa, the United States, and the Asia Pacific with a market cap of £409.76 million.

Operations: No specific revenue segments are reported for the company.

Market Cap: £409.76M

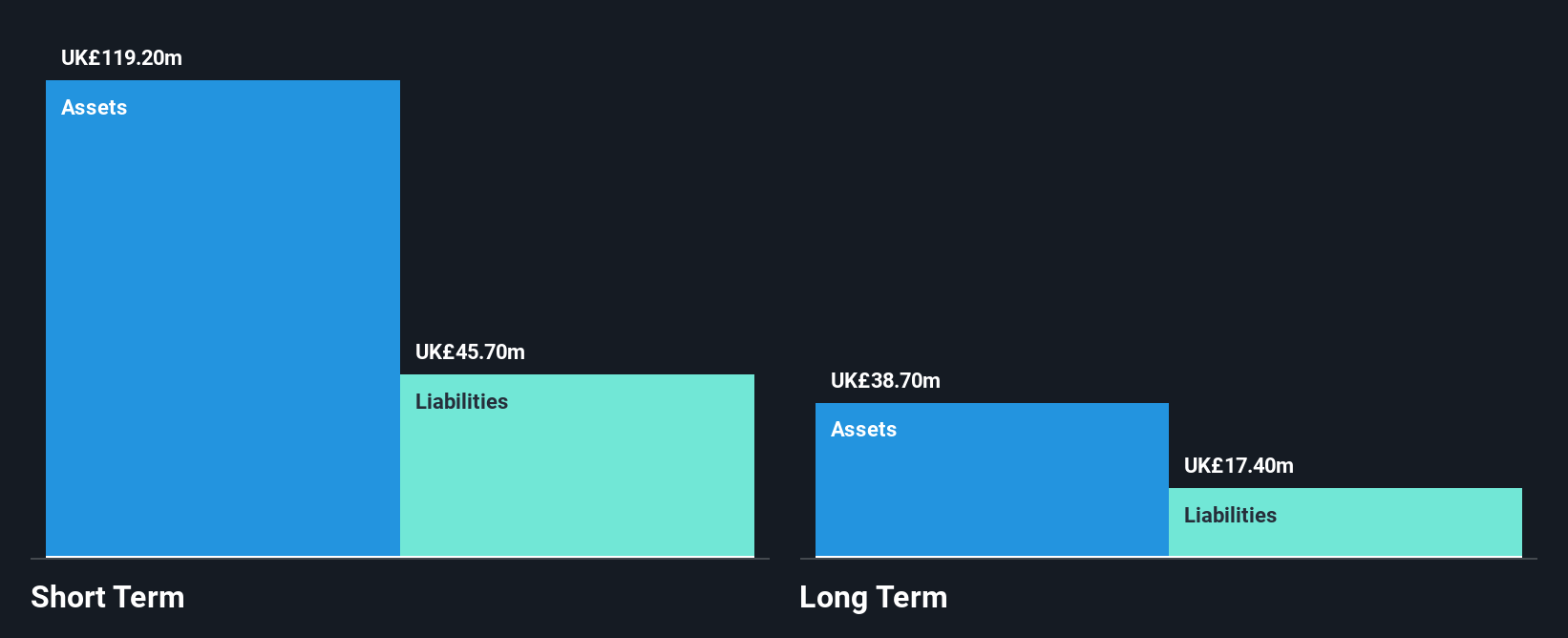

Next 15 Group plc, with a market cap of £409.76 million, shows strong financial metrics despite some challenges. The company's net profit margins have improved to 8.3% from last year's 3.5%, and earnings growth of 132% outpaces the media industry average significantly. It trades at a value considered below its fair estimate, with short-term assets exceeding both short- and long-term liabilities, indicating solid liquidity management. However, it carries a high debt-to-equity ratio of 61.7%, and earnings are forecasted to decline by an average of 8% annually over the next three years amidst increased share price volatility recently observed.

- Click here and access our complete financial health analysis report to understand the dynamics of Next 15 Group.

- Learn about Next 15 Group's future growth trajectory here.

Where To Now?

- Get an in-depth perspective on all 476 UK Penny Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FRP

FRP Advisory Group

Provides business advisory services to companies, lenders, investors, individuals, and other stakeholders.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives