- United Kingdom

- /

- Construction

- /

- AIM:VANL

Ebiquity And 2 Other Promising Penny Stocks On The UK Exchange

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced a downturn, with the FTSE 100 closing lower due to weak trade data from China, highlighting global economic challenges. Amidst these fluctuations, investors often seek opportunities in lesser-known areas of the market, such as penny stocks. Although considered niche and somewhat outdated by name, penny stocks can still offer intriguing prospects for growth when they are backed by strong financial health and potential for long-term success.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.50 | £173.92M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.865 | £459.28M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.28 | £323.7M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.135 | £800.61M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.235 | £409.76M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.41 | £163.26M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.42 | £121.65M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.414 | £216.54M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.49 | £190.39M | ★★★★★☆ |

| Serabi Gold (AIM:SRB) | £0.915 | £67.71M | ★★★★★★ |

Click here to see the full list of 476 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Ebiquity (AIM:EBQ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ebiquity plc, with a market cap of £29.44 million, offers media consultancy and investment analysis services across the United Kingdom, Ireland, North America, Continental Europe, and the Asia Pacific.

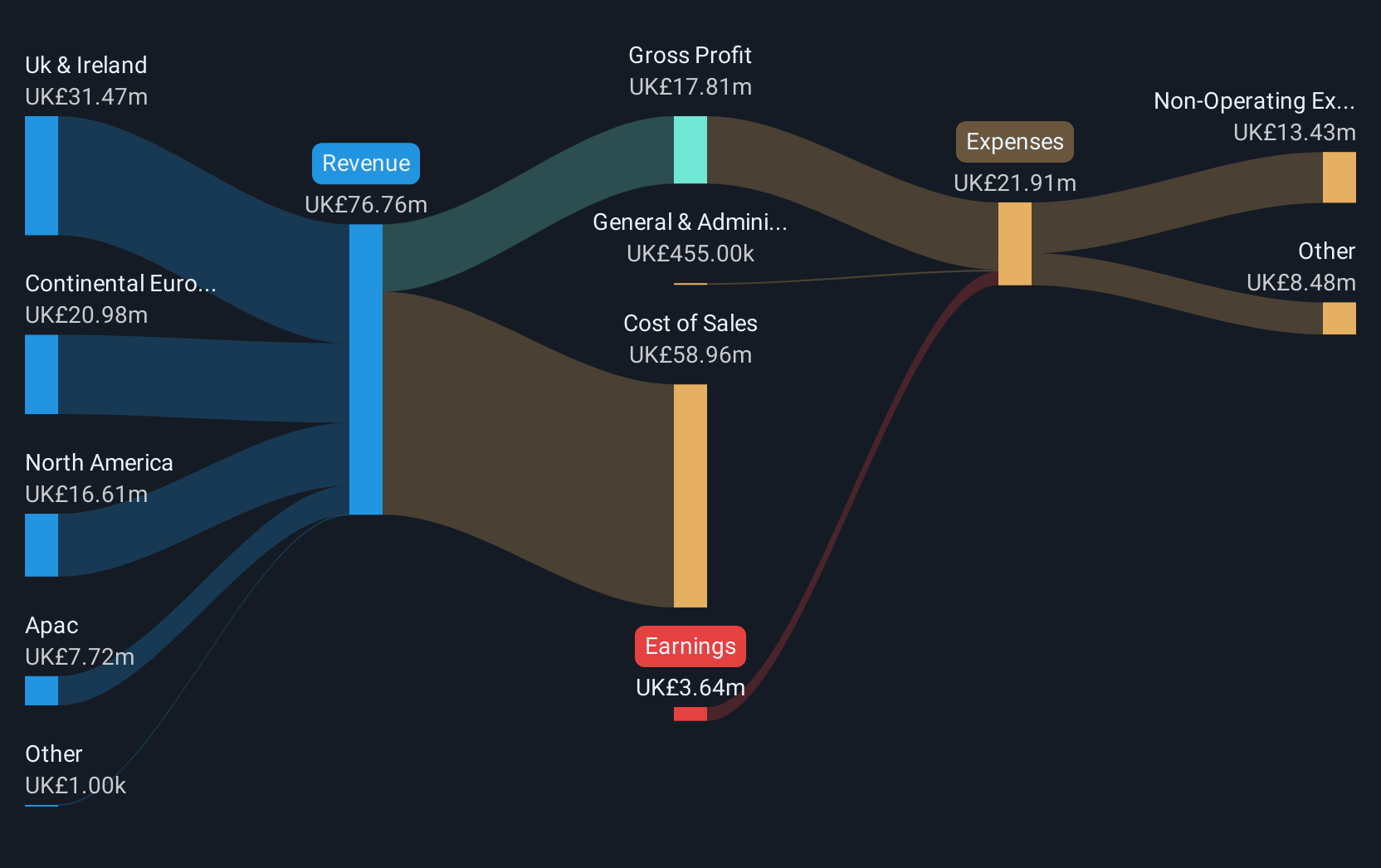

Operations: The company's revenue is derived from the following regions: £8.57 million from Asia Pacific, £31.58 million from the UK and Ireland, £17.19 million from North America, and £19.95 million from Continental Europe.

Market Cap: £29.44M

Ebiquity plc, with a market cap of £29.44 million, faces challenges as it remains unprofitable despite reducing losses by 7.6% annually over five years. Its short-term assets exceed both short and long-term liabilities, providing some financial stability. However, the company's debt to equity ratio has increased to 54.7%, and its share price has been highly volatile recently. Revenue for H1 2024 declined to £37.85 million from £40.63 million in H1 2023 due to budget cuts by large clients, resulting in a net loss of £1.17 million compared to a profit last year, highlighting ongoing operational hurdles amidst management changes.

- Click here and access our complete financial health analysis report to understand the dynamics of Ebiquity.

- Learn about Ebiquity's future growth trajectory here.

NAHL Group (AIM:NAH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NAHL Group Plc operates in the United Kingdom, offering products and services in consumer legal services and catastrophic injury markets, with a market cap of £32.43 million.

Operations: The company's revenue is derived from two main segments: Critical Care, generating £15.37 million, and Consumer Legal Services, contributing £25.26 million.

Market Cap: £32.43M

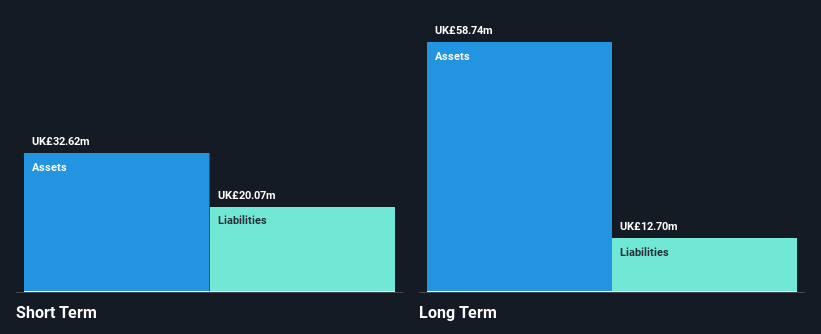

NAHL Group Plc, with a market cap of £32.43 million, operates in consumer legal services and catastrophic injury markets. The company has demonstrated financial resilience with short-term assets of £32.6 million exceeding both short and long-term liabilities (£20.1M and £12.7M respectively). Despite a slight dip in H1 2024 sales to £19.39 million from the previous year's £20.95 million, NAHL reported a net income of GBP 0.333 million compared to a loss last year, reflecting improved profitability margins (2%). Earnings have grown significantly over the past five years, supported by stable management and an experienced board.

- Dive into the specifics of NAHL Group here with our thorough balance sheet health report.

- Understand NAHL Group's earnings outlook by examining our growth report.

Van Elle Holdings (AIM:VANL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Van Elle Holdings plc operates as a geotechnical and ground engineering contractor in the United Kingdom, with a market cap of £45.04 million.

Operations: The company's revenue is generated from three primary segments: General Piling (£56.69 million), Specialist Piling & Rail (£43.87 million), and Ground Engineering Services (£38.32 million).

Market Cap: £45.04M

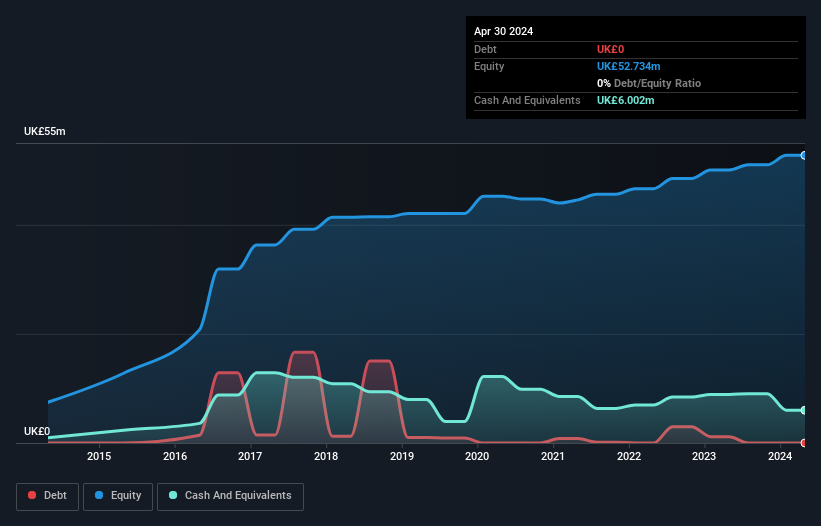

Van Elle Holdings plc, with a market cap of £45.04 million, is strategically positioned in the UK construction sector despite recent negative earnings growth. The company benefits from no debt and strong asset coverage over liabilities (£50.0M vs £34.8M short-term and £11.3M long-term). Its valuation appears attractive, trading significantly below estimated fair value and compared to industry peers. Recent contract wins in Canada for the CAD 20 billion GO Expansion project and participation in Network Rail's Southern Renewals framework underscore its growth potential despite an unstable dividend history and low return on equity (8%).

- Get an in-depth perspective on Van Elle Holdings' performance by reading our balance sheet health report here.

- Examine Van Elle Holdings' earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Reveal the 476 hidden gems among our UK Penny Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VANL

Van Elle Holdings

Operates as a geotechnical and ground engineering contractor in the United Kingdom.

Flawless balance sheet and undervalued.