- United Kingdom

- /

- Professional Services

- /

- AIM:PPHC

UK Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices both closing lower amid weak trade data from China, highlighting ongoing global economic uncertainties. Despite these broader market fluctuations, investors often look to penny stocks for their potential to offer affordability and growth opportunities. While the term "penny stocks" may seem outdated, these smaller or newer companies can still provide significant value when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.84 | £11.57M | ✅ 3 ⚠️ 3 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.72 | £60.67M | ✅ 4 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.95 | £304.36M | ✅ 5 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £3.98 | £321.53M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.955 | £446M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.085 | £393.78M | ✅ 3 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.71 | £218.49M | ✅ 2 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.99 | £157.89M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.22 | £2.31B | ✅ 4 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 398 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Eden Research (AIM:EDEN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eden Research plc, with a market cap of £21.07 million, develops and sells biopesticide solutions for crop protection, animal health, and consumer products industries in the United Kingdom and Europe.

Operations: The company's revenue is derived from two main segments: Agrochemicals, generating £4.03 million, and Consumer Products, contributing £0.27 million.

Market Cap: £21.07M

Eden Research plc, with a market cap of £21.07 million, is currently unprofitable but has shown some positive developments. The company reported sales of £4.3 million for the year ended December 31, 2024, an increase from £3.19 million the previous year, while reducing its net loss significantly to £1.91 million from £6.49 million. Eden's short-term assets surpass both its short and long-term liabilities, and it remains debt-free with a cash runway exceeding one year if current cash flow trends continue. Recent agreements like the supply deal with Veto-pharma could enhance future revenue streams despite historical earnings volatility.

- Click here to discover the nuances of Eden Research with our detailed analytical financial health report.

- Evaluate Eden Research's historical performance by accessing our past performance report.

Frontier Developments (AIM:FDEV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frontier Developments plc develops and publishes video games for the interactive entertainment sector, with a market cap of £76.92 million.

Operations: The company generates revenue from its Computer Graphics segment, amounting to £88.88 million.

Market Cap: £76.92M

Frontier Developments plc, with a market cap of £76.92 million, has recently turned profitable, though its earnings are forecast to decline significantly over the next three years. The company is debt-free and maintains strong liquidity, with short-term assets of £53.1 million exceeding both short-term (£17.5M) and long-term liabilities (£20.3M). Its management and board are experienced, but the Return on Equity is relatively low at 19.5%. Frontier's Price-To-Earnings ratio of 4.8x suggests it may be undervalued compared to the broader UK market average of 16.3x.

- Get an in-depth perspective on Frontier Developments' performance by reading our balance sheet health report here.

- Understand Frontier Developments' earnings outlook by examining our growth report.

Public Policy Holding Company (AIM:PPHC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Public Policy Holding Company, Inc. offers consulting services in the United States and has a market cap of £161.09 million.

Operations: The company generates revenue through its Diversified Services ($10.69 million), Government Relations ($102.46 million), and Public Affairs Consulting ($36.41 million) segments in the United States.

Market Cap: £161.09M

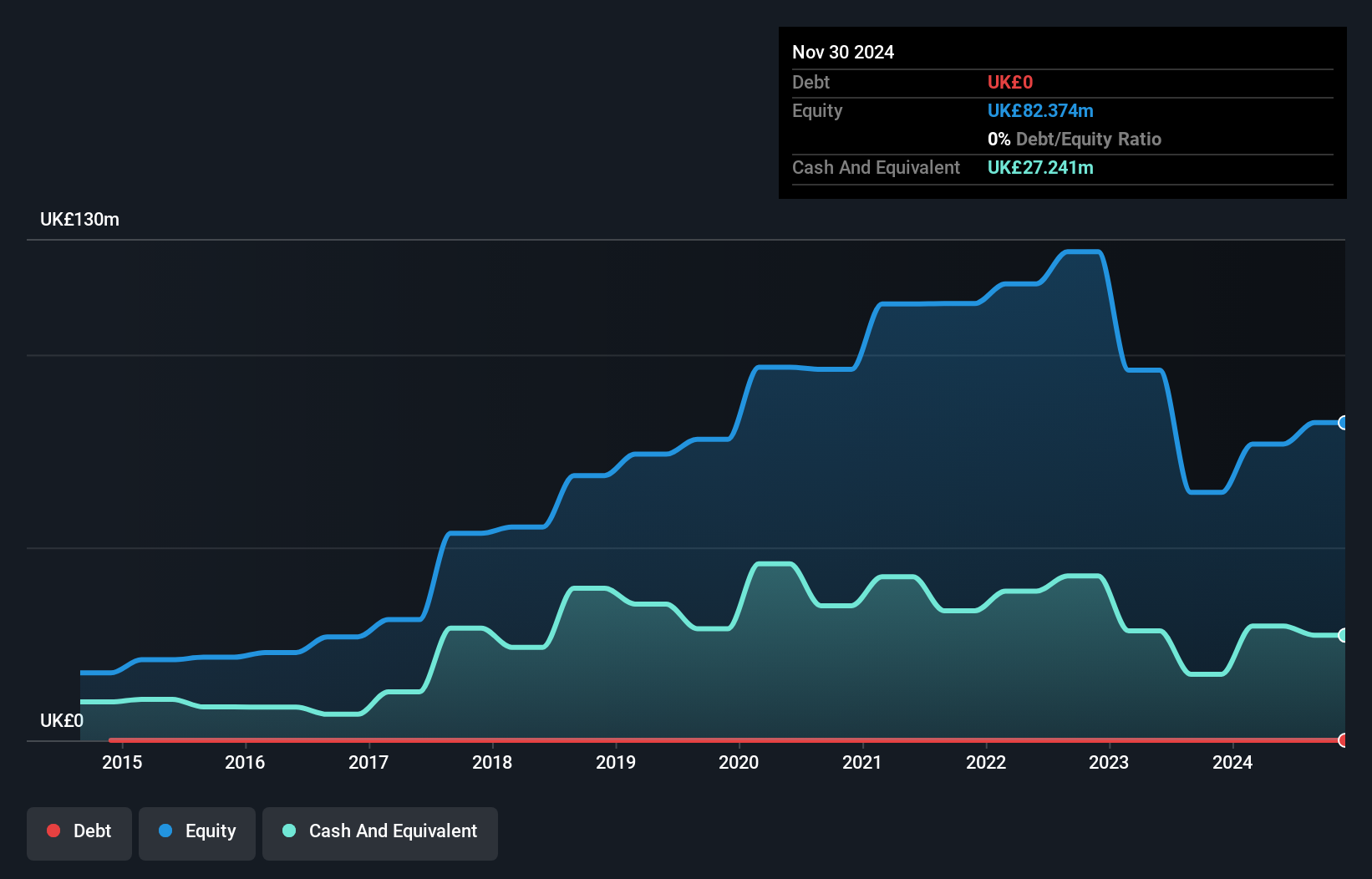

Public Policy Holding Company, Inc. operates in the United States with a market cap of £161.09 million and generates significant revenue across its diversified services, government relations, and public affairs consulting segments totaling US$149.56 million for 2024. Despite being unprofitable with increasing losses over the past five years, it maintains a positive cash flow sufficient for more than three years of operations. Recent private placements raised US$4.95 million to support ongoing initiatives while dividends were decreased but remain payable shortly after their annual general meeting on May 15, 2025. The company's debt levels have risen but remain within satisfactory limits relative to equity.

- Click to explore a detailed breakdown of our findings in Public Policy Holding Company's financial health report.

- Gain insights into Public Policy Holding Company's future direction by reviewing our growth report.

Taking Advantage

- Get an in-depth perspective on all 398 UK Penny Stocks by using our screener here.

- Searching for a Fresh Perspective? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:PPHC

Public Policy Holding Company

Provides consulting services in the United States.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives