- United Kingdom

- /

- Software

- /

- AIM:ELCO

Top UK Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

The UK market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China and its impact on global economic recovery. In such fluctuating conditions, investors often look beyond the established giants to explore opportunities in lesser-known areas of the market. Penny stocks, typically involving smaller or newer companies, remain an intriguing investment avenue as they offer potential growth at lower price points while maintaining solid financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.23 | £305.1M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.275 | £345.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 5 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £4.05 | £51.39M | ✅ 3 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.06 | £315.07M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.60 | £129.47M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.245 | £198.62M | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.80 | £11.01M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.14 | £66.12M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.20 | £830.64M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Eleco (AIM:ELCO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eleco plc is a software and services provider operating in the UK, Scandinavia, Germany, Europe, the US, and internationally with a market cap of £143.22 million.

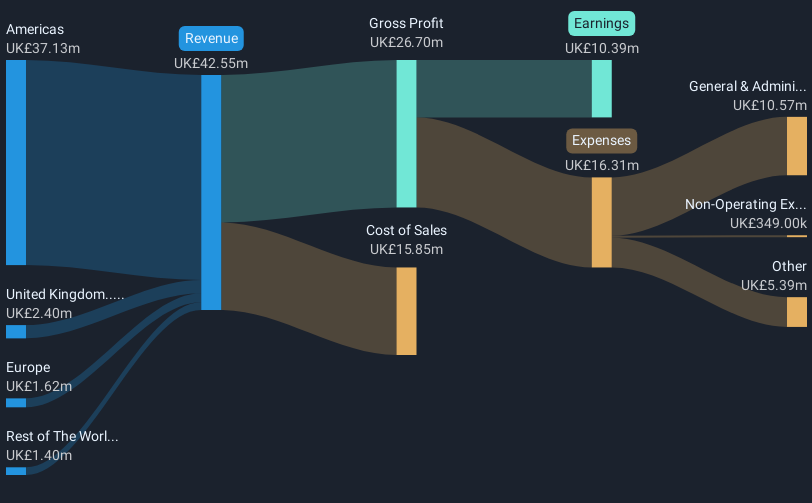

Operations: The company generates revenue of £32.39 million from its software segment.

Market Cap: £143.22M

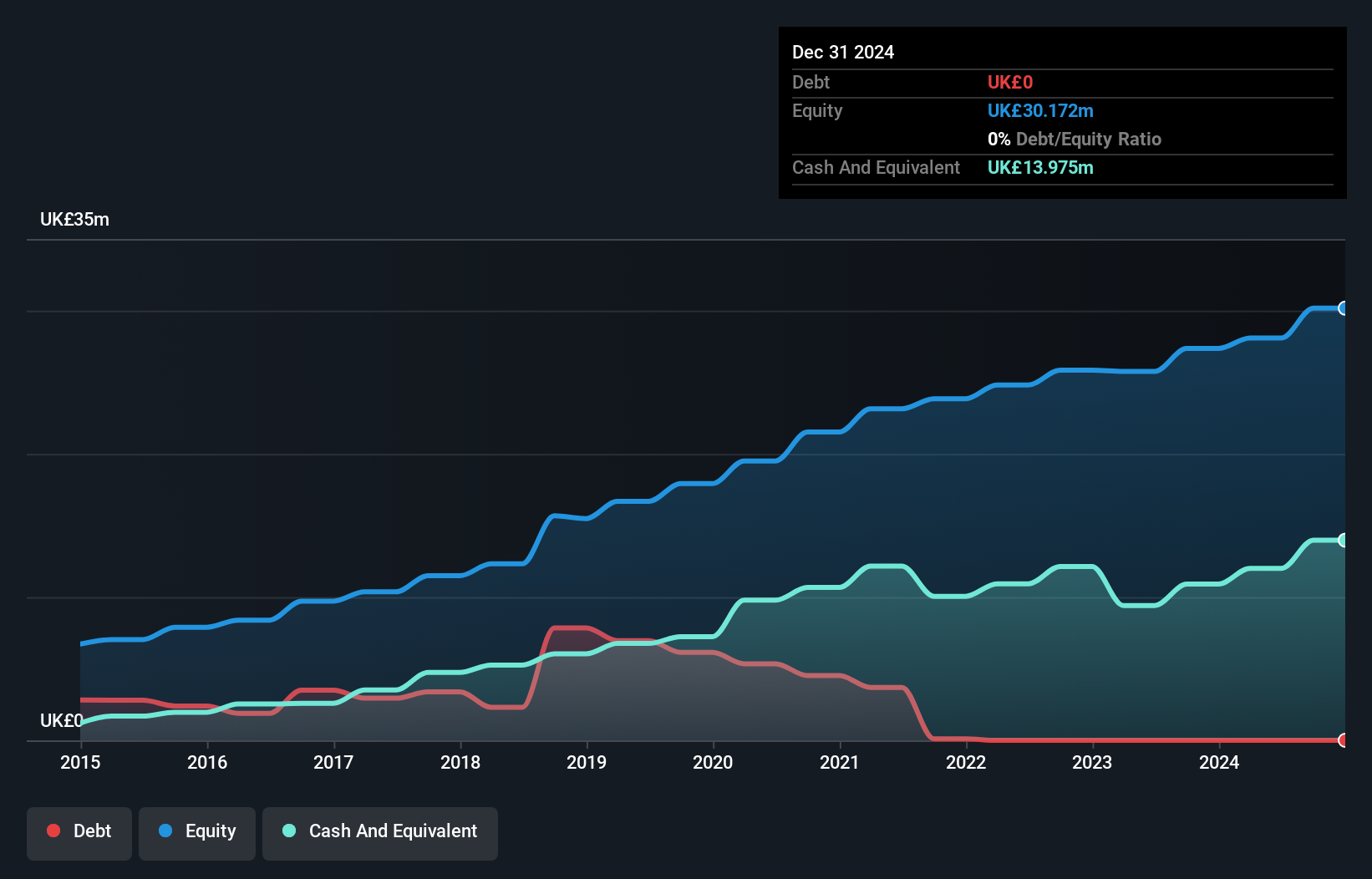

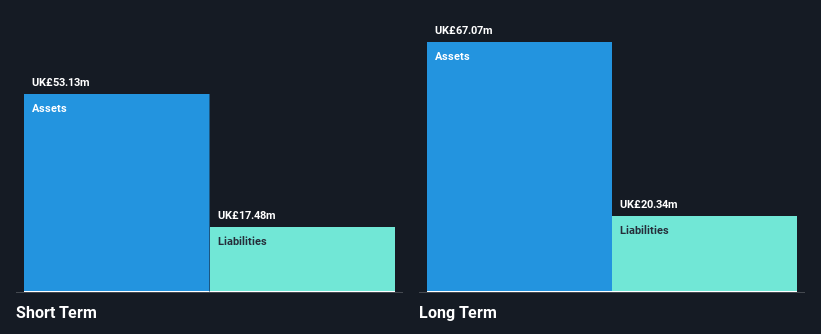

Eleco plc, with a market cap of £143.22 million, has demonstrated resilience in the penny stock space by maintaining a debt-free balance sheet and achieving stable earnings growth. Despite a historical decline in profits over five years, recent performance shows improvement with earnings growing 25.6% last year, surpassing industry averages. The company reported sales of £32.39 million for 2024 and increased its net income to £3.33 million from £2.66 million the previous year, alongside proposing an increased dividend payout of 1 pence per share for the year—reflecting solid financial health and shareholder value enhancement.

- Get an in-depth perspective on Eleco's performance by reading our balance sheet health report here.

- Gain insights into Eleco's outlook and expected performance with our report on the company's earnings estimates.

Frontier Developments (AIM:FDEV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frontier Developments plc is a company that develops and publishes video games for the interactive entertainment sector, with a market cap of £139.58 million.

Operations: The company generates revenue from its Computer Graphics segment, totaling £88.88 million.

Market Cap: £139.58M

Frontier Developments, with a market cap of £139.58 million, operates debt-free and has recently become profitable, though its earnings have declined by 47% annually over the past five years. The company is executing a share buyback program worth £10 million to enhance shareholder value and improve return on equity. Despite challenges in profit growth forecasts, Frontier's revenue performance remains strong with expected fiscal year 2025 revenue around £90 million. Additionally, the upcoming release of Jurassic World Evolution 3 could bolster future revenues as it expands its popular game franchise portfolio.

- Dive into the specifics of Frontier Developments here with our thorough balance sheet health report.

- Learn about Frontier Developments' future growth trajectory here.

Filtronic (AIM:FTC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Filtronic plc designs, develops, manufactures, and sells radio frequency (RF) technology globally, with a market cap of £360.26 million.

Operations: The company generates revenue primarily from its Wireless Communications Equipment segment, which accounted for £42.55 million.

Market Cap: £360.26M

Filtronic plc, with a market cap of £360.26 million, has transitioned to profitability and operates without debt, showcasing financial stability. The company anticipates significant revenue growth for 2025, projecting approximately £56.3 million compared to FY2024's £25.4 million. Recent strategic wins include a substantial $32.5 million order from SpaceX and contracts with Airbus Defence and Viasat under the European Space Agency initiative, enhancing its position in the RF technology sector. Despite high share price volatility recently, Filtronic's robust partnerships and expanding product offerings underscore its potential within the competitive landscape of penny stocks in the UK market.

- Navigate through the intricacies of Filtronic with our comprehensive balance sheet health report here.

- Evaluate Filtronic's prospects by accessing our earnings growth report.

Taking Advantage

- Gain an insight into the universe of 295 UK Penny Stocks by clicking here.

- Interested In Other Possibilities? The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eleco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ELCO

Eleco

Provides software and related services in the United Kingdom, Scandinavia, Germany, the rest of Europe, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives