- United Kingdom

- /

- Entertainment

- /

- AIM:FDEV

I Ran A Stock Scan For Earnings Growth And Frontier Developments (LON:FDEV) Passed With Ease

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Frontier Developments (LON:FDEV), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Frontier Developments

Frontier Developments's Improving Profits

Over the last three years, Frontier Developments has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a falcon taking flight, Frontier Developments's EPS soared from UK£0.41 to UK£0.55, over the last year. That's a impressive gain of 33%.

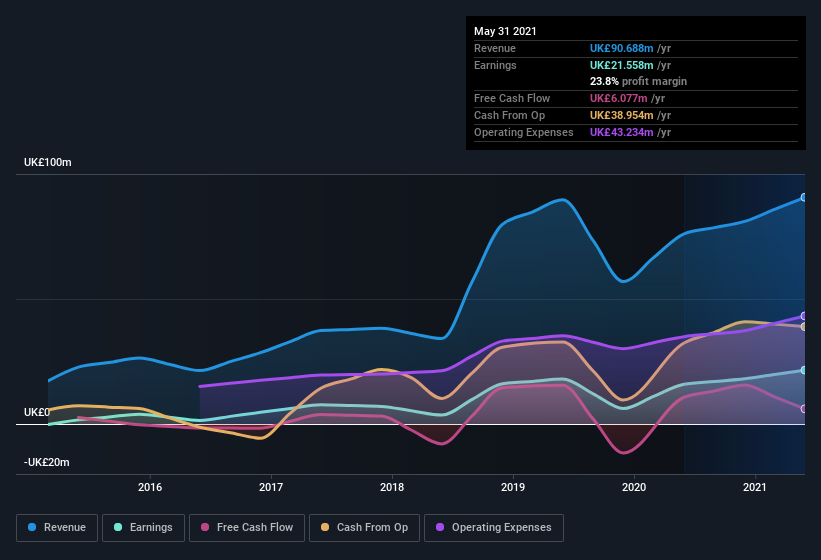

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Frontier Developments maintained stable EBIT margins over the last year, all while growing revenue 19% to UK£91m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Frontier Developments?

Are Frontier Developments Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

While we did see insider selling of Frontier Developments stock in the last year, one single insider spent plenty more buying. Specifically the Independent Non-Executive Director, Charles William Cotton, spent UK£546k, paying about UK£26.09 per share. That certainly pricks my ears up.

The good news, alongside the insider buying, for Frontier Developments bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enormous stake in the company, worth UK£239m. That equates to 35% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, David Braben is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like Frontier Developments with market caps between UK£295m and UK£1.2b is about UK£772k.

Frontier Developments offered total compensation worth UK£498k to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Frontier Developments Worth Keeping An Eye On?

For growth investors like me, Frontier Developments's raw rate of earnings growth is a beacon in the night. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So I do think this is one stock worth watching. You still need to take note of risks, for example - Frontier Developments has 2 warning signs (and 1 which can't be ignored) we think you should know about.

As a growth investor I do like to see insider buying. But Frontier Developments isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:FDEV

Frontier Developments

Develops and publishes video games for the interactive entertainment sector.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives