- United Kingdom

- /

- Capital Markets

- /

- LSE:ASHM

Frontier Developments And 2 Other UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK market has recently experienced volatility, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic challenges. In such a fluctuating market landscape, identifying stocks with strong fundamentals becomes crucial for investors seeking potential growth opportunities. Penny stocks, while often considered a throwback term, represent an intriguing area of investment; these smaller or newer companies can offer significant potential when backed by robust financials and sound business models.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.75 | £182.42M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.06 | £780M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.85M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.885 | £491.62M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.67 | £432.46M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.70 | £343.12M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £4.33 | £85.44M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.025 | £90.69M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.08 | £148.39M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.425 | £180.84M | ★★★★★☆ |

Click here to see the full list of 446 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Frontier Developments (AIM:FDEV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frontier Developments plc is a company that develops and publishes video games for the interactive entertainment sector, with a market cap of £91.33 million.

Operations: The company generates revenue from its Computer Graphics segment, amounting to £88.88 million.

Market Cap: £91.33M

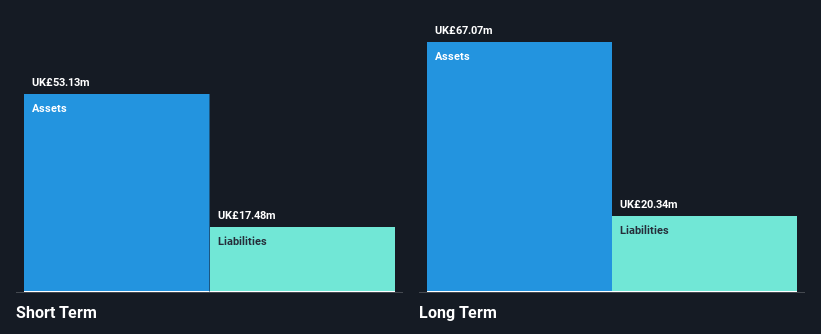

Frontier Developments plc, with a market cap of £91.33 million, recently reported a turnaround in profitability, achieving net income of £4.4 million for the half-year ended November 30, 2024. Despite stable weekly volatility and no debt burden, its earnings have declined significantly over the past five years. The company’s price-to-earnings ratio of 5.7x suggests it may be undervalued compared to the broader UK market average of 15.8x. While Frontier has high-quality earnings and covers liabilities well with short-term assets (£53.1M), future earnings are forecasted to decline sharply by an average of 108.4% annually over three years.

- Navigate through the intricacies of Frontier Developments with our comprehensive balance sheet health report here.

- Explore Frontier Developments' analyst forecasts in our growth report.

Ashmore Group (LSE:ASHM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ashmore Group plc is a publicly owned investment manager with a market cap of approximately £1.08 billion.

Operations: The company generates revenue of £186.8 million from providing investment management services.

Market Cap: £1.08B

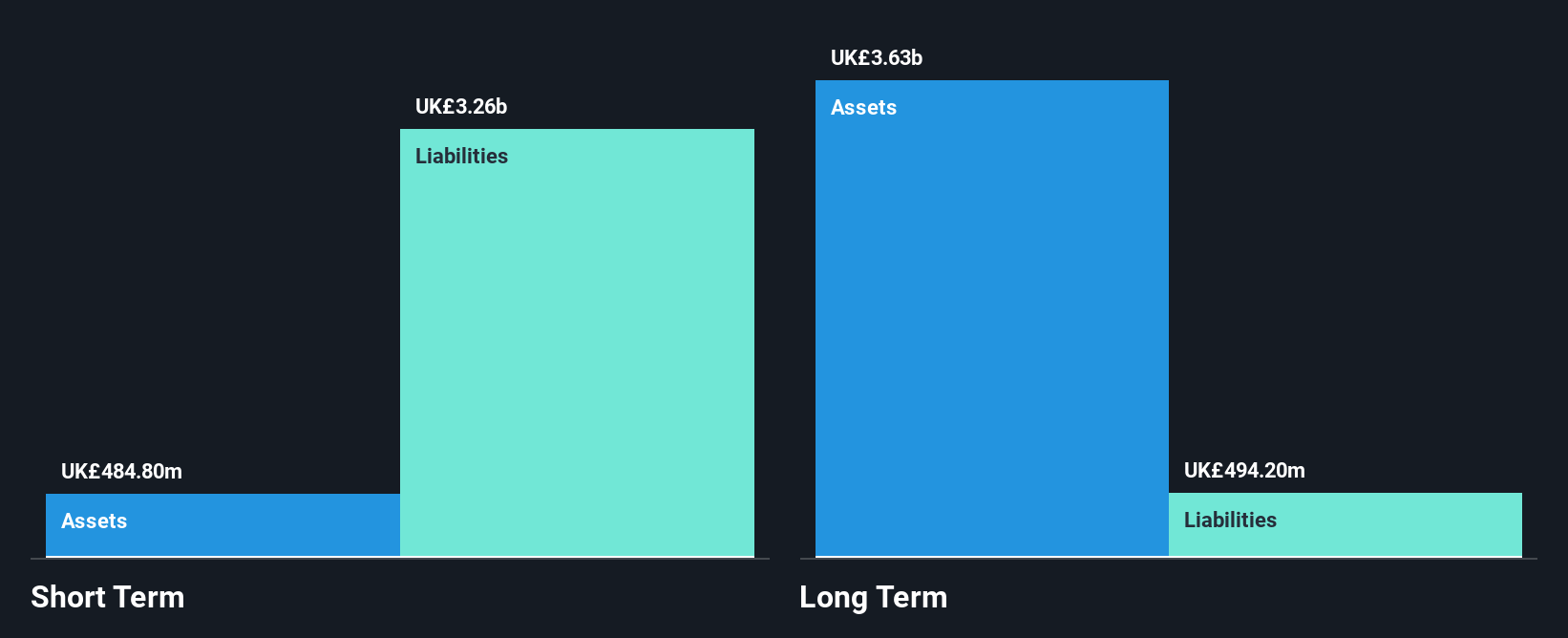

Ashmore Group plc, with a market cap of £1.08 billion, operates debt-free and maintains strong asset coverage over both short and long-term liabilities, showcasing financial stability. Despite high-quality earnings and a recent increase in net profit margins to 50.2%, the company's earnings have historically declined by 21.8% annually over five years, with future declines anticipated at 5.5% per year for the next three years. The dividend yield of 10.39% is not well-supported by earnings or cash flows, raising sustainability concerns despite recent affirmations of a final dividend payout of 12.1 pence per share for June 2024's fiscal year-end.

- Get an in-depth perspective on Ashmore Group's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Ashmore Group's future.

Secure Trust Bank (LSE:STB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Secure Trust Bank PLC operates as a provider of banking and financial products and services in the United Kingdom with a market cap of £85.44 million.

Operations: The company's revenue is primarily derived from its Consumer Finance division, with £71.9 million from Retail Finance and £15.7 million from Vehicle Finance, alongside its Business Finance division which includes £22.3 million from Commercial Finance and £27.1 million from Real Estate Finance, all figures in millions of pounds sterling (£).

Market Cap: £85.44M

Secure Trust Bank PLC, with a market cap of £85.44 million, shows potential within the penny stock realm due to its diverse revenue streams from Consumer and Business Finance divisions. Despite a low Return on Equity at 6.8% and an unstable dividend track record, the company has experienced significant earnings growth of 20.4% over the past year, surpassing industry averages. Analysts anticipate further growth at 35.26% annually, suggesting undervaluation as it trades significantly below fair value estimates. However, investors should note high weekly volatility and a concerning bad loans ratio of 4.5%, indicating potential risks in its financial health management.

- Jump into the full analysis health report here for a deeper understanding of Secure Trust Bank.

- Examine Secure Trust Bank's earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Discover the full array of 446 UK Penny Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ASHM

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives