- United Kingdom

- /

- Professional Services

- /

- AIM:BEG

UK Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market fluctuations, penny stocks remain an intriguing area for investors seeking untapped potential in smaller or newer companies. Although the term "penny stocks" may seem outdated, these investments can still offer significant opportunities when backed by strong financials and growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.85 | £293.96M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.20 | £339.31M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.93 | £443.18M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.115 | £396.67M | ✅ 3 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.724 | £220.28M | ✅ 2 ⚠️ 3 View Analysis > |

| FRP Advisory Group (AIM:FRP) | £1.25 | £308.53M | ✅ 4 ⚠️ 0 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.978 | £156.02M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.344 | £2.37B | ✅ 4 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 400 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

accesso Technology Group (AIM:ACSO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: accesso Technology Group plc, with a market cap of £198.93 million, develops technology solutions for the attractions and leisure industry through its subsidiaries.

Operations: The company's revenue is derived from Ticketing ($113.03 million), Guest Experience ($31.46 million), and Professional Services ($7.80 million).

Market Cap: £198.93M

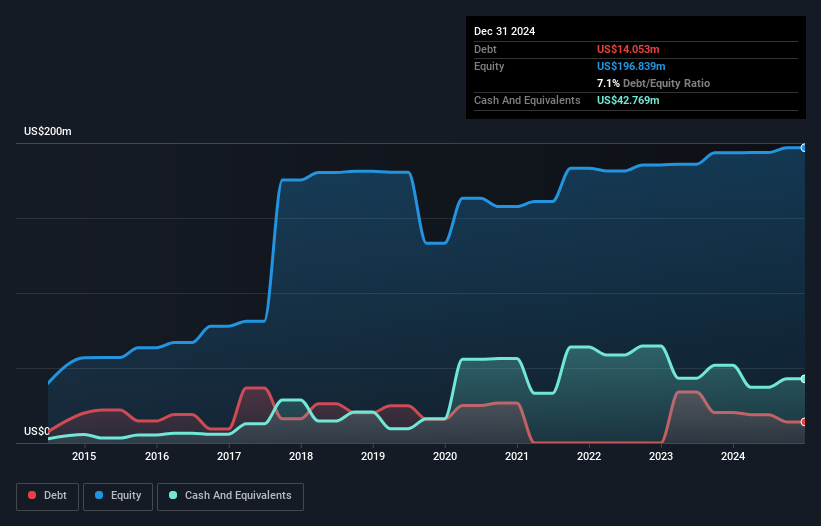

accesso Technology Group plc, with a market cap of £198.93 million, shows promise in the penny stock arena due to its strong financial position and strategic initiatives. The company boasts robust short-term assets exceeding both short- and long-term liabilities, ensuring solid liquidity. Its recent earnings report highlights a net income increase to US$9.08 million for 2024, reflecting improved profit margins and high-quality earnings. A significant contract win with Saudi Arabia's Qiddiya project underscores potential growth opportunities. However, the management team is relatively new, which could pose challenges in executing its ambitious plans effectively.

- Take a closer look at accesso Technology Group's potential here in our financial health report.

- Evaluate accesso Technology Group's prospects by accessing our earnings growth report.

Begbies Traynor Group (AIM:BEG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Begbies Traynor Group plc offers professional services to businesses, advisors, large corporations, and financial institutions in the UK with a market cap of £156.02 million.

Operations: The company generates revenue through its Property Advisory segment (£44.96 million) and Business Recovery and Advisory segment (£102.18 million).

Market Cap: £156.02M

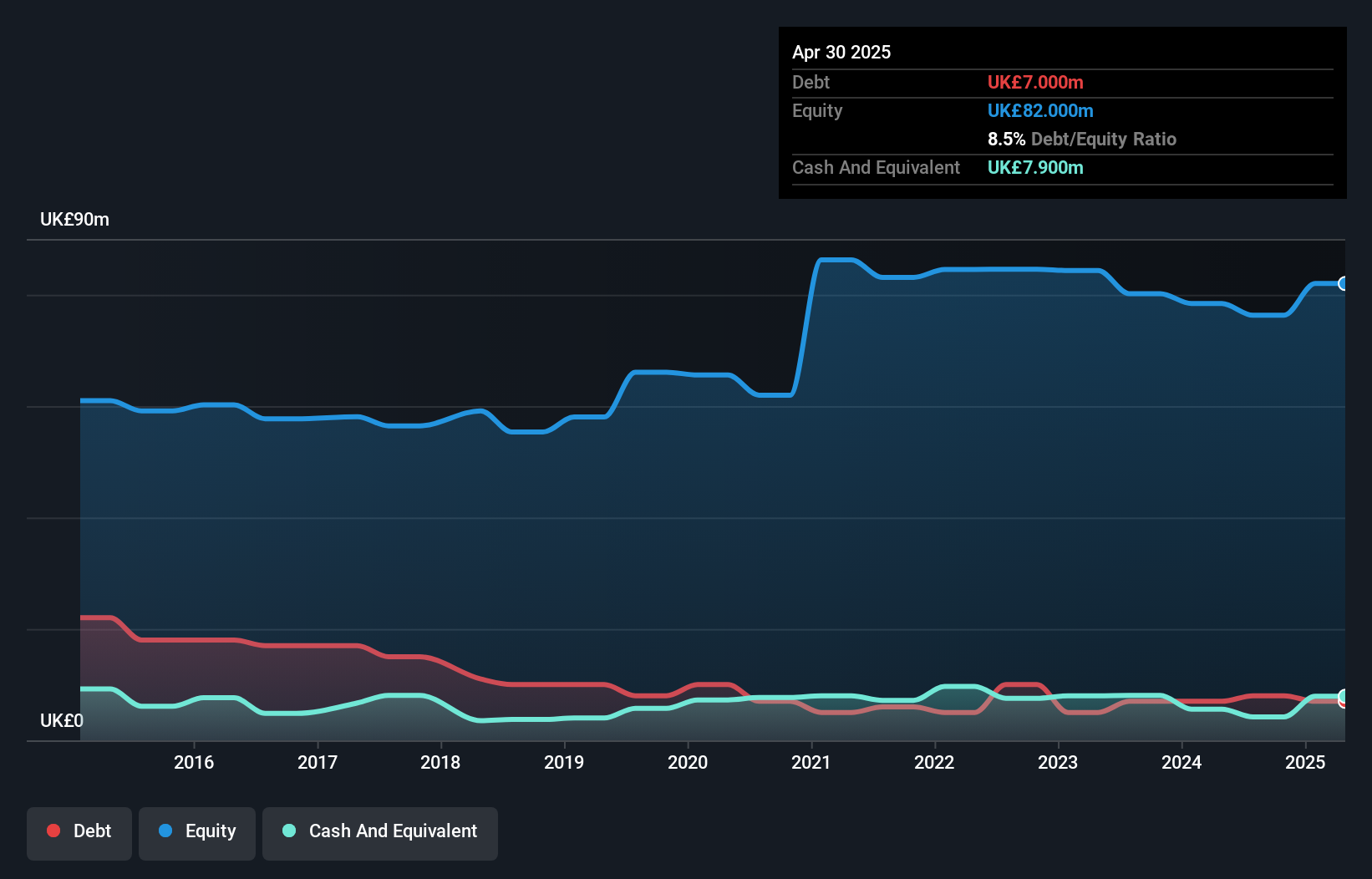

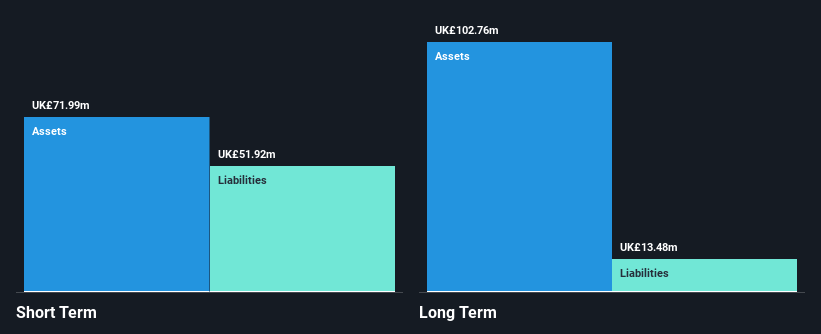

Begbies Traynor Group, with a market cap of £156.02 million, demonstrates potential in the penny stock sector through its diversified revenue streams from Property Advisory (£44.96 million) and Business Recovery and Advisory (£102.18 million). The company has shown impressive earnings growth of 528.7% over the past year, surpassing industry averages, though impacted by a significant one-off loss of £10.6M. While trading at 41.6% below estimated fair value suggests potential upside, challenges include low return on equity (3.2%) and a dividend not well covered by earnings despite strong debt coverage ratios and seasoned management stability.

- Click here and access our complete financial health analysis report to understand the dynamics of Begbies Traynor Group.

- Learn about Begbies Traynor Group's future growth trajectory here.

Zotefoams (LSE:ZTF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zotefoams plc, along with its subsidiaries, manufactures, distributes, and sells polyolefin foams across the United Kingdom, Europe, North America, and internationally with a market cap of £130.59 million.

Operations: The company's revenue is primarily derived from three segments: Polyolefin Foams (£66.93 million), High-Performance Products (£79.64 million), and Mucell Extrusion LLC (£1.22 million).

Market Cap: £130.59M

Zotefoams, with a market cap of £130.59 million, faces challenges as an unprofitable entity despite its broad international reach and diverse revenue streams from Polyolefin Foams (£66.93 million) and High-Performance Products (£79.64 million). Recent executive changes, including the appointment of Nick Wright as Group CFO, aim to steer the company towards improved financial performance amid expansion plans in Vietnam and South Korea to strengthen its partnership with Nike. While trading at a significant discount to estimated fair value indicates potential upside, high volatility and negative return on equity present risks for investors considering this penny stock.

- Dive into the specifics of Zotefoams here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Zotefoams' future.

Summing It All Up

- Click this link to deep-dive into the 400 companies within our UK Penny Stocks screener.

- Interested In Other Possibilities? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Begbies Traynor Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BEG

Begbies Traynor Group

Provides professional services to businesses, professional advisors, large corporations, and financial institutions in the United Kingdom.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives