- United Kingdom

- /

- Metals and Mining

- /

- LSE:RIO

Does Rio Tinto Still Offer Upside After Strong 2025 Share Price Gains

Reviewed by Bailey Pemberton

- Wondering if Rio Tinto Group is still good value after its recent run, or if you are late to the party? This breakdown will help you figure out whether the current price makes sense or is quietly offering upside.

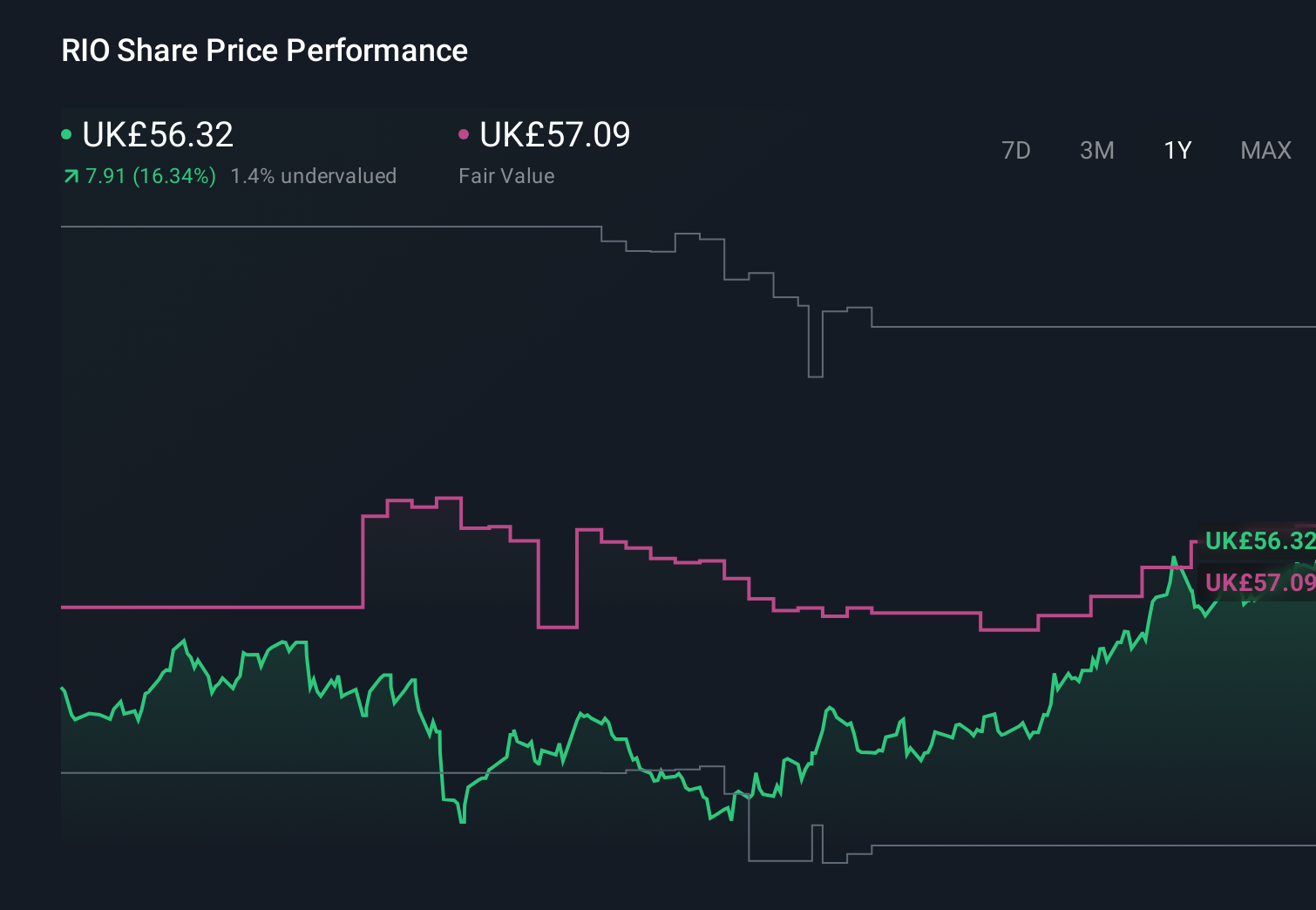

- Over the last week the stock is up 3.5%, 6.8% over the past month, and roughly 19.3% year to date, building on a 20.7% 1-year gain and a 53.0% rise over 5 years that has clearly rewarded patient holders.

- Recent moves have been driven by shifting expectations around global steel demand and infrastructure spending, alongside ongoing debates about the long term outlook for iron ore and critical minerals. At the same time, investors are weighing Rio Tinto's capital allocation discipline and environmental commitments as key signals for future risk and reward.

- Right now Rio Tinto scores a solid 5/6 on our valuation checks, suggesting the market might still be underestimating parts of the story. Next we will walk through the different valuation lenses investors are using today, before finishing with a more complete way to think about what the shares are really worth.

Find out why Rio Tinto Group's 20.7% return over the last year is lagging behind its peers.

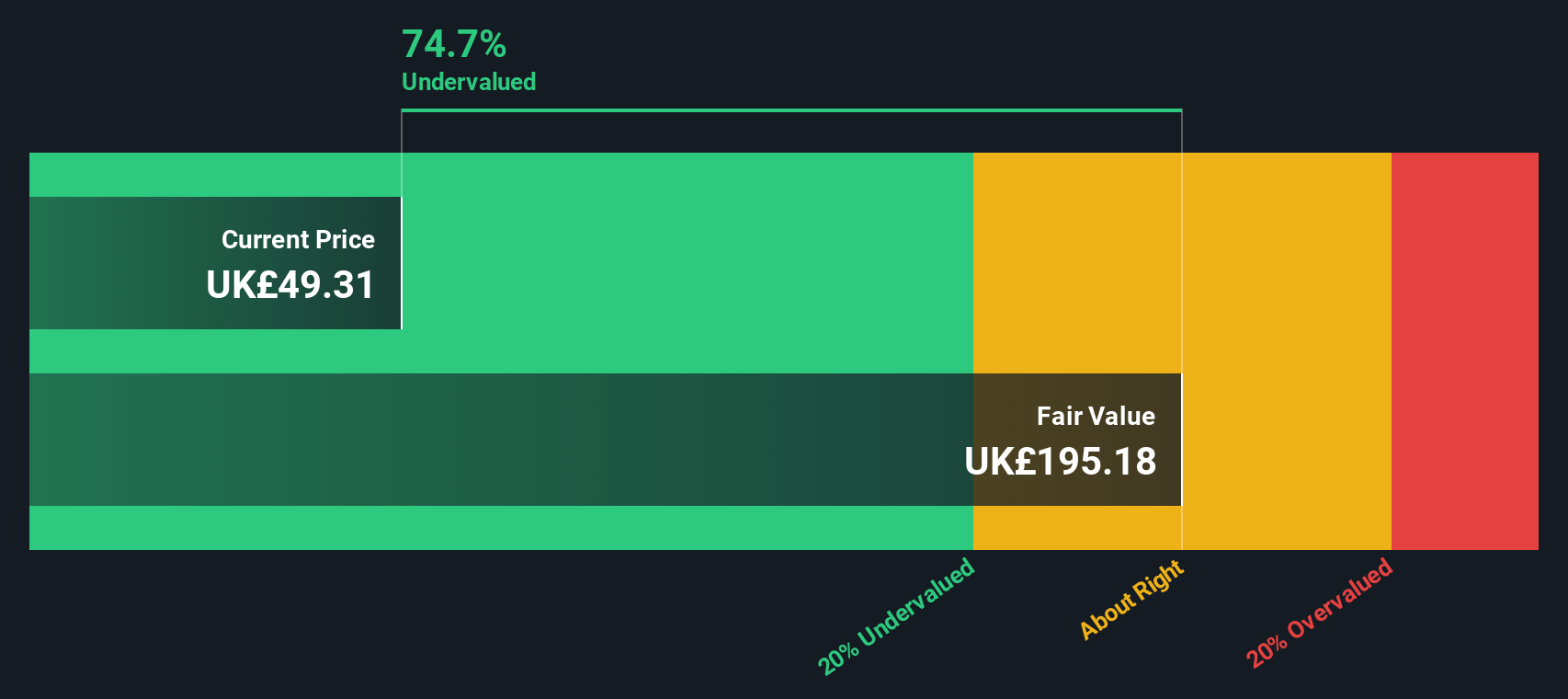

Approach 1: Rio Tinto Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today, to account for risk and the time value of money.

For Rio Tinto Group, the latest twelve month Free Cash Flow is about $7.1 billion, and analysts expect this to climb steadily as demand for iron ore and other key commodities normalizes. By 2027, projections point to Free Cash Flow of roughly $9.9 billion. Simply Wall St then extrapolates growth further out to build a 10 year view under a 2 Stage Free Cash Flow to Equity model.

Aggregating and discounting these future cash flows produces an estimated intrinsic value of $89.24 per share. Compared with the current share price, this implies Rio Tinto is trading at a 36.3% discount to its DCF fair value, suggesting the market is still cautious relative to the underlying cash generation story.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rio Tinto Group is undervalued by 36.3%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

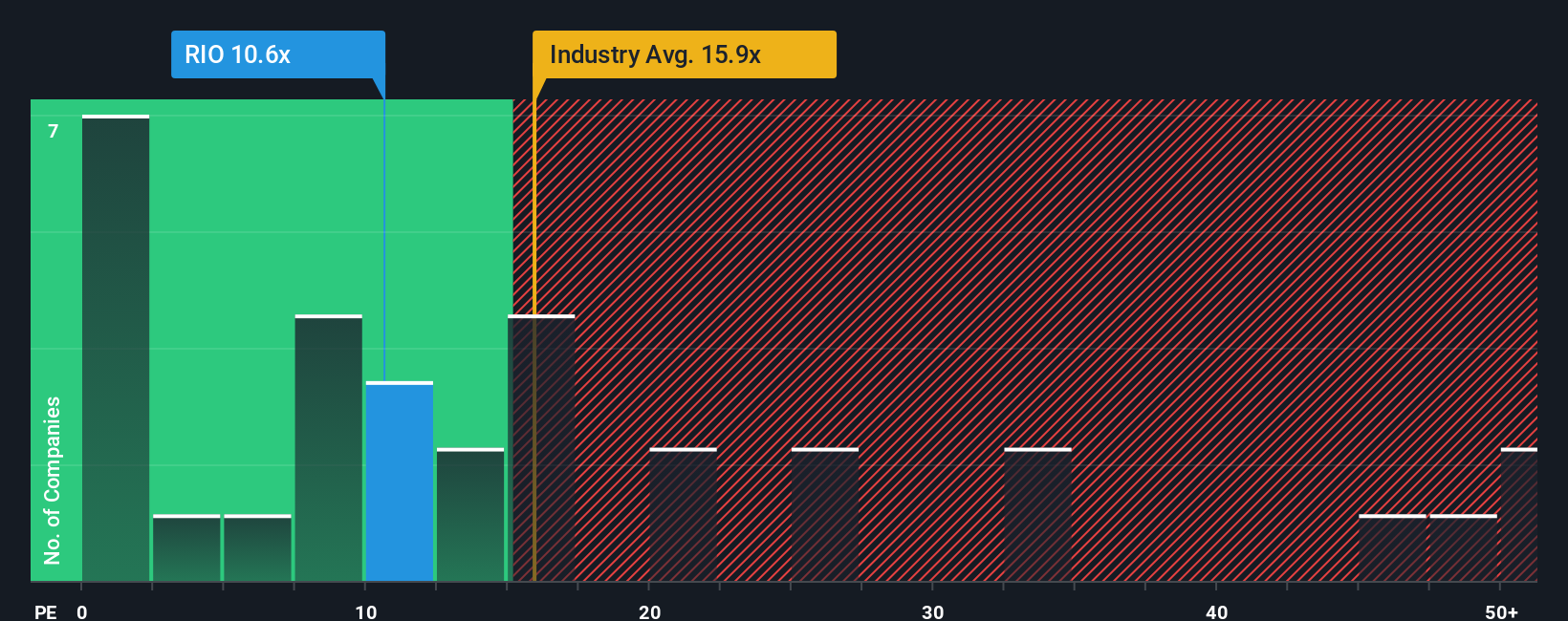

Approach 2: Rio Tinto Group Price vs Earnings

For profitable, established businesses like Rio Tinto, the Price to Earnings ratio is a practical way to gauge valuation because it connects what investors pay today with the profits the company is already generating. In general, higher expected growth and lower perceived risk justify a higher PE ratio, while slower growth and greater uncertainty usually mean investors demand a lower multiple.

Rio Tinto currently trades on about 12.1x earnings, which is below both the wider Metals and Mining industry average of roughly 17.4x and the broader peer group sitting near 43.2x. To refine this view, Simply Wall St calculates a Fair Ratio of around 25.5x. This is an estimate of the multiple Rio Tinto might reasonably command given its specific earnings growth outlook, risk profile, profitability, industry and market cap.

This Fair Ratio is more tailored than a simple comparison with sector or peer averages, which can be distorted by very high growth or highly cyclical names. Since Rio Tinto’s current 12.1x multiple is well below the 25.5x Fair Ratio, the shares appear attractively priced on earnings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rio Tinto Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Rio Tinto’s future to clear numbers like revenue, earnings, margins and, ultimately, a fair value estimate.

A Narrative is your story about the company, captured as assumptions about how its business will evolve. The Simply Wall St platform turns these assumptions into a financial forecast and a fair value that you can then compare with today’s share price to help inform a decision to buy, hold or sell.

On the Community page, used by millions of investors, Narratives are easy to set up and automatically update when new information such as earnings, project news or commodity headlines arrives. This helps your valuation stay aligned with the latest developments rather than a static spreadsheet.

For example, one Rio Tinto Narrative might assume that copper and lithium expansion, solid margins and disciplined capital allocation justify a fair value around £66.68. A more cautious Narrative could focus on execution, pricing and geopolitical risks and land closer to £41.00, illustrating how different perspectives on the same facts can lead to very different yet transparent conclusions.

Do you think there's more to the story for Rio Tinto Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:RIO

Rio Tinto Group

Engages in exploring, mining, and processing mineral resources worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion