- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

UK Growth Companies With High Insider Ownership For October 2024

Reviewed by Simply Wall St

The United Kingdom market has shown robust performance recently, climbing 1.1% in the past week and achieving a 12% increase over the last year, with earnings projected to grow by 14% annually. In this thriving environment, identifying growth companies with high insider ownership can be particularly appealing as it often signals confidence from those closest to the business and aligns their interests with shareholders.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 82.5% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 28.2% |

| Judges Scientific (AIM:JDG) | 10.6% | 23% |

| Enteq Technologies (AIM:NTQ) | 20% | 53.8% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| Foresight Group Holdings (LSE:FSG) | 31.9% | 29.0% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| RUA Life Sciences (AIM:RUA) | 13.3% | 98.2% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

Let's explore several standout options from the results in the screener.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £1.21 billion.

Operations: The company's revenue is primarily derived from its San Jose segment, contributing $266.70 million, and its Inmaculada segment, contributing $451.91 million.

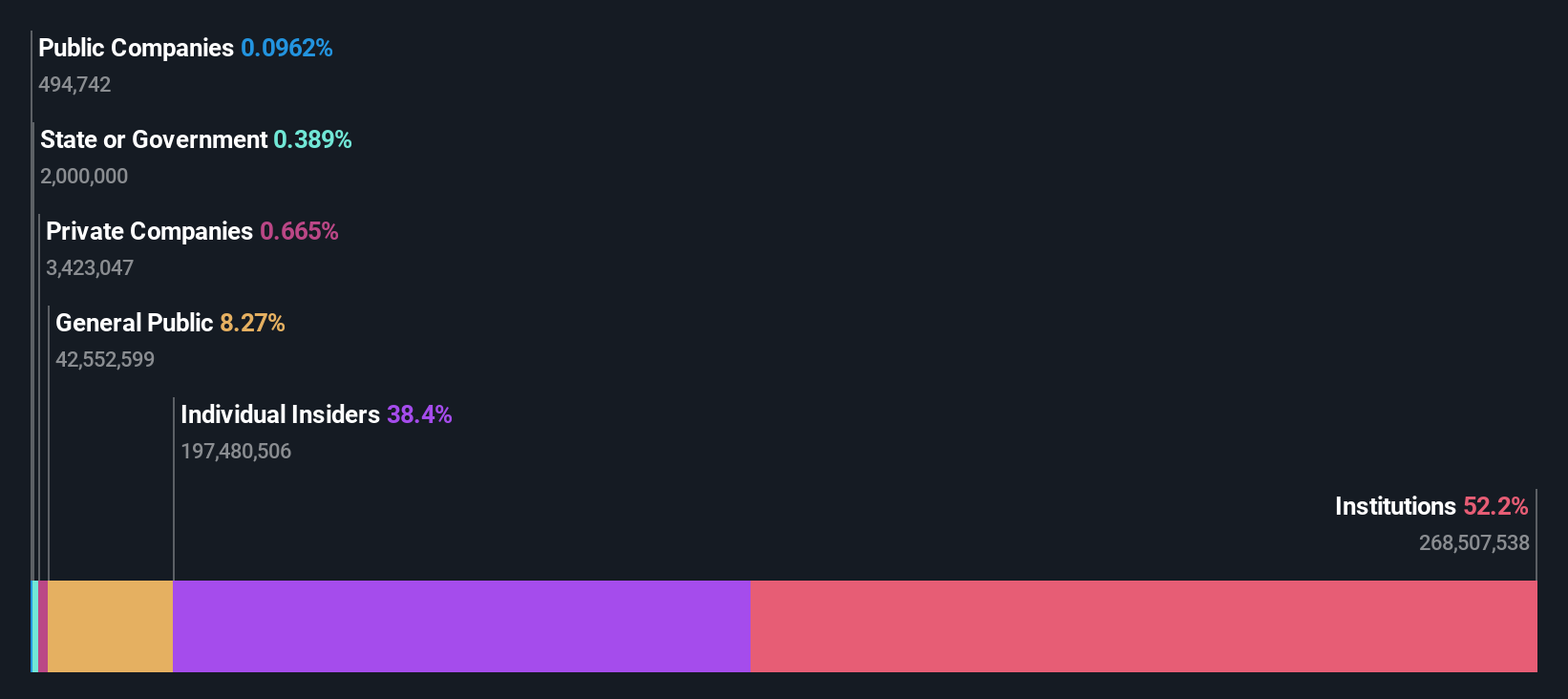

Insider Ownership: 38.4%

Earnings Growth Forecast: 49.8% p.a.

Hochschild Mining has shown a turnaround with USD 39.52 million net income for H1 2024, contrasting last year's loss. Revenue increased to USD 391.74 million, indicating strong growth potential despite high debt levels and share price volatility. Forecasts suggest significant earnings growth of nearly 50% annually over the next three years, surpassing UK market averages. However, insider trading data is unavailable for recent months, and large one-off items have impacted financial results.

- Click here to discover the nuances of Hochschild Mining with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Hochschild Mining's current price could be inflated.

International Workplace Group (LSE:IWG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Workplace Group plc, along with its subsidiaries, offers workspace solutions across the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions and has a market cap of £1.78 billion.

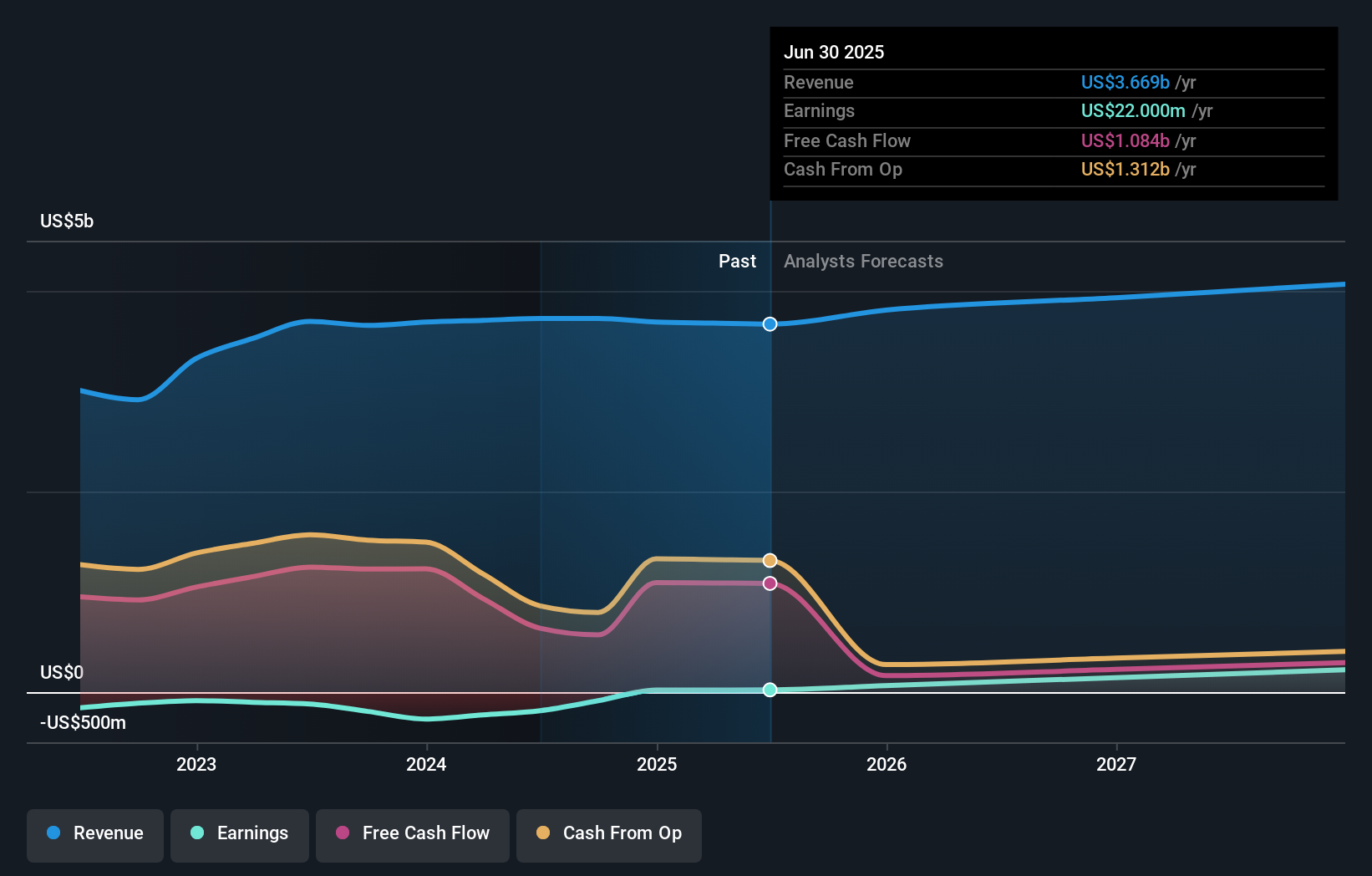

Operations: The company's revenue segments include $400.56 million from Worka, $1.29 billion from the Americas, $341.30 million from Asia Pacific, and $1.69 billion from Europe, the Middle East and Africa (EMEA).

Insider Ownership: 25.2%

Earnings Growth Forecast: 120.8% p.a.

International Workplace Group (IWG) is poised for growth with insiders showing confidence through recent share purchases, despite a lack of substantial volumes. Analysts project IWG's earnings to grow at 120.77% annually, outpacing the UK market's average. The company reported a net income of US$16 million for H1 2024 after a previous loss, signaling improved profitability. Activist investor Buckley Capital urges strategic moves like a US listing and share buybacks to bridge the gap between market and intrinsic value.

- Click here and access our complete growth analysis report to understand the dynamics of International Workplace Group.

- According our valuation report, there's an indication that International Workplace Group's share price might be on the cheaper side.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

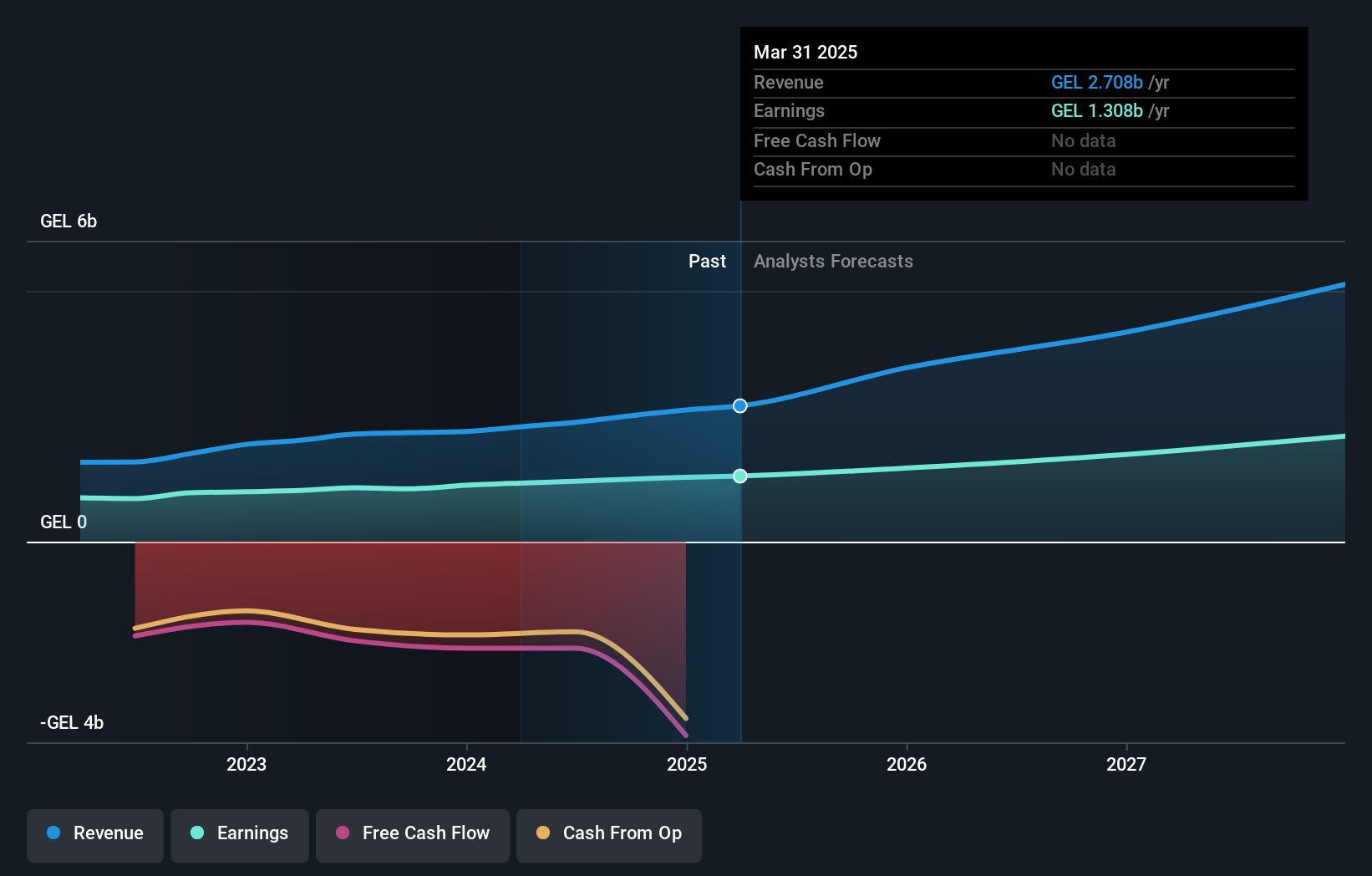

Overview: TBC Bank Group PLC operates in Georgia, Azerbaijan, and Uzbekistan offering banking, leasing, insurance, brokerage, and card processing services to both corporate and individual customers with a market cap of £1.53 billion.

Operations: The revenue segments for TBC Bank Group PLC include GEL 2.13 billion from segment adjustment and GEL 236.42 million from Uzbekistan operations.

Insider Ownership: 17.6%

Earnings Growth Forecast: 15.3% p.a.

TBC Bank Group shows potential with earnings forecasted to grow 15.3% annually, surpassing the UK market's average. Recent earnings reports indicate growth with net income rising from GEL 537.46 million to GEL 617.4 million year-over-year, reflecting solid performance despite an unstable dividend history. The company trades below its estimated fair value and is considered a good relative value compared to peers, although insider activity remains unchanged over the past three months.

- Delve into the full analysis future growth report here for a deeper understanding of TBC Bank Group.

- The valuation report we've compiled suggests that TBC Bank Group's current price could be quite moderate.

Summing It All Up

- Get an in-depth perspective on all 63 Fast Growing UK Companies With High Insider Ownership by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hochschild Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United States, Canada, Brazil, and Chile.

Reasonable growth potential and fair value.