- United Kingdom

- /

- Real Estate

- /

- LSE:IWG

Top UK Growth Companies With High Insider Ownership In October 2024

Reviewed by Simply Wall St

In the wake of recent challenges in the global economy, particularly with China's sluggish recovery impacting the FTSE 100 and FTSE 250 indices, investors are increasingly seeking resilient growth opportunities within the United Kingdom. Amidst these market conditions, companies with high insider ownership often stand out as they suggest a strong alignment between management and shareholder interests, making them appealing prospects for those looking to navigate uncertain economic landscapes.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Helios Underwriting (AIM:HUW) | 23.9% | 16.7% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 28.2% |

| Foresight Group Holdings (LSE:FSG) | 31.8% | 27.9% |

| Judges Scientific (AIM:JDG) | 11% | 23% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| Enteq Technologies (AIM:NTQ) | 20% | 53.8% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

We'll examine a selection from our screener results.

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★★☆

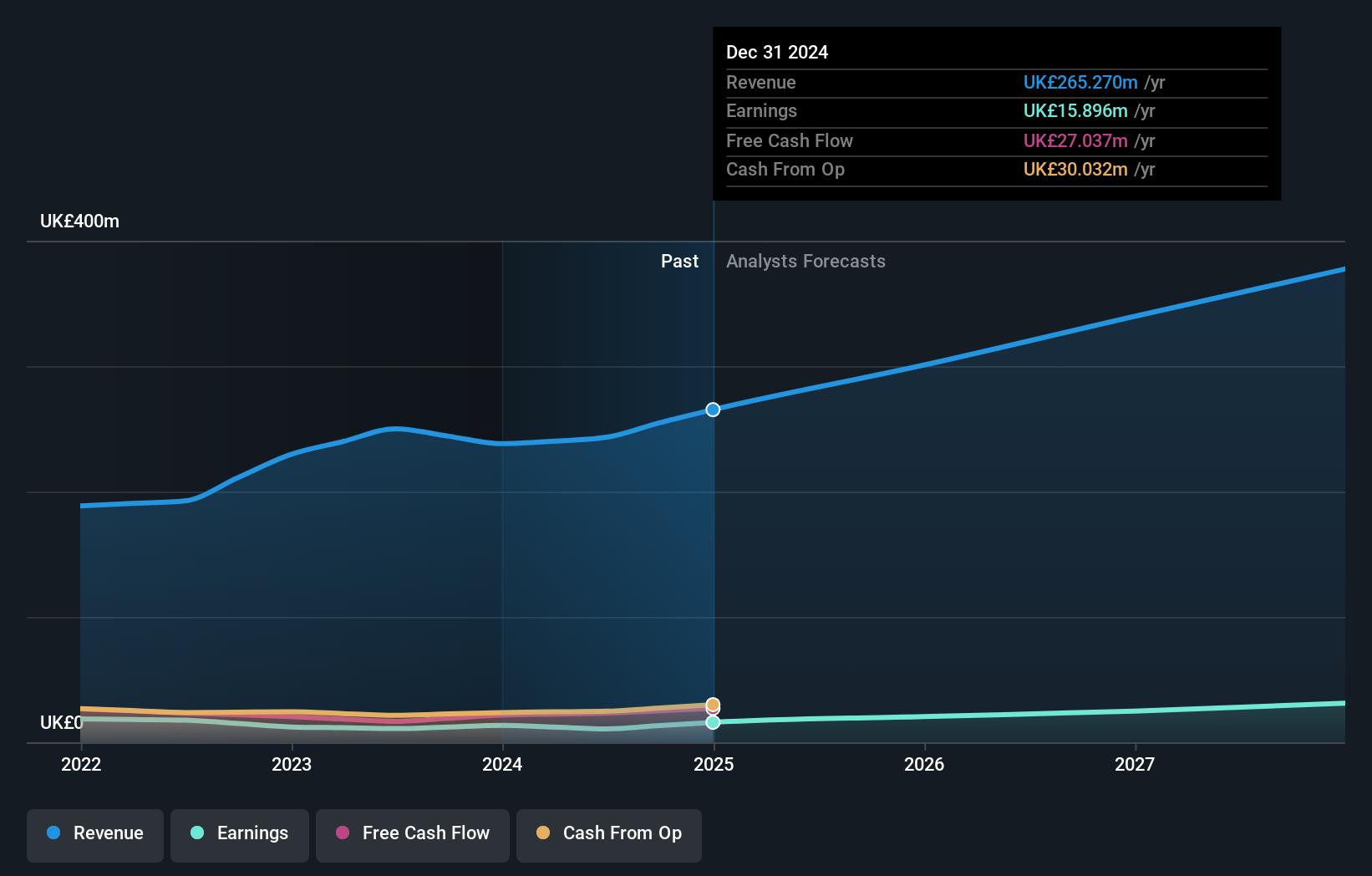

Overview: Mortgage Advice Bureau (Holdings) plc, with a market cap of £397.58 million, offers mortgage advice services across the United Kingdom through its subsidiaries.

Operations: The company's primary revenue segment is the provision of financial services, generating £243.31 million.

Insider Ownership: 19.8%

Mortgage Advice Bureau (Holdings) is poised for growth with earnings forecasted to increase by 29.6% annually, outpacing the UK market's average. Despite a volatile share price recently, insider transactions have trended towards buying rather than selling over the past three months. However, recent earnings showed a decline to £3.7 million from £6.42 million year-on-year, and dividend coverage remains weak at 4.1%. Revenue growth is expected at 15.3% per year, surpassing the broader market growth rate.

- Delve into the full analysis future growth report here for a deeper understanding of Mortgage Advice Bureau (Holdings).

- In light of our recent valuation report, it seems possible that Mortgage Advice Bureau (Holdings) is trading beyond its estimated value.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

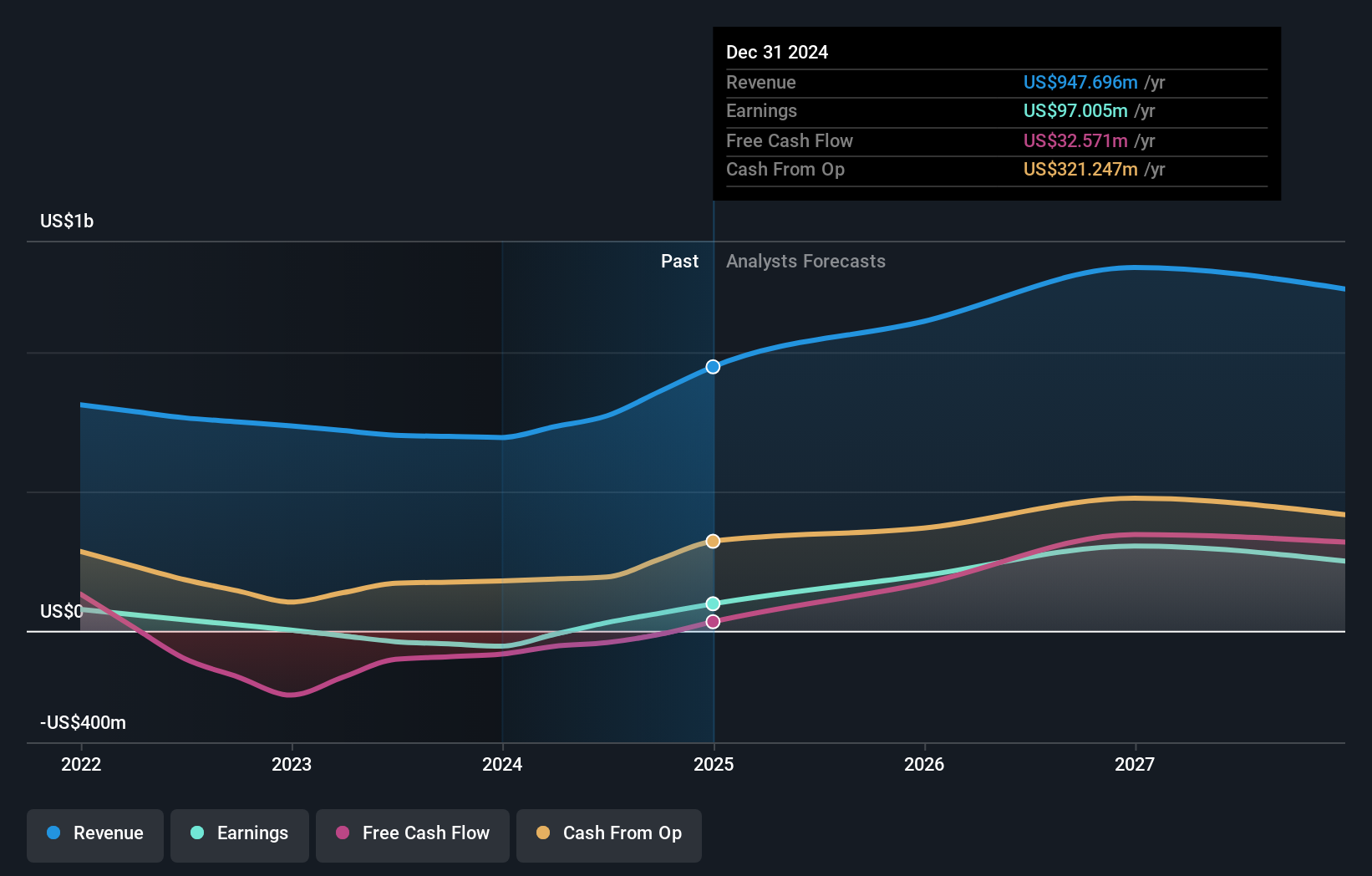

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver across several countries including Peru, Argentina, the United States, Canada, Brazil, and Chile; it has a market cap of £981.59 million.

Operations: The company's revenue is primarily derived from its San Jose segment, contributing $266.70 million, and the Inmaculada segment, adding $451.91 million.

Insider Ownership: 38.4%

Hochschild Mining shows promising growth potential, with earnings expected to grow significantly at 44.6% annually, surpassing the UK market average. Recent financials reveal a turnaround to profitability with net income of US$39.52 million for H1 2024, compared to a loss last year. Despite trading below estimated fair value and facing high debt levels, the company’s revenue growth forecast of 5.9% annually outpaces the UK market's rate but remains below high-growth thresholds.

- Unlock comprehensive insights into our analysis of Hochschild Mining stock in this growth report.

- Our valuation report unveils the possibility Hochschild Mining's shares may be trading at a premium.

International Workplace Group (LSE:IWG)

Simply Wall St Growth Rating: ★★★★☆☆

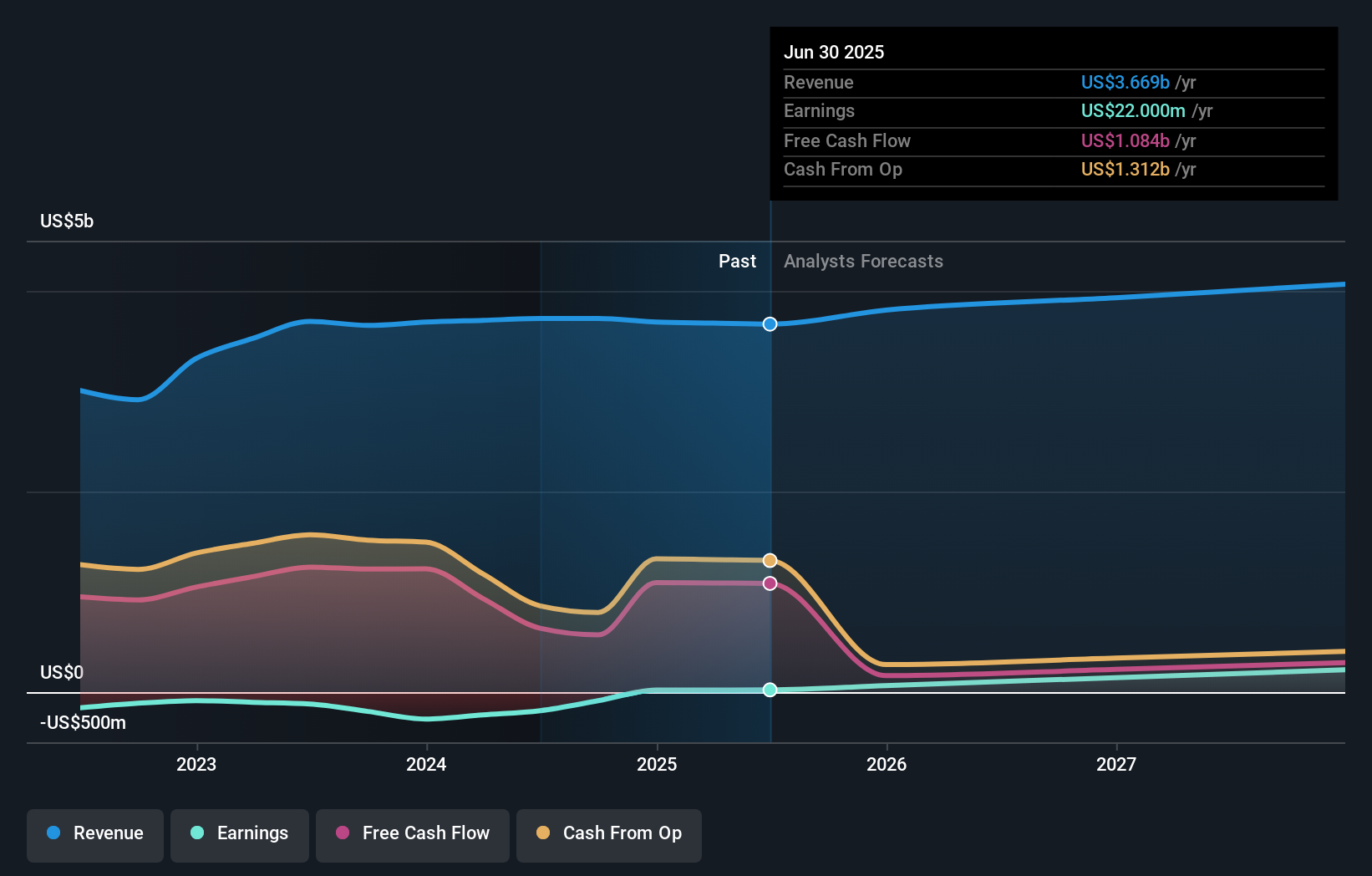

Overview: International Workplace Group plc, along with its subsidiaries, offers workspace solutions across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £1.76 billion.

Operations: The company's revenue segments are comprised of $400.56 million from Worka, $1.29 billion from the Americas, $341.30 million from Asia Pacific, and $1.69 billion from Europe, the Middle East, and Africa (EMEA).

Insider Ownership: 25.2%

International Workplace Group is poised for growth, with earnings forecast to rise significantly by 115.9% annually, outpacing the UK market. Despite a recent activist push from Buckley Capital Management urging strategic actions like a US listing and share buyback to unlock value, insiders have shown confidence through net buying over three months. The company's shift to profitability in H1 2024 with net income of US$16 million underscores its improving fundamentals amid undervaluation concerns.

- Dive into the specifics of International Workplace Group here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, International Workplace Group's share price might be too pessimistic.

Where To Now?

- Embark on your investment journey to our 65 Fast Growing UK Companies With High Insider Ownership selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IWG

International Workplace Group

Provides workspace solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives