- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

Shareholders in Hochschild Mining (LON:HOC) have lost 55%, as stock drops 11% this past week

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But long term Hochschild Mining plc (LON:HOC) shareholders have had a particularly rough ride in the last three year. So they might be feeling emotional about the 58% share price collapse, in that time. And the share price decline continued over the last week, dropping some 11%.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Hochschild Mining

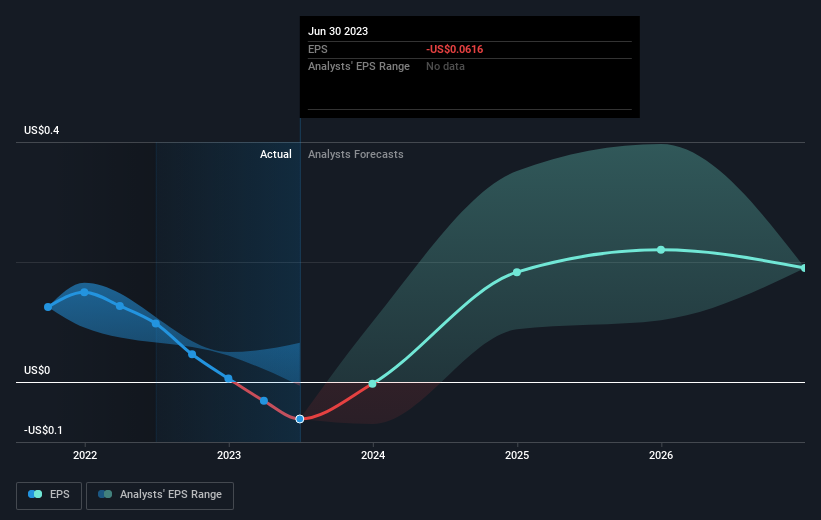

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Hochschild Mining saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Extraordinary items contributed to this situation. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Hochschild Mining's key metrics by checking this interactive graph of Hochschild Mining's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Hochschild Mining's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Hochschild Mining's TSR of was a loss of 55% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

It's good to see that Hochschild Mining has rewarded shareholders with a total shareholder return of 43% in the last twelve months. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. You could get a better understanding of Hochschild Mining's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hochschild Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United Kingdom, Canada, Brazil, and Chile.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)