- United Kingdom

- /

- Metals and Mining

- /

- LSE:CAPD

3 UK Dividend Stocks Yielding 3.5% To 9.5%

Reviewed by Simply Wall St

In the current economic landscape, the United Kingdom's FTSE 100 index has experienced a downturn, influenced by weak trade data from China and global economic uncertainties. Despite these challenges, dividend stocks remain an attractive option for investors seeking regular income streams, offering potential stability and returns even in volatile markets.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Keller Group (LSE:KLR) | 3.10% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.24% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.68% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.48% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.02% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.87% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.60% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.97% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.81% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.52% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top UK Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

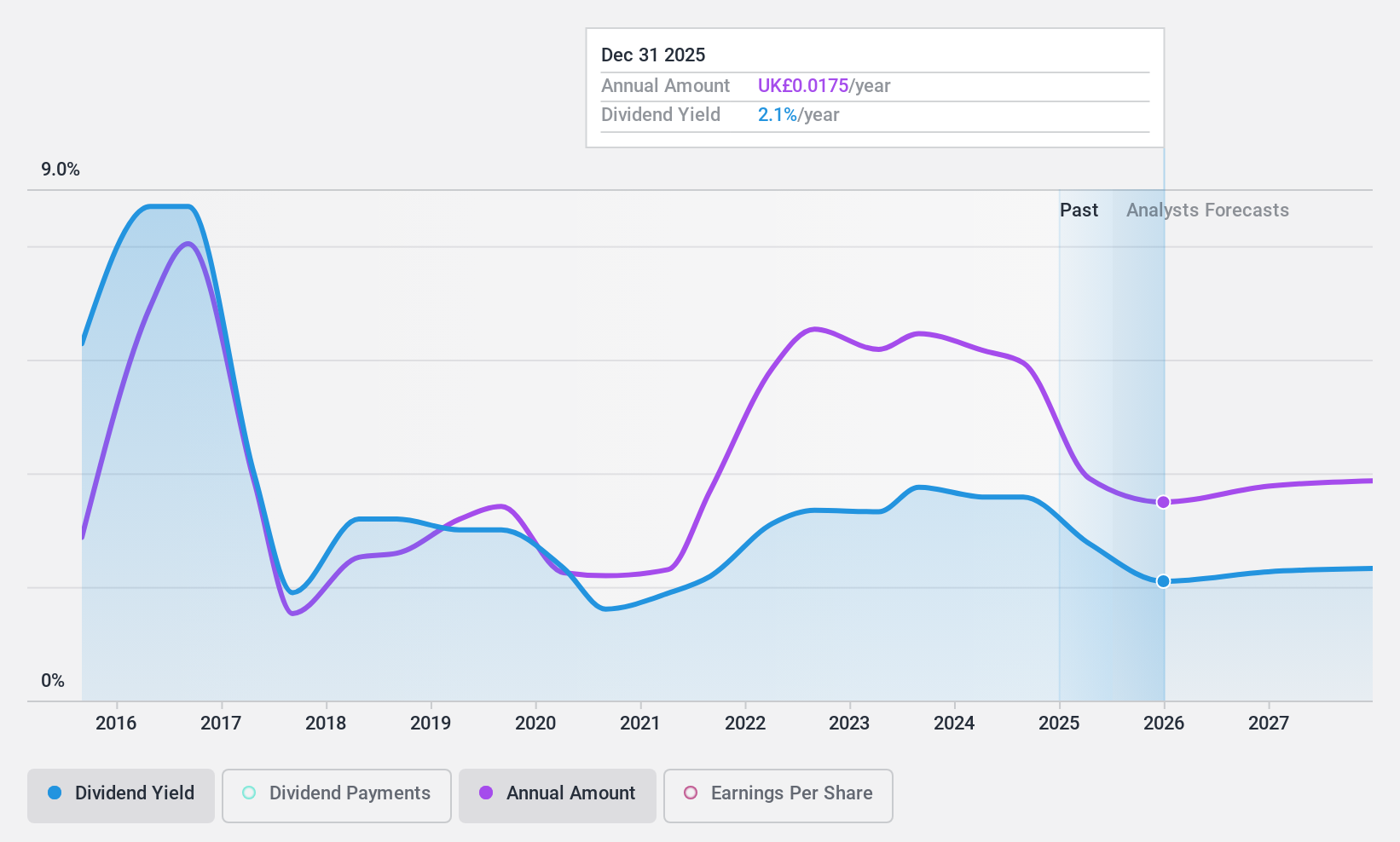

Capital (LSE:CAPD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Capital Limited, along with its subsidiaries, offers a range of drilling solutions to the minerals industry and has a market cap of £166.82 million.

Operations: Capital Limited generates revenue primarily through its Business Services segment, which accounted for $333.59 million.

Dividend Yield: 3.6%

Capital's dividend payments have been volatile over the past decade, though recent increases show potential growth. The dividends are well covered by both earnings and cash flows, with payout ratios of 26.1% and 24%, respectively. Trading significantly below its estimated fair value, Capital offers a lower yield compared to top UK dividend payers. Recent board changes include appointing Graeme Dacomb as an Independent Non-Executive Director, potentially strengthening governance which could impact future stability positively.

- Take a closer look at Capital's potential here in our dividend report.

- The valuation report we've compiled suggests that Capital's current price could be quite moderate.

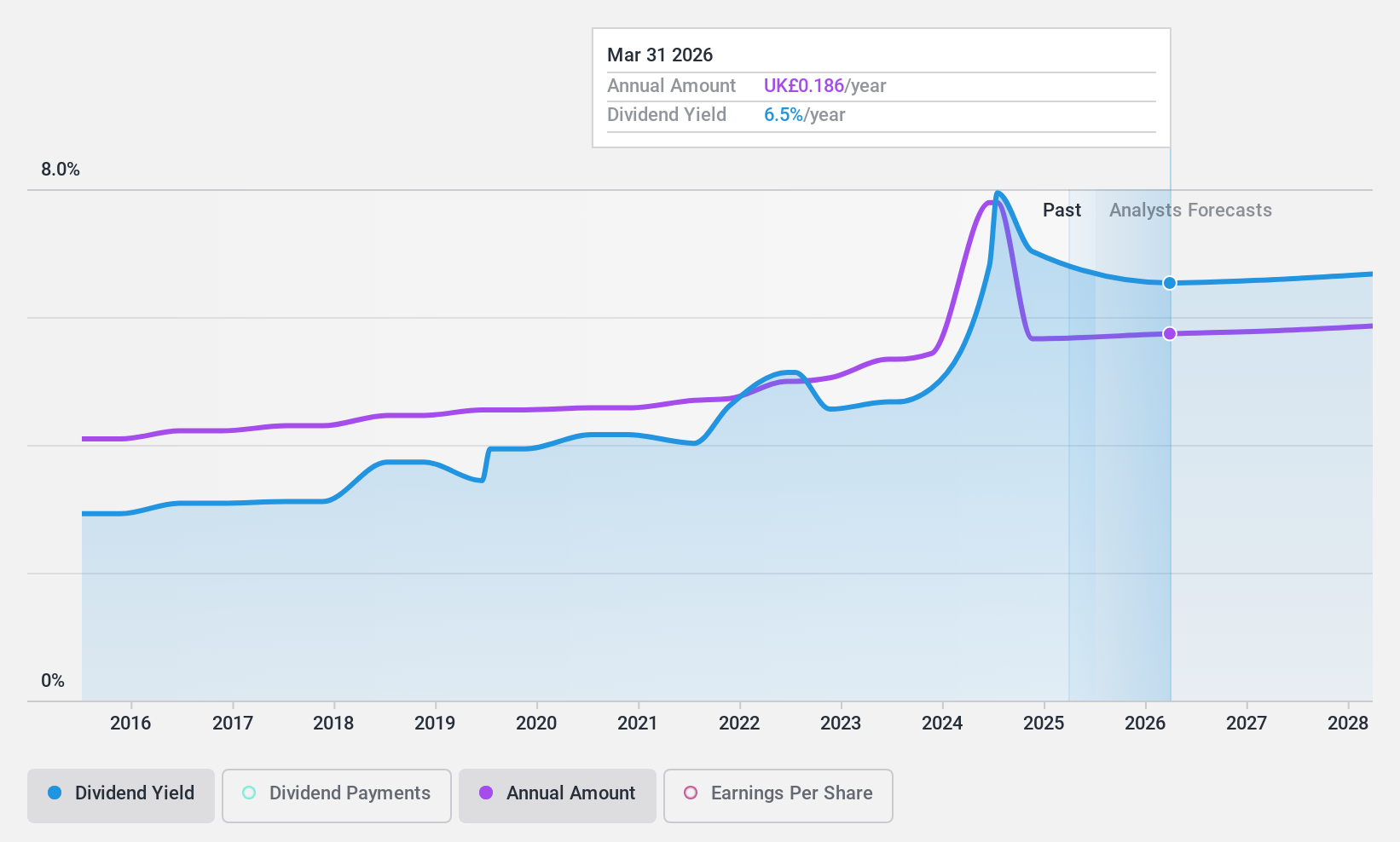

Castings (LSE:CGS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Castings P.L.C. is involved in iron casting and machining operations across the UK, Europe, the Americas, and internationally, with a market cap of £114.73 million.

Operations: Castings P.L.C. generates its revenue from two main segments: Foundry Operations, which contribute £225.67 million, and Machining Operations, which add £35.57 million.

Dividend Yield: 9.6%

Castings P.L.C. has consistently increased its dividends over the past decade, with the latest interim dividend at 4.21 pence per share, slightly up from last year. Despite a reasonable payout ratio of 66.1%, dividends aren't covered by free cash flows, raising sustainability concerns given recent declines in earnings and revenue—GBP 89.18 million in sales and GBP 3.07 million net income for the half-year ended September 2024 compared to previous figures.

- Unlock comprehensive insights into our analysis of Castings stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Castings shares in the market.

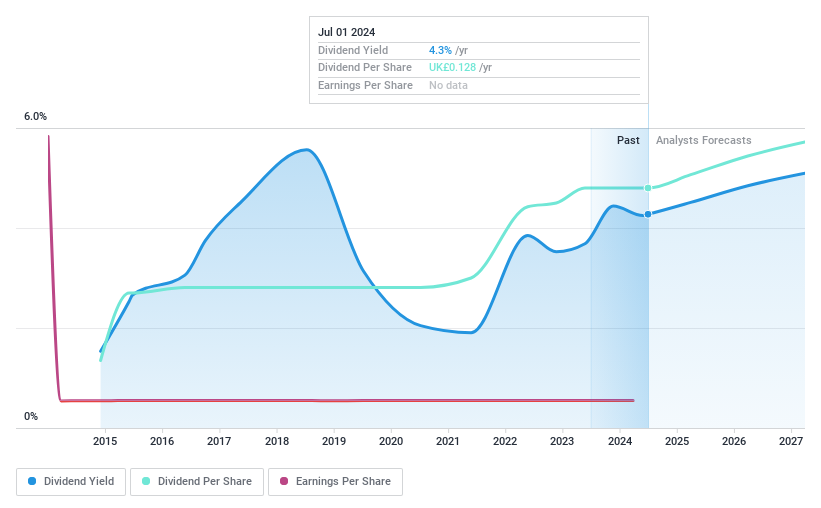

Pets at Home Group (LSE:PETS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Pets at Home Group Plc is a UK-based company specializing in the omnichannel retailing of pet food, pet-related products, and accessories, with a market cap of £1.05 billion.

Operations: Pets at Home Group Plc generates revenue through its Retail segment, which accounts for £1.33 billion, and its Vet Group segment, contributing £161.10 million.

Dividend Yield: 5.5%

Pets at Home Group's dividends have been stable and growing over the past decade, with a recent interim dividend increase to 4.7 pence per share. The company's payout ratio of 67.3% suggests dividends are well covered by earnings, while a cash payout ratio of 35.8% indicates strong cash flow support. Recent earnings show growth, with net income rising to £37.6 million for the half-year ended October 2024, enhancing its dividend reliability despite a yield slightly below top UK payers.

- Dive into the specifics of Pets at Home Group here with our thorough dividend report.

- Our expertly prepared valuation report Pets at Home Group implies its share price may be lower than expected.

Summing It All Up

- Click this link to deep-dive into the 61 companies within our Top UK Dividend Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CAPD

Capital

Provides various drilling solutions to customers in the minerals industry.

Undervalued with excellent balance sheet and pays a dividend.