- United Kingdom

- /

- Capital Markets

- /

- LSE:BAY

UK Penny Stocks To Consider In December 2024

Reviewed by Simply Wall St

The UK stock market has recently experienced some turbulence, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China, which continues to impact global markets. In such a climate, investors may find value in exploring penny stocks—an investment category that often includes smaller or newer companies with potential for growth at lower price points. Despite being an older term, penny stocks can still offer opportunities when they are backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Secure Trust Bank (LSE:STB) | £3.49 | £66.56M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.95 | £149.86M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.885 | £185.28M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.55M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.16 | £99.11M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.288 | £198.65M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.225 | £420.2M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £1.18 | £89.37M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.437 | $254.04M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.375 | £175.11M | ★★★★★☆ |

Click here to see the full list of 467 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Shearwater Group (AIM:SWG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shearwater Group plc, with a market cap of £8.70 million, offers cyber security, managed security, and professional advisory services to corporate clients across the UK, Europe, North America, and internationally.

Operations: The company generates revenue from two main segments: Services, contributing £21.17 million, and Software, accounting for £2.27 million.

Market Cap: £8.7M

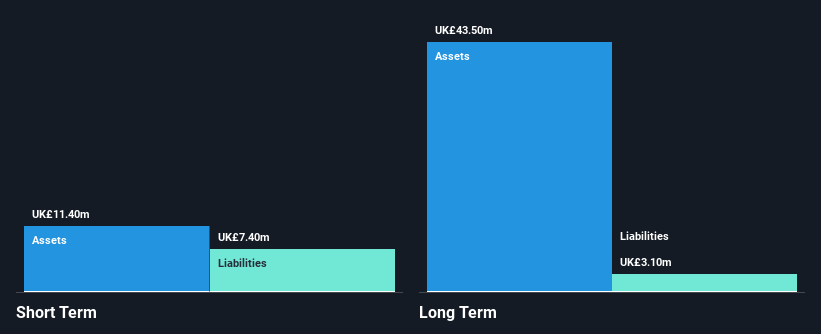

Shearwater Group plc, with a market cap of £8.70 million, operates in the cyber security sector and reported half-year sales of £11.3 million, up from £10.5 million the previous year. Despite this revenue growth, the company remains unprofitable with a net loss increasing to £1.6 million from £0.9 million last year and a negative return on equity of -6.46%. However, Shearwater is debt-free and has sufficient cash runway for over three years due to positive free cash flow growth and stable short-term asset coverage over liabilities, making it an interesting prospect within penny stocks despite ongoing challenges in profitability improvement.

- Unlock comprehensive insights into our analysis of Shearwater Group stock in this financial health report.

- Review our historical performance report to gain insights into Shearwater Group's track record.

Alina Holdings (LSE:ALNA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alina Holdings Plc, along with its subsidiaries, focuses on the investment and rental of properties in the United Kingdom and has a market capitalization of £2.18 million.

Operations: The company generates £1.11 million in revenue from its property investment and rental activities in the United Kingdom.

Market Cap: £2.18M

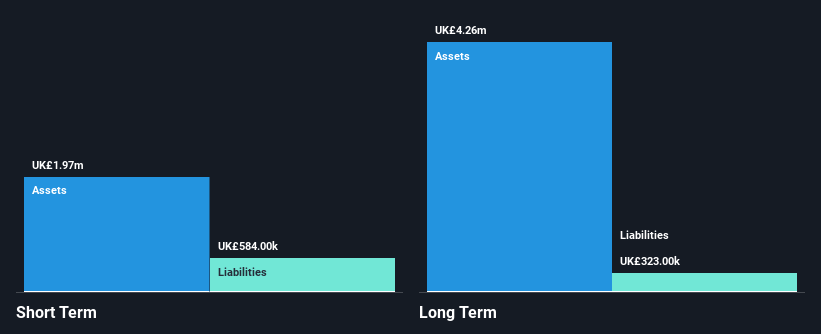

Alina Holdings Plc, with a market cap of £2.18 million, focuses on property investment and rental in the UK. Recently becoming profitable, it reported half-year net income of £0.348 million compared to a loss the previous year. Despite its small revenue base (£0.503 million), Alina is debt-free and has sufficient short-term assets (£2 million) to cover liabilities, indicating financial stability within its operations. However, the company's earnings are characterized by high non-cash components and low return on equity (0.9%). Its share price remains highly volatile, reflecting typical risks associated with penny stocks in this sector.

- Get an in-depth perspective on Alina Holdings' performance by reading our balance sheet health report here.

- Gain insights into Alina Holdings' past trends and performance with our report on the company's historical track record.

Bay Capital (LSE:BAY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bay Capital Plc currently does not have significant operations and has a market cap of £2.87 million.

Operations: Bay Capital Plc has not reported any revenue segments.

Market Cap: £2.87M

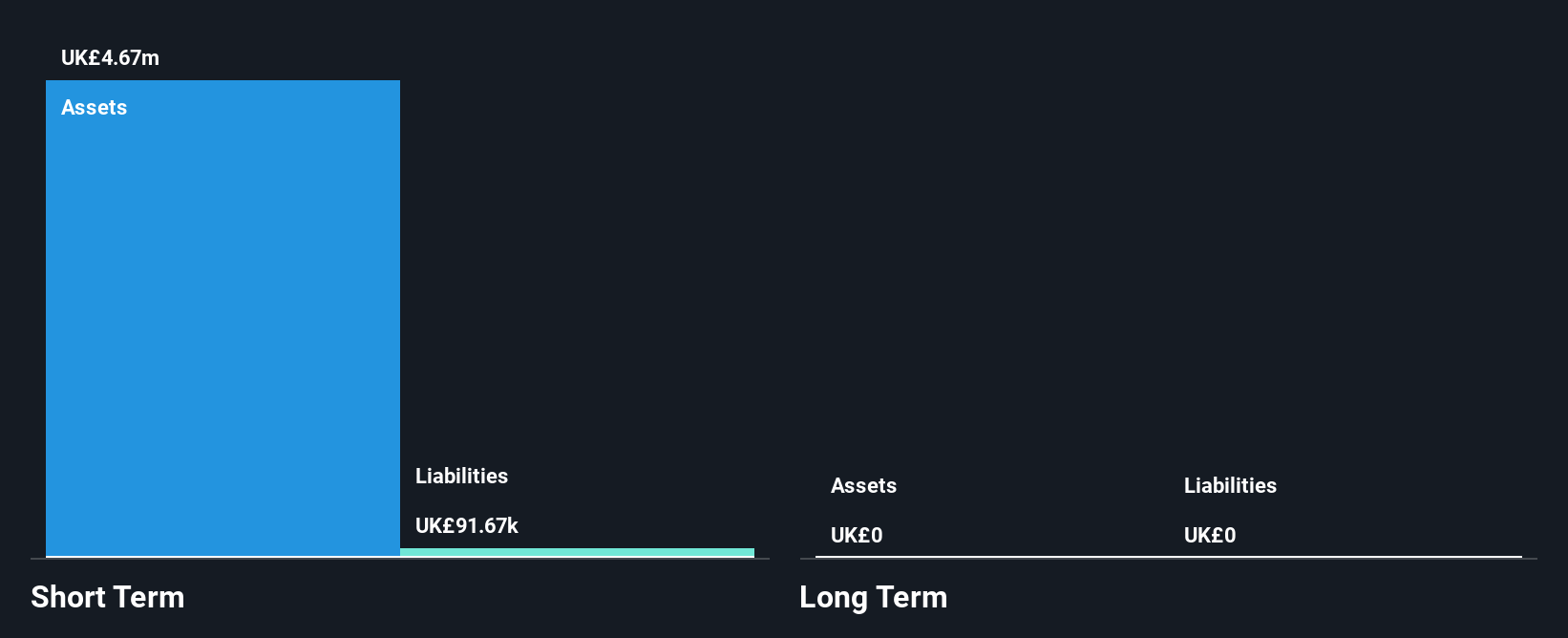

Bay Capital Plc, with a market cap of £2.87 million, is currently pre-revenue and debt-free. The company has not reported any significant revenue segments and remains unprofitable, with a recent half-year net loss of £0.28 million compared to the previous year's loss of £0.17 million. Despite this, Bay Capital's short-term assets (£4.9M) significantly exceed its short-term liabilities (£61.9K), offering some financial stability amid its speculative nature as a penny stock. Additionally, shareholders have not experienced dilution over the past year, and the company maintains a cash runway exceeding three years under stable conditions.

- Click here to discover the nuances of Bay Capital with our detailed analytical financial health report.

- Evaluate Bay Capital's historical performance by accessing our past performance report.

Where To Now?

- Dive into all 467 of the UK Penny Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bay Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BAY

Flawless balance sheet very low.