- United Kingdom

- /

- Metals and Mining

- /

- AIM:KP2

Discover 3 UK Penny Stocks With Market Caps Under £600M

Reviewed by Simply Wall St

The UK market has been experiencing fluctuations, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting ongoing global economic challenges. Amid these conditions, investors often seek opportunities in smaller or newer companies that can offer potential growth at lower price points. Penny stocks, despite their somewhat outdated moniker, represent such opportunities and can provide significant upside when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.968 | £152.69M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.66M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.274 | £196.49M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.715 | £369.48M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.44 | $255.78M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.96 | £453.67M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.52 | £321.99M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.0875 | £92.91M | ★★★★★★ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Boku (AIM:BOKU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boku, Inc. offers local payment solutions for merchants across the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market cap of £554.50 million.

Operations: The company generates revenue primarily from its Payments segment, which amounts to $91.83 million.

Market Cap: £554.5M

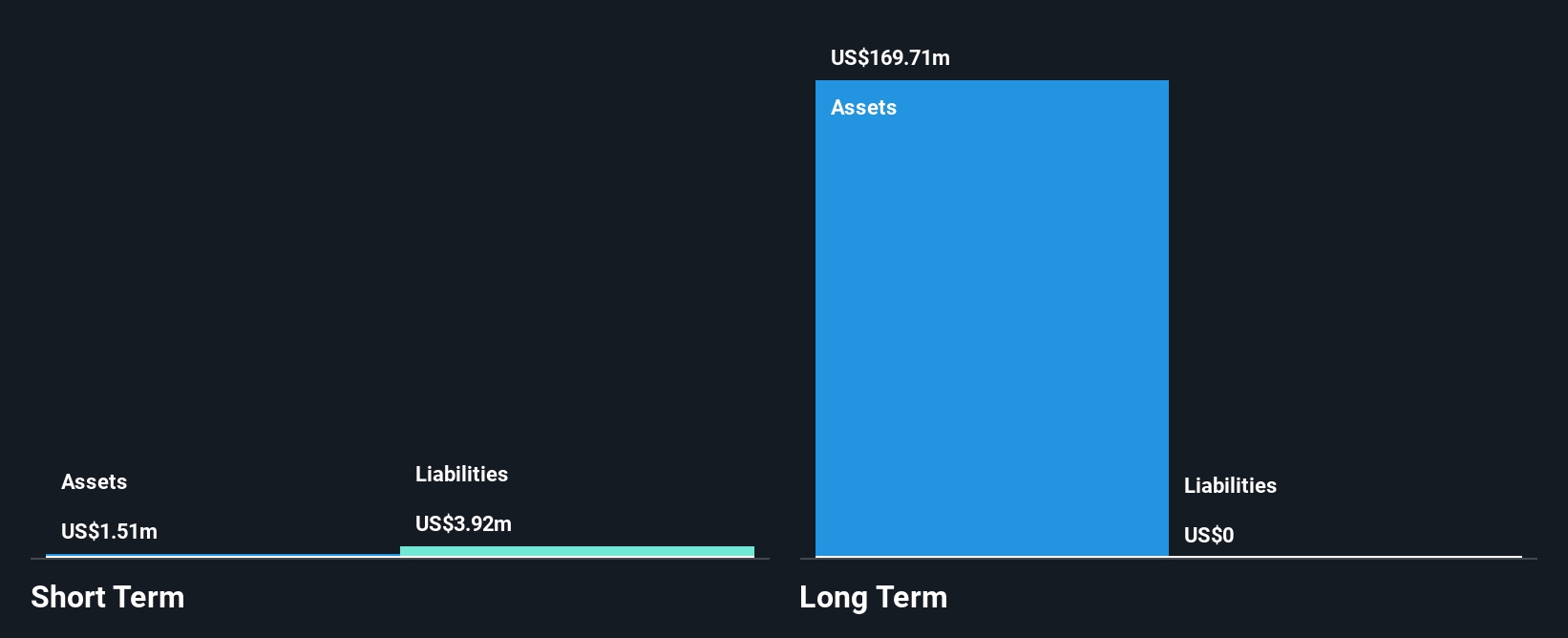

Boku, Inc. has shown significant earnings growth of 169.3% over the past year, surpassing its five-year average of 43.6% annually, and outperforming the Diversified Financial industry growth rate. The company is debt-free, with strong short-term assets covering both short and long-term liabilities. Despite a low Return on Equity at 5.2%, Boku maintains high-quality earnings and improved net profit margins from last year (7.9% vs 3.7%). Recent developments include a share repurchase program and a new commercial agreement with Amazon Japan G.K., potentially boosting future revenue streams through transaction-based income.

- Dive into the specifics of Boku here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Boku's future.

Kore Potash (AIM:KP2)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kore Potash plc, with a market cap of £109.54 million, focuses on the exploration and development of potash minerals in the Republic of Congo.

Operations: Kore Potash plc has not reported any revenue segments as it is primarily engaged in the exploration and development of potash minerals in the Republic of Congo.

Market Cap: £109.54M

Kore Potash plc, with a market cap of £109.54 million, remains pre-revenue and unprofitable as it focuses on developing the Kola Project in the Republic of Congo. The recent signing of a USD 1.929 billion fixed-price EPC contract with PowerChina aims to mitigate cost overrun risks, marking progress toward becoming a low-cost potash producer targeting Brazil and Africa's agricultural markets. However, challenges persist due to limited cash runway and shareholder dilution. Recent delisting from OTC Equity highlights trading inactivity concerns, while additional capital raised may provide short-term financial relief amidst ongoing project developments.

- Jump into the full analysis health report here for a deeper understanding of Kore Potash.

- Explore historical data to track Kore Potash's performance over time in our past results report.

Capital (LSE:CAPD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Capital Limited, along with its subsidiaries, offers a range of drilling solutions to the minerals industry and has a market capitalization of £164.46 million.

Operations: The company generates revenue from its Business Services segment, amounting to $333.59 million.

Market Cap: £164.46M

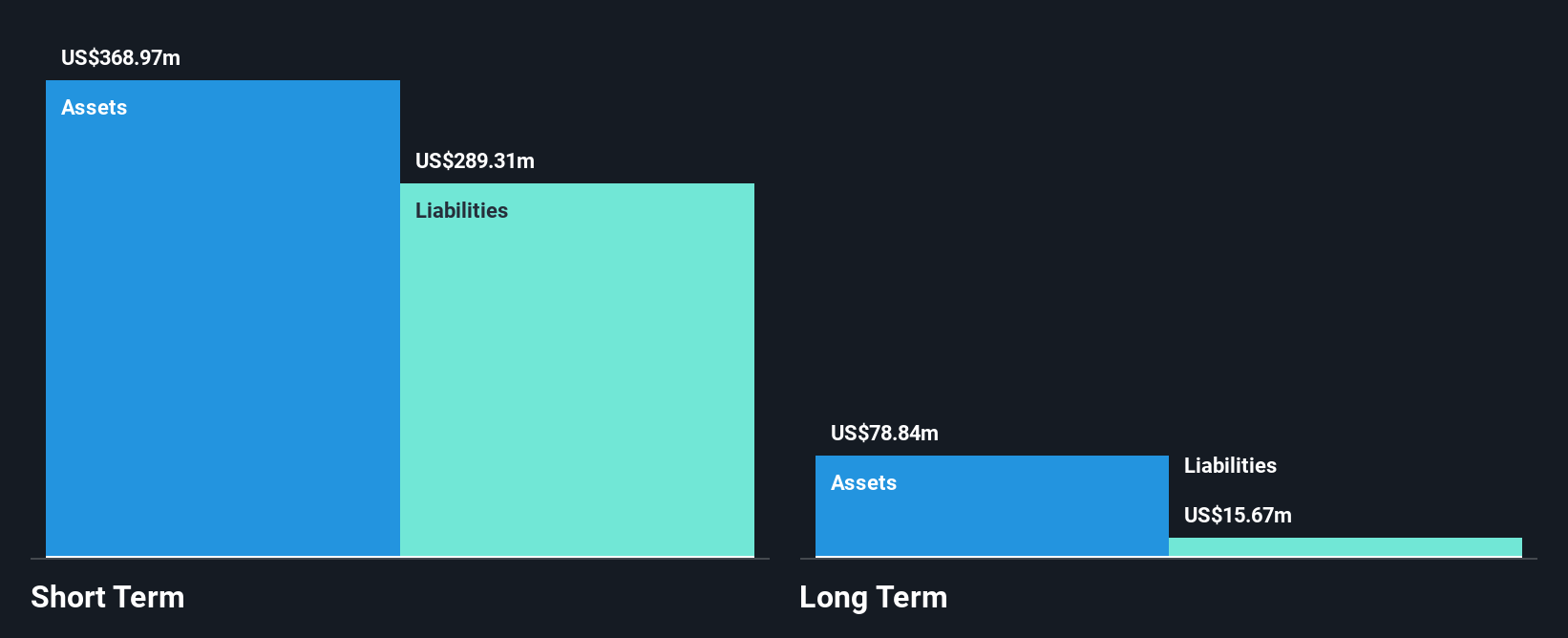

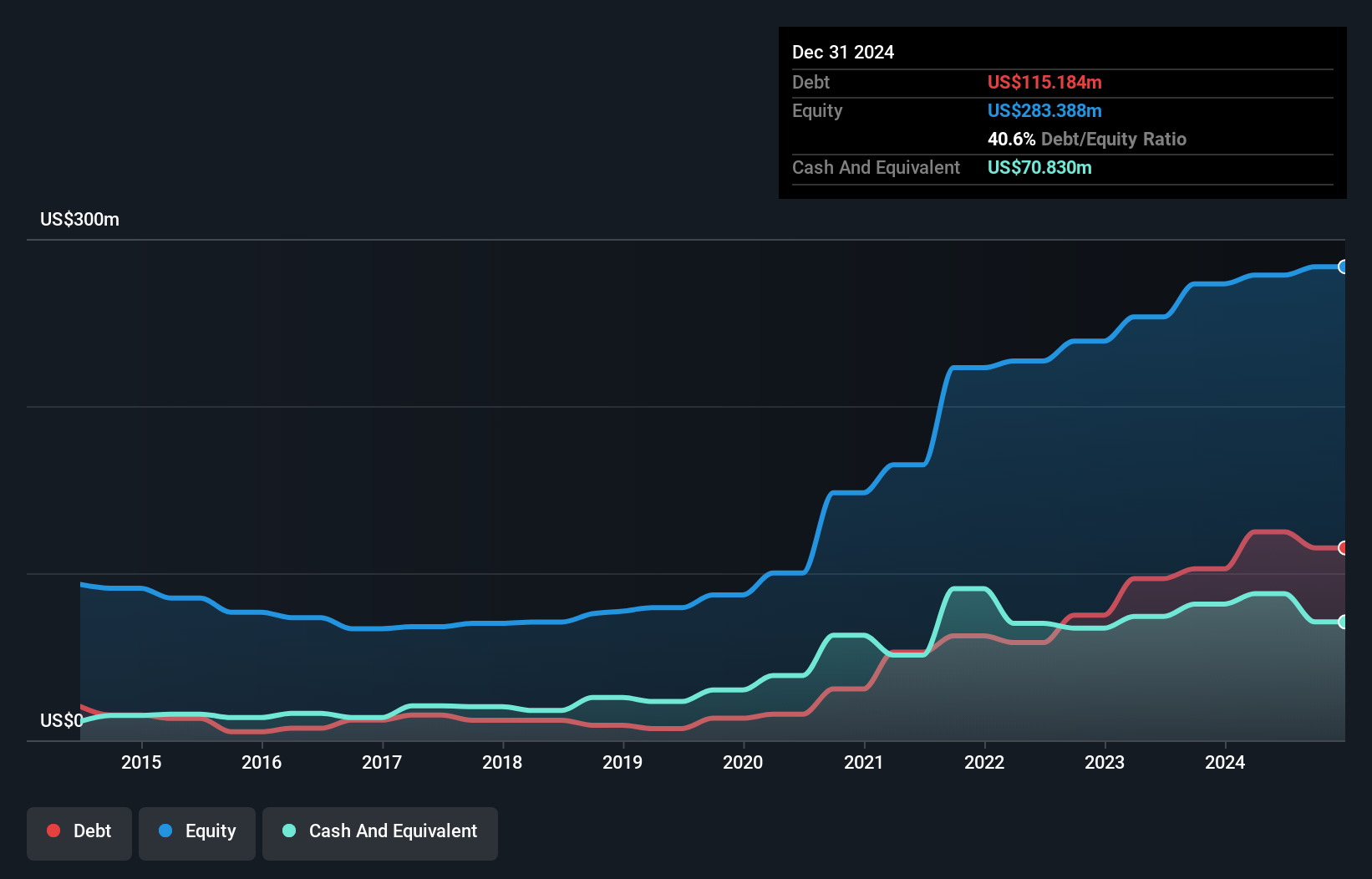

Capital Limited, with a market cap of £164.46 million, is financially stable with short-term assets of $231.3 million exceeding both its short and long-term liabilities. The company's debt is well-covered by operating cash flow, and it maintains a satisfactory net debt to equity ratio of 13.3%. Despite high-quality earnings and an experienced board, recent negative earnings growth contrasts with past profit increases. Revenue guidance for 2024 stands between $355 million to $375 million, indicating potential growth despite unstable dividend records. The appointment of Graeme Dacomb as Independent Non-Executive Director could enhance governance amid these financial dynamics.

- Click here and access our complete financial health analysis report to understand the dynamics of Capital.

- Gain insights into Capital's future direction by reviewing our growth report.

Taking Advantage

- Click this link to deep-dive into the 465 companies within our UK Penny Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kore Potash might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:KP2

Kore Potash

Engages in the exploration and development of potash minerals in the Republic of Congo.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives