- United Kingdom

- /

- Metals and Mining

- /

- AIM:EUA

Eurasia Mining And 2 Other UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting global economic uncertainties. In such a climate, investors often seek opportunities that balance affordability with growth potential. Penny stocks, despite their somewhat outdated moniker, can offer intriguing prospects for those willing to explore smaller or newer companies with strong fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.21M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.75 | £178.85M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.94 | £448.27M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.14 | £806.38M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £4.40 | £83.91M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.39 | £337.16M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.378 | £40.9M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.01 | £85.93M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.16 | £154.1M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.43 | £182.11M | ★★★★★☆ |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Eurasia Mining (AIM:EUA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Eurasia Mining Plc is a mining and mineral exploration company focused on the exploration, development, and production of palladium, platinum, rhodium, iridium, copper, nickel, gold, and other minerals in Russia with a market cap of £77.74 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: £77.74M

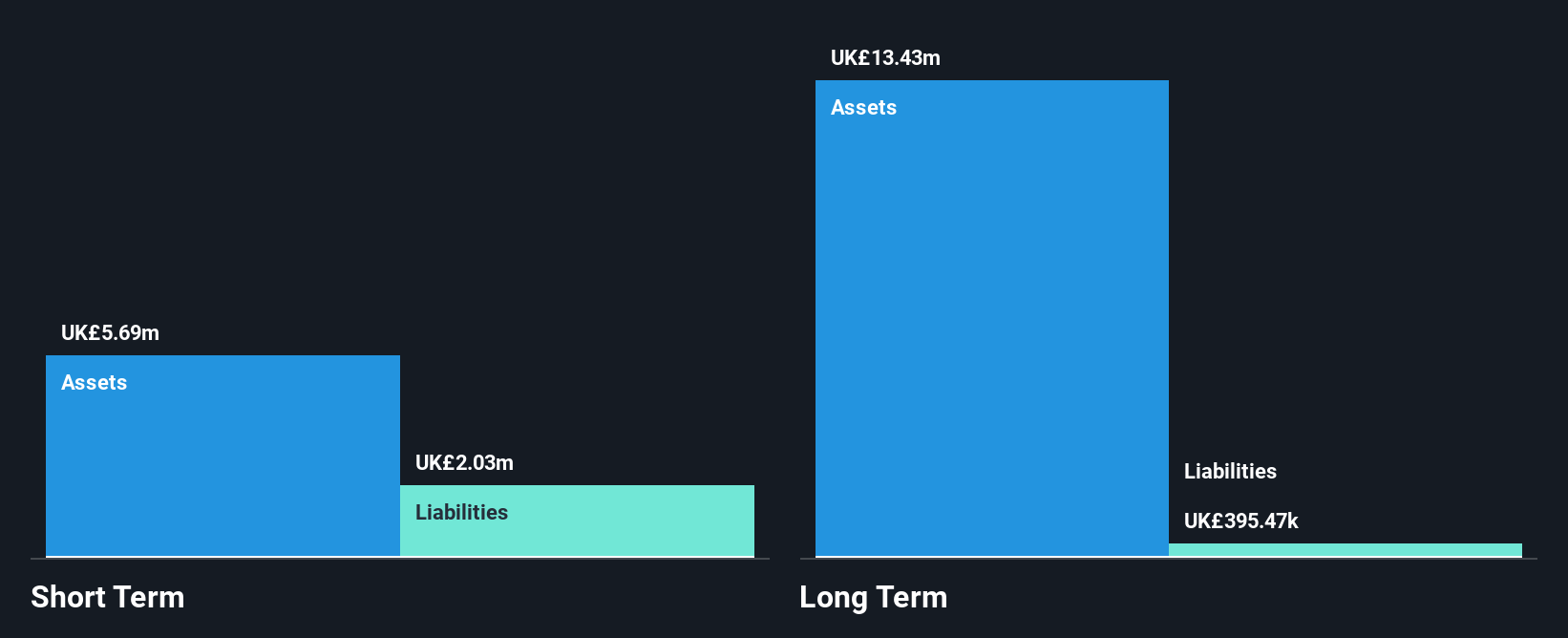

Eurasia Mining, with a market cap of £77.74 million, is pre-revenue and unprofitable, having seen losses increase by 28% annually over the past five years. Despite this, it has more cash than debt and short-term assets covering both short- and long-term liabilities. The company's cash runway is under a year if current free cash flow trends persist. Its share price remains highly volatile despite reduced weekly volatility from 23% to 11%. Management and board members are experienced with an average tenure of 3.8 years each, providing some stability amidst financial challenges.

- Jump into the full analysis health report here for a deeper understanding of Eurasia Mining.

- Understand Eurasia Mining's track record by examining our performance history report.

Supreme (AIM:SUP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Supreme Plc is involved in the ownership, manufacturing, and distribution of batteries, lighting, vaping products, sports nutrition and wellness items, and branded household consumer goods across the UK, Ireland, the Netherlands, France, Europe at large and internationally with a market cap of £204.71 million.

Operations: The company's revenue is derived from various segments, including Vaping (£77.29 million), Lighting (£17.13 million), Batteries (£42.00 million), Sports Nutrition & Wellness (£18.52 million), and Branded Household Consumer Goods (£67.25 million).

Market Cap: £204.71M

Supreme Plc, with a market cap of £204.71 million, demonstrates strong financial health and growth potential in the penny stock landscape. The company is debt-free and maintains high-quality earnings, with an impressive return on equity of 36.5%. Earnings have grown significantly by 32.7% over the past year, surpassing industry averages, although future earnings are forecast to decline by 9% annually over the next three years. Recent developments include advanced talks to acquire Typhoo Tea Limited and an interim dividend increase aligning with its policy. Despite these positive indicators, Supreme's management team lacks extensive experience with an average tenure of 1.3 years.

- Click to explore a detailed breakdown of our findings in Supreme's financial health report.

- Gain insights into Supreme's outlook and expected performance with our report on the company's earnings estimates.

Hunting (LSE:HTG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hunting PLC, along with its subsidiaries, manufactures components, technology systems, and precision parts globally, with a market cap of £556.04 million.

Operations: The company's revenue is primarily derived from its Hunting Titan segment at $247.6 million, followed by Asia Pacific at $150.3 million, Subsea Technologies at $134.8 million, and the Europe, Middle East and Africa (EMEA) segment at $88.4 million.

Market Cap: £556.04M

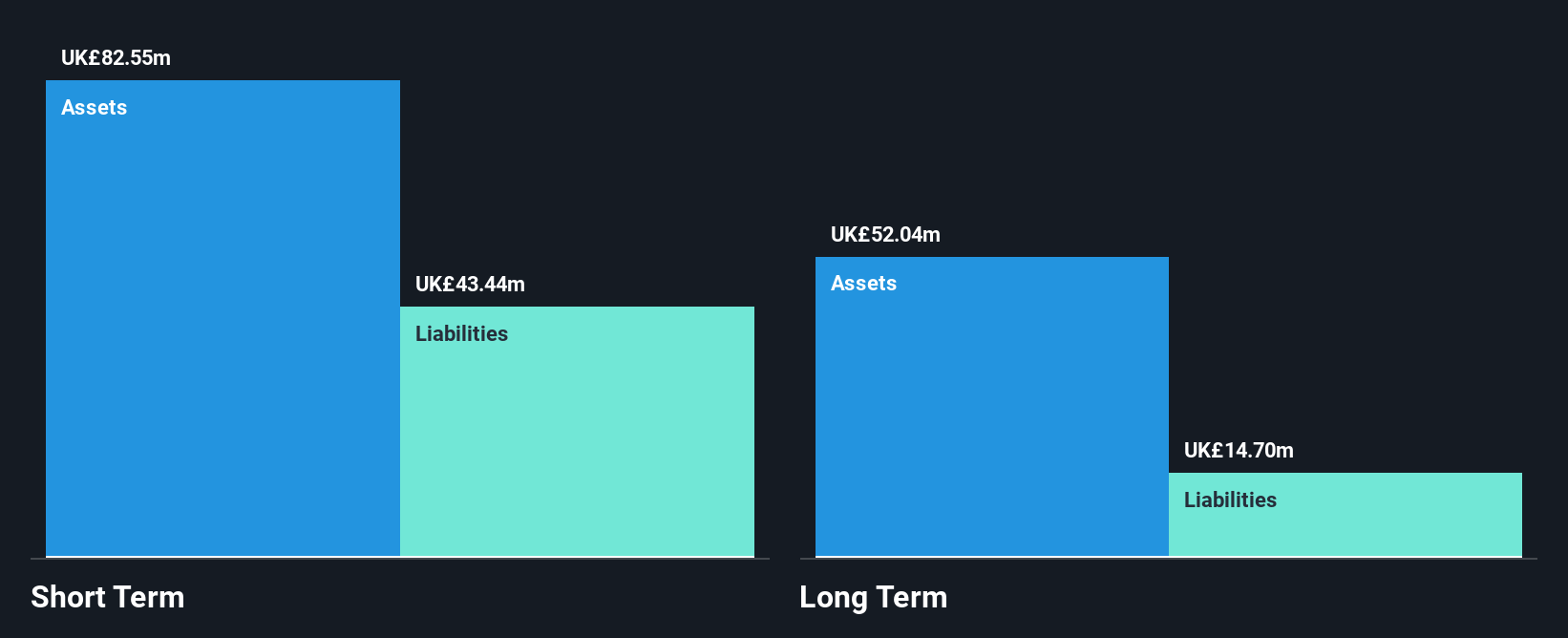

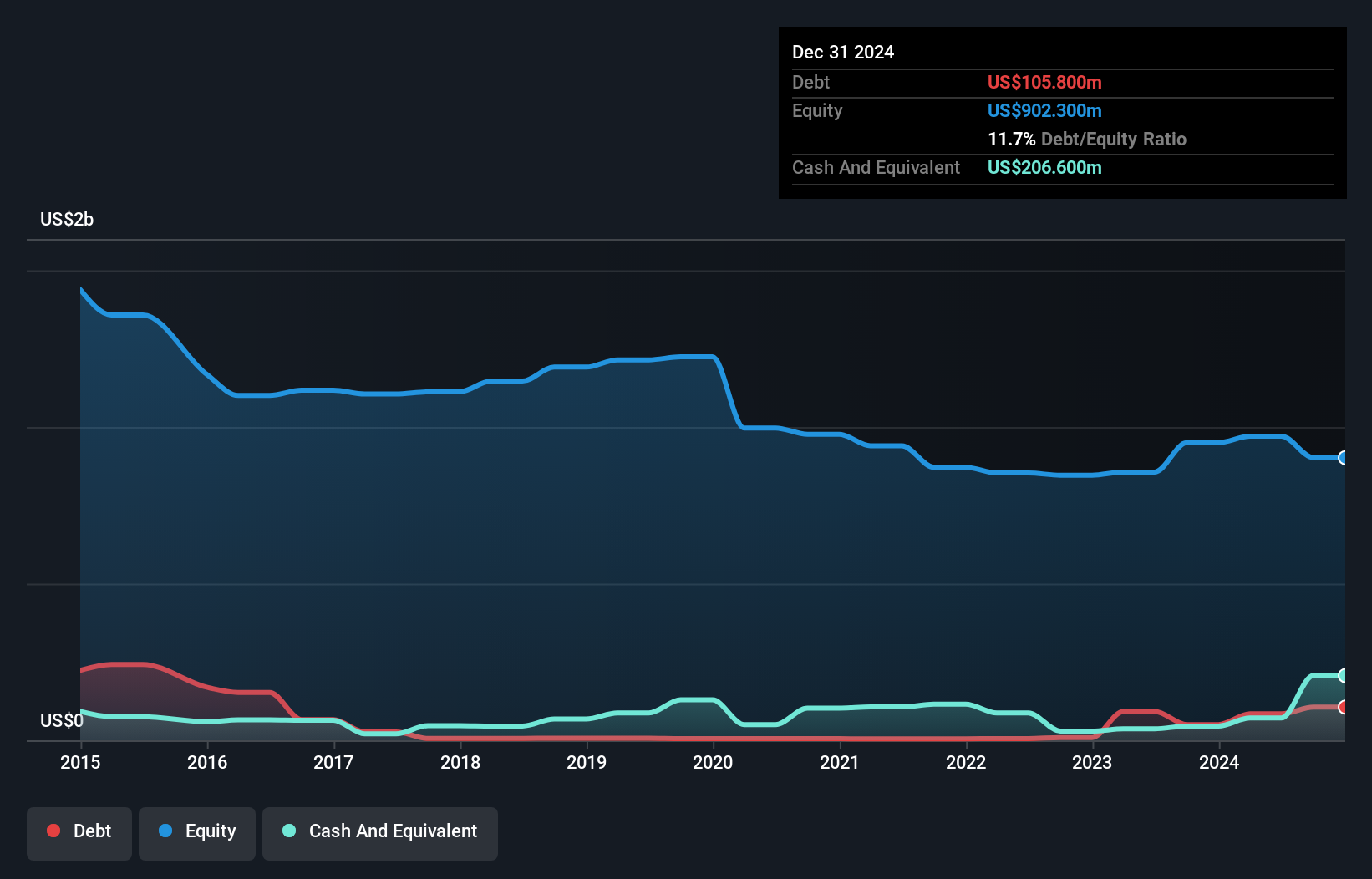

Hunting PLC, with a market cap of £556.04 million, shows robust financial metrics within the penny stock arena. The company has achieved significant earnings growth of 1285.4% over the past year, surpassing its industry peers and historical averages. Its debt is well-covered by operating cash flow at 127.1%, and short-term assets exceed liabilities comfortably. However, future earnings are expected to decline by 12.9% annually over the next three years despite revenue growth forecasts of 8.26%. Recent strategic focus on mergers and acquisitions in subsea technologies suggests potential for expansion in high-IP product lines.

- Get an in-depth perspective on Hunting's performance by reading our balance sheet health report here.

- Learn about Hunting's future growth trajectory here.

Make It Happen

- Navigate through the entire inventory of 443 UK Penny Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Eurasia Mining, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eurasia Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EUA

Eurasia Mining

A mining and mineral exploration company, engages in the exploration, development, and production of palladium, platinum, rhodium, iridium, copper, nickel, gold, and other minerals in Russia.

Adequate balance sheet slight.

Market Insights

Community Narratives