The UK market has been experiencing some turbulence, with the FTSE 100 and FTSE 250 indices recently closing lower due to weak trade data from China, highlighting global economic challenges. Despite these broader market uncertainties, penny stocks continue to offer intriguing opportunities for investors seeking growth at a lower price point. While the term "penny stocks" may seem outdated, they remain relevant as they often represent smaller or newer companies that can provide substantial growth potential when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.65 | £520.6M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.22 | £179.35M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.78 | £11.78M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.095 | £15.07M | ✅ 4 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.5375 | $312.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.50 | £72.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.14 | £181.49M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.70 | £9.64M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.43 | £74.04M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £1.89 | £713.9M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 291 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Empire Metals (AIM:EEE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Empire Metals Limited focuses on the exploration and development of properties in the United Kingdom, Australia, and Austria, with a market cap of £409.10 million.

Operations: Empire Metals Limited has not reported any revenue segments.

Market Cap: £409.1M

Empire Metals Limited, with a market cap of £409.10 million, is a pre-revenue company focused on exploration projects in the UK and Australia. Despite being unprofitable and having increased losses over the past five years, Empire has no long-term liabilities or debt, providing some financial stability. Recent advancements at its Pitfield Project in Western Australia have shown promising metallurgical test results for titanium dioxide recovery, indicating potential future revenue streams. The company's experienced board and management team are actively working on process development to enhance project viability while maintaining sufficient cash runway for ongoing operations.

- Click to explore a detailed breakdown of our findings in Empire Metals' financial health report.

- Understand Empire Metals' track record by examining our performance history report.

Currys (LSE:CURY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Currys plc is an omnichannel retailer of technology products and services across the UK, Ireland, and several Nordic countries, with a market cap of approximately £1.50 billion.

Operations: The company's revenue is derived from two primary segments: £5.35 billion from the UK & Ireland and £3.42 billion from the Nordics.

Market Cap: £1.5B

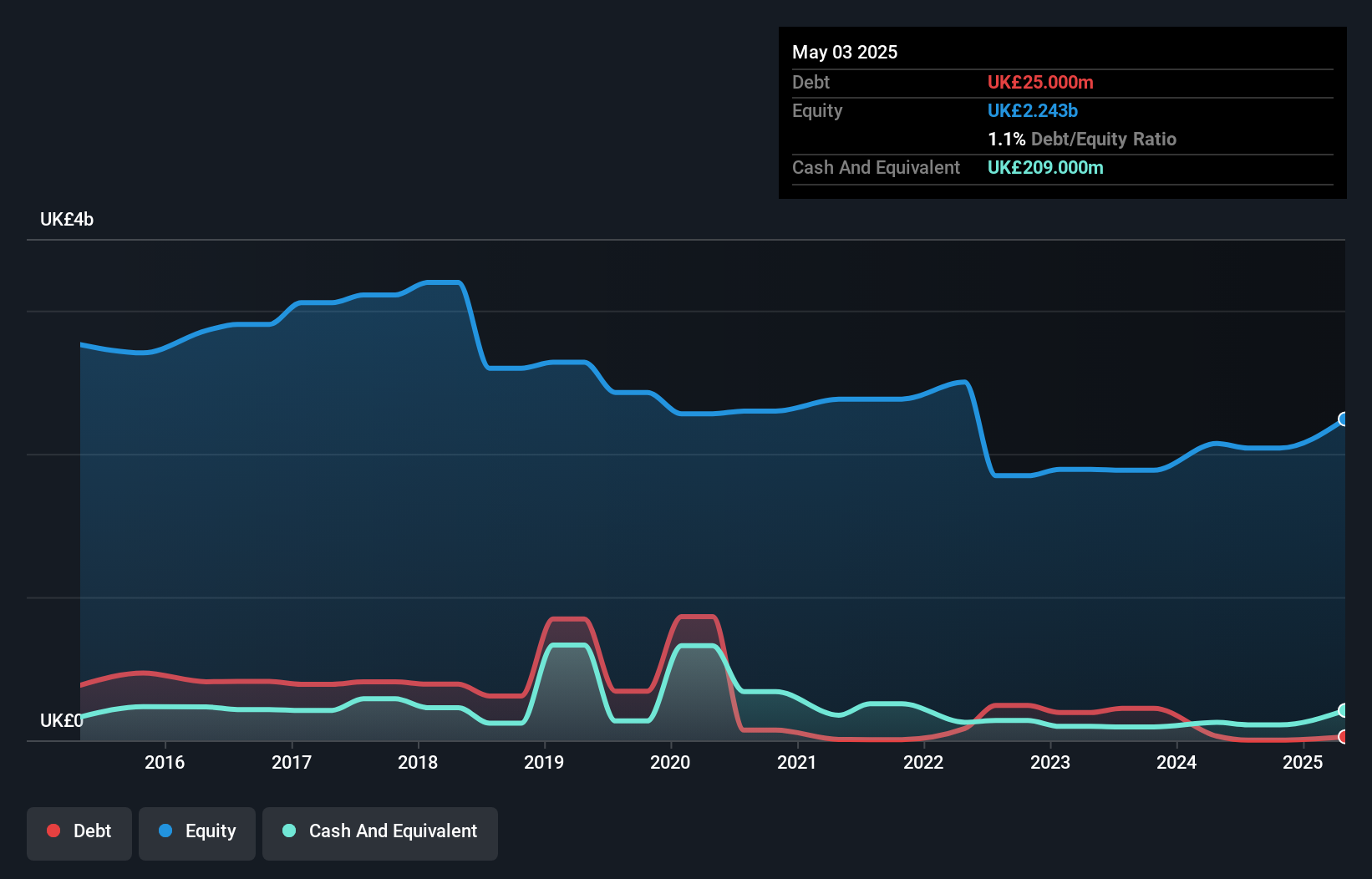

Currys plc, with a market cap of £1.50 billion, has shown stable weekly volatility and strong financial health, evidenced by its operating cash flow covering debt significantly. The company has experienced substantial earnings growth over the past year at 286.2%, outpacing industry averages, and maintains high-quality earnings without shareholder dilution. Despite a low return on equity of 4.8%, Currys trades at a favorable price-to-earnings ratio compared to the UK market and is actively executing a £50 million share repurchase program funded by cash reserves to optimize capital structure and enhance shareholder value. Recent board changes reflect an evolving governance strategy for ESG initiatives.

- Navigate through the intricacies of Currys with our comprehensive balance sheet health report here.

- Understand Currys' earnings outlook by examining our growth report.

Trustpilot Group (LSE:TRST)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Trustpilot Group plc operates an online review platform connecting businesses and consumers across the United Kingdom, North America, Europe, and other international markets, with a market cap of £903.54 million.

Operations: The company's revenue is primarily generated from its Internet Information Providers segment, amounting to $233.80 million.

Market Cap: £903.54M

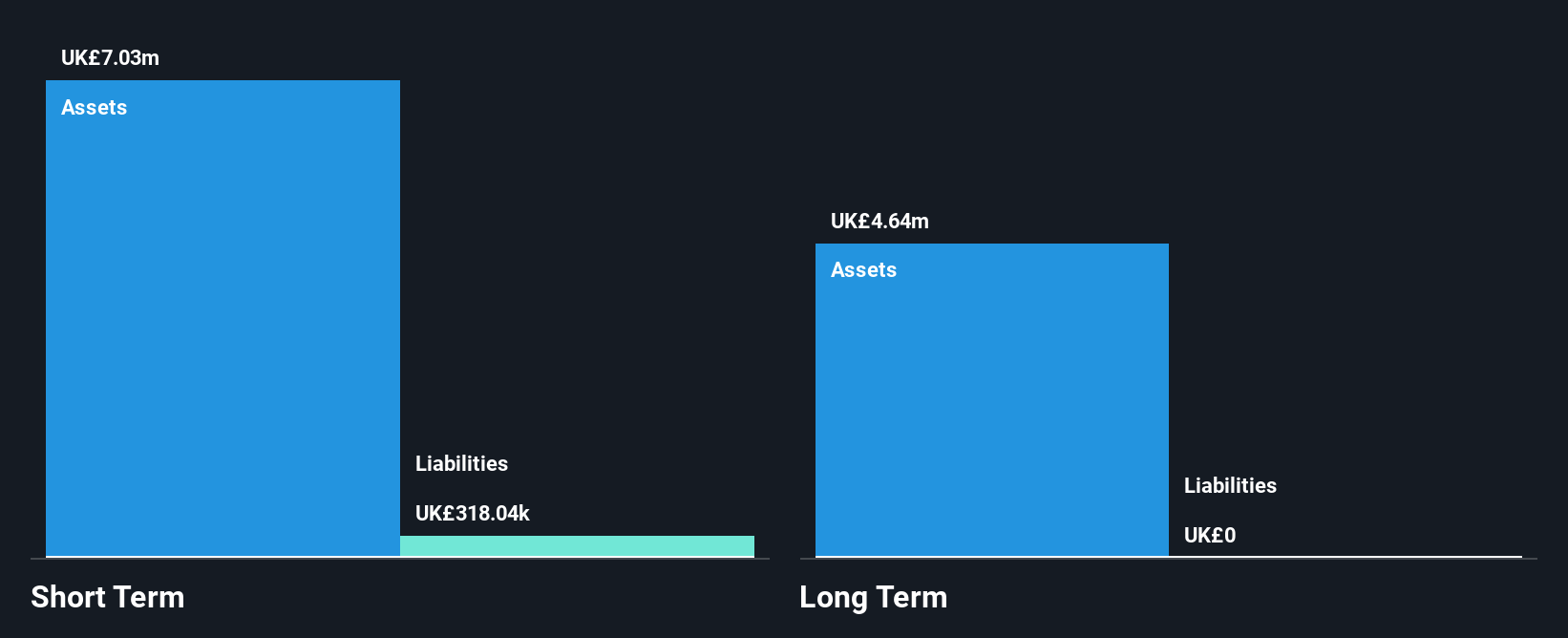

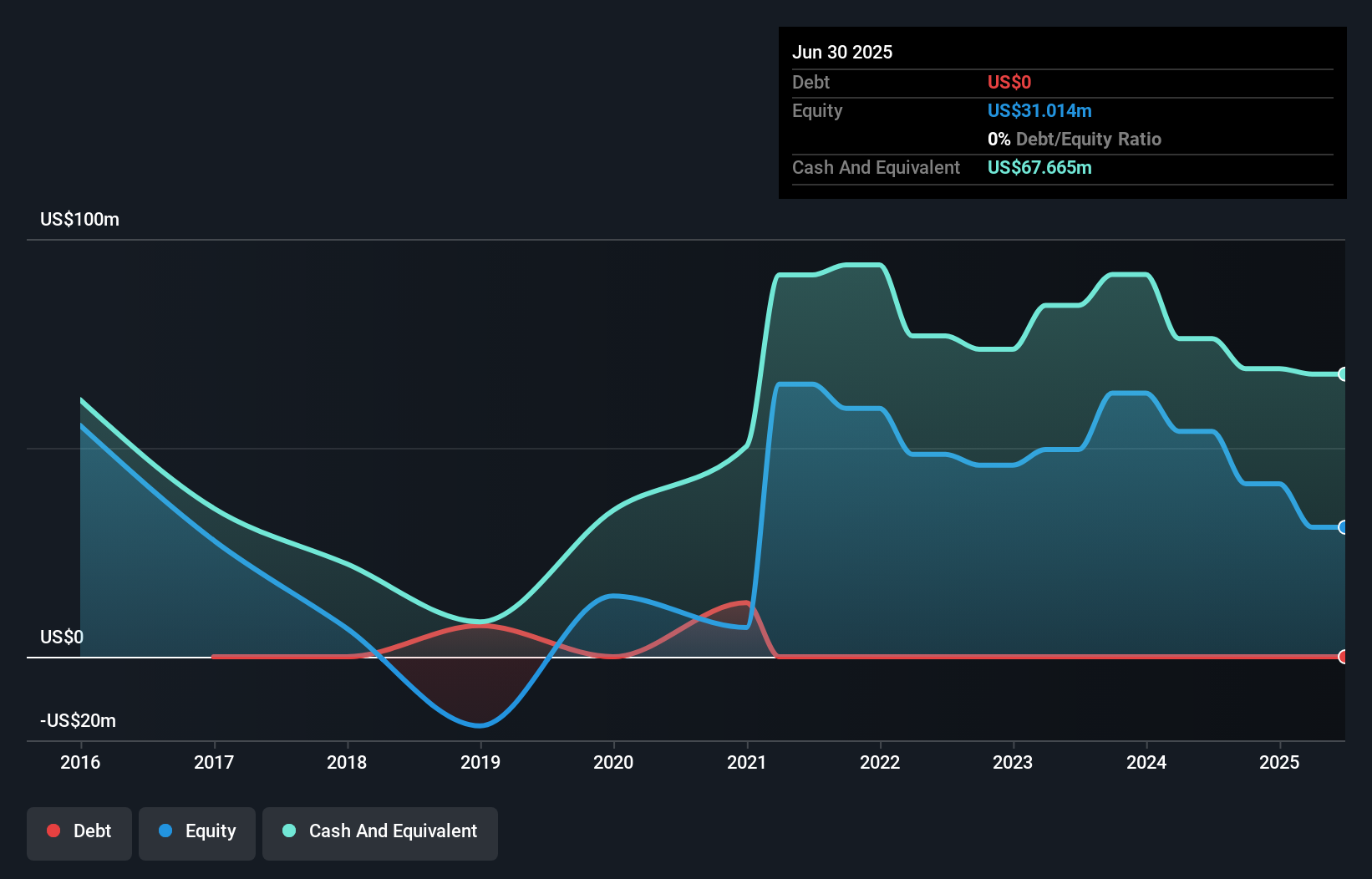

Trustpilot Group, with a market cap of £903.54 million, has demonstrated financial stability by maintaining a debt-free status while its short-term assets exceed long-term liabilities. Despite experiencing negative earnings growth over the past year and a decline in net profit margins from 9% to 0.5%, the company forecasts significant earnings growth of 66.72% annually. Trustpilot recently announced a £30 million share repurchase program aimed at reducing share capital, which aligns with its strategy to enhance shareholder value amidst stable revenue growth projections for 2025 and consistent high-quality earnings without meaningful shareholder dilution.

- Take a closer look at Trustpilot Group's potential here in our financial health report.

- Learn about Trustpilot Group's future growth trajectory here.

Where To Now?

- Jump into our full catalog of 291 UK Penny Stocks here.

- Ready For A Different Approach? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trustpilot Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TRST

Trustpilot Group

Engages in the development and hosting of an online review platform for businesses and consumers in the United Kingdom, North America, Europe, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives