- United Kingdom

- /

- IT

- /

- AIM:BKS

UK Penny Stocks Worth Watching In May 2025

Reviewed by Simply Wall St

The UK market has been experiencing fluctuations, with the FTSE 100 index closing lower due to weak trade data from China, impacting companies tied to Chinese economic performance. Despite these broader market challenges, penny stocks—often representing smaller or newer companies—remain an intriguing area for investors seeking growth opportunities at lower price points. By focusing on those with strong financial foundations and potential for long-term growth, investors can discover hidden gems that offer both stability and upside potential in a volatile market landscape.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.855 | £11.77M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.88 | £297.21M | ✅ 5 ⚠️ 1 View Analysis > |

| One Media iP Group (AIM:OMIP) | £0.0375 | £8.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.23 | £161.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.80 | £306.99M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.755 | £424.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.04 | £389.44M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.6M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.008 | £2.2B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.35 | £37.87M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 395 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Atlantic Lithium (AIM:ALL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Atlantic Lithium Limited focuses on the exploration and development of mineral properties in Australia, Ivory Coast, and Ghana with a market cap of £50.25 million.

Operations: The company generates revenue from its exploration activities in base and precious metals, totaling A$1.15 million.

Market Cap: £50.25M

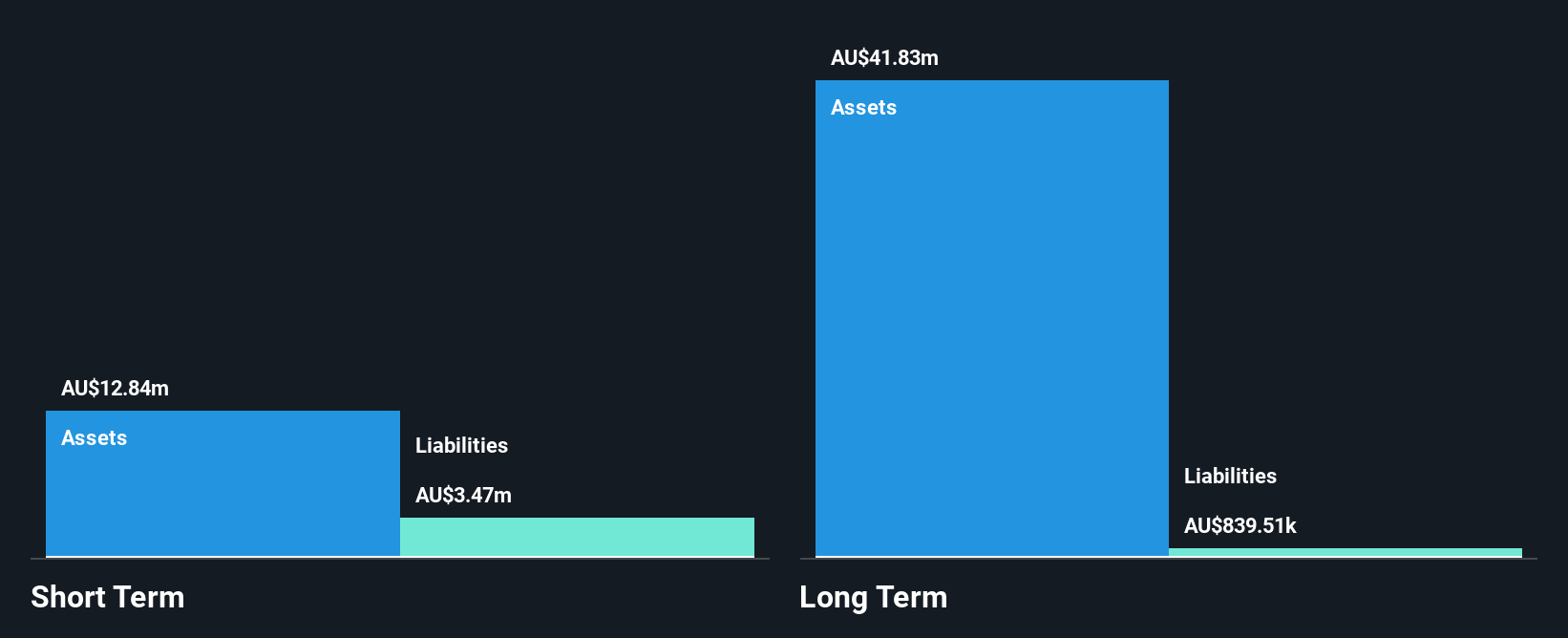

Atlantic Lithium Limited, with a market cap of £50.25 million, is pre-revenue and currently unprofitable, reporting a net loss of A$2.08 million for the half-year ending December 2024. Despite its losses increasing by 11.2% annually over five years, the company maintains short-term assets of A$12.8 million exceeding both short-term and long-term liabilities. The firm is debt-free but faces high volatility in share price and has less than a year of cash runway at current free cash flow reduction rates. Shareholder dilution has not been significant recently, offering some stability amidst financial challenges.

- Click to explore a detailed breakdown of our findings in Atlantic Lithium's financial health report.

- Examine Atlantic Lithium's earnings growth report to understand how analysts expect it to perform.

Beeks Financial Cloud Group (AIM:BKS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beeks Financial Cloud Group plc offers managed cloud computing, connectivity, and analytics services for capital markets and financial services sectors globally, with a market cap of £138.34 million.

Operations: The company generates revenue from its Public/private Cloud segment, which accounts for £26.01 million, and its Proximity/Exchange Cloud segment, contributing £5.32 million.

Market Cap: £138.34M

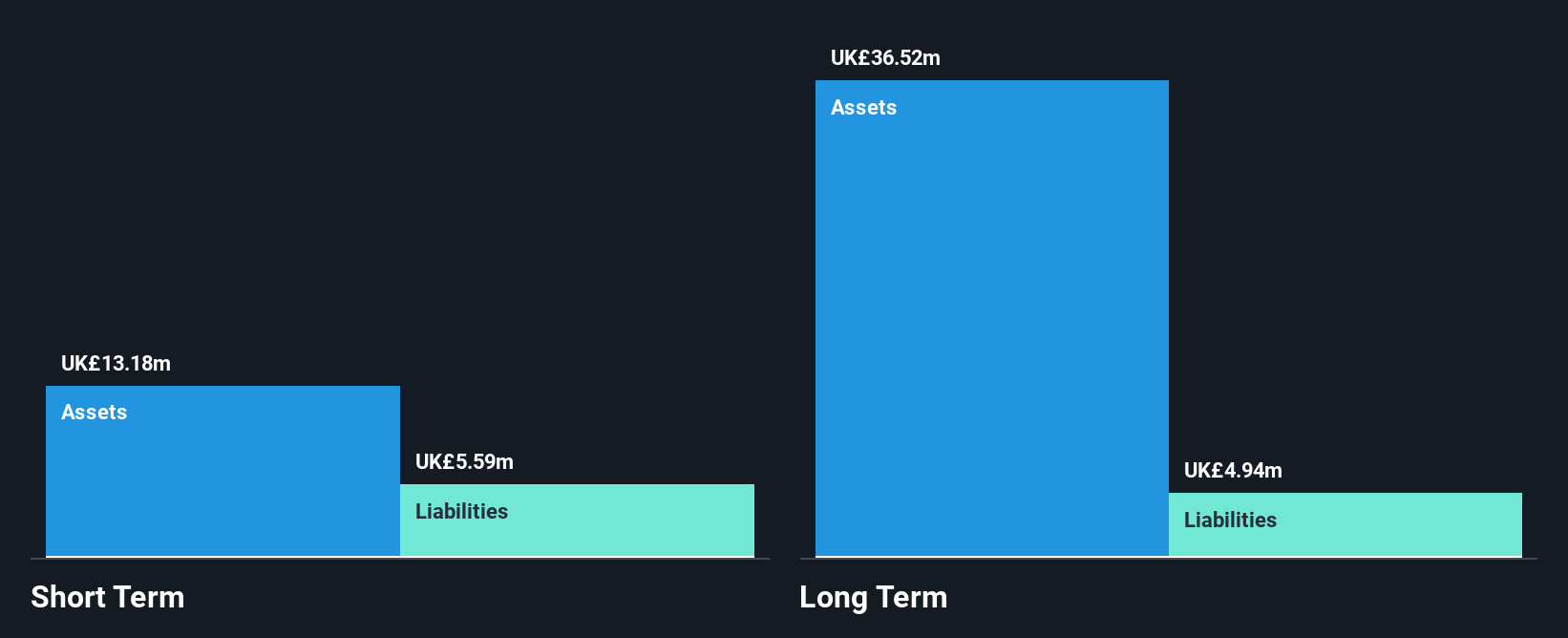

Beeks Financial Cloud Group plc, with a market cap of £138.34 million, has shown strong financial growth, reporting earnings that grew by 293.4% over the past year and a net profit margin improvement from 2.4% to 7.4%. The company is debt-free and boasts short-term assets of £13.2 million surpassing both its short-term and long-term liabilities. Recent contracts with Kraken and a global FX brokerage firm highlight Beeks' expansion into new markets, promising revenue growth as these partnerships commence in H2 FY25. Despite stable weekly volatility over the past year, its share price remains highly volatile recently.

- Navigate through the intricacies of Beeks Financial Cloud Group with our comprehensive balance sheet health report here.

- Assess Beeks Financial Cloud Group's future earnings estimates with our detailed growth reports.

Hostelworld Group (LSE:HSW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hostelworld Group plc operates as an online travel agent specializing in the hostel market globally, with a market cap of £144.66 million.

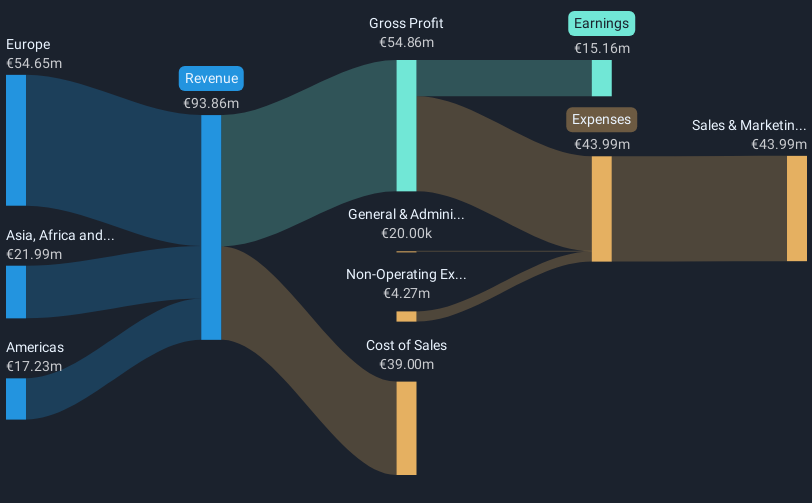

Operations: The company generates revenue of €92 million from providing software and data processing services.

Market Cap: £144.66M

Hostelworld Group plc, with a market cap of £144.66 million, has demonstrated robust earnings growth of 78.4% over the past year, surpassing both its historical average and industry benchmarks. The company is debt-free and maintains high-quality earnings; however, its short-term assets (€12.7M) fall short of covering short-term liabilities (€16.9M). Despite this, long-term liabilities are well-covered by assets. Recent executive changes include the upcoming departure of Chairman Ulrik Bengtsson later in 2025 as the company seeks new leadership to support its growth trajectory amidst stable weekly volatility and an experienced board and management team.

- Dive into the specifics of Hostelworld Group here with our thorough balance sheet health report.

- Explore Hostelworld Group's analyst forecasts in our growth report.

Summing It All Up

- Navigate through the entire inventory of 395 UK Penny Stocks here.

- Want To Explore Some Alternatives? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beeks Financial Cloud Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BKS

Beeks Financial Cloud Group

Provides managed cloud computing, connectivity, and analytics services for capital markets and financial services sectors in the United Kingdom, Europe, the United States, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives