- United Kingdom

- /

- Insurance

- /

- LSE:SAGA

UK Growth Companies With High Insider Ownership To Watch In September 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting ongoing global economic uncertainties. In such a climate, investors often look for growth companies with high insider ownership as these firms can offer potential stability and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Taylor Maritime (LSE:TMI) | 20.9% | 65% |

| SRT Marine Systems (AIM:SRT) | 24.3% | 91.4% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 18.2% | 20.8% |

| Manolete Partners (AIM:MANO) | 38.1% | 29.5% |

| Helios Underwriting (AIM:HUW) | 21.2% | 12.2% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 85.7% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 24.6% | 62% |

| ENGAGE XR Holdings (AIM:EXR) | 15.3% | 84.5% |

| B90 Holdings (AIM:B90) | 22.1% | 138.6% |

| ASA International Group (LSE:ASAI) | 18.4% | 23.3% |

Let's uncover some gems from our specialized screener.

M&C Saatchi (AIM:SAA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: M&C Saatchi plc offers advertising and marketing communications services across the United Kingdom, Europe, the Middle East, the Asia Pacific, and the Americas, with a market cap of £195.15 million.

Operations: M&C Saatchi plc generates its revenue through advertising and marketing communications services across various regions, including the United Kingdom, Europe, the Middle East, the Asia Pacific, and the Americas.

Insider Ownership: 15.2%

Earnings Growth Forecast: 25.2% p.a.

M&C Saatchi, with significant insider ownership, has seen a shift in leadership as Dame Heather Rabbatts becomes Non-Executive Chair. The company's earnings are forecast to grow significantly at 25.2% annually, outpacing the UK market's growth rate of 11.4%. Despite trading at nearly 65% below its estimated fair value and having high-quality earnings, revenue is expected to decline by 9.7% annually over the next three years.

- Click to explore a detailed breakdown of our findings in M&C Saatchi's earnings growth report.

- The analysis detailed in our M&C Saatchi valuation report hints at an deflated share price compared to its estimated value.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £511.64 million.

Operations: The company's revenue is derived from three main segments: Infrastructure (£95.89 million), Private Equity (£50.52 million), and Foresight Capital Management (£7.58 million).

Insider Ownership: 35.4%

Earnings Growth Forecast: 18.6% p.a.

Foresight Group Holdings, with substantial insider ownership, recently appointed Gary Fraser as Group CEO. The company reported a net income increase to £33.25 million for the year ending March 2025 and approved a 16.8 pence dividend per share. While Foresight's earnings are projected to grow at 18.6% annually, outpacing the UK market, revenue growth is aligned with market averages at 9.4%. The firm actively seeks accretive M&A opportunities despite stock valuation challenges.

- Get an in-depth perspective on Foresight Group Holdings' performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Foresight Group Holdings shares in the market.

Saga (LSE:SAGA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Saga plc, operating in the United Kingdom, offers package and cruise holidays, general insurance, and personal finance products through its subsidiaries with a market cap of £287.62 million.

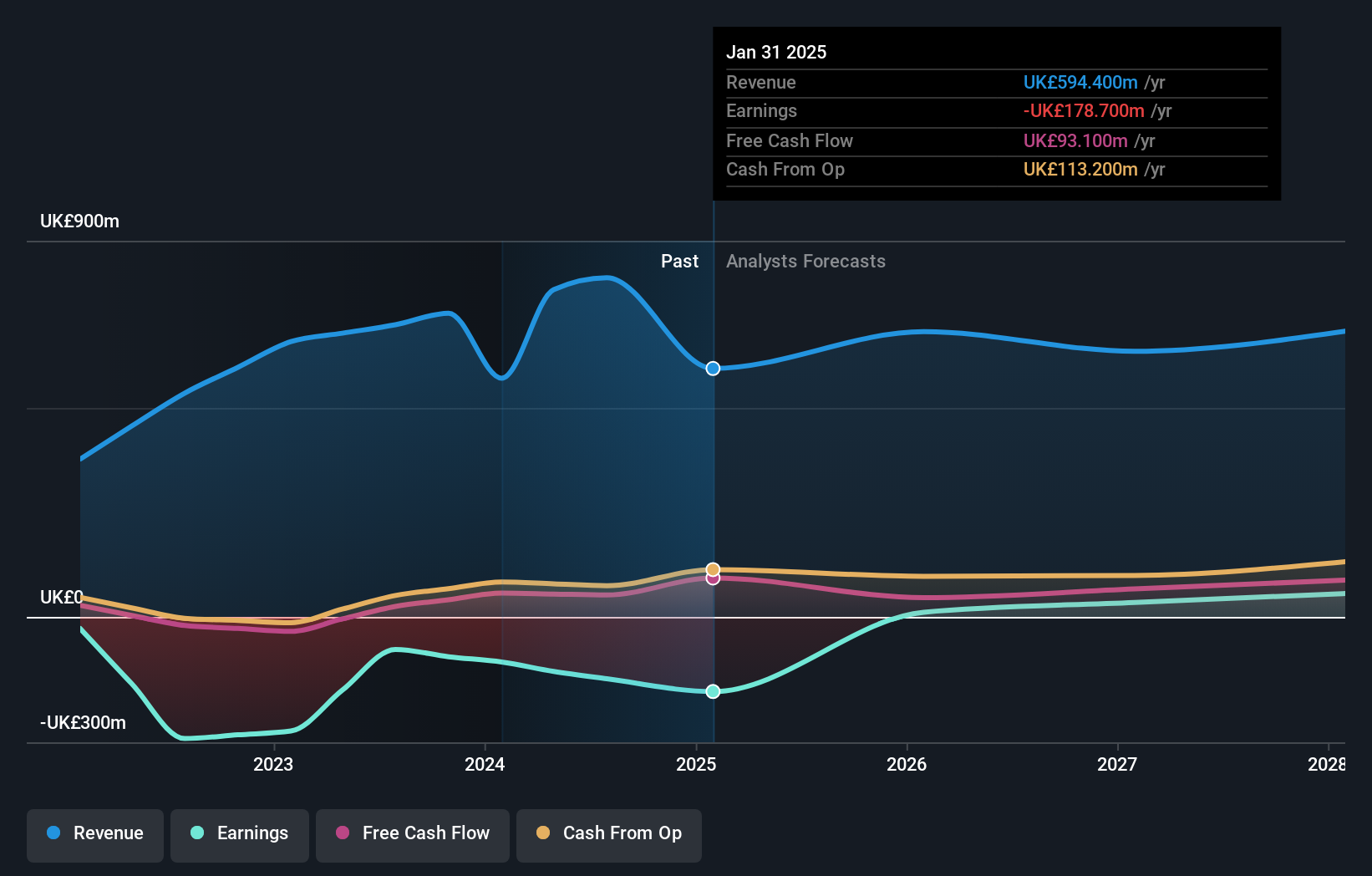

Operations: The company's revenue segments consist of £455.40 million from travel, £31.80 million from home insurance broking, £46.80 million from motor insurance broking, and £36.70 million from other insurance broking in the United Kingdom.

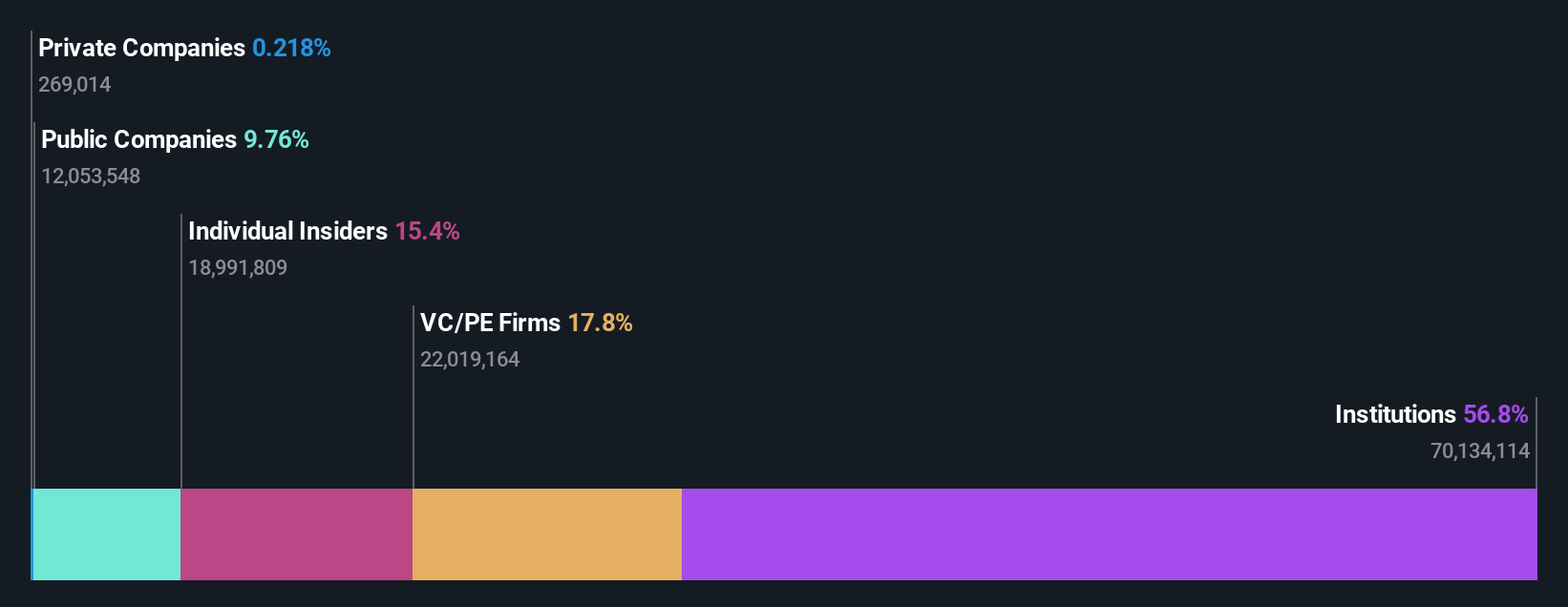

Insider Ownership: 36.1%

Earnings Growth Forecast: 90.8% p.a.

Saga, with significant insider ownership, is poised for transformation through a seven-year partnership with NatWest Boxed to expand its financial services for those over 50. While revenue growth is projected at 3.6% annually, slower than the UK market average, earnings are expected to grow significantly at 90.77% per year. The company anticipates becoming profitable within three years and trades at good relative value compared to peers. Recent committee restructuring supports operational efficiency enhancements.

- Navigate through the intricacies of Saga with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Saga's share price might be too pessimistic.

Key Takeaways

- Investigate our full lineup of 43 Fast Growing UK Companies With High Insider Ownership right here.

- Curious About Other Options? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SAGA

Saga

Provides package and cruise holidays, general insurance, and personal finance products and services in the United Kingdom.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives