- United Kingdom

- /

- Insurance

- /

- LSE:ADM

Top UK Dividend Stocks To Consider In Your Portfolio

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and falling commodity prices impacting major companies. In such uncertain times, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for investors seeking resilience in their portfolios.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.01% | ★★★★★☆ |

| RS Group (LSE:RS1) | 4.14% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 6.02% | ★★★★★★ |

| OSB Group (LSE:OSB) | 5.97% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.65% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.43% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.31% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.36% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.49% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.74% | ★★★★★★ |

Click here to see the full list of 50 stocks from our Top UK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

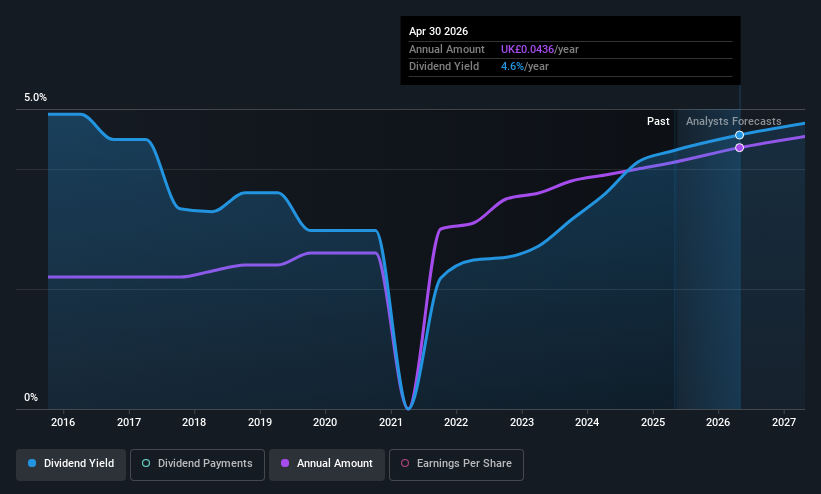

Begbies Traynor Group (AIM:BEG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Begbies Traynor Group plc offers business recovery, financial advisory, and property services consultancy in the United Kingdom, with a market cap of £178.31 million.

Operations: Begbies Traynor Group's revenue is derived from its Property Advisory segment, contributing £46.40 million, and its Business Recovery and Advisory segment, which brings in £107.30 million.

Dividend Yield: 3.8%

Begbies Traynor Group offers stable and reliable dividend payments, having increased over the past decade with little volatility. However, its high payout ratio of 108.5% indicates dividends aren't well covered by earnings, though cash flows provide better coverage at a 51.1% cash payout ratio. Recent executive changes aim to support growth strategy execution, which may impact future financial performance and dividend sustainability. Despite a low yield of 3.84%, analysts see potential stock price appreciation.

- Navigate through the intricacies of Begbies Traynor Group with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Begbies Traynor Group's current price could be quite moderate.

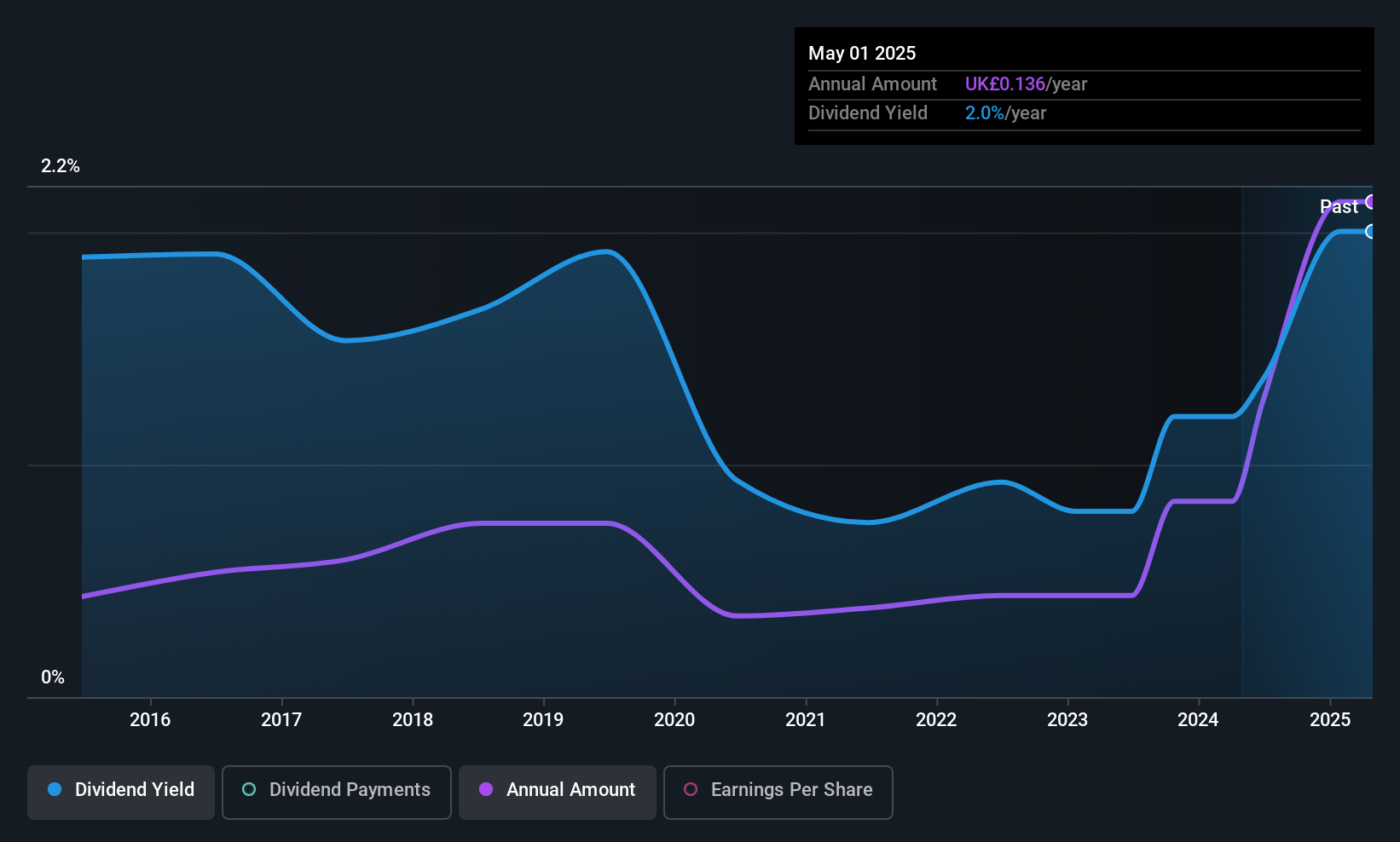

B.P. Marsh & Partners (AIM:BPM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: B.P. Marsh & Partners PLC focuses on investing in early-stage and SME financial services intermediary businesses both in the United Kingdom and internationally, with a market cap of £247.96 million.

Operations: B.P. Marsh & Partners PLC generates revenue of £115.24 million from providing consultancy services and trading investments in financial services.

Dividend Yield: 3.2%

B.P. Marsh & Partners' dividend payments have been volatile, lacking consistent growth over the past decade. Despite this instability, dividends are well-covered by earnings and cash flows with low payout ratios of 5% and 23.4%, respectively, suggesting sustainability. However, the yield of 3.15% is below top-tier UK dividend payers. Recent equity offerings raising £23.57 million could impact future financial strategies but don't immediately address dividend reliability concerns despite strong earnings growth last year.

- Get an in-depth perspective on B.P. Marsh & Partners' performance by reading our dividend report here.

- According our valuation report, there's an indication that B.P. Marsh & Partners' share price might be on the cheaper side.

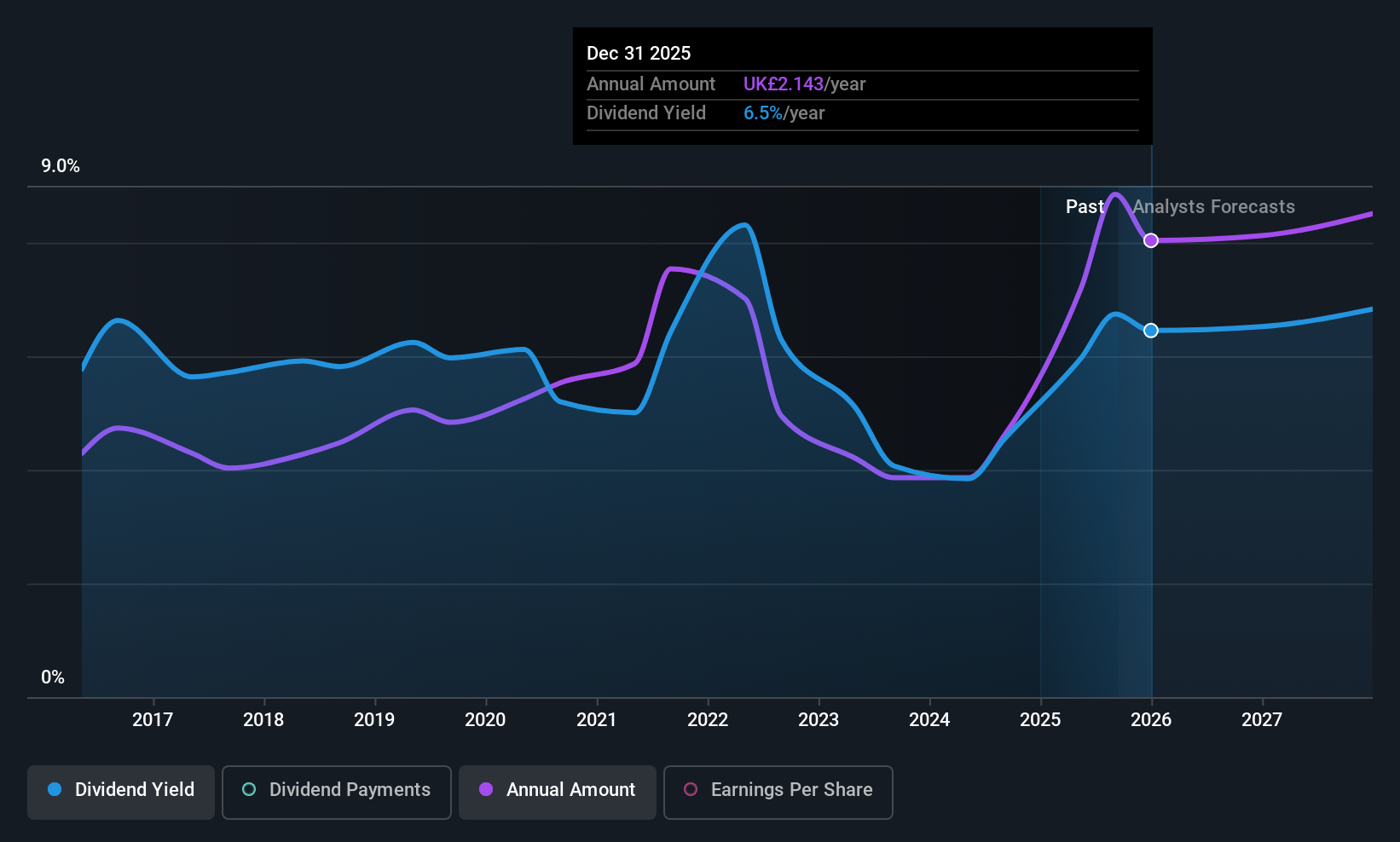

Admiral Group (LSE:ADM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Admiral Group plc is a financial services company offering insurance and personal lending products across the United Kingdom, France, Italy, Spain, and the United States, with a market cap of £10.21 billion.

Operations: Admiral Group's revenue is primarily derived from its UK Insurance segment, which accounts for £4.33 billion, complemented by Admiral Money contributing £20.10 million.

Dividend Yield: 7.0%

Admiral Group's dividend yield of 7% ranks in the top 25% among UK dividend payers, yet its sustainability is questionable due to a high cash payout ratio of 248%. Despite earnings growth of 108.9% over the past year, dividends remain unreliable and volatile, with historical annual drops over 20%. Recent earnings announcements showed net income at £401 million for H1 2025. Upcoming dividends include regular (£0.859) and special (£0.291) payouts scheduled for September.

- Delve into the full analysis dividend report here for a deeper understanding of Admiral Group.

- Our expertly prepared valuation report Admiral Group implies its share price may be lower than expected.

Key Takeaways

- Investigate our full lineup of 50 Top UK Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ADM

Admiral Group

A financial services company, provides insurance and personal lending products in the United Kingdom, France, Italy, Spain, and the United States.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives