- United Kingdom

- /

- Personal Products

- /

- LSE:APN

3 UK Growth Companies With High Insider Ownership And 20% Revenue Growth

Reviewed by Simply Wall St

The United Kingdom market has faced recent challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over weak trade data from China and its impact on global demand. In this environment, identifying growth companies with high insider ownership can be appealing to investors seeking resilience and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.4% | 59.2% |

| Foresight Group Holdings (LSE:FSG) | 35.1% | 26.3% |

| QinetiQ Group (LSE:QQ.) | 13.1% | 30.1% |

| Facilities by ADF (AIM:ADF) | 13.2% | 161.5% |

| Judges Scientific (AIM:JDG) | 10.7% | 24.4% |

| Audioboom Group (AIM:BOOM) | 15.6% | 59.3% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 20.3% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Hochschild Mining (LSE:HOC) | 38.4% | 24.7% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 116.2% |

Let's review some notable picks from our screened stocks.

Applied Nutrition (LSE:APN)

Simply Wall St Growth Rating: ★★★★☆☆

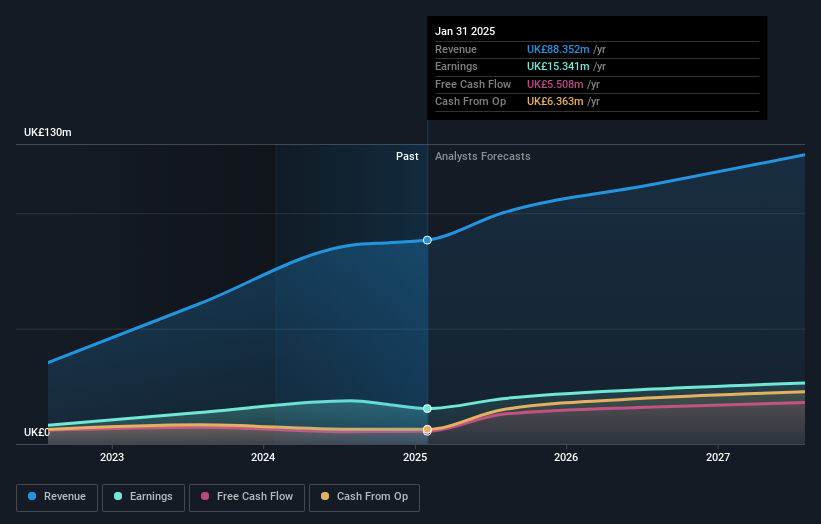

Overview: Applied Nutrition Plc manufactures, wholesales, and retails sports nutritional products in the United Kingdom and internationally, with a market cap of £292.50 million.

Operations: The company's revenue segment comprises Vitamins & Nutrition Products, generating £88.35 million.

Insider Ownership: 35.5%

Revenue Growth Forecast: 11.9% p.a.

Applied Nutrition's earnings are forecast to grow at 15.7% annually, outpacing the UK market, while trading at a significant discount to its estimated fair value. The company's revenue is expected to rise by 11.9% per year, bolstered by strategic partnerships such as the recent TANG® co-branding deal in North America. Despite a decrease in net income for H1 2025 compared to last year, its inclusion in the S&P Global BMI Index highlights its market relevance and growth potential.

- Dive into the specifics of Applied Nutrition here with our thorough growth forecast report.

- According our valuation report, there's an indication that Applied Nutrition's share price might be on the cheaper side.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Growth Rating: ★★★★★☆

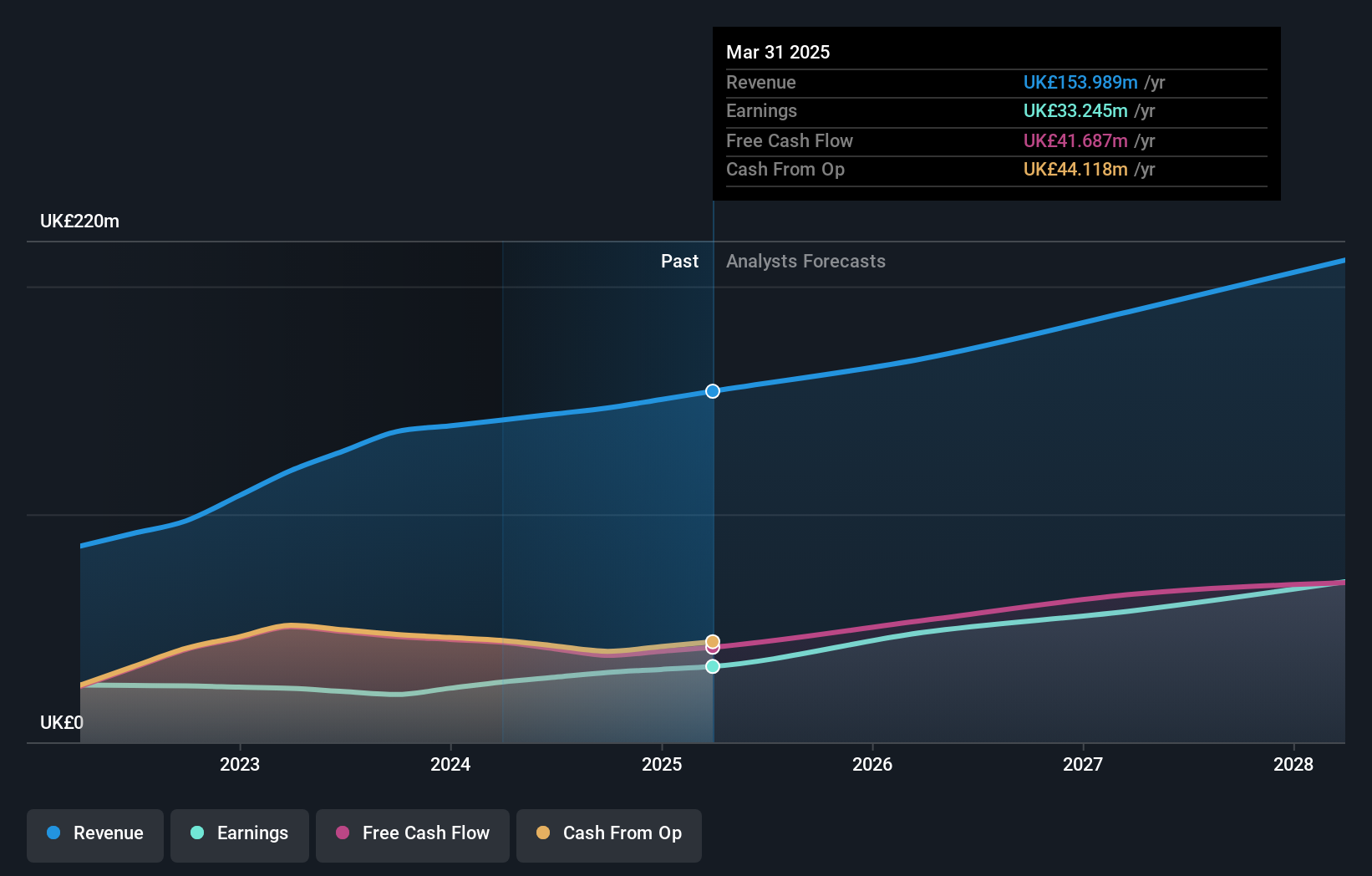

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £437.90 million.

Operations: The company's revenue is derived from three segments: Infrastructure (£87.79 million), Private Equity (£50.78 million), and Foresight Capital Management (£8.10 million).

Insider Ownership: 35.1%

Revenue Growth Forecast: 10.7% p.a.

Foresight Group Holdings is set to experience significant earnings growth at 26.3% annually, surpassing the UK market rate, while its revenue growth of 10.7% per year exceeds market averages. The company is trading at a notable discount to its fair value and has initiated a £50 million share buyback program, reflecting confidence in its financial health. Despite large one-off items affecting results, analysts anticipate a substantial stock price increase of 62.2%.

- Navigate through the intricacies of Foresight Group Holdings with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Foresight Group Holdings is priced lower than what may be justified by its financials.

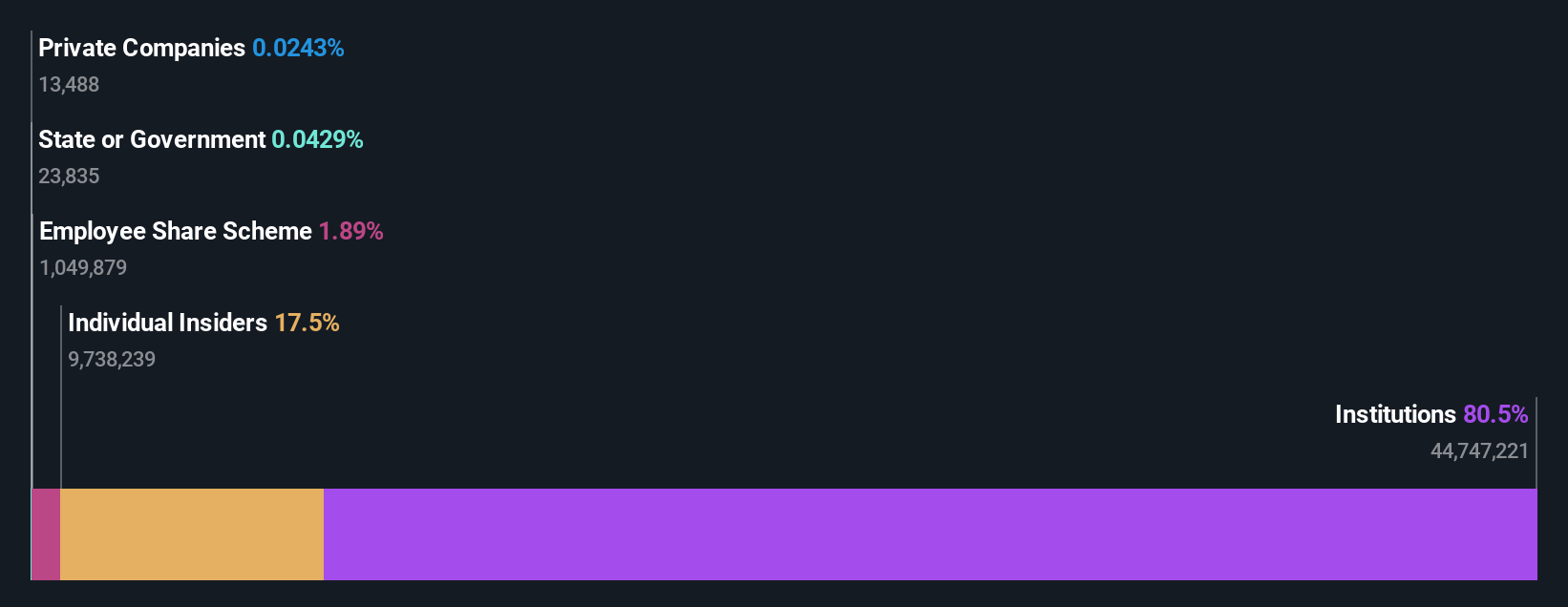

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TBC Bank Group PLC operates in Georgia, Azerbaijan, and Uzbekistan, offering banking, leasing, insurance, brokerage, and card processing services to both corporate and individual clients with a market cap of £2.66 billion.

Operations: The company's revenue segments include Georgian Financial Services generating GEL 2.28 billion and Uzbekistan Operations contributing GEL 336.77 million.

Insider Ownership: 17.8%

Revenue Growth Forecast: 20.3% p.a.

TBC Bank Group is poised for robust growth, with revenue expected to increase over 20% annually, outpacing the UK market. Despite a high bad loans ratio of 2.3%, its earnings growth forecast of 16.48% per year remains strong. The stock trades significantly below its estimated fair value, suggesting potential upside. Recent board changes and improved earnings results underscore strategic positioning, while a proposed dividend increase reflects confidence in future profitability.

- Unlock comprehensive insights into our analysis of TBC Bank Group stock in this growth report.

- Our expertly prepared valuation report TBC Bank Group implies its share price may be lower than expected.

Taking Advantage

- Get an in-depth perspective on all 62 Fast Growing UK Companies With High Insider Ownership by using our screener here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:APN

Applied Nutrition

Engages in the manufacture, wholesale, and retail of sports nutritional products in the United Kingdom and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)