- United Kingdom

- /

- Personal Products

- /

- AIM:W7L

UK Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China, impacting companies closely tied to its economic performance. In such times, investors might consider exploring penny stocks—typically smaller or newer companies—as they can offer unique opportunities for growth and value. While the term "penny stocks" may seem outdated, these investments remain relevant for those seeking potential upside with less risk by focusing on firms with robust financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.80 | £537.39M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.20 | £177.73M | ✅ 3 ⚠️ 2 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.14 | £153.09M | ✅ 4 ⚠️ 3 View Analysis > |

| Ingenta (AIM:ING) | £0.77 | £11.63M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.535 | $311.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.52 | £126.58M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.19 | £189.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.73 | £10.05M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.42 | £73.73M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £1.806 | £682.17M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 290 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Mercia Asset Management (AIM:MERC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mercia Asset Management PLC is a private equity and venture capital firm that focuses on a wide range of investment stages including incubation, venture debt, and growth capital, with a market cap of £146.66 million.

Operations: The company generates revenue primarily through its Proactive Specialist Asset Management segment, which reported £35.20 million.

Market Cap: £146.66M

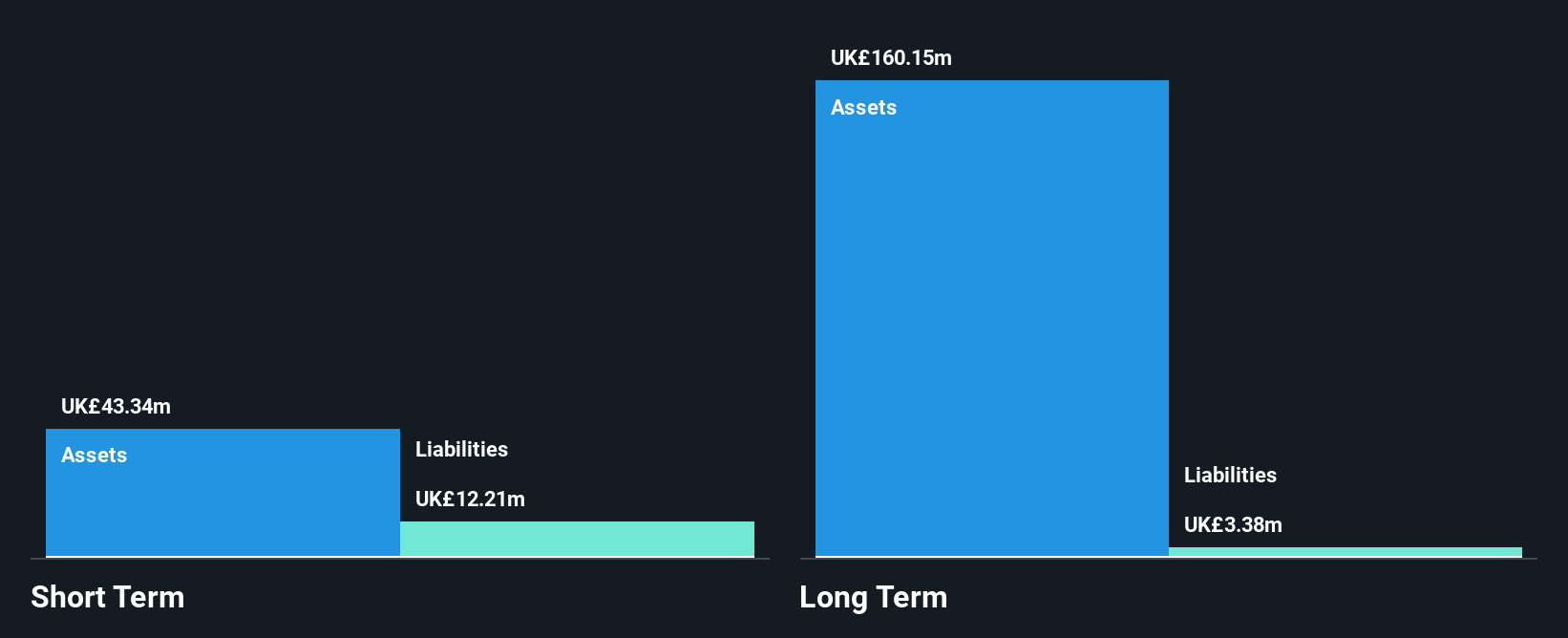

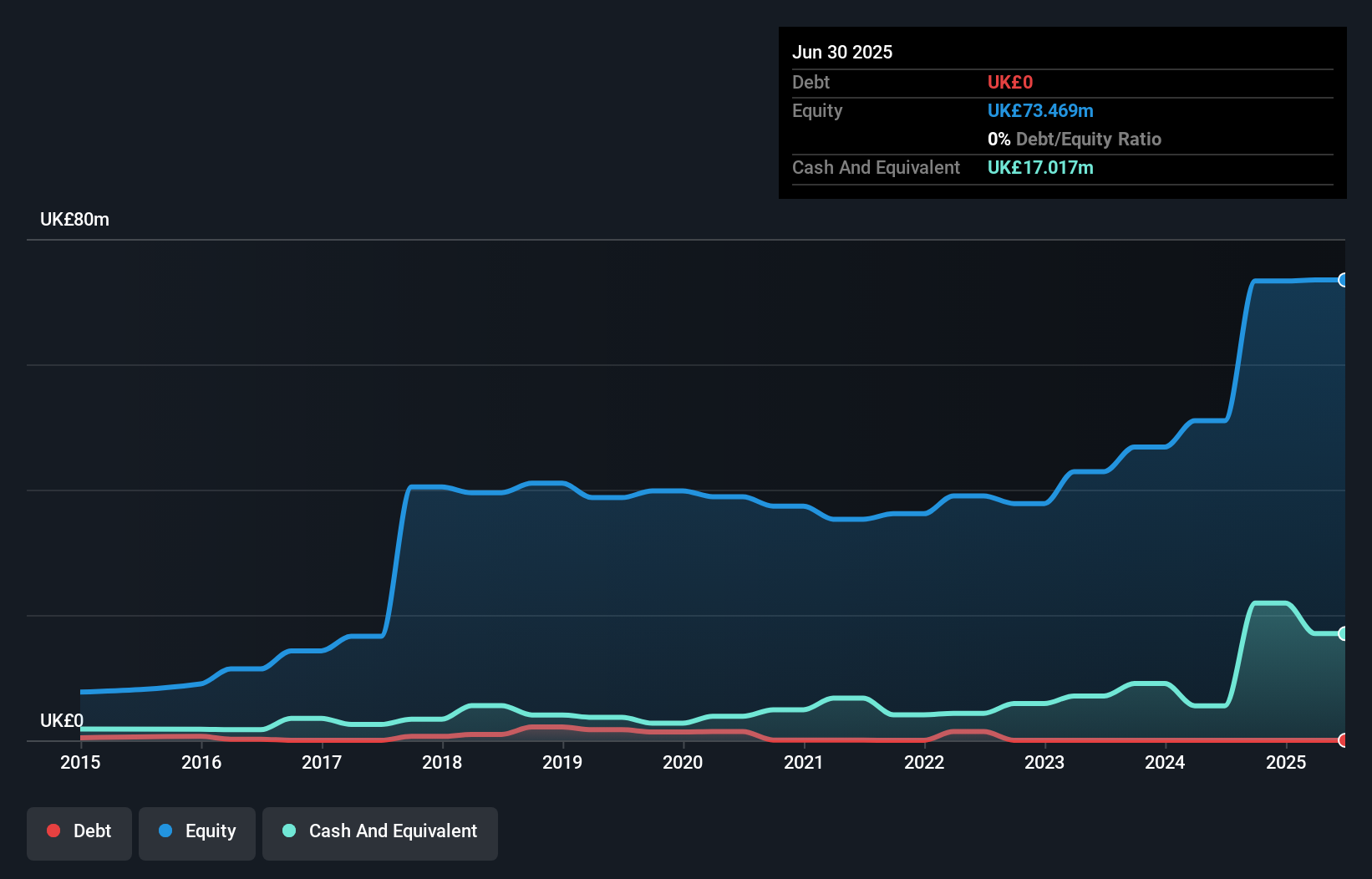

Mercia Asset Management, with a market cap of £146.66 million, has demonstrated financial stability by maintaining a debt-free status for the past five years. The company recently became profitable, although its Return on Equity remains low at 1.8%. While earnings are forecast to grow at 4.98% annually, the current dividend yield of 2.79% is not well covered by earnings. Mercia's short-term assets significantly exceed both its short and long-term liabilities, indicating strong liquidity management. Recent board changes include the retirement of Caroline Plumb OBE and ongoing efforts to appoint an additional Non-executive Director.

- Get an in-depth perspective on Mercia Asset Management's performance by reading our balance sheet health report here.

- Gain insights into Mercia Asset Management's future direction by reviewing our growth report.

Warpaint London (AIM:W7L)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Warpaint London PLC, with a market cap of £177.73 million, produces and sells cosmetics through its subsidiaries.

Operations: The company's revenue is derived from two main segments: Close-Out, contributing £2.15 million, and Own Brand, generating £102.66 million.

Market Cap: £177.73M

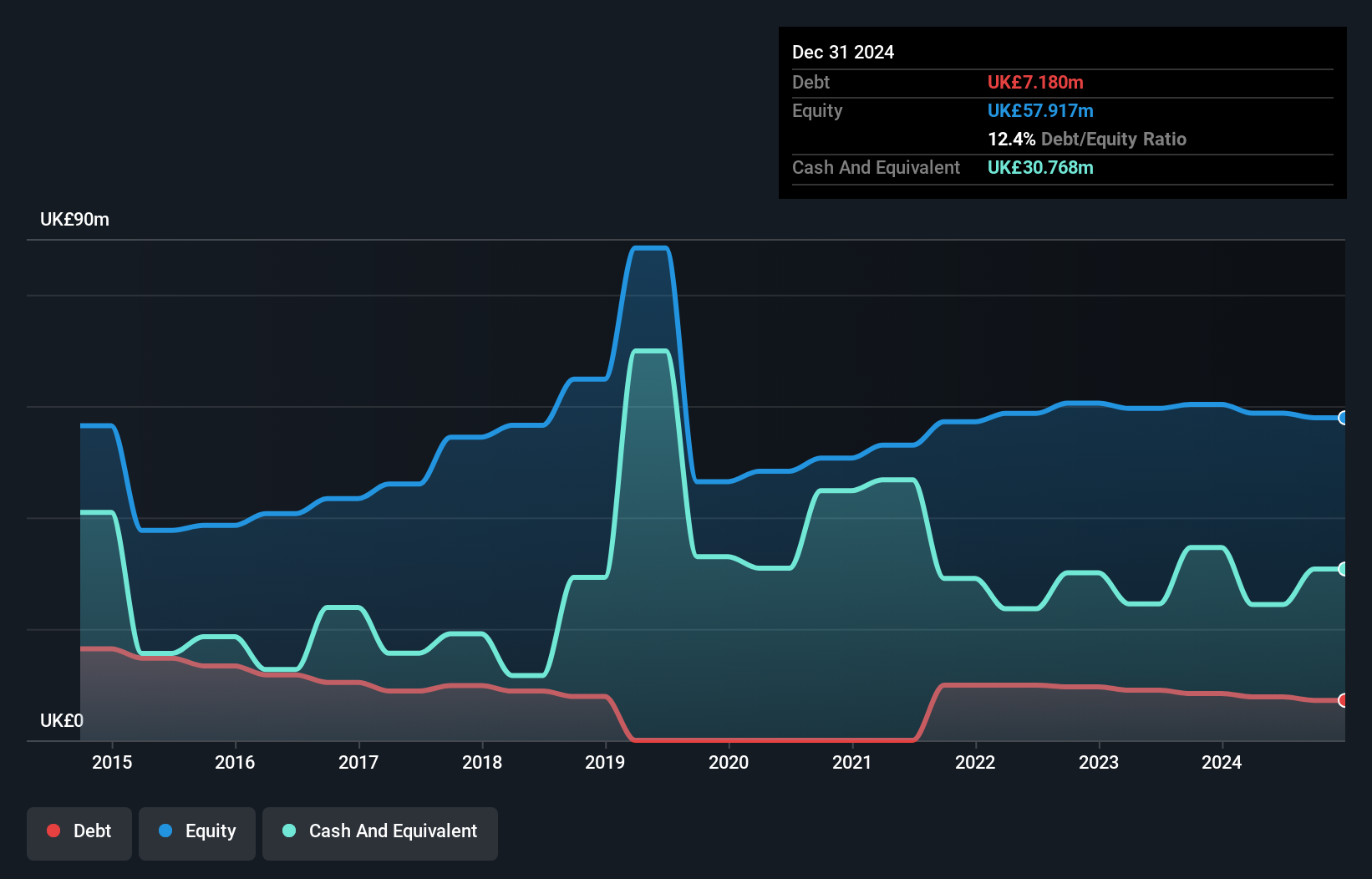

Warpaint London PLC, with a market cap of £177.73 million, operates debt-free and has stable short-term assets (£76.7M) that exceed both short-term (£21.7M) and long-term liabilities (£10.0M). Despite recent negative earnings growth of -8.7%, the company has achieved significant profit growth over the past five years at 53.3% annually, supported by high-quality earnings and a seasoned management team with an average tenure of 5.8 years. However, its share price remains highly volatile over the past three months, and net profit margins have declined from 17.4% to 14.9%.

- Click here and access our complete financial health analysis report to understand the dynamics of Warpaint London.

- Evaluate Warpaint London's prospects by accessing our earnings growth report.

Aptitude Software Group (LSE:APTD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aptitude Software Group plc, with a market cap of £170.45 million, offers financial management software solutions both in the United Kingdom and internationally through its subsidiaries.

Operations: The company generates £67.61 million in revenue through its financial management software solutions provided both domestically and internationally.

Market Cap: £170.45M

Aptitude Software Group plc, with a market cap of £170.45 million, is transitioning to a SaaS model, which is expected to drive double-digit operating profit growth despite recent revenue declines. The company has completed share buybacks worth £6.25 million and declared an interim dividend of 1.8 pence per share. While its short-term assets (£37.6M) do not cover short-term liabilities (£41.6M), it maintains more cash than total debt and has strong interest coverage (20.4x). However, earnings have declined by 11.9% annually over five years and were impacted by a £2M one-off loss recently.

- Click here to discover the nuances of Aptitude Software Group with our detailed analytical financial health report.

- Gain insights into Aptitude Software Group's outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Reveal the 290 hidden gems among our UK Penny Stocks screener with a single click here.

- Contemplating Other Strategies? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warpaint London might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:W7L

Flawless balance sheet and undervalued.

Market Insights

Community Narratives