- United Kingdom

- /

- Healthcare Services

- /

- AIM:TLY

Shareholders Will Probably Hold Off On Increasing Totally plc's (LON:TLY) CEO Compensation For The Time Being

The share price of Totally plc (LON:TLY) has increased significantly over the past few years. However, the earnings growth has not kept up with the share price momentum, suggesting that some other factors may be driving the price direction. Some of these issues will occupy shareholders' minds as the AGM rolls around on 06 September 2021. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

View our latest analysis for Totally

How Does Total Compensation For Wendy Lawrence Compare With Other Companies In The Industry?

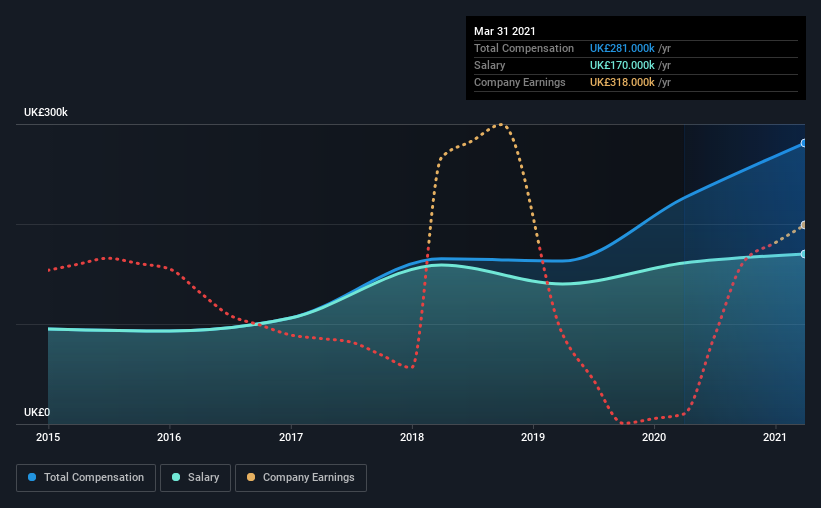

At the time of writing, our data shows that Totally plc has a market capitalization of UK£67m, and reported total annual CEO compensation of UK£281k for the year to March 2021. Notably, that's an increase of 24% over the year before. We note that the salary portion, which stands at UK£170.0k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under UK£145m, the reported median total CEO compensation was UK£173k. Hence, we can conclude that Wendy Lawrence is remunerated higher than the industry median. What's more, Wendy Lawrence holds UK£54k worth of shares in the company in their own name.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£170k | UK£161k | 60% |

| Other | UK£111k | UK£65k | 40% |

| Total Compensation | UK£281k | UK£226k | 100% |

On an industry level, around 60% of total compensation represents salary and 40% is other remuneration. Our data reveals that Totally allocates salary more or less in line with the wider market. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Totally plc's Growth

Totally plc has reduced its earnings per share by 61% a year over the last three years. It achieved revenue growth of 7.3% over the last year.

Overall this is not a very positive result for shareholders. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Totally plc Been A Good Investment?

We think that the total shareholder return of 65%, over three years, would leave most Totally plc shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 3 warning signs for Totally that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Totally, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Totally might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:TLY

Adequate balance sheet and fair value.

Market Insights

Community Narratives