- United Kingdom

- /

- Leisure

- /

- AIM:CCT

Character Group And 2 Other UK Penny Stocks To Boost Your Investment Strategy

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn following weak trade data from China, impacting companies tied to its economic health. Amidst such fluctuations, investors often seek opportunities that can provide potential growth at lower price points. Penny stocks, though an older term, still represent smaller or newer companies that may offer hidden value when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.946 | £149.22M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.08 | £783.67M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.50 | £66.75M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.155 | £98.68M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.90 | £186M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.39 | £177.02M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.20 | £417.71M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.445 | $258.69M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.39 | £305.38M | ★★★★★★ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Character Group (AIM:CCT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Character Group plc is involved in the design, development, manufacture, and distribution of toys, games, and gifts across the United Kingdom, Scandinavia, the Far East, and internationally with a market cap of £51.29 million.

Operations: Revenue Segments: No specific revenue segments reported.

Market Cap: £51.29M

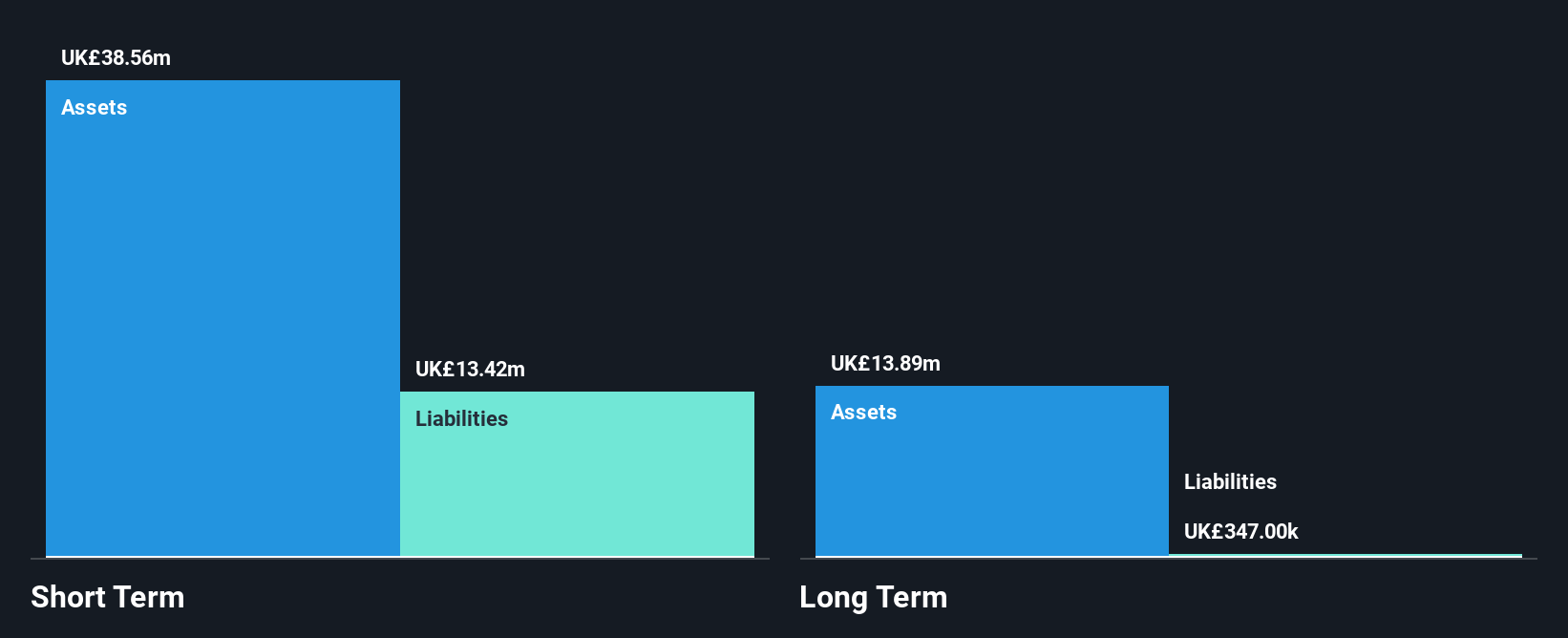

The Character Group plc, with a market cap of £51.29 million, recently reported an increase in net income to £4.95 million for the year ended August 31, 2024. The company has shown a significant improvement in its debt-to-equity ratio over the past five years and maintains more cash than total debt. Its short-term assets exceed both short-term and long-term liabilities, indicating strong liquidity positions. Despite unstable dividend history, earnings grew by 41.5% over the past year—outpacing industry growth—and are supported by high-quality earnings and experienced management with an average tenure of 8.8 years.

- Navigate through the intricacies of Character Group with our comprehensive balance sheet health report here.

- Gain insights into Character Group's historical outcomes by reviewing our past performance report.

Minoan Group (AIM:MIN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Minoan Group Plc, with a market cap of £5.49 million, designs, creates, develops, and manages luxury hotels and resorts through its subsidiaries.

Operations: Minoan Group Plc has not reported any revenue segments.

Market Cap: £5.49M

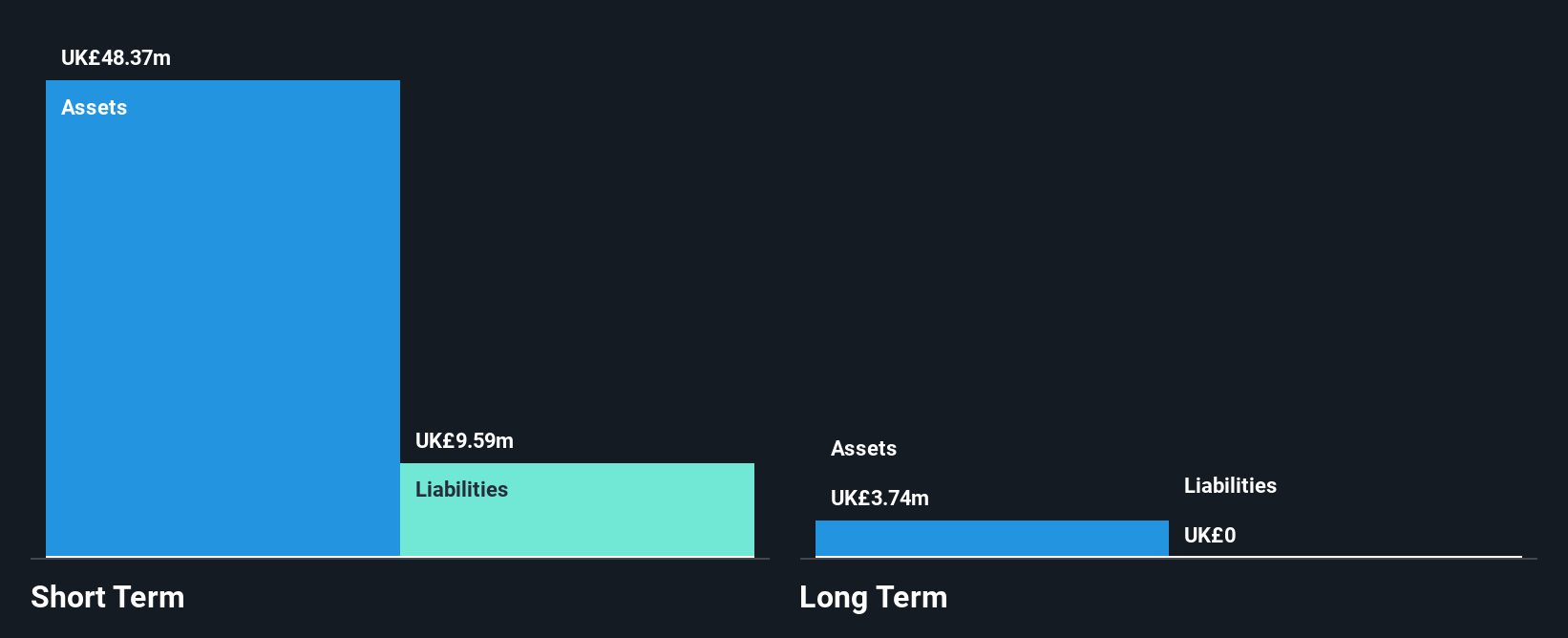

Minoan Group Plc, with a market cap of £5.49 million, is currently pre-revenue and unprofitable but has managed to reduce its losses by 33.1% annually over the past five years. The company has no debt and short-term assets of £48.4 million significantly exceed its short-term liabilities of £9.6 million, highlighting strong liquidity despite having less than a year of cash runway if current free cash flow trends persist. Minoan's share price remains highly volatile, with shareholders experiencing dilution as shares outstanding increased by 2.7% last year, reflecting potential challenges in capital management strategies.

- Jump into the full analysis health report here for a deeper understanding of Minoan Group.

- Evaluate Minoan Group's historical performance by accessing our past performance report.

INSPECS Group (AIM:SPEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: INSPECS Group plc is involved in the design, production, sale, marketing, and distribution of fashion eyewear, lenses, and OEM products globally with a market cap of £44.74 million.

Operations: The company's revenue is primarily derived from Frames and Optics (£174.94 million), followed by Manufacturing (£21.12 million) and Lenses (£4.92 million).

Market Cap: £44.74M

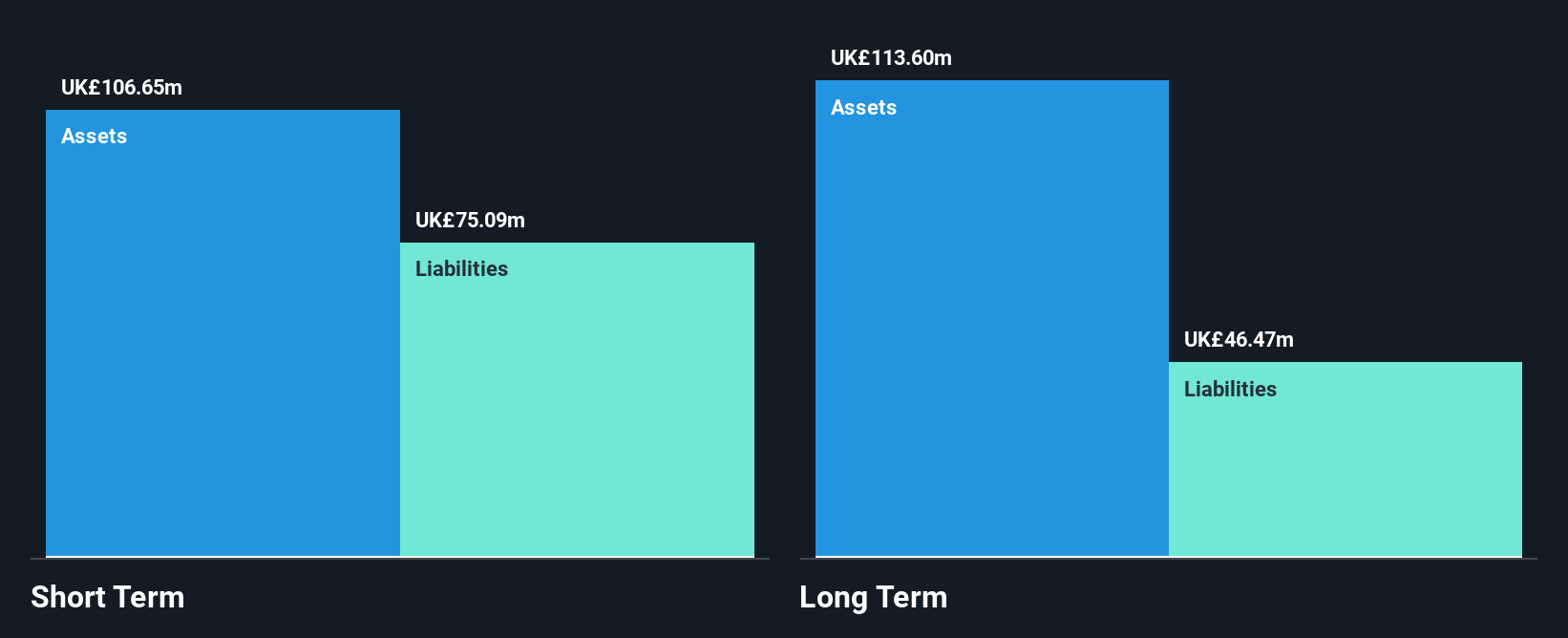

INSPECS Group, with a market cap of £44.74 million, is unprofitable but maintains a positive cash flow and has a cash runway exceeding three years. The company's revenue guidance for 2024 stands at approximately £197 million, reflecting modest growth. Its short-term assets (£98.2M) comfortably cover both short-term (£67.3M) and long-term liabilities (£49M), indicating sound liquidity management. Although trading significantly below its estimated fair value, INSPECS faces challenges with negative return on equity (-4.03%) and is not expected to achieve profitability in the next three years despite stable weekly volatility and an experienced management team.

- Dive into the specifics of INSPECS Group here with our thorough balance sheet health report.

- Explore INSPECS Group's analyst forecasts in our growth report.

Where To Now?

- Reveal the 465 hidden gems among our UK Penny Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CCT

Character Group

A holding company, designs, develops, manufactures, and distributes toys, games, and giftware products in the United Kingdom, Scandinavia, the Far East, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives