- United Kingdom

- /

- Electrical

- /

- AIM:IES

3 UK Penny Stocks With Market Caps Under £100M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting the interconnectedness of global economies. In such a climate, identifying stocks with strong financials becomes crucial for investors seeking opportunities. While "penny stocks" may sound like an outdated term, they continue to hold potential for those looking at smaller or newer companies that combine affordability with growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.60 | £515M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.55 | £286.79M | ✅ 4 ⚠️ 2 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.71 | £217.77M | ✅ 4 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.26 | £137.74M | ✅ 3 ⚠️ 3 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.405 | £43.82M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.819 | £302.85M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.84 | £292.21M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.715 | £133.6M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.215 | £193.11M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Invinity Energy Systems (AIM:IES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Invinity Energy Systems plc is a company that manufactures and sells vanadium flow batteries for energy storage markets across Asia, Australia, Europe, and North America with a market cap of £96.92 million.

Operations: The company generates revenue primarily from its Batteries / Battery Systems segment, amounting to £5.02 million.

Market Cap: £96.92M

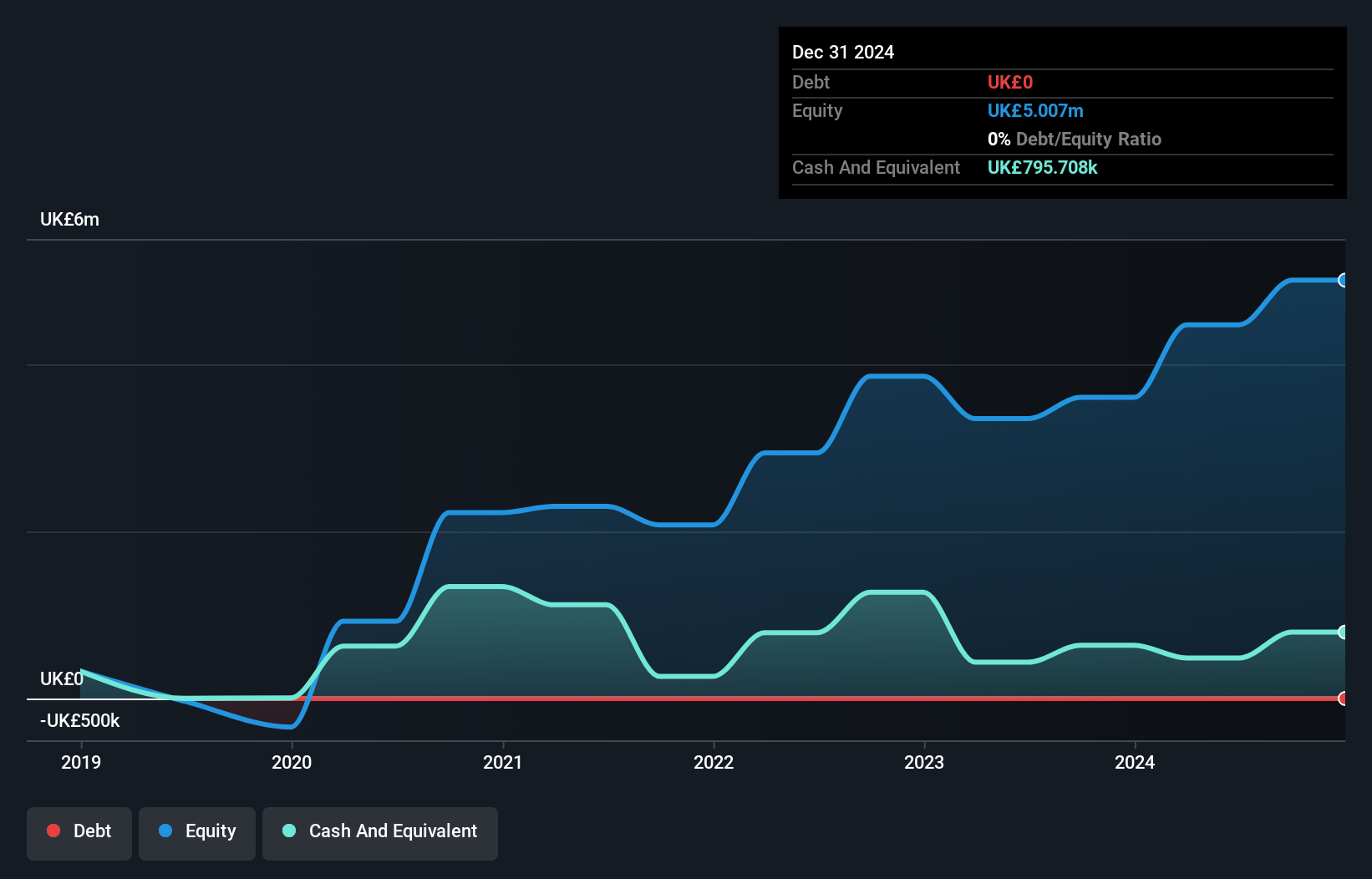

Invinity Energy Systems has been actively expanding its market presence through strategic partnerships and projects, such as a recent agreement with Guangxi United Energy Storage in China and a significant solar-plus-storage project in Hungary. Despite generating £5.02 million in revenue from its battery systems, the company remains unprofitable with increasing losses over the past five years. However, it benefits from no debt and sufficient cash runway for over a year. Recent developments include planning approval for a large-scale energy storage project in England, supported by a £10 million grant, positioning Invinity as an important player in long-duration energy storage solutions.

- Click here and access our complete financial health analysis report to understand the dynamics of Invinity Energy Systems.

- Explore Invinity Energy Systems' analyst forecasts in our growth report.

INSPECS Group (AIM:SPEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: INSPECS Group plc is a company that designs, produces, sells, markets, and distributes fashion eyewear, lenses, and OEM products across multiple regions including the United Kingdom, Europe, North America, South America, Asia, Africa, and Australia with a market cap of £46.26 million.

Operations: The company's revenue is primarily generated from Frames and Optics (£175.99 million), followed by Manufacturing (£22.21 million) and Lenses (£5.21 million).

Market Cap: £46.26M

INSPECS Group faces challenges with a 2.9% revenue decline in the first half of 2025 and flat full-year guidance, yet it maintains financial stability with short-term assets exceeding liabilities and a satisfactory net debt to equity ratio of 23.2%. Despite being unprofitable, the company has over three years of cash runway supported by positive free cash flow growth. Management changes are underway, including the search for a new Chair and CFO following board disputes. While earnings are forecasted to grow significantly, current negative return on equity reflects ongoing profitability issues amidst stable weekly volatility.

- Click to explore a detailed breakdown of our findings in INSPECS Group's financial health report.

- Gain insights into INSPECS Group's outlook and expected performance with our report on the company's earnings estimates.

Cobra Resources (LSE:COBR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cobra Resources plc, along with its subsidiaries, is involved in the exploration, development, and mining of precious and base metal projects in the United Kingdom and Australia, with a market capitalization of £21.57 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: £21.57M

Cobra Resources plc, with a market capitalization of £21.57 million, is a pre-revenue company focused on the exploration and development of rare earth elements (REEs) through innovative in situ recovery (ISR) methods. Recent announcements highlight promising assay results from historical uranium-focused drilling and ongoing metallurgical studies aimed at optimizing recoveries at its Boland Project. Despite financial challenges, including an auditor's going concern doubt and limited cash runway, Cobra remains debt-free with experienced management steering its strategic expansion through new tenement acquisitions. The company's volatile share price reflects the inherent risks associated with early-stage mining ventures.

- Click here to discover the nuances of Cobra Resources with our detailed analytical financial health report.

- Gain insights into Cobra Resources' historical outcomes by reviewing our past performance report.

Taking Advantage

- Discover the full array of 295 UK Penny Stocks right here.

- Want To Explore Some Alternatives? The end of cancer? These 25 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:IES

Invinity Energy Systems

Manufactures and sells vanadium flow batteries and related hardware for energy storage markets in Asia, Australia, Europe, and North America.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives